The Depository Trust Company (DTC) is a crucial entity in the financial industry, offering services such as securities settlement, safekeeping, and asset servicing. It was established in 1973 as a subsidiary of the Depository Trust & Clearing Corporation (DTCC), the largest securities depository and clearing corporation worldwide. Acting as a central securities depository (CSD), DTC securely holds and manages securities on behalf of its participants, streamlining post-trade processes and reducing risks. Its creation was prompted by the paperwork crisis that plagued Wall Street in the late 1960s and early 1970s, caused by a surge in trading volume resulting in extensive backlogs of physical securities certificates and paperwork. DTC was formed to address these challenges by introducing a centralized system for electronic safekeeping and transfer of securities, improving efficiency and speeding up the clearing and settlement process. DTC operates under the umbrella of DTCC and is subject to regulatory oversight and compliance requirements. Its ownership and governance structure ensures that it remains a trusted and neutral party in the financial industry. DTC is owned by its participants, which include major banks, broker-dealers, and other financial institutions. Its Board of Directors is composed of representatives from its participants and independent directors, ensuring that it operates in the best interests of the market and maintains a high level of transparency and accountability. In addition to DTC, DTCC has several other subsidiaries and related entities, including the National Securities Clearing Corporation (NSCC), the Fixed Income Clearing Corporation (FICC), and DTCC Solutions, which provide a range of clearing, settlement, and information services. DTC is a registered clearing agency with the Securities and Exchange Commission (SEC) and is subject to regulatory oversight by the SEC, the Federal Reserve, and other regulatory bodies. This oversight ensures that DTC maintains the highest standards of operational and financial integrity and risk management. DTC offers its participants a wide range of services, including asset, settlement, global tax, underwriting, and repo services. These services enable market participants to manage and settle their securities transactions efficiently and securely. DTC provides electronic safekeeping of securities on behalf of its participants, eliminating the need for physical securities certificates. This service helps to reduce the risk of loss, theft, or damage to certificates, as well as the costs associated with their storage and handling. DTC processes and manages corporate actions, such as dividends, stock splits, and mergers, on behalf of its participants. By centralizing and automating these processes, DTC ensures that participants receive timely and accurate information and that the necessary adjustments are made to their securities holdings. DTC manages the collection and distribution of income payments, such as interest and dividends, on behalf of its participants. This service ensures that income payments are accurately and efficiently processed, reducing the administrative burden on market participants and minimizing the risk of errors. DTC operates the Continuous Net Settlement (CNS) system, which is a central clearing and settlement system for securities transactions. The CNS system nets the obligations of participants, reducing the number of transactions that need to be settled and, in turn, reducing the associated risks and costs. DTC's Funds-Only Settlement service allows participants to settle transactions involving cash payments without transferring securities. This service enables market participants to manage and settle their cash obligations efficiently and securely. DTC's Global Tax Services provide participants with tax relief and reporting solutions for cross-border securities transactions. This service simplifies the process of managing tax obligations for market participants, ensuring compliance with tax regulations and reducing the risk of penalties and fines. DTC supports the issuance of new securities through its underwriting services. These services include eligibility review, securities issuance processing, and securities distribution to investors. By streamlining the issuance process, DTC helps issuers raise capital more efficiently and reduces the time and costs of bringing new securities to market. DTC offers repo services that facilitate the settlement and collateral management of repurchase agreements (repos). Repos are short-term lending transactions involving the sale of securities with an agreement to repurchase them later. DTC's repo services help participants manage their collateral and liquidity needs, supporting the financial system's stability. DTC has specific eligibility requirements for both securities and participants, ensuring that it maintains high operational and financial integrity. To be eligible for DTC services, securities must meet certain criteria, including being issued by a registered issuer, having a valid Committee on Uniform Securities Identification Procedures (CUSIP) number, and being in good standing with applicable regulatory authorities. DTC's eligibility requirements ensure that it only accepts and processes securities that meet high quality and compliance standards. DTC serves diverse market participants, including broker-dealers, banks and trust companies, and clearing agencies. These participants play a crucial role in the financial industry, executing and settling securities transactions on behalf of investors. Broker-dealers are financial firms that trade securities for their clients and on their own behalf. As DTC participants, broker-dealers