Bank account hacking encompasses various techniques employed by cybercriminals to gain unauthorized access to personal banking information. Common types of bank account hacking include: Phishing attacks, where hackers use deceptive emails or websites to trick individuals into revealing sensitive data Card skimming and cloning, where criminals capture card details for fraudulent use Man-in-the-middle attacks, where hackers intercept and manipulate communication between parties ATM hacking, involving physical or digital exploitation of ATMs to withdraw funds; identity theft, where personal information is stolen for fraudulent purposes Malware attacks, where malicious software is used to gain access to bank accounts Protecting against these threats requires awareness, strong security practices, and vigilance in order to mitigate the risks associated with bank account hacking. Target Selection: Hackers identify potential targets based on various criteria such as vulnerability, wealth, or access to valuable information. Information Gathering: Hackers conduct research on their target, collecting personal information from public sources, social media, or even data breaches. Reconnaissance: Hackers analyze the gathered information to assess the target's security measures, online presence, and potential vulnerabilities. Exploiting Vulnerabilities: Hackers use various techniques to exploit weaknesses in the target's security system, such as outdated software, weak passwords, or unpatched vulnerabilities. Gaining Unauthorized Access: Once a vulnerability is identified, hackers use sophisticated methods like phishing, keyloggers, or brute-force attacks to gain unauthorized access to the target's bank account or related systems. Bypassing Security Measures: Hackers employ advanced evasion techniques to bypass security measures like firewalls, intrusion detection systems, or multi-factor authentication. Maintaining Persistence: Once access is gained, hackers often install backdoors or other malware to maintain control over the compromised account and to avoid detection by security systems. Unauthorized Transactions: Hackers carry out unauthorized transactions, such as money transfers, bill payments, or fraudulent purchases, using the compromised bank account. Covering Tracks: To minimize the chances of being caught, hackers attempt to erase their digital footprints by deleting logs, modifying timestamps, or using anonymization techniques. Exit Strategy: After achieving their objectives, hackers exit the compromised system, leaving victims unaware of the breach until suspicious activities are discovered. Phishing is a deceptive method where hackers mimic legitimate communication from banks to trick victims into providing their sensitive data. Card skimming involves capturing card details using a small electronic device placed in ATMs or Point of Sale (POS) machines. Cloning is an associated threat, where the stolen data is used to create counterfeit cards. In a MitM attack, a hacker intercepts communication between two parties to steal or manipulate data. ATM hacking involves gaining physical or digital access to an ATM to withdraw money or collect card data. Identity theft involves stealing someone's personal information to commit fraud or other crimes. Malware attacks involve infecting a victim's device with malicious software to steal sensitive information. Various countries have enacted legislation to address cybercrime and bank account hacking. These laws define offenses, penalties, and legal frameworks for investigating and prosecuting hackers. Many countries have also ratified international agreements and conventions to facilitate cross-border cooperation in investigating and prosecuting cybercrimes. Bank account hacking is a serious offense with severe legal consequences. Hackers convicted of bank account hacking may face imprisonment, hefty fines, and other penalties determined by applicable laws. The severity of punishment may vary based on factors such as the extent of the damage caused, the value of stolen funds, the involvement of organized crime, and the hacker's criminal history. Victims of bank account hacking may have legal recourse to seek justice and compensation for their losses. Depending on the jurisdiction, victims may be able to file civil lawsuits against the hackers or the entities responsible for inadequate security measures. Investigating and prosecuting bank account hacking cases can be challenging due to the complexity and technical nature of cybercrimes. Hackers often hide their identities and operate across borders, making it difficult to track and apprehend them. Promoting public awareness and education about bank account hacking and cybersecurity is crucial. Governments, financial institutions, and organizations play a vital role in educating the public about the risks, preventive measures, and legal consequences associated with bank account hacking. Use strong, unique passwords for each online account, including banking accounts. A strong password should be a combination of letters, numbers, and special characters, and it should be at least 12 characters long. Avoid using easily guessable information such as birthdates or names. Be cautious of unsolicited emails, text messages, or phone calls asking for personal or financial information. Legitimate organizations will never ask you to provide sensitive information through these channels. Regularly update your operating system, web browsers, and other software to ensure they have the latest security patches. These updates often address vulnerabilities that hackers can exploit. Use secure Wi-Fi networks when accessing your bank accounts or conducting financial transactions online. Avoid using public Wi-Fi networks that are unsecured and vulnerable to interception. Keep a close eye on your bank account statements and transaction history. Report any suspicious or unauthorized activity to your bank immediately. Regularly review your credit reports to identify any signs of identity theft or fraudulent accounts opened in your name. You can request free credit reports from the major credit bureaus annually. Stay updated on the latest cybersecurity trends, scams, and hacking techniques. Educate yourself and your family members about potential threats and best practices for online security. Follow reputable sources such as cybersecurity blogs, government agencies, and financial institutions for reliable information on current threats and preventive measures. Bank account hacking is not static; it evolves with technological advances. The rise of mobile banking has led to an increase in SIM swapping attacks, where hackers manipulate telecom providers to gain control of victims' phone numbers and access mobile banking features. Additionally, the rise of cryptocurrencies has seen an increase in crypto wallet hacks. These trends are globally widespread, although they vary based on factors such as local cybersecurity infrastructure and public awareness levels. Bank account hacking poses a significant threat in today's digital age, requiring individuals and organizations to remain vigilant and adopt proactive security measures. The various types of bank account hacking, such as phishing attacks, card skimming, man-in-the-middle attacks, ATM hacking, identity theft, and malware attacks, highlight the complexity and sophistication of cybercriminal tactics. Understanding these methods is crucial for individuals to protect themselves and their financial information. Strong passwords, two-factor authentication, and awareness of phishing attempts are essential safeguards. Regularly updating software, using secure Wi-Fi connections, and monitoring account activity help mitigates risks. Furthermore, staying informed about evolving cybersecurity trends and consistently educating oneself and others are critical to maintaining digital security. By implementing preventive measures and adopting a proactive approach, individuals can reduce the risk of falling victim to bank account hacking and safeguard their financial well-being.Bank Account Hacking Overview

