Sudden wealth syndrome (SWS) is a term used to describe the emotional, psychological, and behavioral challenges that individuals and families may experience after suddenly acquiring a substantial amount of wealth. SWS often results from unexpected financial windfalls, such as lottery winnings, inheritance, or the sale of a successful business. There are various ways in which individuals can experience a sudden increase in wealth, including: 1. Lottery winnings 2. Inheritance 3. Insurance payouts 4. Business sales or IPOs 5. Legal settlements Sudden wealth can have a significant impact on individuals and their families, leading to emotional, psychological, and behavioral changes that may affect their overall well-being, relationships, and financial stability.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Navigating Sudden Wealth Syndrome requires a balanced approach to avoid emotional stress and financial pitfalls. Build a team of professionals, such as a financial advisor, tax expert, and mental health counselor. Focus on setting financial goals, creating a budget, and making informed investment choices to ensure lasting security. Resist the urge for impulsive spending and decisions; thoughtful planning is key to managing your wealth effectively. Let's start developing a personalized plan for your newfound wealth. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Individuals experiencing SWS may feel anxious about their newfound wealth and the potential consequences, such as changes in their relationships or fear of losing the money. Feelings of guilt may arise as individuals struggle with the idea of having more money than others, particularly friends and family members who may be less fortunate. The fear of losing wealth can lead to stress, anxiety, and even paranoia, as individuals become preoccupied with the potential loss of their newfound financial security. Sudden wealth can cause an identity crisis, as individuals grapple with their self-worth and the changes in their lifestyle and social status. Individuals experiencing SWS may be prone to overspending and financial mismanagement, as they struggle to adjust to their new financial situation and may lack the necessary financial knowledge and experience. SWS can lead to social isolation, as individuals may withdraw from their previous social circles, fearing that others may take advantage of their wealth or judge them for their sudden financial success. Impulsive decision-making, particularly with regards to financial matters, can be a common symptom of SWS, as individuals may feel overwhelmed by their new financial responsibilities and make rash decisions without fully considering the consequences. Sudden wealth can strain relationships with friends and family, as individuals may feel pressured to share their wealth or may experience jealousy and resentment from others. A lack of financial literacy and experience can exacerbate the challenges associated with SWS, as individuals may be ill-equipped to manage their newfound wealth effectively. Pressure from friends, family, and society to share wealth or conform to certain lifestyle expectations can contribute to the emotional and psychological difficulties experienced by individuals with SWS. Unrealistic expectations about the impact of sudden wealth on one's happiness and well-being can also contribute to SWS, as individuals may struggle to adjust to the realities of their new financial situation. The difficulty of adjusting to a new lifestyle, including changes in social status and relationships, can exacerbate the emotional and psychological challenges associated with SWS. Financial therapy and counseling can help individuals experiencing SWS to address their emotional and psychological challenges and develop healthy coping strategies. Support groups can provide individuals with a safe space to share their experiences and connect with others who have experienced sudden wealth, fostering a sense of understanding and community. Practicing mindfulness and stress management techniques, such as meditation, yoga, and deep breathing exercises, can help individuals manage their anxiety and stress related to sudden wealth. Consulting with financial advisors can help individuals develop a comprehensive financial plan that addresses their short-term and long-term goals and ensures the responsible management of their newfound wealth. Creating a financial plan can help individuals manage their wealth effectively, providing a roadmap for saving, investing, and spending that aligns with their values and objectives. Establishing a budget can help individuals control their spending and avoid the pitfalls of financial mismanagement associated with SWS. Investing wisely, with the guidance of financial professionals, can help individuals grow and preserve their wealth while minimizing risks. Maintaining existing relationships can provide a sense of stability and support during the transition to newfound wealth, helping individuals cope with the emotional and psychological challenges associated with SWS. Setting boundaries with friends and family can help individuals manage the expectations and pressures associated with sudden wealth while maintaining healthy relationships. Connecting with others who have experienced sudden wealth can provide valuable insights, support, and camaraderie, helping individuals navigate the unique challenges of SWS. Financial education and preparation can help individuals develop the skills and knowledge necessary to manage their wealth effectively, reducing the likelihood of experiencing SWS. Fostering a healthy mindset towards wealth, focusing on values, purpose, and personal growth, can help individuals maintain a balanced perspective and avoid the emotional and psychological pitfalls of SWS. Cultivating a sense of purpose and values can provide a grounding force for individuals experiencing sudden wealth, helping them maintain perspective and prioritize what is truly important in their lives. Sudden wealth syndrome is a complex phenomenon that can have significant emotional, psychological, and behavioral consequences for individuals and their families. By understanding the implications of SWS, individuals can better prepare for and manage the challenges associated with sudden wealth. Addressing the emotional, psychological, and financial aspects of sudden wealth is essential for individuals to successfully navigate the challenges of SWS and maintain their well-being, relationships, and financial stability. Implementing coping strategies, such as seeking emotional and psychological support, developing a comprehensive financial plan, and fostering healthy relationships and social connections, can help individuals manage the challenges of SWS. Preventative measures, including financial education and developing a healthy mindset towards wealth, can further reduce the likelihood of experiencing sudden wealth syndrome.What Is Sudden Wealth Syndrome?

