A bank account is a financial tool provided by banking institutions that allows you to safely store, manage, and access your money. By opening a bank account, you are entering into a contractual relationship with the bank, which enables you to deposit money and withdraw it as needed. The account also provides various financial services such as online banking, money transfers, automatic bill payments, and the issuing of checkbooks or debit cards. Many bank accounts earn interest over time, making them beneficial for long-term savings. Additionally, they are generally protected by federal deposit insurance, ensuring the safety of your funds up to a certain limit. Having a bank account is not only an essential component of personal financial management but also plays a crucial role in building a credit history. Checking accounts are designed for frequent transactions such as paying bills, shopping, or withdrawing cash. These accounts usually come with checkbooks, debit cards, and the ability to make transactions online or via mobile apps. With the convenience of online banking and mobile apps, checking accounts offer seamless access to your funds anytime, anywhere. Savings accounts are for storing money while earning interest over time. They aren't as transaction-friendly as checking accounts, as they often limit the number of transactions you can make each month. By building a habit of regular deposits, savings accounts can help you achieve financial goals and create a safety net for unexpected expenses. Joint accounts are accounts opened by two or more individuals, typically partners or family members. Both parties have access to the account and can deposit or withdraw funds. Joint accounts can facilitate shared expenses, such as household bills or savings for mutual goals, making it easier to manage finances as a team. Business accounts are tailored to meet the needs of businesses and come with features like payroll services, invoicing tools, and high transaction limits. Opening a business account can help separate personal and business finances, simplifying accounting and providing a professional image to clients and customers. Opening a bank account doesn't have to be a daunting process. Here's a step-by-step guide to help you open a bank account smoothly. First, understand why you need a bank account. If it's for regular transactions, a checking account would be suitable. If it's to save money and earn interest, consider a savings account. Assessing your banking needs helps you choose the right account type that aligns with your financial goals. Not all banks are created equal. Look at various factors such as interest rates, fees, services offered, customer service quality, and the convenience of locations or digital platforms. Researching and comparing different banks allows you to make an informed decision that matches your preferences and financial requirements. Once you've narrowed down your choices, select the type of account that suits your needs best. You may need to speak to a representative of the bank or credit union to get more detailed information. Choosing the right account type ensures that you have the necessary features and benefits that align with your financial objectives. Make sure you understand the fine print before you open an account. Look for things like minimum balance requirements, transaction limits, and potential fees. Familiarizing yourself with the terms and conditions helps you make informed decisions and avoid surprises down the road. To open a bank account, you'll typically need identification (like a driver's license or passport), proof of address (like a utility bill), and your Social Security Number or Tax Identification Number. Prepare these documents in advance to streamline the account opening process. Depending on the bank, you may be able to apply for the account online, or you may need to visit a branch in person. Follow the bank's instructions for filling out the application form. Applying for the account accurately and promptly ensures the smooth processing of your application. Most banks require an initial deposit to open the account. The amount varies, so check this before you start the process. Having the required funds ready allows you to complete the account opening process without delays. Once the account is open, set up online banking and download the bank's mobile app. This will make it easy to monitor your account, transfer money, pay bills, and perform other transactions. Embracing the convenience of online banking and mobile apps empowers you to manage your finances efficiently. An overdraft fee is charged when you withdraw more money than you have in your account. Some banks offer overdraft protection, which can help you avoid these fees. By linking your account to a savings account or establishing an emergency fund, you can minimize the risk of overdraft fees. Some banks charge a monthly maintenance fee just for having an account. Often, this fee can be waived if you meet certain conditions, like maintaining a minimum balance or setting up direct deposit. Understanding the requirements for fee waivers can help you avoid unnecessary expenses. Banks often charge a fee if you use an ATM that's not part of their network. Some banks offer reimbursement for a certain number of these fees each month. To avoid or minimize ATM fees, consider using ATMs within your bank's network or opt for digital banking services that allow fee-free withdrawals at designated ATMs. After you've successfully opened a bank account, it's important to manage it well. Regularly check your account balance and review your transactions. This will help you spot any errors or fraudulent activity. Many banks offer alerts that can help you keep track of your account activity. Monitoring your account regularly ensures financial accuracy and security. Automatic payments can be a convenient way to pay bills, but it's important to monitor them to ensure you have enough funds in your account to cover the payments. Regularly review your automatic payments and update them as needed to avoid potential overdrafts or missed payments. Never share your banking passwords, and always make sure to log out of your account when you've finished banking, especially if you're using a public computer. Use complex, unique passwords, and consider using a password manager to help remember them. Taking steps to secure your account helps protect your finances and personal information from unauthorized access. Opening and maintaining a bank account is an integral part of personal financial management and also instrumental in building a credit history. With several types of bank accounts available - checking, savings, joint, and business - it's vital to identify the one that aligns with your financial needs and goals. The step-by-step guide provided simplifies the account opening process, ensuring a seamless experience. Additionally, understanding common banking fees and effective ways to avoid them aids in smart financial management. Lastly, implementing strategies for maintaining the account, such as regular monitoring, updating automatic payments, and ensuring security, can safeguard your finances. Take advantage of the benefits and security a bank account offers today. Seek reliable banking services tailored to your needs to gain control of your financial future.Understanding Bank Accounts

