When it comes to managing personal finances, selecting the right bank accounts can significantly impact an individual's financial well-being. Among the multitude of banking products available, two primary account types stand out: savings accounts and checking accounts. Savings account is designed for individuals to deposit and safeguard their money while earning interest, while a checking account allows for easy access to funds for everyday transactions, typically through checks, debit cards, and electronic transfers. Each of these accounts plays a crucial role in a person's financial journey, offering distinct functionalities and benefits that cater to various financial needs and goals. A savings account is a foundational financial product provided by banks and credit unions that enables individuals to securely deposit and withdraw their money while earning interest on the balance. Unlike checking accounts, which primarily serve as transactional accounts, the main purpose of a savings account is to promote saving and wealth accumulation over time. As individuals deposit money into their savings accounts, the financial institution pays them a small percentage of interest on their balance as an incentive to save. This makes savings accounts an ideal tool for setting aside money for various purposes, including emergency expenses, planned purchases, and long-term financial objectives. Typical features of a student savings account include: Interest Earning: Although the interest rates may not be as lucrative as those associated with more aggressive investment options, the money grows safely over time. Liquidity: Savings accounts offer a high degree of liquidity, allowing account holders to access their funds when needed. This accessibility makes them a suitable choice for short-term savings goals or unforeseen emergencies. No Fixed Term: Unlike certain investment products that have specific maturity periods, savings accounts do not have a fixed term, granting account holders the flexibility to keep their funds in the account for as long as they desire. FDIC Insurance: Most savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to a certain limit. The primary benefit of a savings account lies in its low risk, serving as a safe haven compared to riskier investments like the stock market, thanks to FDIC insurance protection. While the interest rates may not match riskier options, savings accounts provide a risk-free way to earn some return on deposits, fostering steady and secure accumulation of savings. Additionally, savings accounts are ideal for building emergency funds, offering readily accessible funds for unexpected expenses, and helping individuals work towards specific financial goals through disciplined and targeted saving practices. During periods of high inflation, the purchasing power of saved funds may erode, necessitating consideration of alternative investment avenues for higher returns. Additionally, savings accounts often have transaction limits on monthly withdrawals or transfers, which are imposed due to federal regulations like the Federal Reserve's Regulation D. Exceeding these transaction limits can result in fees or the account being converted to a non-interest-bearing account, affecting the overall growth potential of the savings. A checking account is a versatile and transactional bank account that offers individuals easy access to their deposited funds for various everyday financial activities. Unlike savings accounts, which prioritize wealth accumulation, checking accounts are geared towards providing quick and convenient means for making payments, purchases, and transfers. The primary purpose of a checking account revolves around facilitating daily financial transactions and managing ongoing expenses with ease. By providing a readily accessible repository for funds, individuals can efficiently handle bills, expenses, and other immediate financial needs. Typical features of a checking account often include: Unlimited Transactions: Checking accounts typically come with no limits on the number of transactions. This feature allows account holders to make frequent withdrawals, transfers, and payments without incurring penalties or fees. Debit Card and Checks: These accounts often come with a debit card and a checkbook, providing individuals with versatile payment options for both in-person and online transactions. Overdraft Protection: Many checking accounts offer overdraft protection, a feature that prevents the account from going negative in case of insufficient funds. However, it may come with its own fees and interest charges. No Fixed Term: Similar to savings accounts, checking accounts do not have a fixed term, enabling customers to keep funds in the account for as long as needed without worrying about maturity dates. The primary advantage of a checking