Hear It From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

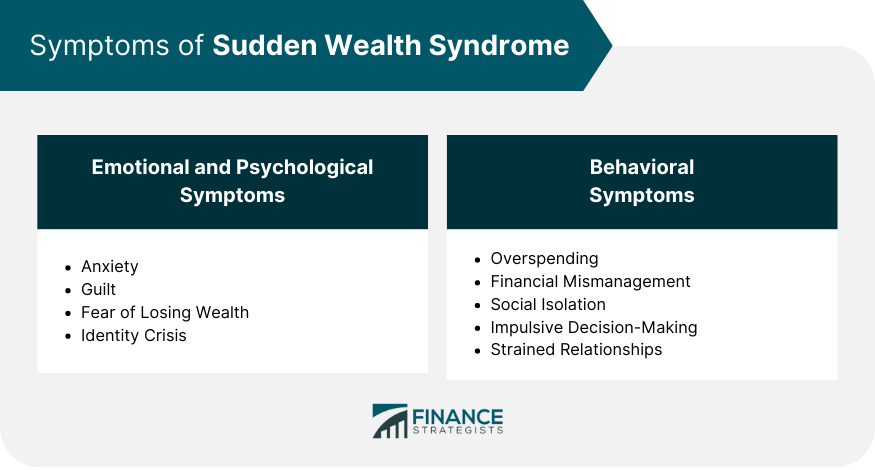

Symptoms of Sudden Wealth Syndrome

Emotional and Psychological Symptoms

Anxiety

Guilt

Fear of Losing Wealth

Identity Crisis

Behavioral Symptoms

Overspending and Financial Mismanagement

Social Isolation

Impulsive Decision-Making

Strained Relationships

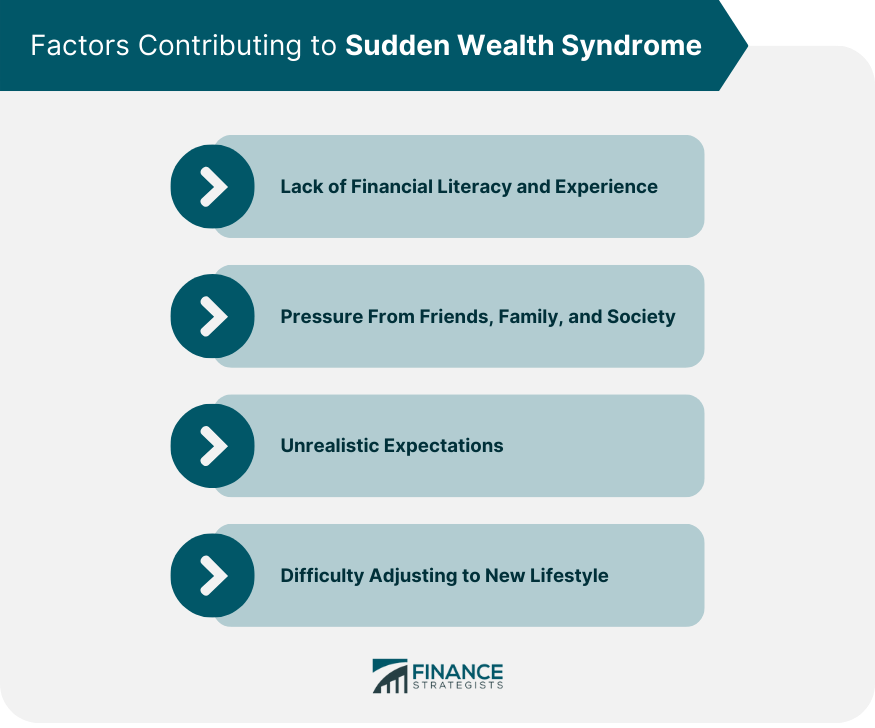

Factors Contributing to Sudden Wealth Syndrome

Lack of Financial Literacy and Experience

Pressure From Friends, Family, and Society

Unrealistic Expectations

Difficulty Adjusting to New Lifestyle

Coping Strategies for Sudden Wealth Syndrome

Emotional and Psychological Support

Therapy and Counseling

Support Groups

Mindfulness and Stress Management Techniques

Financial Planning and Management

Working With Financial Advisors

Developing a Financial Plan

Establishing a Budget

Investing Wisely

Building Healthy Relationships and Social Connections

Maintaining Existing Relationships

Establishing Boundaries

Seeking New Connections With Similar Experiences

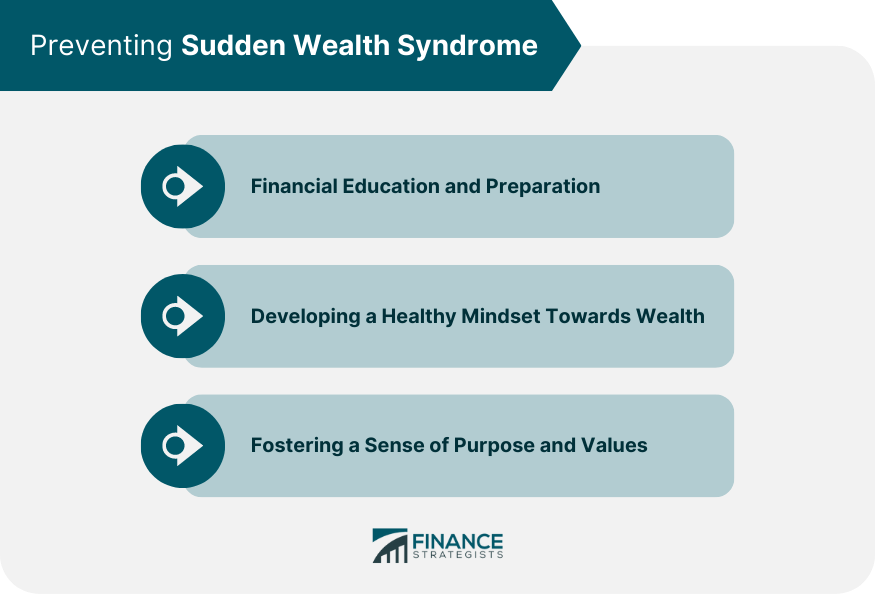

Preventing Sudden Wealth Syndrome

Financial Education and Preparation

Developing a Healthy Mindset Towards Wealth

Fostering a Sense of Purpose and Values

Conclusion

Sudden Wealth Syndrome FAQs

Sudden wealth syndrome is a psychological condition that some people experience when they come into a large amount of money quickly, such as through inheritance, lottery winnings, or a legal settlement. It can cause a range of emotional and behavioral issues, including anxiety, depression, and overspending.

Symptoms of sudden wealth syndrome may include anxiety, depression, guilt, loss of identity, feelings of isolation, difficulty making decisions, and overspending. People may also experience relationship problems with family and friends, as well as difficulty trusting others.

Managing sudden wealth syndrome typically involves working with a financial advisor, therapist, and other professionals to develop a plan for managing the money and adjusting to the new financial situation. This may include developing a budget, setting financial goals, creating a long-term financial plan, and addressing emotional issues that may arise.

Anyone who comes into a large amount of money quickly may be at risk for sudden wealth syndrome, but it is more common among those who have not had experience managing large sums of money before. It may also be more likely to occur in individuals who have a history of mental health issues, substance abuse, or other psychological conditions.

Preventing sudden wealth syndrome involves taking steps to prepare for the possibility of coming into a large amount of money, such as creating a financial plan and discussing it with a financial advisor. It may also be helpful to develop a support network of friends, family, and professionals who can provide guidance and support during the transition.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.