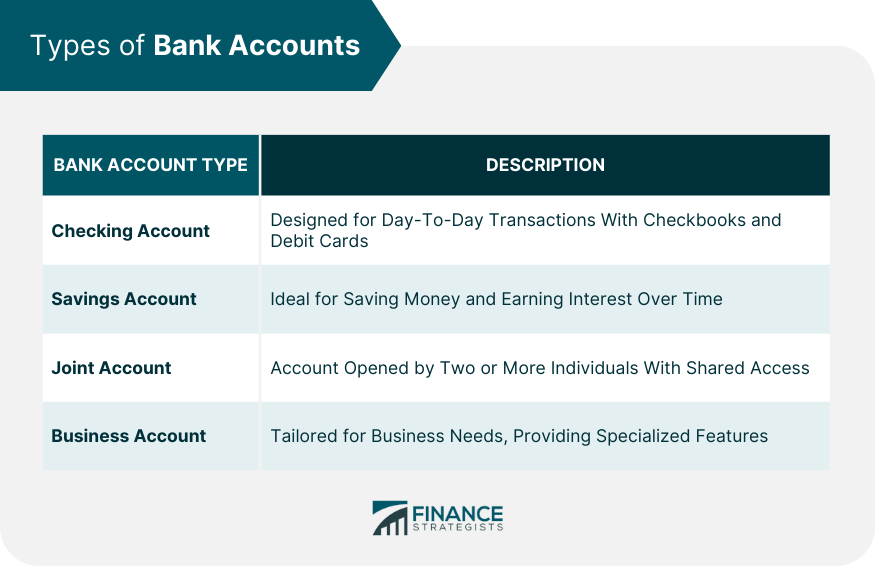

Types of Bank Accounts

Checking Accounts

Savings Accounts

Joint Accounts

Business Accounts

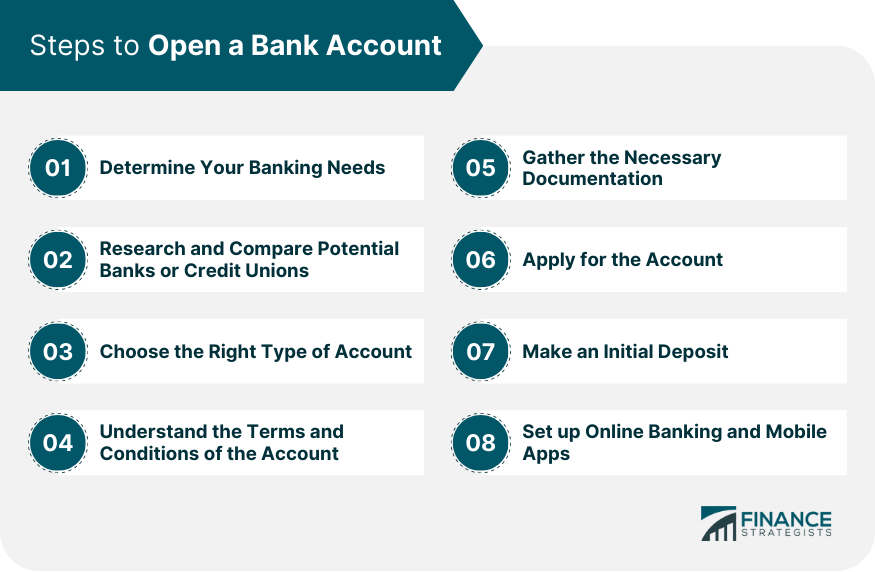

How to Open a Bank Account: Step-By-Step Guide

Step 1: Determine Your Banking Needs

Step 2: Research and Compare Potential Banks or Credit Unions

Step 3: Choose the Right Type of Account

Step 4: Understand the Terms and Conditions of the Account

Step 5: Gather the Necessary Documentation

Step 6: Apply for the Account

Step 7: Make an Initial Deposit

Step 8: Set up Online Banking and Mobile Apps

Understanding Banking Fees

Overdraft Fees

Maintenance Fees

ATM Fees

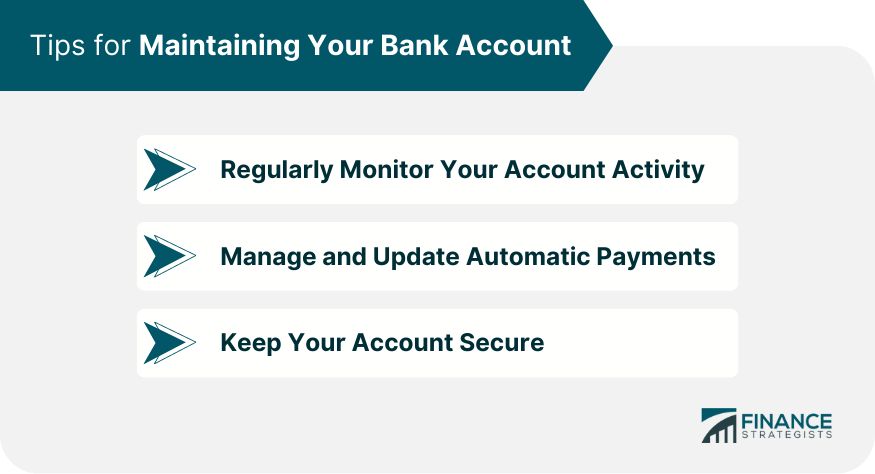

Tips for Maintaining Your Bank Account

Regularly Monitor Your Account Activity

Manage and Update Automatic Payments

Keep Your Account Secure

Bottom Line

Opening a Bank Account FAQs

Different types include checking, savings, joint, and business accounts.

Research and compare factors like fees, services, and customer satisfaction to find the best fit.

Typically, you'll need identification, proof of address, and a Social Security Number or Tax ID.

Maintain minimum balances, set up direct deposits, and use in-network ATMs to minimize fees.

Protect your passwords, log out after use, and use strong, unique passwords or a password manager.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.