Terminal value, or TV for short, is the expected value of a business or project beyond the forecast period--usually five years. It addresses the challenge of valuing a company's long-term potential when traditional projections might become unreliable. Since forecasting gets hazy as the time horizon increases, forecasting a company's cash flow or the value of a project becomes more difficult. Instead of attempting to wade into the unknown, analysts use financial models like Discounted Cash Flow (DCF) along with some baseline assumptions to ascertain Terminal Value. The estimation of Terminal Value heavily depends on prevailing economic conditions, such as inflation rates, interest rates, and overall macroeconomic stability. Economic fluctuations can significantly impact the long-term growth assumptions, affecting Terminal Value calculations. An economic downturn may result in lower growth projections, reducing Terminal Value, while a thriving economy could lead to more optimistic estimates. Terminal Value also hinges on the trajectory of the specific industry in which the company operates. Industry trends, technological advancements, and shifts in consumer preferences can shape a company's growth prospects beyond the forecasted period. A dynamic industry with evolving opportunities might yield a higher Terminal Value, whereas an industry facing disruption or stagnation could limit growth assumptions and subsequently, Terminal Value. Unique characteristics of the company, such as its competitive positioning, management quality, and operational efficiencies, play a vital role in Terminal Value determination. A company with a strong brand, solid market share, and effective cost management might sustain growth better, leading to a higher Terminal Value. Conversely, company-specific risks, such as legal issues or poor strategic decisions, could impact the ability to achieve projected growth, thereby affecting Terminal Value estimates. Two of the most commonly used methods to calculate a terminal value are the Perpetual Growth Model (Gordon Growth Model), which assumes a business or project will last into perpetuity, and the "Exit Approach," which assumes an end date to said business or project. The TV of a business or asset includes the value of all future cash flows, even those not part of the projection period, in an attempt to capture values that are typically difficult to predict in regular financial models. TV takes into account all possible changes in value expected to occur before the maturity date, such as interest rates, and it assumes a steady growth rate. However, due to the Time Value of Money, the TV must be translated into the present value in order to mean anything. The formula for Terminal Value is as follows: For example, John is a financial analyst and is asked to determine the TV of a project expected to grow perpetually by 2% annually. John estimates that the FCF (Free Cash Flow) in year six will be $22 million and calculates a discount rate of 12%. Using the information provided and the formula above, the equation for John would be as follows: $22 x ( 1 + 0.02 ) / ( 0.12 - 0.02 ) = $22 x 1.02 / 0.1 = $224.4 million. So, John calculates that the TV of the project is worth $224.4M today. Terminal Value holds a pivotal role in DCF analysis, as it captures the present value of a company's future cash flows beyond the projected period. Integrating the Terminal Value into DCF requires a careful selection of growth and discount rates, impacting the final valuation significantly. Terminal Value is often employed in CCA to estimate a company's value based on multiples from similar publicly traded companies. While the primary valuation is based on these multiples, incorporating Terminal Value is essential for a comprehensive valuation, considering the perpetuity of a company's operations. In PTA, where historical acquisition data is used for valuation, Terminal Value helps to bridge the valuation gap beyond the historical transaction period. It enables the estimation of a company's value in the context of potential future transactions, enhancing the accuracy of the valuation. Selecting the right growth and discount rates for Terminal Value calculations is critical. Growth rates should reflect long-term industry and company trends, while discount rates should account for the risk associated with the investment. Mismatched rates can lead to distorted valuations. Terminal Value assumes that a company's growth will stabilize over the long run. Thus, it's crucial to align Terminal Value assumptions with a realistic long-term vision for the company, ensuring that the projections are sustainable and coherent. Unrealistically high or low Terminal Value estimates can significantly impact overall valuation outcomes. It's vital to validate Terminal Value against factors like industry norms, company performance history, and broader economic conditions, ensuring that the calculated value is reasonable and justifiable within a reasonable range. Terminal Value (TV) serves as the estimated worth of a business or project beyond a defined projection period. This concept addresses the challenge of valuing long-term potential when traditional forecasts lose accuracy. Factors influencing TV include economic conditions, industry trends, and company-specific attributes, all shaping the reliability of growth assumptions. Calculating TV involves methods like the Perpetual Growth Model and the "Exit Approach," aiming to capture elusive values beyond the forecasted horizon. In diverse valuation methods like DCF analysis, CCA, and PTA, Terminal Value is crucial, demanding careful growth and discount rate analysis. When utilizing Terminal Value, it's essential to ensure consistency with long-term expectations and validate its reasonability against industry norms and company history. In essence, Terminal Value offers a crucial perspective on a business's enduring value, enhancing the accuracy and reliability of financial analyses.Terminal Value Definition