can access DTC's services to manage and settle their securities transactions more efficiently and securely. Banks and trust companies provide various financial services, including custody, lending, and investment management. DTC participants can use DTC's services to manage their clients' securities holdings and settle transactions. Clearing agencies act as intermediaries between market participants, ensuring the smooth and efficient settlement of securities transactions. As DTC participants, clearing agencies can access DTC's services to facilitate their clients' clearing and settlement process. DTC participants play a crucial role in maintaining the Depository Trust Company and the financial system's stability. They have specific responsibilities that are essential for DTC's operations: Compliance With Rules and Regulations: Participants must adhere to DTC's rules, which promote industry standards and transparency. This ensures fairness and openness in the marketplace. Adequate Financial Resources: Participants are required to maintain sufficient capital and liquidity. This helps them fulfill their obligations and settle transactions promptly, contributing to overall financial stability and reducing the risk of default. Accuracy of Transaction Data: Participants must provide accurate information about securities deposited, transferred, or withdrawn from their accounts. Data integrity is crucial for smooth processing and settlement, preventing errors or discrepancies that could impact the system's efficiency. DTC plays a central role in the clearing and settlement process, facilitating the efficient and secure transfer of securities ownership and the settlement of transactions. The clearing process involves the confirmation and netting of securities transactions. Through its subsidiaries, such as NSCC, DTC facilitates the clearing process by verifying the details of each transaction, matching buy and sell orders, and calculating the net obligations of each participant. This process ensures the accuracy of transaction data and reduces the overall risk and costs associated with securities trading. Settlement refers to the final transfer of securities ownership and the exchange of funds between the buyer and seller. DTC's settlement services, such as the CNS system and Funds-Only Settlement, enable participants to settle their transactions efficiently and securely, reducing the risk of failed trades and enhancing the financial system's stability. DTC employs robust risk management measures to protect its participants and the financial system from potential losses and disruptions. These measures include the collection of collateral, the use of a guarantee fund, and the implementation of sophisticated risk models. By effectively managing risk, DTC helps to maintain the integrity and stability of the financial industry. DTC's centralized and automated processes enable market participants to manage and settle their securities transactions more efficiently, reducing the time and resources required for post-trade processes. By facilitating the clearing and settlement process and employing robust risk management measures, DTC helps to reduce the risk of failed trades, financial losses, and systemic disruptions in the financial industry. DTC's services enable market participants to achieve significant cost savings by reducing the need for physical securities certificates, minimizing manual processing, and streamlining the overall post-trade process. As a central securities depository, DTC plays a critical role in the financial industry, raising concerns about the risks associated with its centralization. Critics argue that DTC's central role could make it a target for cyberattacks or operational failures, potentially causing widespread disruptions in the financial system. Some critics argue that DTC's centralized position in the market may enable it to manipulate securities prices or influence market outcomes. However, DTC's strict regulatory oversight and governance structure help to mitigate these concerns and ensure its impartiality and transparency. As a key financial infrastructure provider, DTC faces ongoing cybersecurity threats. DTC invests in advanced security measures to address these risks and collaborates with regulatory authorities and other financial institutions to share information and best practices. The Depository Trust Company (DTC) plays a crucial role in the financial industry by offering a range of services that streamline the clearing, settlement, and management of securities. Established in response to the paperwork crisis of the 1960s and 1970s, DTC introduced a centralized system for electronic safekeeping and transfer of securities, improving efficiency and reducing risks. Operating under the umbrella of the Depository Trust & Clearing Corporation (DTCC), DTC ensures high operational and financial integrity through regulatory oversight and compliance. Its services, including asset, settlement, global tax, underwriting, and repo services, enable market participants to manage their securities transactions securely and efficiently. DTC's eligibility requirements ensure that it only accepts securities of high quality and compliance. Market participants, including broker-dealers, banks, trust companies, and clearing agencies, benefit from DTC's centralized and automated processes, risk reduction measures, and cost savings. While concerns about centralization, market manipulation, and cybersecurity exist, DTC's regulatory oversight, governance structure, and cybersecurity measures mitigate these risks and reinforce its role as a trusted and neutral party in the financial industry.What Is the Depository Trust Company (DTC)?

