Restricted stock refers to company shares granted to employees or executives as part of their compensation package, with certain restrictions attached to them. These restrictions typically involve vesting periods or performance conditions that must be met before the recipient can freely sell or transfer the shares. Restricted stock is designed to incentivize employees to remain with the company and contribute to its long-term success. The primary purpose of restricted stock is to align the interests of employees and shareholders by tying a portion of an employee's compensation to the performance of the company's stock. This can encourage employees to focus on the company's long-term success and motivate them to work harder to increase the value of the company's shares, as their financial rewards are directly tied to the stock's performance. It is essential for both employees and employers to understand the mechanics, benefits, and risks associated with restricted stock. This knowledge can help them make informed decisions about whether to include restricted stock in a compensation package and how to structure the terms of the grant to maximize its effectiveness as an incentive tool. Time-based restricted stock grants are subject to vesting schedules based on the passage of time. Employees must remain with the company for a specified period before they can fully own the shares. This type of restricted stock is designed to encourage employee retention and long-term commitment to the company. Performance-based restricted stock grants are tied to the achievement of specific performance targets, such as revenue growth, earnings per share, or stock price appreciation. Employees only receive the shares if the company meets these predetermined goals. This type of restricted stock can incentivize employees to focus on achieving the company's strategic objectives and drive its financial success. Hybrid restricted stock grants combine elements of both time-based and performance-based grants. The shares may be subject to both a vesting schedule and the achievement of performance targets. This dual approach can encourage employee retention while also promoting the pursuit of the company's strategic goals. Companies typically grant restricted stock to key employees, executives, and sometimes board members as a form of long-term incentive. The decision to grant restricted stock and the specific terms of the grant are generally determined by the company's board of directors or compensation committee. The vesting schedule for restricted stock grants specifies the time period during which the recipient must remain employed with the company to fully own the shares. Vesting schedules can vary widely, with some grants vesting over several years, while others may require the employee to remain with the company for a decade or more. The vesting schedule is an essential component of a restricted stock grant, as it influences the degree to which the shares serve as an effective retention and performance incentive. The share price for restricted stock grants is typically based on the market value of the company's stock at the time of the grant. Some companies may also use an average stock price over a specified period to determine the value of the restricted shares. The chosen share price can impact the perceived value of the grant for the recipient and may influence their behavior and decision-making as an employee or executive. Restricted stock grants can have significant tax implications for both the recipient and the granting company. In many jurisdictions, the recipient is subject to income tax on the value of the shares at the time they vest, while the company may be able to claim a tax deduction for the value of the granted shares. Both parties should consult with tax professionals to understand the specific tax consequences of a restricted stock grant in their jurisdiction. Restricted stock can help align the interests of employees and shareholders, as the value of the shares granted to employees is directly tied to the company's stock performance. This encourages employees to focus on the company's long-term success, as their financial rewards are dependent on the stock's performance. By requiring employees to remain with the company for a specified period before their restricted stock fully vests, these grants can serve as an effective retention tool. Employees are incentivized to stay with the company to realize the full value of their restricted stock, which can reduce employee turnover and help the company retain key talent. Restricted stock grants can increase employee motivation by providing a tangible financial reward tied to the company's success. Employees who hold restricted stock may feel a greater sense of ownership and responsibility for the company's performance, leading them to work harder and contribute more effectively to the company's strategic objectives. Compared to stock options, restricted stock grants can result in less dilution for existing shareholders. This is because restricted stock grants do not require the issuance of new shares when they vest, as stock options do when they are exercised. As a result, restricted stock grants can be a more shareholder-friendly form of equity-based compensation. Restricted stock grants expose employees to market risk, as the value of the shares is dependent on the company's stock price. If the stock price declines, the value of the employee's restricted stock may also decrease, reducing the grant's effectiveness as a financial incentive. Employees who leave the company before their restricted stock fully vests risk forfeiting the unvested portion of their grant. This can result in a loss of potential financial rewards for the employee and may be particularly detrimental if the employee leaves the company for reasons beyond their control, such as illness or family circumstances. As mentioned earlier, restricted stock grants can have significant tax implications for both the employee and the company. Employees should be aware of the potential tax consequences of their restricted stock grants and plan accordingly to avoid unexpected financial burdens. Restricted stock refers to company shares granted to employees or executives as part of their compensation package, with certain restrictions attached to them. These restrictions typically involve vesting periods or performance conditions that must be met before the recipient can freely sell or transfer the shares. There are several types of restricted stock grants, including time-based, performance-based, and hybrid restricted stock. Each type serves a different purpose and offers unique benefits and risks for both the employee and the company. Restricted stock grants can provide numerous benefits, such as aligning employee and shareholder interests, promoting employee retention, increasing motivation, and reducing dilution. However, they also come with risks, including market risk, forfeiture risk, and tax risk. Both employees and employers should carefully consider the benefits and risks associated with restricted stock grants when deciding whether to include them in a compensation package.What Is a Restricted Stock?

