Overallotment is a provision that allows underwriters in a securities offering, usually an Initial Public Offering (IPO), to sell more shares than initially planned if demand exceeds supply. Typically, the additional shares amount to 15% of the original offering. Overallotment helps stabilize the stock's price post-IPO by accommodating higher-than-expected demand and reducing volatility. It can also provide an additional profit to underwriters if the share price rises post-IPO. This concept is closely tied to the green shoe option, a clause allowing this over-allotment. Overallotment is a crucial tool in securities underwriting, demonstrating the dynamic nature of financial markets. The additional shares in overallotment come into play when the demand for a new issue exceeds the initial offering. This happens when a stock is particularly popular among investors. Instead of capping the number of shares at the original amount, underwriters can issue additional shares to meet this demand. The overallotment option serves multiple purposes. Firstly, it allows underwriters to meet excess demand for a new issue. Secondly, it provides a buffer against market volatility and price instability. Lastly, overallotment can potentially lead to additional profits for underwriters, should the stock's price increase after the public offering. Overallotment involves the intricate workings of underwriters, issuers, and the broader financial market. At its core, overallotment involves issuing more shares than initially planned. Underwriters exercise this option when the demand for a new issue exceeds the supply. The additional shares usually come from the company issuing the stock and are limited to a certain percentage of the original offering. The green shoe option, officially known as the over-allotment option, grant the underwriter the right to sell investors more shares than originally planned by the issuer. Named after the Green Shoe Manufacturing Company (now Stride Rite Corporation), the first to use this provision, the green shoe option is a legal mechanism that allows overallotment to take place. The green shoe option is closely tied to overallotment. When underwriters foresee higher demand for a new issue, they exercise the green shoe option. This allows them to sell additional shares, typically up to 15% more than the original number. If the stock price rises post-IPO, underwriters can buy back the additional shares at the lower IPO price, making a profit from the price difference. Underwriters plays a crucial role in overallotment. Their primary responsibility is to ensure that the new issue is fully subscribed. They bear the risk of the offering and stand to profit from successful underwriting. The economic implications of overallotment stretch beyond the entities directly involved in a public offering. Overallotment aids in stabilizing stock prices after a public offering. By meeting excess demand, underwriters help avoid a sudden drop in share prices due to a supply-demand mismatch. In the event of downward pressure on the share price post-IPO, underwriters can buy back the additional shares at the IPO price, which effectively puts a floor under the share price and helps prevent a significant price decline. When the stock price increases after the IPO, underwriters have the opportunity to buy back the additional shares at the lower IPO price, making a profit from the price difference. Despite its benefits, overallotment comes with a few limitations and risks. Regulatory restrictions cap the percentage of additional shares that can be issued through overallotment. In the US, for example, the Securities and Exchange Commission (SEC) limits it to 15% of the original offering. Underwriters bear the risk of the stock price not falling below the IPO price, making it impossible to buy back shares at a lower price. This could potentially lead to losses if the underwriters have already sold the over-allotted shares at a lower price. While overallotment offers advantages, it also risks diluting the shares of existing shareholders. By introducing more shares into the market, the ownership percentage of existing shareholders reduces. The practice and impact of overallotment vary across different markets. Different countries have different regulations and practices around overallotment. For instance, while the US limits overallotment to 15% of the original offering, some countries might have higher or lower caps. Market conditions significantly influences the use of overallotment. In bullish markets, the demand for new issues tends to be high, increasing the likelihood of overallotment. On the other hand, in bearish markets, overallotment may be less common due to lower demand for new issues. Overallotment, an instrument in public offerings, provides underwriters the ability to issue up to 15% more shares than initially declared. This mechanism is exercised when there's higher-than-expected demand for a new issue, enabling underwriters to meet this excess demand, thereby stabilizing stock prices. Integral to the functioning of overallotment is the green shoe option, granting underwriters the right to sell more shares than initially planned by the issuer. However, despite its distinct advantages, overallotment comes with potential risks and limitations. Regulatory restrictions cap the number of additional shares, and underwriters bear the risk of the stock price not falling below the IPO price. Furthermore, overallotment can lead to share dilution, diminishing the ownership percentage of existing shareholders. Despite these challenges, overallotment remains a critical part of securities underwriting, illustrating the complexity and sophistication of financial markets.Definition of Overallotment

