Bank account verification is a crucial procedure performed by a bank or other financial entity to ensure that a bank account is valid and is owned by the individual or entity who claims to own it. This process is an important part of many banking operations including the establishment of new accounts, setting up automatic bill payments, or facilitating funds transfers between different financial establishments. The verification of bank accounts serves a key purpose in promoting the security and safety of financial transactions. By verifying bank accounts, the possibilities of fraudulent activities such as identity theft and phishing scams can be greatly reduced. Additionally, it ensures that the funds being transferred are going to and coming from the correct bank accounts, hence avoiding potential costly errors. It safeguards both the consumer and the bank from possible fraud and makes sure that their money is being handled correctly. The bank account verification process kicks off when a transaction requiring verification is requested by the account holder or an external organization. This might be for setting up a regular deposit, authorizing a new payment recipient, or initiating a transfer of funds. The requester must then provide the necessary details for verification, which typically include the bank's routing number, the account number, and in certain cases, personal identifiers such as a Social Security number. Gathering this information is a critical step in ensuring that the verification process runs smoothly. Upon collecting the required information, the bank or financial institution will carry out the verification process. For example, in the case of micro-deposits, small sums of money are deposited into the account to be verified. The owner of the account must then confirm the precise amounts that were deposited, which confirms their access to and control over the account. Other methods might involve cross-referencing the provided information against the bank's own records or using the account holder's online banking credentials to instantly access the details of the account. Each method involves a systematic process to ensure the validity of the account in question. In this technique, small, random amounts (usually less than a dollar) are deposited into the account that needs to be verified by the institution conducting the verification. The account holder is then asked to confirm these amounts. This confirmation process provides evidence of their control over the account. Although this technique is reliable, it can take several business days to complete because of the waiting period for the deposits to clear, which can potentially slow down the entire verification process. This is a more contemporary technique for bank account verification that leverages the account holder's online banking credentials. The person owning the account provides their online banking username and password, which the verifying institution uses to log in and confirm the account details. This method is much quicker than the micro-deposit method, often completing in mere seconds. However, its efficiency is dependent on the account holder's willingness to share sensitive login information, which some may view as a potential security risk. A conventional method of bank account verification that involves the use of physical documents such as bank statements to prove the existence and ownership of an account. For this method to be successful, these documents must be official and current. This method, while reliable and secure, can be time-consuming, particularly if the necessary documents need to be sent through postal mail. By ensuring that an account indeed belongs to the person or organization claiming to own it, banks can effectively combat fraudulent activities like unauthorized transactions, scams, and identity theft. By reducing the risk of funds being sent to the wrong account, verification serves as a protective barrier for both the bank and the account holder, thereby securing the financial well-being of both parties. Beyond the prevention of fraud, bank account verification also enhances the security of financial transactions. By confirming the identities of the sender and receiver of a transaction, verification decreases the chances of errors or fraudulent transfers. This becomes even more significant when large sums of money are involved, or when new payees or direct deposit relationships are being established. Bank account verification is an effective tool for building trust between banks and their customers. When a bank takes the effort to verify accounts, it sends a message to its customers that it is committed to protecting their funds and personal information. This can lead to enhanced customer satisfaction, strengthen the relationship between the bank and its customers, and ultimately increase customer loyalty. Account verification also assists banks in staying compliant with financial regulations. Many jurisdictions require banks to verify accounts as a measure against money laundering, financing of terrorism, and other illegal activities. By conducting account verification, banks stay on the right side of these laws, avoiding penalties and sanctions that could result from non-compliance. A false positive is when a legitimate account is mistakenly marked as fraudulent, while a false negative is when a fraudulent account is incorrectly flagged as legitimate. Such errors can lead to unnecessary complications, delays, and potential financial losses. While these cases are relatively rare, their impact can be significant and, as such, they pose a considerable challenge to the account verification process. Account verification process might require the account holder to provide certain information or carry out specific actions, such as confirming the amounts of micro-deposits or providing online banking credentials. If a customer is unwilling or unable to comply, the verification process might be unsuccessful or significantly delayed. Therefore, effective communication and the provision of clear instructions to customers are essential components of a successful verification process. The process can also raise privacy concerns, especially with techniques like instant verification that require the sharing of sensitive information such as online banking credentials. Even though this information is typically managed securely and confidentially, the potential risk of misuse can deter some customers from choosing this method. Hence, maintaining strong data privacy standards is essential in assuaging these concerns and ensuring customer comfort and participation. There is no universal method or standard for account verification, leading to a diversity in the verification processes. These differences can potentially lead to confusion or complications for customers, particularly for those who have accounts with multiple banks. This highlights the need for banks to clearly communicate their specific verification processes and requirements to their customers to ensure a seamless verification process. Bank account verification is a critical process that ensures the validity and ownership of bank accounts, promoting security and reducing the risk of fraudulent activities. Verification methods include direct deposits and micro-deposits, instant verification, and paperwork verification. Each method has its advantages and limitations, such as speed, reliance on customer cooperation, and privacy concerns. The benefits of bank account verification are significant, including fraud prevention, enhanced transaction security, trust-building with customers, and regulatory compliance. However, limitations such as false positives and negatives, customer cooperation, privacy concerns, and inconsistent verification procedures across banks can pose challenges. Overall, bank account verification plays a crucial role in protecting the interests of both customers and financial institutions, ensuring the secure handling of funds and maintaining regulatory compliance.What Is Bank Account Verification?

