Naked shorting, or naked short selling, refers to the practice of selling securities that the seller does not own and has not borrowed. This controversial method differs from traditional short selling, where an investor borrows shares and sells them in anticipation of buying them back at a lower price. The purpose of naked shorting, like traditional short selling, is to profit from an expected decrease in the price of a security. However, the practice of naked shorting can artificially inflate the supply of security in the market, leading to potential market manipulation and distortions. It's a high-risk strategy that has sparked regulatory scrutiny and is illegal in many jurisdictions, including the United States and the European Union, due to its potential for damaging market integrity and causing a significant financial loss for investors. Naked shorting operates under the same basic premise as traditional short selling. The difference is that in traditional short selling, the seller borrows the security to sell it, expecting the price to drop before buying it back at a lower price and returning it to the lender. In contrast, in naked shorting, the seller doesn't borrow the security before selling it. This means they are selling a security they do not own, have not borrowed, and potentially, one that does not even exist. This can lead to an artificial increase in the supply of security, which can manipulate market prices. While both practices involve betting against a security's price, the key difference is the absence of borrowing in naked shorting. This creates higher risks and potential market manipulation. With traditional short selling, there is a cap on the number of securities that can be sold short, equivalent to the number of securities available for borrowing. Naked shorting, on the other hand, theoretically allows for unlimited short sales. In the United States, the Securities and Exchange Commission (SEC) has rules in place to regulate short selling, including naked shorting. Under the Regulation SHO, naked short selling is largely prohibited. Similarly, in the European Union, naked shorting has been under regulatory scrutiny. The European Securities and Markets Authority (ESMA) introduced stringent rules against naked shorting as part of the Short Selling Regulation in 2012. Some financial experts and market observers argue that naked short-selling played a role in exacerbating the 2008 financial crisis. They contend that aggressive short selling, including naked short selling, puts downward pressure on the shares of banks and other financial institutions, contributing to the market's destabilization. Naked shorting continues to be a hotly debated topic, especially with the rise of retail investing. Notably, the GameStop trading frenzy in early 2021 sparked fresh discussions about market manipulation, including potential naked short selling. Naked shorting can distort the market by artificially increasing the supply of a security, which can lead to a drop in its price. This can harm investors who hold long positions in security. Companies can also be negatively impacted by naked short selling, especially smaller public companies that can be more susceptible to stock price manipulation. A sudden and unexplained drop in a company's stock price can trigger panic selling, further depressing the price. On a larger scale, rampant naked short-selling can undermine confidence in the stock market. This can potentially lead to decreased market participation, negatively affecting liquidity and overall market health. Detecting naked shorting is challenging due to the complex nature of trading systems and regulations. However, a sudden increase in the number of a company's shares sold short, coupled with an unexplained drop in its stock price, could be an indicator. Regulatory bodies like the SEC monitor and investigate unusual market activities for signs of illegal practices, including naked short selling. Additionally, some market participants use sophisticated algorithms to detect possible instances of naked shorting. The SEC has implemented regulations, like the Regulation SHO, to curb naked short selling. These rules require brokers to locate security for borrowing before they can facilitate a short sale. Many other regulatory bodies worldwide, such as ESMA in the European Union, have implemented rules and regulations against naked shorting to prevent potential market manipulation. Investors can protect themselves by staying informed about the companies they invest in and keeping an eye out for unusual market activity. Using limit orders instead of market orders can also prevent buying shares that have been naked short-sold. Companies can employ strategies like issuing registered shares, which must be registered before they can be traded. They can also keep track of their shares outstanding and communicate any discrepancies to their shareholders and the public. Blockchain technology, with its ability to provide a transparent and immutable record of transactions, can play a significant role in preventing naked short-selling. It could enable real-time tracking of securities lending and short selling, making it impossible to sell a security that doesn't exist. As trading becomes more technologically advanced, new methods for detecting and preventing illegal practices like naked short selling will continue to emerge. Machine learning algorithms, real-time tracking systems, and decentralized trading platforms are just some of the advancements that could reshape the trading landscape and curb illegal practices. Naked shorting raises ethical questions, as it involves selling something that doesn't exist. Critics argue that it enables market manipulation, creating false signals about a company's stock and misleading investors. The potential for market manipulation is perhaps the most significant criticism of naked shorting. By artificially increasing the supply of a security, naked short sellers can drive down its price, leading to potential market distortions and investor losses. Naked shorting is a contentious and risky practice that has the potential to distort markets and harm both investors and companies. Differing fundamentally from traditional short selling by bypassing the step of borrowing securities, it can artificially amplify the supply of securities and manipulate market prices. Though it's largely prohibited in many jurisdictions due to its potential for damage to market integrity and investor losses, detection remains challenging. Nevertheless, technological advancements like blockchain and machine learning algorithms hold promise in curbing this practice. Moreover, regulatory bodies continue to monitor and implement strategies against market manipulation. In the face of these advancements and efforts, the trading landscape is poised to evolve, hopefully creating a more secure environment for investors and companies alike.Naked Shorting Overview

