An anti-dilution provision is a clause in an investment agreement that protects an investor from diluting their ownership percentage. This dilution can occur when a company issues additional shares for purchase, often at a lower price than the initial investor paid. Essentially, the provision enables the investor to maintain proportional business ownership. It gives investors the assurance that their stake in the company will be retained if the company raises more capital. While the anti-dilution provision is investor-friendly, it also aids in stabilizing the company's ownership structure. Preserving the ownership percentage of the initial investors, it helps maintain a consistent investor base, which can be beneficial for the company's strategic direction. This provision is often a point of negotiation between the investor and the company, with the specifics of the provision varying based on the leverage of both parties. The full ratchet anti-dilution provision is the most robust form of dilution protection for investors. This provision reduces the conversion price of the existing preferred shares to the price at which the new shares are sold, regardless of the number of shares in the new issue. In essence, the investors' initial shares are recalculated as if they had originally purchased at the new, lower price. This provision heavily favors the investor over the company. Investors are protected from any value dilution of their shares, maintaining their percentage of ownership even in down rounds. However, implementing a full ratchet provision for the company can result in substantial equity give-away to existing investors in a down round, which can be detrimental to the company’s ownership structure and future financing efforts. Consider a scenario where an investor initially bought 1 million shares at $1 each in a company, owning 10% of the company. Later, the company issues new shares at 50 cents each. With a full ratchet anti-dilution provision in place, the investor's initial shares would be repriced at 50 cents each, doubling their shares to 2 million and maintaining their 10% ownership. The Full Ratchet anti-dilution provision is one type that is more investor-friendly. Under this provision, the price of the shares owned by the existing investors is reduced to the price at which the new shares are issued, irrespective of the number of new shares. This mechanism ensures that the existing investors maintain their percentage of ownership. Weighted average anti-dilution provisions adjust the conversion price based on the new issue price and the number of new shares issued, effectively creating a new average price per share. This method prevents drastic changes in ownership percentages while still providing some level of protection to investors. The weighted average provision provides a balance between investor protection and company interests. Investors receive some protection against dilution, but not to the same extent as with the full ratchet. On the other hand, the company avoids a significant equity giveaway while still offering some form of protection to its existing investors. In the same scenario as before, with a weighted average anti-dilution provision, the new conversion price would depend on the number of new shares issued. If the company issued another million shares at 50 cents, the new average price would be 75 cents per share. The investor's shares would then be recalculated at this new price, resulting in them owning approximately 1.33 million shares and a slightly reduced ownership percentage. The Weighted Average anti-dilution provision, on the other hand, is less severe and more company-friendly. It considers both the price and the number of newly issued shares. The new average price per share is calculated based on these factors, and the existing investors' share price is adjusted to this new average. Both Full Ratchet and Weighted Average anti-dilution provisions have their respective benefits and drawbacks. The Full Ratchet method ensures absolute protection for investors against dilution. However, it could lead to substantial dilution for the founders and other shareholders, making it less appealing to companies. On the other hand, the Weighted Average method provides a more balanced approach, considering both the price and the number of new shares issued. While it does not offer as much protection as Full Ratchet, it is less likely to cause drastic dilution for existing shareholders. The suitability of these provisions depends on the specific circumstances. Full Ratchet provisions might be more suitable for investors who wish to maintain their proportional ownership, regardless of how many new shares are issued. Conversely, Weighted Average provisions might appeal to companies aiming to balance protecting investors and preventing drastic equity dilution. The Full Ratchet provision is the most protective from an investor's perspective. However, this could deter future investors and put the company at a disadvantage. While less protective, the Weighted Average provision is often seen as a fairer approach, providing some protection to existing investors while not overly punitive to the company. In Series A financing, companies are typically still in their early stages, with investor protection often prioritized. As such, it is not uncommon to see Full Ratchet provisions in Series A funding rounds. By Series B, companies are usually more established, and the financing terms often become more balanced. As such, Weighted Average provisions are more common in these rounds, providing a middle ground between investor protection and company interests. The focus shifts toward the company's interests in Series C and beyond. As such, anti-dilution provisions may be less stringent or, sometimes, non-existent. However, this largely depends on the company's performance and negotiation dynamics. Investors should consider several factors when negotiating anti-dilution provisions. These include the type of provision (full ratchet or weighted average), the potential impact on their ownership stake, and the possible effects on the company's future financing efforts. On the other hand, companies must also balance investor protection with their long-term interests. Overly protective provisions may deter future investment and dilute the founders' shares. Companies should strive for a reasonable and fair provision that protects existing investors without being overly detrimental to the company's equity structure. An anti-dilution provision is a contractual clause in an investment agreement that protects an investor's ownership stake from being diluted when a company issues additional shares. Through various types, such as a full ratchet and weighted average, anti-dilution provisions serve to protect investors, especially in down rounds. While these provisions can be beneficial for investors, they can also impact a company's ownership structure, future financing efforts, and valuation. Thus, striking a balance in negotiating these provisions is essential. Understanding and navigating anti-dilution provisions are crucial for both investors and companies. For investors, these provisions can provide significant protection for their investment. While these provisions can help attract and retain investors, companies must also be mindful of the potential impact on their equity structure and future fundraising efforts. As such, legal advice should be sought when drafting and negotiating these provisions. Staying abreast of the changing trends and regulations surrounding anti-dilution provisions will be vital in the global investment landscape as we move forward.What Is an Anti-Dilution Provision?