Concept of Additional Shares

Purpose and Benefits of Overallotment

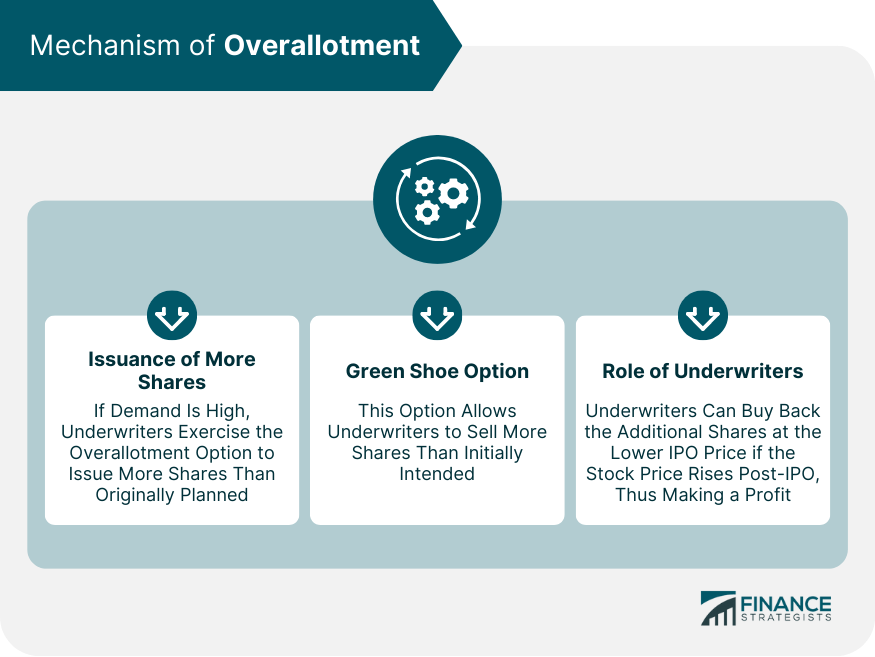

Mechanism of Overallotment

Issuance of More Shares Than Initially Planned

Green Shoe Option – Overview and Purpose

How a Green Shoe Option Works With Overallotment

Role of Underwriters

Economic Implications of Overallotment

Stabilization of Stock Prices

Protection Against Downward Pressure on Share Prices

Profit Opportunity for Underwriters

Limitations and Risks of Overallotment

Regulatory Restrictions

Risk of Stock Prices Not Falling

Overallotment vs Dilution

Overallotment in Different Markets

Comparison of Overallotment Practices in Different Countries

Impact of Market Conditions on the Use of Overallotment

The Bottom Line

Overallotment FAQs

An overallotment is an option that allows underwriters to issue up to 15% more shares than originally planned during a public offering. This occurs when the demand for shares exceeds the initial supply, helping stabilize stock prices and potentially yield additional profits for underwriters.

Underwriters play a crucial role in overallotment. They predict the demand for the new issue and decide whether to exercise the overallotment option. If the stock price rises post-IPO, underwriters can buy back the extra shares at the lower IPO price, thus making a profit.

Overallotment can help stabilize the stock price after a public offering. By fulfilling excess demand, underwriters can prevent a sudden drop in share prices due to a supply-demand mismatch. Additionally, overallotment provides a buffer against potential downward pressure on the share price.

The green shoe option, also known as the over-allotment option, is closely tied to overallotment. This option gives underwriters the right to sell investors more shares than originally planned by the issuer. When underwriters anticipate high demand for a new issue, they can exercise the green shoe option, allowing them to sell additional shares.

While overallotment offers several advantages, it also has its risks. Regulatory restrictions limit the number of additional shares that can be issued, and underwriters bear the risk of the stock price not falling below the IPO price. Also, overallotment might dilute the shares of existing shareholders, as the introduction of more shares into the market reduces their ownership percentage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.