How Naked Shorting Works

Differences Between Naked Shorting and Traditional Short Selling

Controversies Around Naked Shorting

Legal Status in Different Countries

Naked Shorting in the United States

Naked Shorting in the European Union

Role of Naked Shorting in Financial Crises

The 2008 Financial Crisis

Recent Controversies

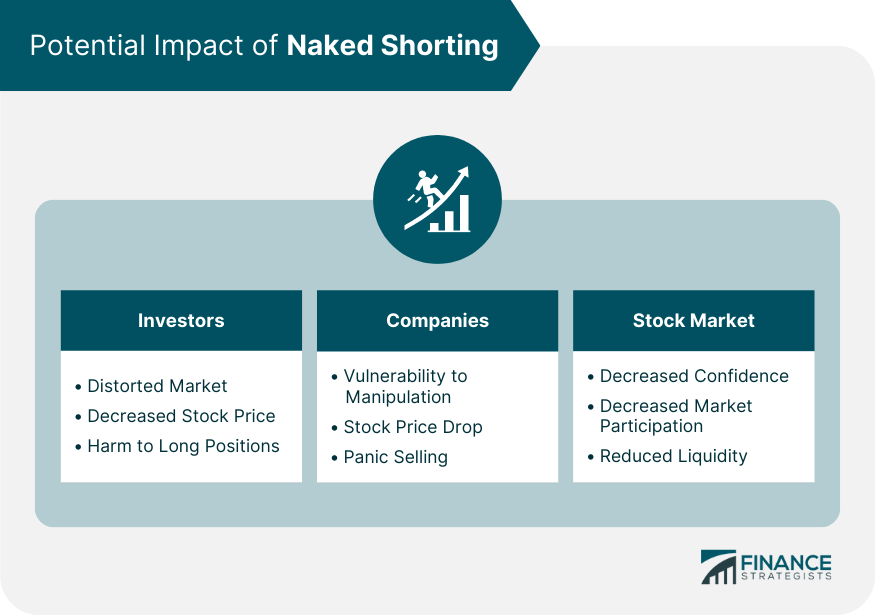

Potential Impact of Naked Shorting

Investors

Companies

Stock Market

Detection of Naked Shorting

Indicators of Naked Shorting

Monitoring and Reporting

Regulations Regarding Naked Shorting

US Securities and Exchange Commission (SEC) Regulations

Other Regulatory Bodies and Their Stances

Strategies for Preventing Naked Shorting

Investors

Companies

Naked Shorting and Technological Advances

Role of Blockchain in Preventing Naked Shorting

Future of Trading and Impact on Naked Shorting

Criticisms of Naked Shorting

Ethical Considerations

Potential for Market Manipulation

Final Thoughts

Naked Shorting FAQs

Naked shorting is a controversial practice in securities trading where a seller sells a security they do not own, have not borrowed, and sometimes, one that does not even exist. Unlike traditional short selling, where the seller borrows the security before selling, naked shorting bypasses this borrowing step.

The legality of naked shorting varies by jurisdiction. In the United States, for example, the practice is largely prohibited under the Regulation SHO by the Securities and Exchange Commission (SEC). Similarly, in the European Union, naked shorting is regulated under the Short Selling Regulation by the European Securities and Markets Authority (ESMA).

Naked shorting can distort the market by artificially increasing the supply of a security, potentially leading to a drop in its price. This can harm investors holding long positions in the security. Companies, especially smaller public companies more susceptible to stock price manipulation, can also be negatively affected by sudden and unexplained drops in their stock price.

Detecting naked shorting is complex due to intricate trading systems and regulations. However, potential indicators could be a sudden increase in the number of a company's shares sold short combined with an unexplained drop in its stock price. Regulatory bodies and market participants often use sophisticated algorithms to detect possible instances of naked shorting.

Technological advances like blockchain technology, machine learning algorithms, real-time tracking systems, and decentralized trading platforms can play a significant role in preventing naked shorting. For example, blockchain technology can provide a transparent and immutable record of transactions, making it impossible to sell a security that doesn't exist.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.