Process of Bank Account Hacking

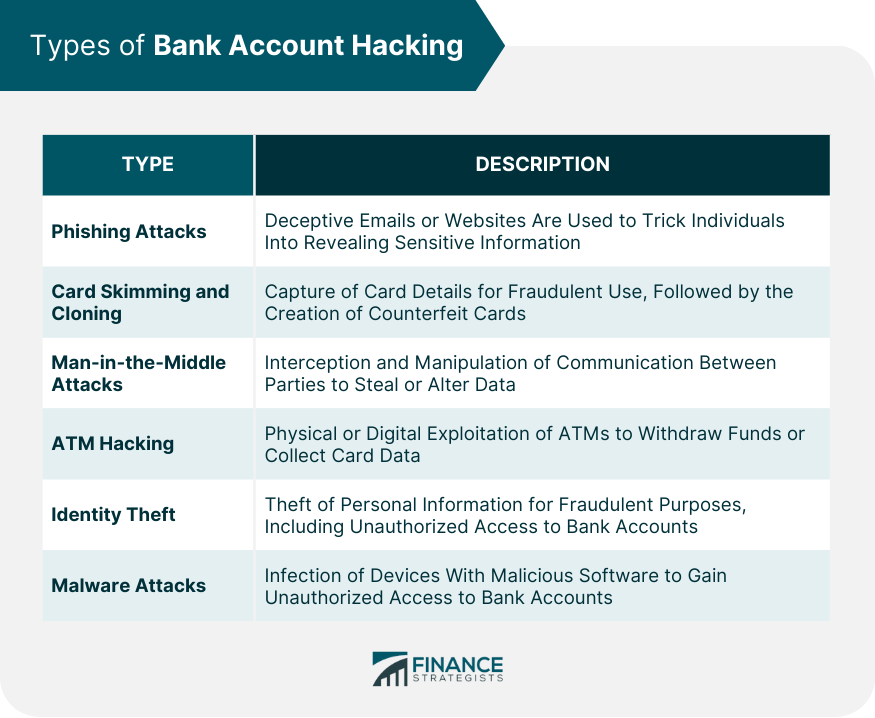

Types of Bank Account Hacking

Phishing Attacks

Card Skimming and Cloning

Man-in-the-Middle (MitM) Attacks

ATM Hacking

Identity Theft

Malware Attacks

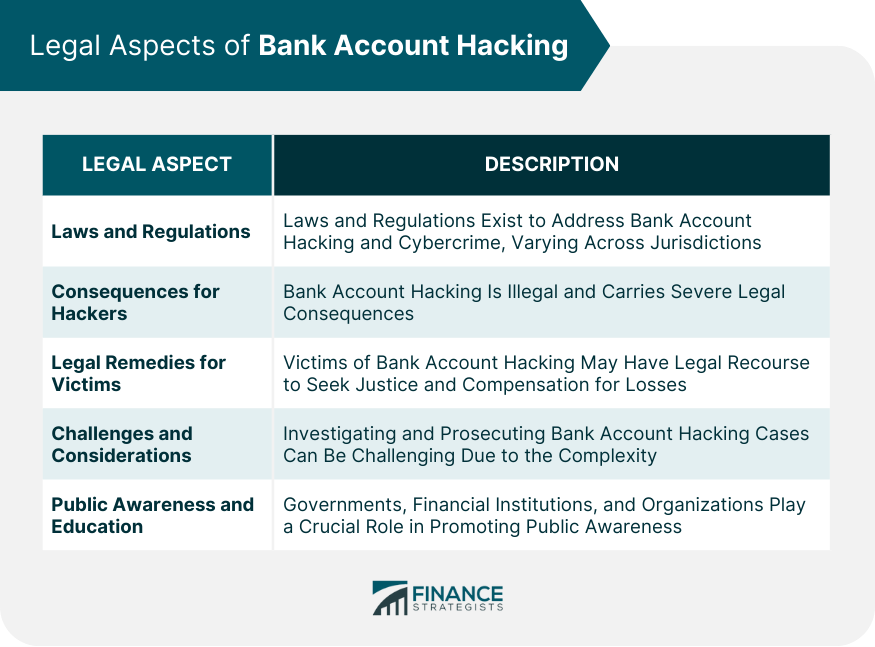

Legal Aspects of Bank Account Hacking

Laws and Regulations

Consequences for Hackers

Legal Remedies for Victims

Challenges and Considerations

Public Awareness and Education

Prevention and Protection Against Bank Account Hacking

Use Strong Passwords and Two-Factor Authentication

Beware of Phishing Attempts

Keep Software and Devices Updated

Secure Wi-Fi and Network Connections

Monitor Your Accounts Regularly

Educate Yourself and Stay Informed

Analysis of Bank Account Hacking Trends

Conclusion

Types of Bank Account Hacking FAQs

Bank account hacking is a type of cybercrime involving unauthorized access to a person's bank account, typically with the intention of stealing funds. This can occur through various methods, such as phishing attacks, ATM skimming, malware attacks, and identity theft, among others.

Various types of bank account hacking include phishing attacks, where hackers trick victims into divulging sensitive information; ATM skimming and card cloning, where credit or debit card information is stolen; man-in-the-middle attacks, where hackers intercept communication to steal or manipulate data; malware attacks, which involve infecting a device to gain access to bank account details; and identity theft, where personal data is used to gain access to bank accounts.

To protect yourself from bank account hacking, practice safe internet usage. This includes regularly updating passwords, avoiding suspicious emails or links, using secure and private internet connections for banking, and regularly checking your bank statements for any unusual activities. It's also advisable to use two-factor authentication for your banking and personal accounts whenever possible.

Bank account hacking is illegal and can result in severe penalties, including fines and imprisonment. While laws vary across different countries, most have legislation in place to prosecute cybercrime. Victims of bank account hacking may also be able to sue for damages, although tracking down culprits can be challenging.

Some high-profile instances of bank account hacking include the 2014 JPMorgan Chase data breach, where data from 76 million households were compromised, and the 2016 theft from Bangladesh Bank, where hackers stole $81 million by exploiting weaknesses in the SWIFT banking communication system.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.