How Bank Account Verification Works

Initial Request and Information Collection

Execution of Verification Process

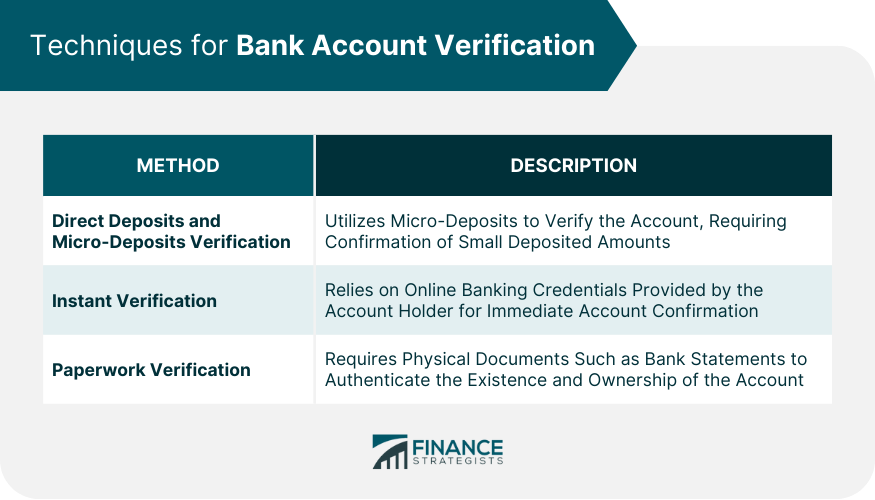

Techniques for Bank Account Verification

Direct Deposits and Micro-deposits Verification

Instant Verification

Paperwork Verification

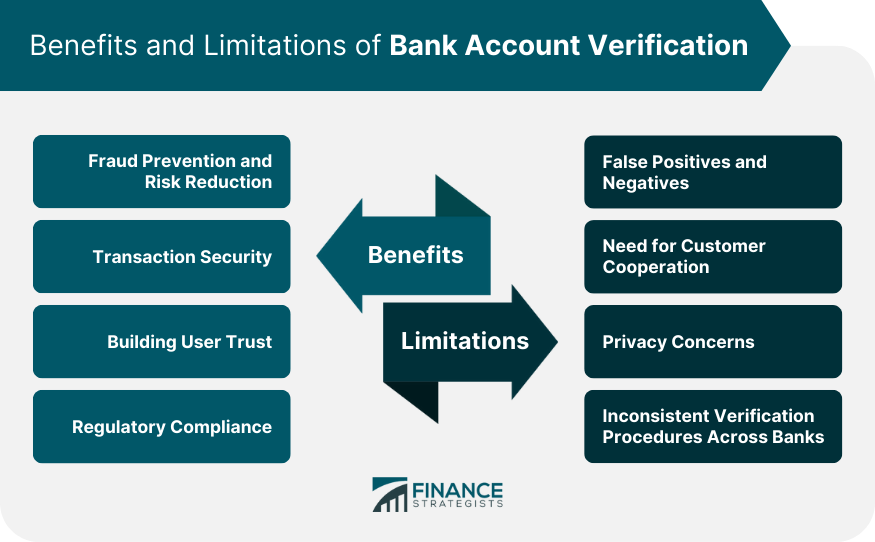

Benefits of Bank Account Verification

Fraud Prevention and Risk Reduction

Transaction Security

Building User Trust

Regulatory Compliance

Limitations of Bank Account Verification

False Positives and Negatives

Need for Customer Cooperation

Privacy Concerns

Inconsistent Verification Procedures Across Banks

Conclusion

Bank Account Verification FAQs

Bank account verification is the process of confirming the validity and ownership of a bank account to ensure it belongs to the claimed individual or entity.

Bank account verification is crucial for promoting transaction security, reducing the risk of fraud, preventing unauthorized transactions, and ensuring the accuracy of fund transfers.

Common methods include direct deposits and micro-deposits, instant verification using online banking credentials, and paperwork verification through physical documents like bank statements.

While instant verification using online banking credentials can be quick and efficient, it is important to ensure that the verifying institution handles the sensitive information securely to minimize potential risks.

Challenges include the potential for false positives or negatives, the need for customer cooperation in providing necessary information, privacy concerns regarding sensitive data sharing, and inconsistencies in verification procedures across different banks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.