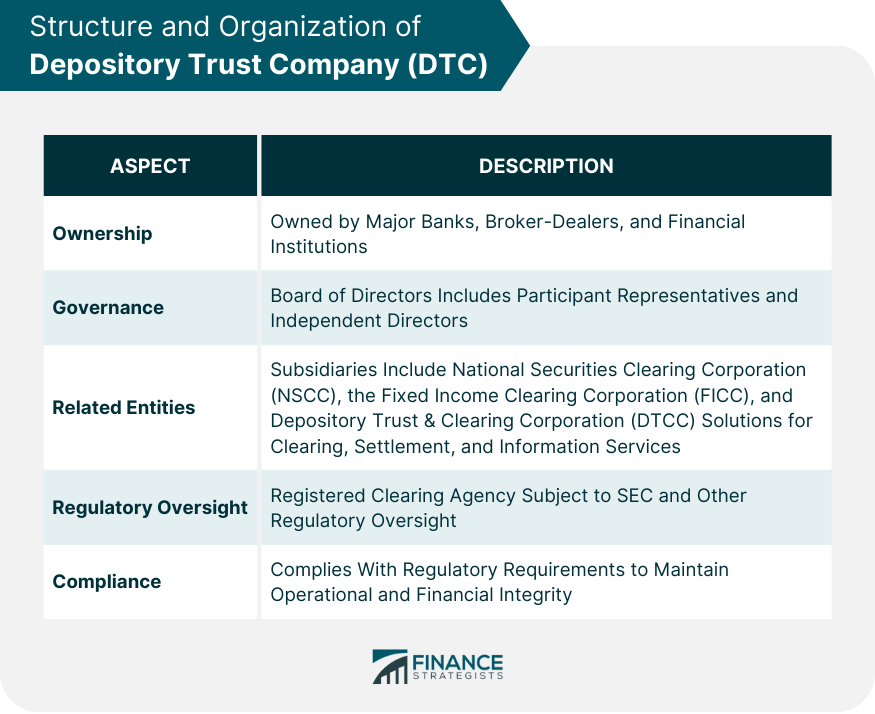

Structure and Organization of DTC

Ownership and Governance

Subsidiaries and Related Entities

Regulatory Oversight and Compliance

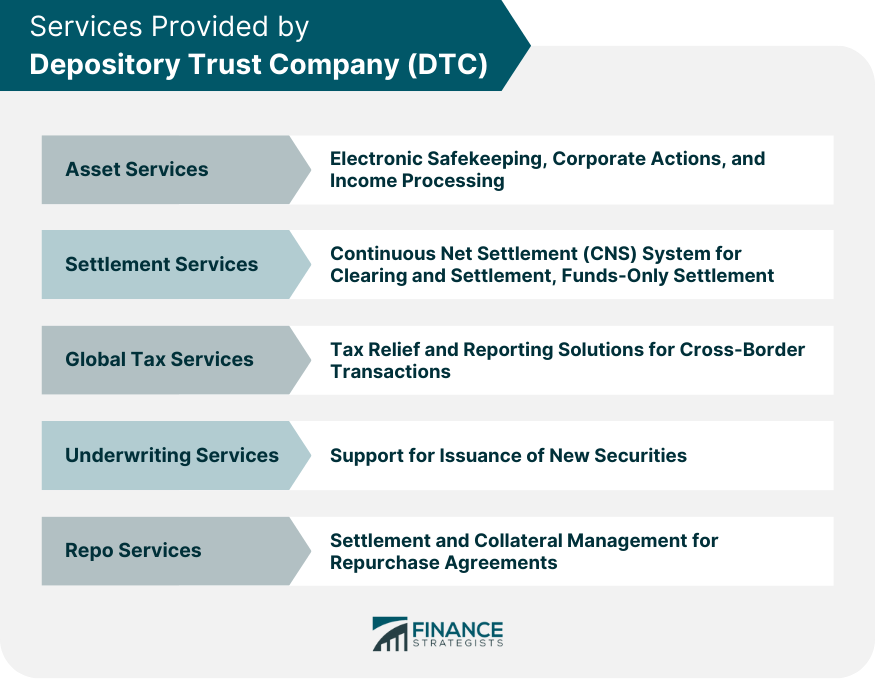

Services Provided by DTC

Asset Services

Securities Safekeeping

Corporate Actions

Income Processing

Settlement Services

Continuous Net Settlement (CNS) System

Funds-Only Settlement

Global Tax Services

Underwriting Services

Repo Services

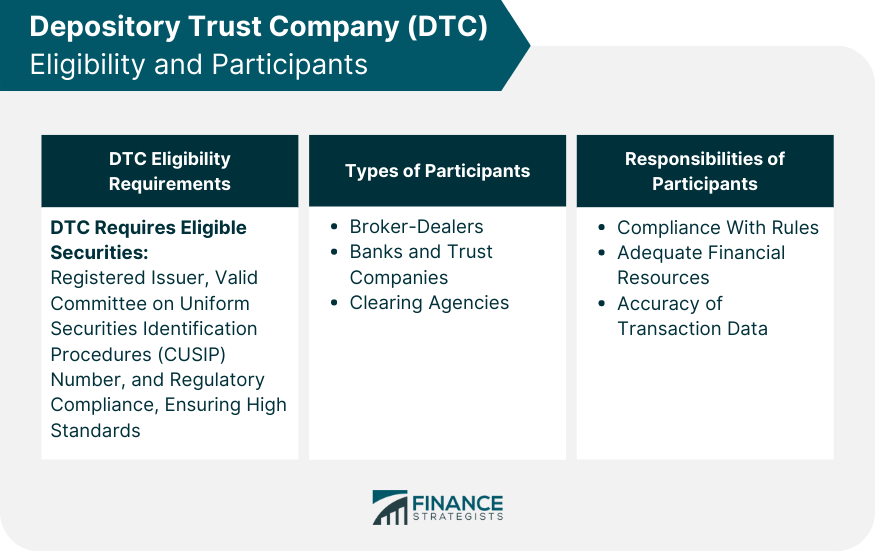

DTC Eligibility and Participants

DTC Eligibility Requirements for Securities

Types of DTC Participants

Broker-Dealers

Banks and Trust Companies

Clearing Agencies

Responsibilities of DTC Participants

Role of DTC in the Clearing and Settlement Process

Clearing Process

Settlement Process

Risk Management and Collateralization

Benefits of DTC to Market Participants

Operational Efficiency

Risk Reduction

Cost Savings

Criticisms and Challenges

Centralization Risks

Potential for Market Manipulation

Cybersecurity Concerns

Conclusion

Depository Trust Company (DTC) FAQs

The Depository Trust Company (DTC) is a subsidiary of the Depository Trust & Clearing Corporation (DTCC) and is responsible for holding and clearing securities for the securities industry in the United States.

The Depository Trust Company (DTC) acts as a central clearinghouse for securities transactions, providing electronic record-keeping and settlement services for broker-dealers and other financial institutions.

The Depository Trust Company (DTC) provides services to a wide range of market participants, including broker-dealers, banks, mutual funds, and other financial institutions.

The Depository Trust Company (DTC) offers a range of benefits for market participants, including increased efficiency, reduced costs, and improved risk management.

Yes, the Depository Trust Company (DTC) is regulated by the US Securities and Exchange Commission (SEC) and the Federal Reserve System.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.