account is its unparalleled convenience and accessibility. Serving as a central hub for managing day-to-day expenses, individuals can easily access their funds through various means such as debit cards, checks, and electronic transfers. This allows for seamless payments, whether it's making purchases at a store, paying bills online, or transferring money to friends and family. The use of debit cards also adds an extra layer of security, reducing the need to carry large sums of cash and providing protection against potential theft or loss. Moreover, many employers offer direct deposit options for paychecks, making it effortless for individuals to receive their salaries directly into their checking accounts. Additionally, the inclusion of online and mobile banking features empowers users with 24/7 access to their accounts, allowing them to monitor transactions and manage their finances from the comfort of their homes or on the go. In general, checking accounts provide minimal to no interest on the deposited amount, making them less suitable for individuals seeking to grow their money over time. While checking accounts excel in facilitating everyday transactions, they may not be the most lucrative option for individuals looking to maximize their returns. Another limitation to consider is the potential for fees and overdraft charges. Some checking accounts may come with maintenance fees or transaction fees, depending on the account type and banking institution. Additionally, overdrawing from a checking account, and spending more than the available balance can lead to significant overdraft charges and penalties. To avoid such fees, individuals must be vigilant in monitoring their account balance and practice responsible financial management. After exploring the unique features, benefits, and limitations of savings and checking accounts, it becomes evident that these two account types cater to different financial needs. Here are the key differences between them: Purpose and Usage: The primary purpose of a savings account is to accumulate funds over time and earn some interest, making it ideal for long-term saving goals and emergency funds. Interest Earning: While savings accounts offer modest interest on deposits, checking accounts usually do not provide any interest on the balance. Therefore, individuals looking to earn a return on their savings should consider a savings account. Transaction Limits: Savings accounts often have limitations on the number of monthly withdrawals or transfers, while checking accounts typically come with unlimited transactions. Risk and Security: Savings accounts are considered low-risk due to FDIC insurance, making them a safe place to hold money with the added benefit of earning some interest. Financial Goals: Individuals seeking to achieve specific long-term financial goals, such as saving for a down payment on a house or retirement, are more likely to benefit from a savings account. When it comes to choosing between a savings account and a checking account, individuals must assess their financial needs and priorities. Here are some considerations to help make an informed decision: Emergency Fund: If building an emergency fund is a priority, a savings account is an excellent option. Its safety and ability to earn some interest will ensure that the funds are readily available when needed. Financial Goals: Consider the specific financial goals you want to achieve. If you are saving for a future event, such as buying a car or funding a college education, a savings account can assist in reaching those milestones. Daily Expenses and Transactions: For managing day-to-day expenses and having quick access to funds, a checking account is indispensable. Its convenience and versatility make it ideal for frequent transactions. Balancing Both: It's not uncommon for individuals to maintain both a savings account and a checking account. Selecting the right bank accounts is crucial for managing personal finances effectively. Among the various options, savings and checking accounts are two primary types that stand out. A savings account is designed for long-term saving and wealth accumulation, offering modest interest and a secure place to safeguard funds. In contrast, a checking account prioritizes convenience, providing easy access to funds for day-to-day financial activities through checks, debit cards, and online transfers. Individuals should consider their specific financial needs and objectives when choosing between these accounts. In some cases, maintaining both account types can provide a balanced approach, ensuring funds are allocated for both immediate needs and future aspirations. Overall, a thoughtful assessment of financial priorities will guide individuals in making informed decisions to optimize their financial well-being.Savings vs Checking Accounts Overview