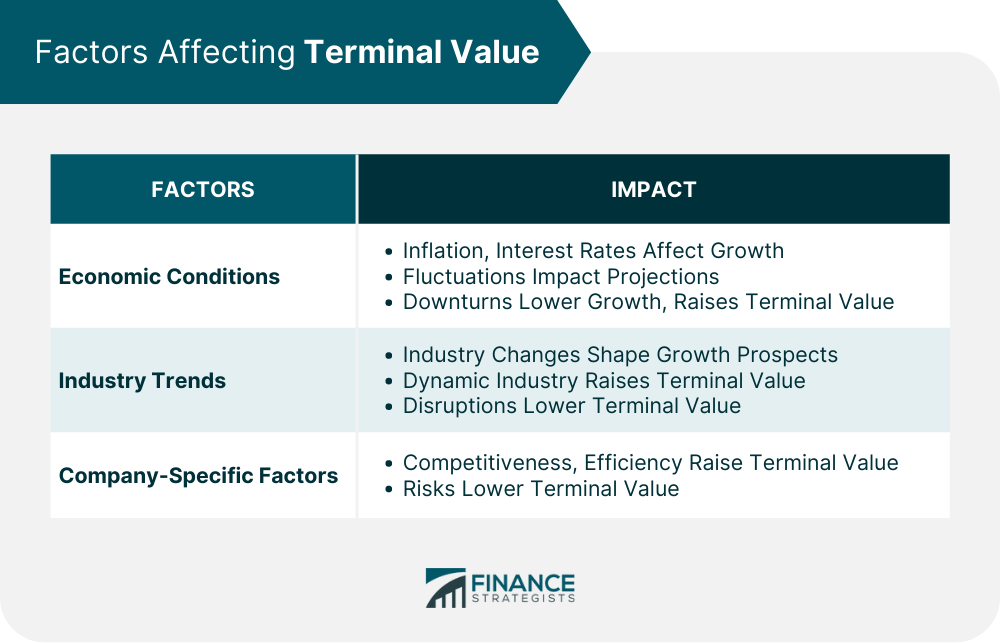

Factors Affecting Terminal Value

Economic Conditions

Industry Trends

Company-Specific Factors

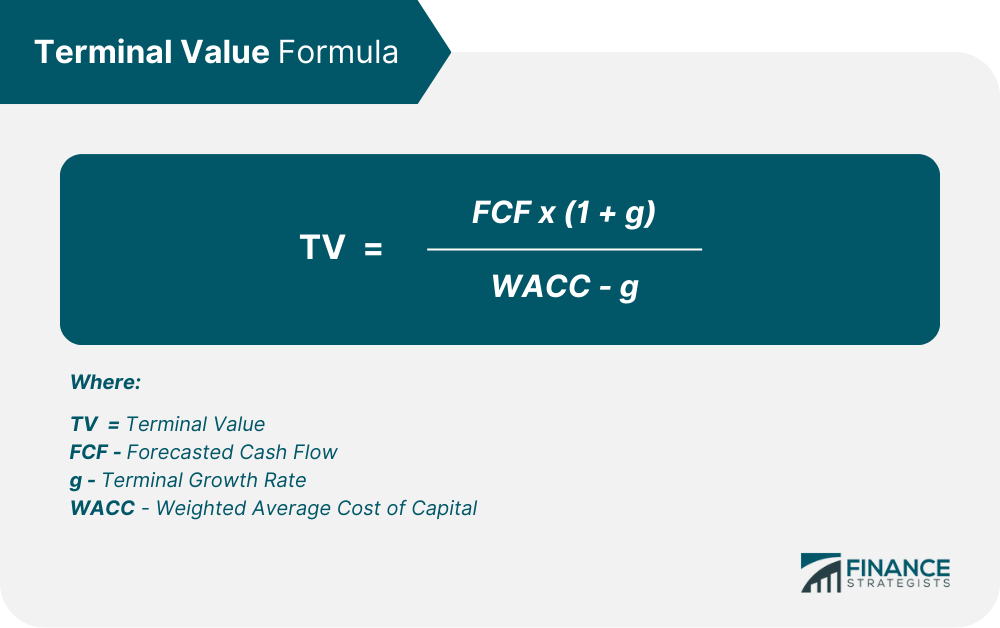

How to Calculate Terminal Value

Terminal Value Example

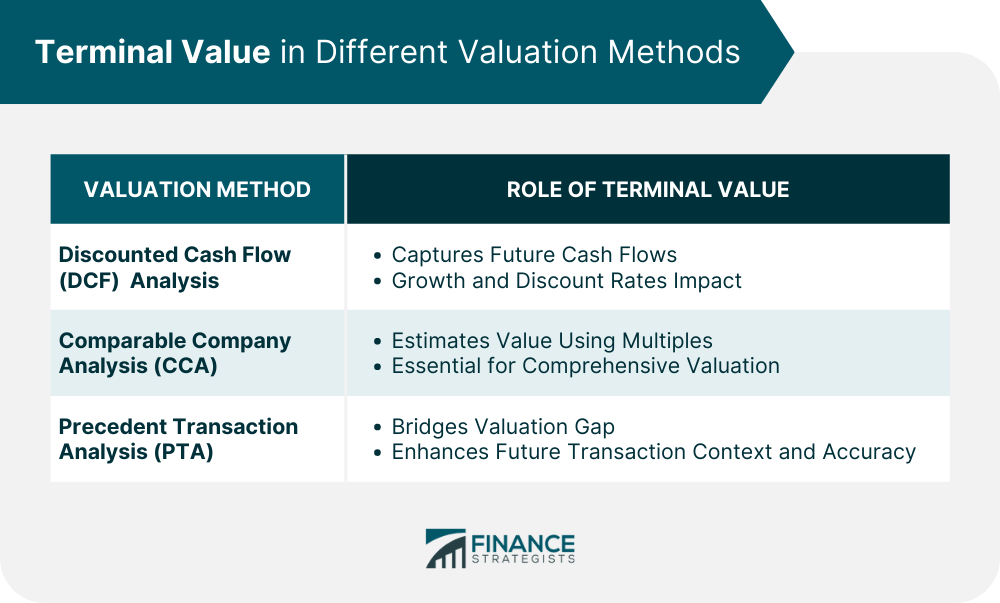

Terminal Value in Different Valuation Methods

Discounted Cash Flow (DCF) analysis

Comparable Company Analysis (CCA)

Precedent Transaction Analysis (PTA)

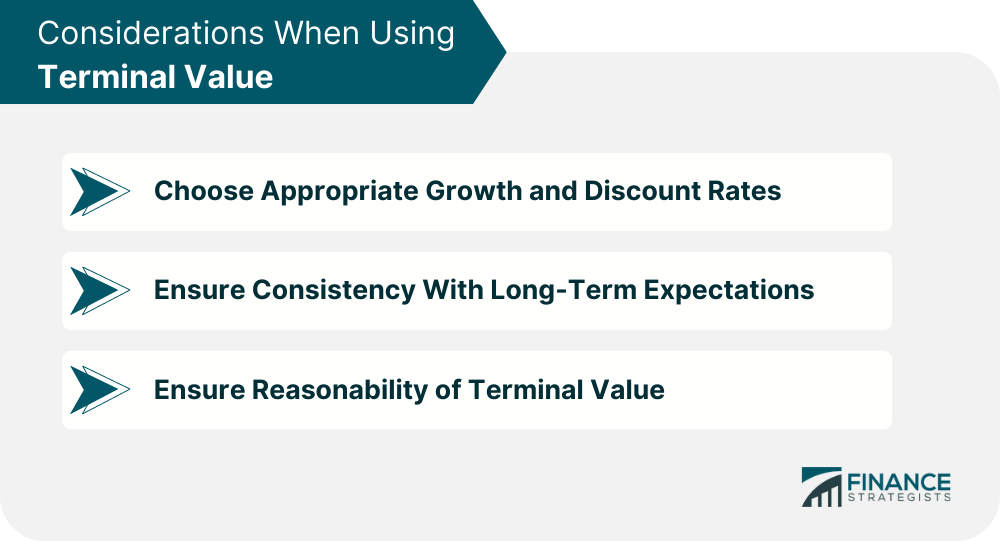

Considerations When Using Terminal Value

Choose Appropriate Growth and Discount Rates

Ensure Consistency With Long-Term Expectations

Ensure Reasonability of Terminal Value

Conclusion

Terminal Value (TV) FAQs

Terminal value, or TV for short, is the expected value of a business or project beyond the forecast period – usually five years.

Two of the most commonly used methods to calculate terminal value are the Perpetual Growth Model (Gordon Growth Model), which assumes a business or project will last into perpetuity, and the “Exit Approach,”which assumes an end date to said business or project.

Since forecasting gets hazy as the time horizon increases, determining a company’s cash flow or the value of a project becomes more difficult. Instead of wading into the unknown, analysts use financial models like Discounted Cash Flow (DCF) along with some baseline assumptions to ascertain Terminal Value.

TV takes into account all possible changes in value expected to occur before the maturity date, such as interest rates, and it assumes a steady growth rate.

Due to the Time Value of Money, the TV must be translated into the present value in order to mean anything.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.