While joint bank accounts can be advantageous for certain situations, there are instances where closing such an account becomes a necessary and prudent step. The decision to close a joint bank account should never be taken lightly, as it involves careful consideration of various factors and potential consequences. When closing a joint bank account, all co-owners must be involved in the decision-making process and adhere to the bank's specific procedures for closing the account to ensure a smooth and hassle-free experience. By understanding the reasons and process for closing a joint bank account, individuals can make informed choices that align with their financial goals and priorities. Closing a joint bank account begins with the agreement of all parties involved. It is critical that everyone who has ownership over the account gives their consent to close it. This is not just a courteous step but is often a requirement of many banking institutions. A joint bank account, by definition, belongs to all parties equally, regardless of who contributes more money or uses the account more frequently. Before initiating the closure of the account, ensure all checks have cleared, and all automatic payments or direct deposits have been stopped or transferred to another account. Pay particular attention to any potential fees or penalties that may apply if you close the account. For instance, some banks may charge a fee if an account is closed before a specified period after opening. Once you have ensured there are no outstanding transactions, the next step is to withdraw or transfer the funds to the account. The exact method depends on the bank's policies and the preferences of the account holders. It's also essential to decide how the remaining balance will be divided among the account holders. After all, preparations have been made, contact your bank to start the closure process. Most banks allow you to close a joint bank account in person, by mail, or even online. Be prepared to provide personal identification and possibly a written request to close the account. Bank policies regarding joint account closures can differ significantly. Some banks require all account holders to be present or provide written consent for the closure. Others might allow one account holder to close the account with the proper authorization. Therefore, it is crucial to understand your bank's specific policies to avoid unnecessary complications or delays. Usually, banks require identification documents of all account holders, along with a formal written request for closure. The specifics may vary, so it's advisable to contact your bank or visit their website for detailed information. Closing a bank account can sometimes involve fees or penalties, especially if the account is closed soon after it was opened. Check your bank's fee schedule or speak with a customer service representative to understand any costs associated with closing your joint bank account. Once any outstanding transactions have been settled, the account holders must agree on how to divide the remaining balance. The division could be equal, or it could be based on the initial contributions of each account holder or even a previous agreement. After deciding on the division, ensure that the funds are distributed accordingly. This step may involve multiple transactions or checks if the funds are being distributed among several account holders. After you've initiated the closure process, it's vital to monitor the account to ensure it has indeed been closed. Occasionally, an overlooked automatic payment or deposit can keep the account open. Regular monitoring helps avoid such situations. Any automated payments or deposits linked to the joint account need to be transferred to a different account before closure. Overlooking this step can lead to missed payments, additional fees, and potential damage to your credit score. Ensure all services linked to the joint account, like utilities or subscriptions, are updated with new payment information. This will prevent any disruption in services due to non-payment after the joint account is closed. Disagreements between account holders can complicate the account closure process. If an account holder is uncooperative, consider seeking legal advice. A mediator or attorney can provide guidance based on the laws of your jurisdiction. Disputes over the division of funds can also arise when closing a joint account. To avoid legal issues, consider involving a neutral third party or a legal professional to help mediate the dispute. In certain cases, you may need to explore legal avenues to close a joint account, especially if there's a dispute between account holders. Professional assistance from a lawyer can help navigate these complexities. One alternative to closing a joint account is to convert it into an individual account. This can be a viable option if one party wants to maintain the account and all other account holders agree. Another alternative is freezing the account, which stops all transactions. This can be a temporary measure during a dispute or until a decision is made about how to handle the account. Closing a joint bank account requires consensus among all account holders, a thorough check for outstanding transactions, and careful consideration of the bank's specific closure process. Account holders must also agree on a fair division of remaining funds. Post-closure considerations include monitoring the account to ensure it's closed, rerouting automated payments, and updating linked services. Navigating potential challenges, such as an uncooperative account holder or disputes over asset division, may necessitate legal advice. Lastly, alternatives like converting the account into an individual one or freezing it could be explored. The process can seem complex, but with clear communication, understanding, and planning, it can be accomplished smoothly.Why Close a Joint Bank Account?