What Is a Savings Account?

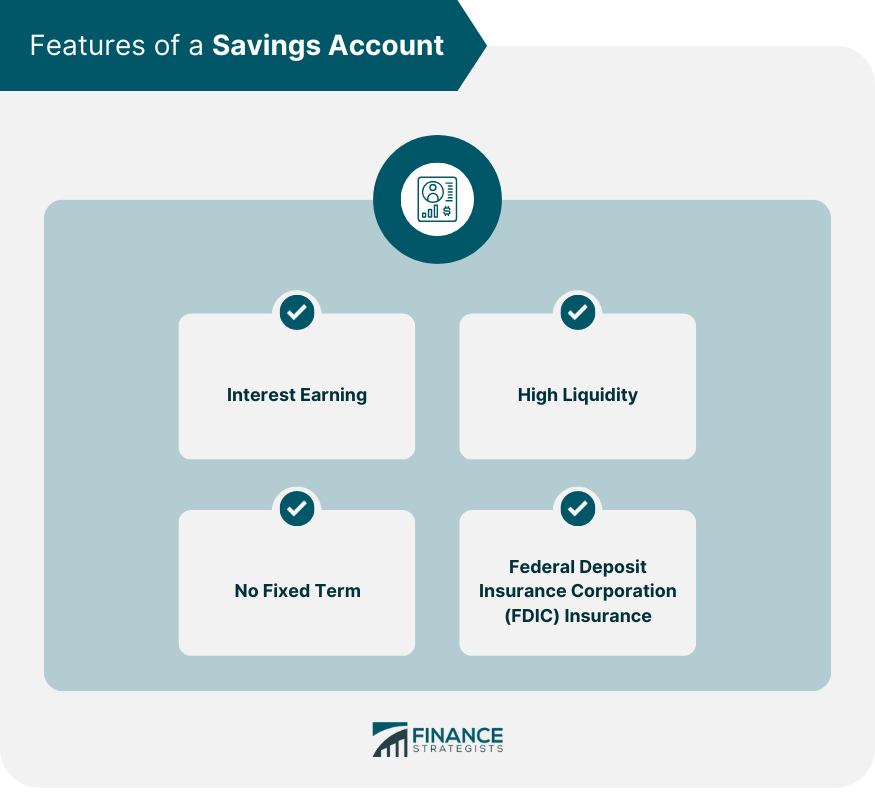

Features

This insurance protection ensures that even in the unlikely event of the financial institution's failure, the account holder's deposits are safe and reimbursed, promoting confidence and security in saving.

Benefits

Limitations

What Is a Checking Account?