Purpose of Restricted Stocks

Importance of Understanding Restricted Stocks

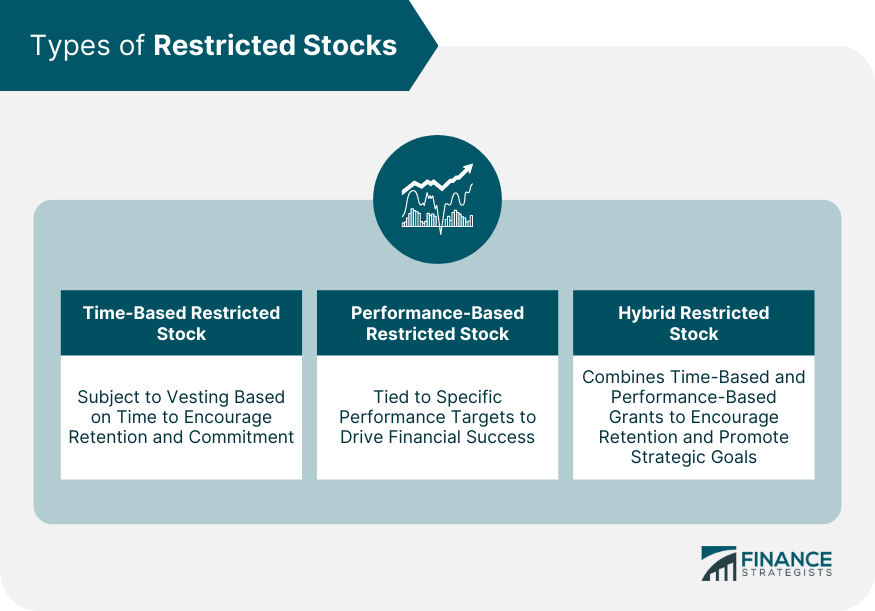

Types of Restricted Stocks

Time-Based Restricted Stock

Performance-Based Restricted Stock

Hybrid Restricted Stock

Granting Restricted Stocks

Eligibility

Vesting Schedule

Share Price Determination

Tax Implications

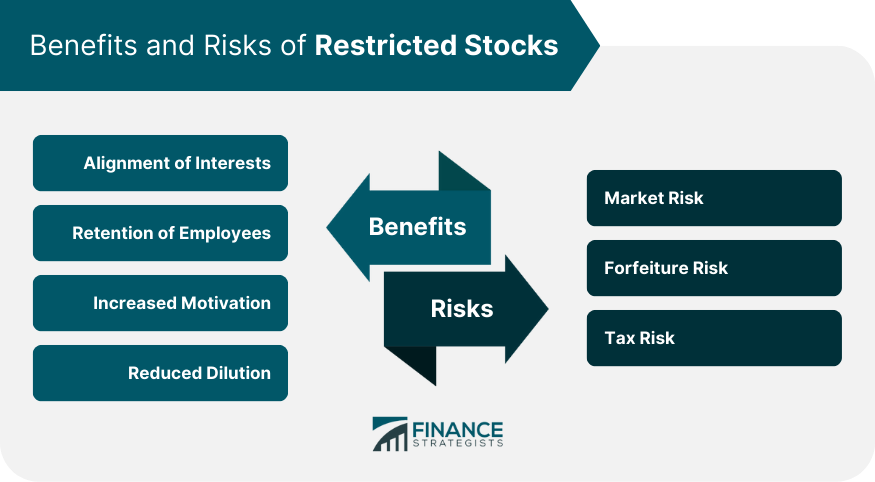

Benefits of Restricted Stocks

Alignment of Interests

Retention of Employees

Increased Motivation

Reduced Dilution

Risks of Restricted Stocks

Market Risk

Forfeiture Risk

Tax Risk

Final Thoughts

Restricted Stock FAQs

Restricted Stock is a type of equity compensation where shares are granted to employees, subject to certain restrictions.

Restricted Stock aligns employees' interests with those of the company, motivates them to stay, and reduces shareholder dilution.

Restricted Stock comes with market risk, forfeiture risk, and tax risk, which can impact the value of the shares.

The three main types of Restricted Stock are time-based, performance-based, and hybrid, each with its own vesting requirements.

The value of Restricted Stock is taxed as ordinary income when it vests, and employees may be eligible for a tax deduction in certain cases.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.