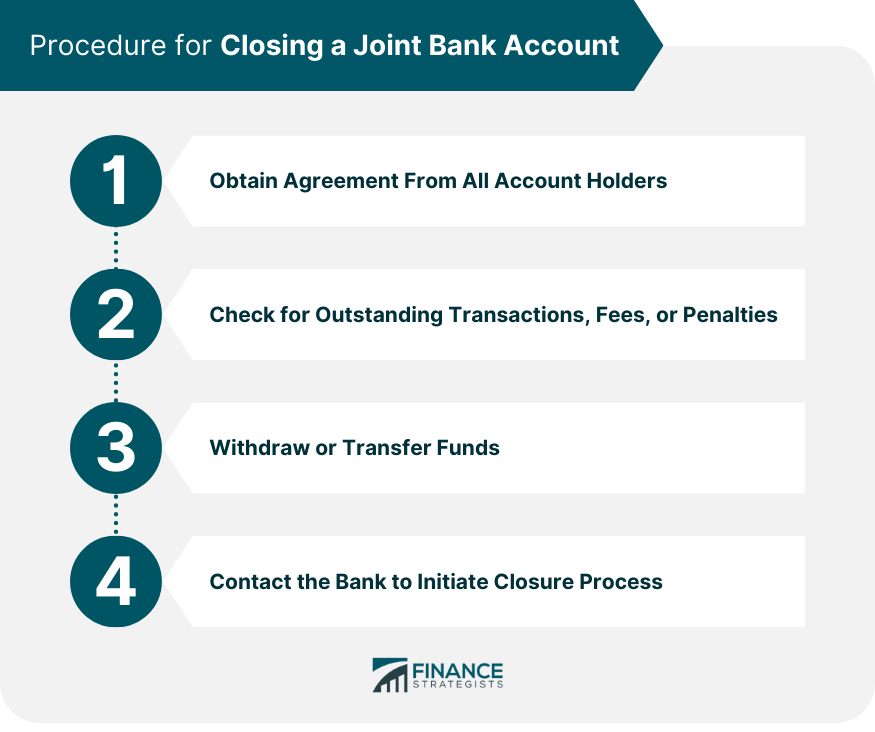

Procedure for Closing a Joint Bank Account

Obtain Agreement From All Account Holders

Check for Outstanding Transactions, Fees, or Penalties

Withdraw or Transfer Funds

Contact the Bank to Initiate Closure Process

Understanding the Bank’s Policies Before Account Closure

How Different Banks Handle Joint Account Closures

Required Documentation for Closure

Potential Fees or Penalties Associated With Closure of the Account

Division of Assets Before Account Closure

Discuss and Agree on How to Divide Remaining Funds

Ensure Fair Distribution as per Agreement or Initial Contribution

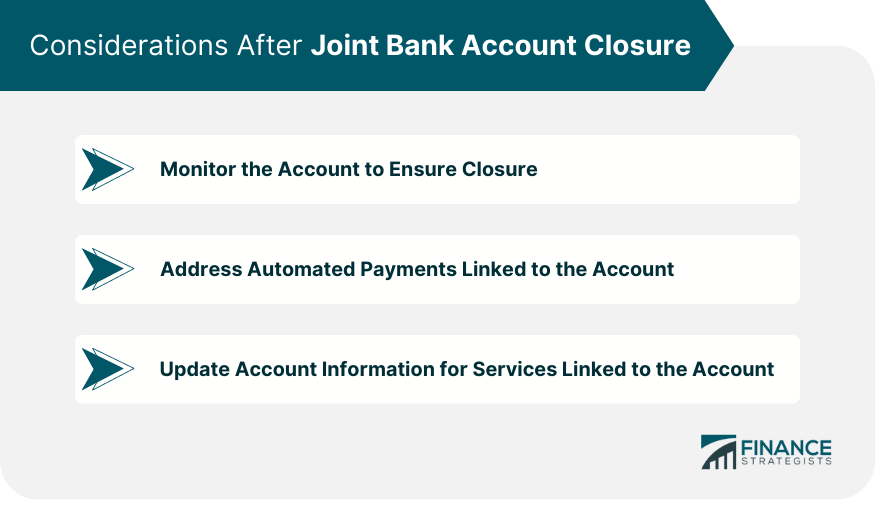

Considerations After Joint Bank Account Closure

Monitor the Account to Ensure Closure

Address Automated Payments Linked to the Account

Update Account Information for Services Linked to the Account

Potential Challenges and Solutions to Closing a Joint Bank Account

What to Do if an Account Holder Is Uncooperative

Resolving Disputes Over the Division of Assets

Legal Avenues and Professional Assistance

Alternatives to Joint Bank Account Closure

Convert the Joint Account Into an Individual Account

Freeze the Account to Prevent Further Transactions

Conclusion

How to Close a Joint Bank Account FAQs

If an account holder refuses to cooperate in closing the joint account, you may need to seek legal advice. A legal professional can provide guidance on your rights and the next steps according to the laws in your jurisdiction.

Typically, banks require consent from all account holders to close a joint account. However, some banks might allow one account holder to close the account with proper authorization. It's crucial to understand your bank's specific policies regarding this.

Before closing a joint account, all account holders must agree on how the remaining funds will be distributed. This could be an equal division or based on each holder's initial contributions or a prior agreement. The funds are then distributed accordingly.

Before closing the joint account, make sure to transfer any automated payments or deposits to another account. Also, update the payment information for any services linked to the joint account to prevent missed payments, additional fees, or potential damage to your credit score.

Yes, instead of closing the joint account, you can consider converting it into an individual account if one party wishes to maintain the account and all other account holders agree. Another alternative is freezing the account, which stops all transactions until a final decision is made.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.