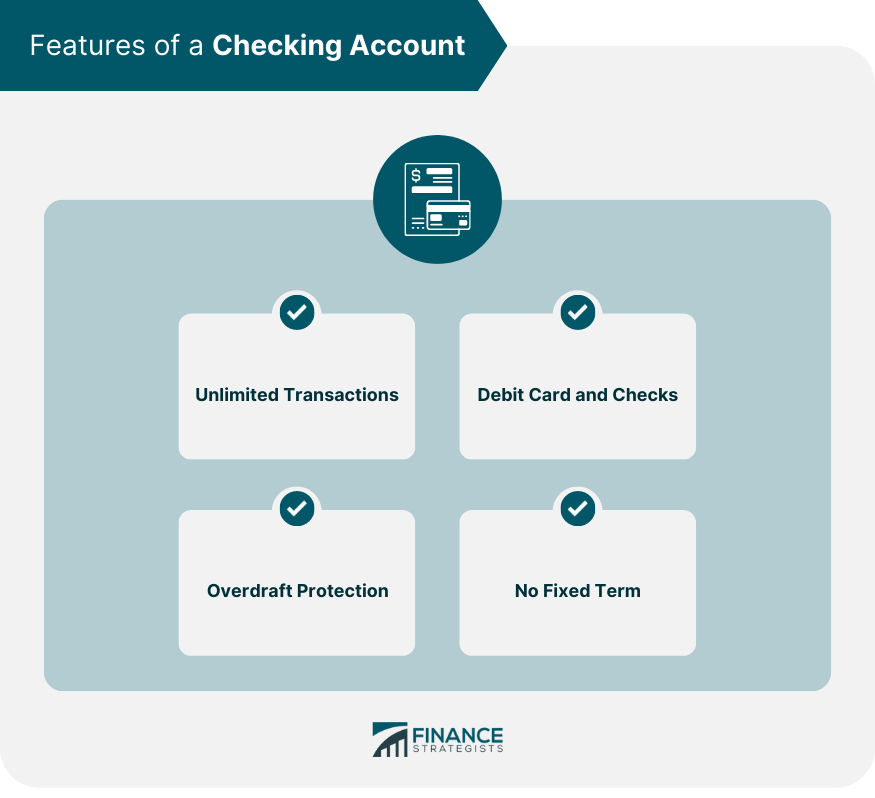

Features

Benefits

Limitations

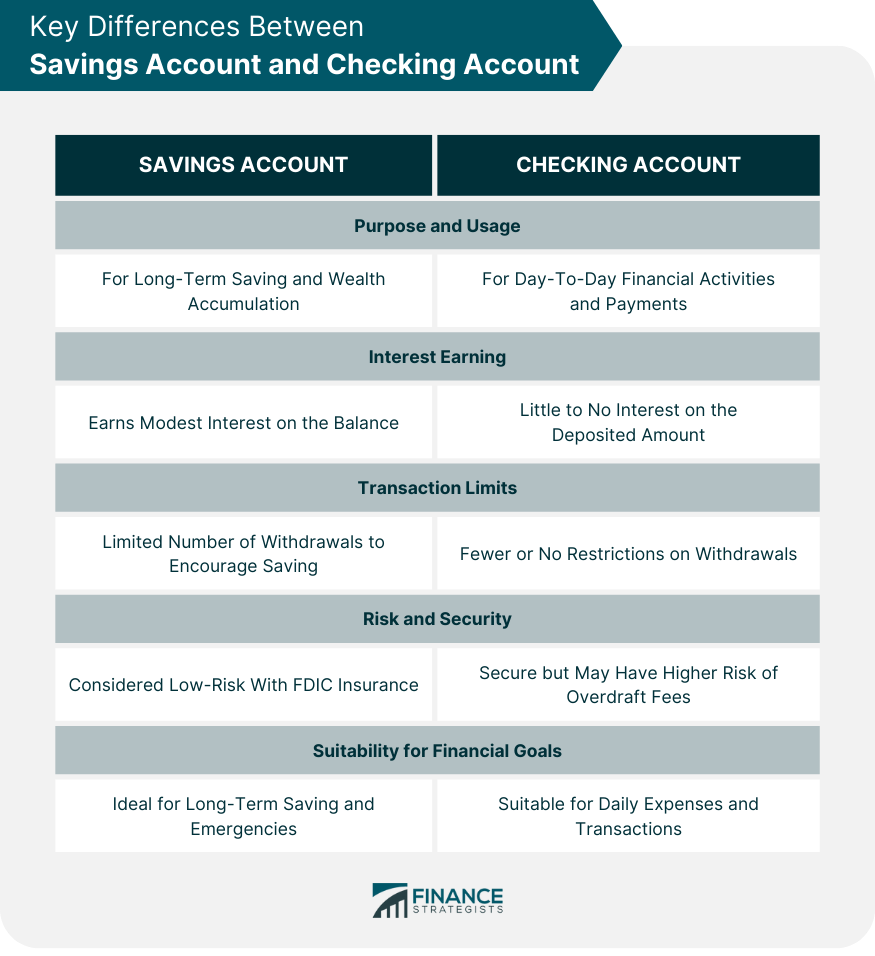

Key Differences Between Savings Account and Checking Account

On the other hand, a checking account is more suitable for day-to-day financial activities, bill payments, and easy access to funds for ongoing expenses.

If frequent access to funds is crucial, a checking account may be the better choice.

Checking accounts are also secure, but they may not offer the same level of interest and can have a higher risk of overdraft fees.

Meanwhile, those focusing on day-to-day financial activities and transactions will find a checking account more advantageous.

Choosing Between Savings and Checking Accounts

This approach allows you to separate funds for different purposes, ensuring that you are saving for the future while having easy access to funds for daily expenses.Conclusion

Savings vs Checking Accounts FAQs

The main difference lies in their purposes and usage. Savings accounts are designed for long-term saving and earn interest while checking accounts prioritize day-to-day transactions and easy access to funds.

Yes, typically, savings accounts provide higher interest rates, making them more suitable for individuals looking to grow their money over time.

Savings accounts often come with transaction limits due to federal regulations, whereas checking accounts offer unlimited transactions, making them more suitable for frequent financial activities.

Both accounts are generally secure, but savings accounts may offer added security through FDIC insurance, making them a safe place to hold money and earn interest.

Yes, many individuals maintain both types of accounts to balance long-term saving goals with easy access to funds for daily expenses and transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.