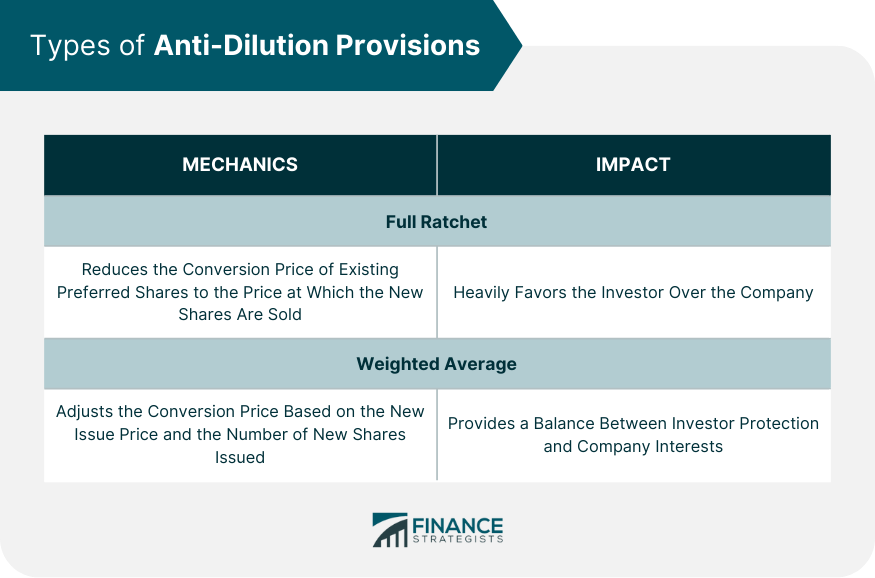

Types of Anti-Dilution Provision

Full Ratchet

Explanation and Mechanics

Impact on Company and Investors

Example

Weighted Average

Explanation and Mechanics

Impact on Company and Investors

Example

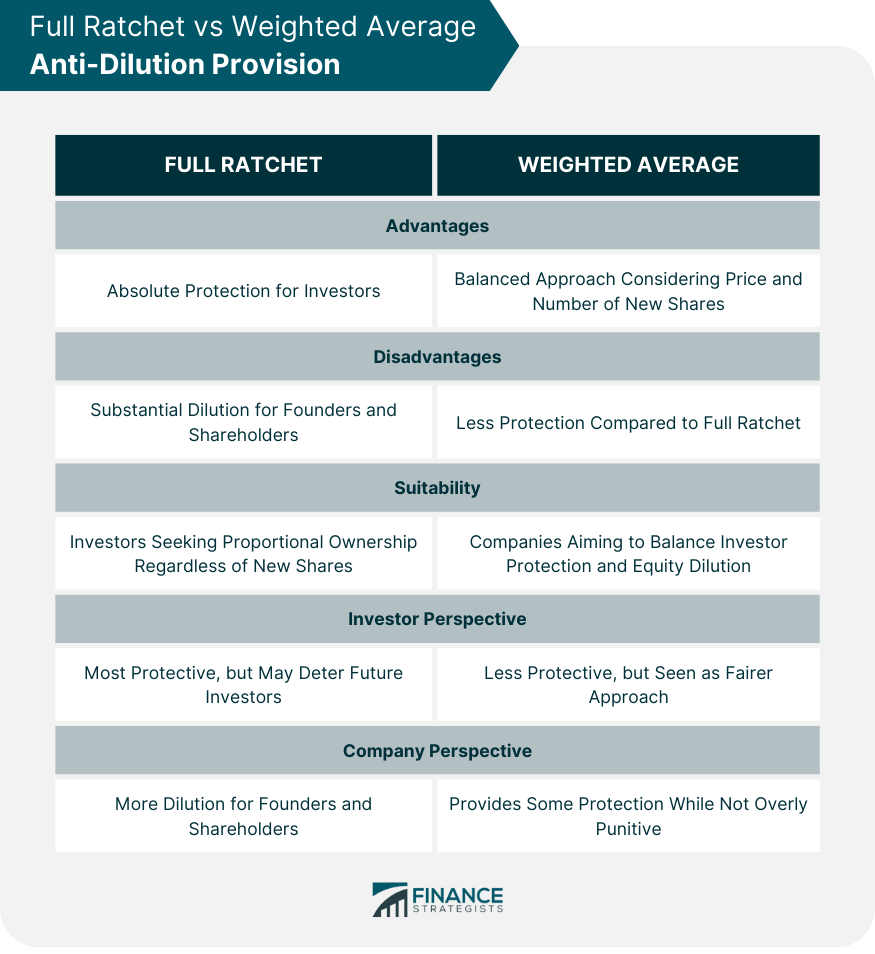

Comparison Between Full Ratchet and Weighted Average Anti-Dilution Provision

Advantages and Disadvantages

Suitability in Different Scenarios

Investor and Company Perspectives

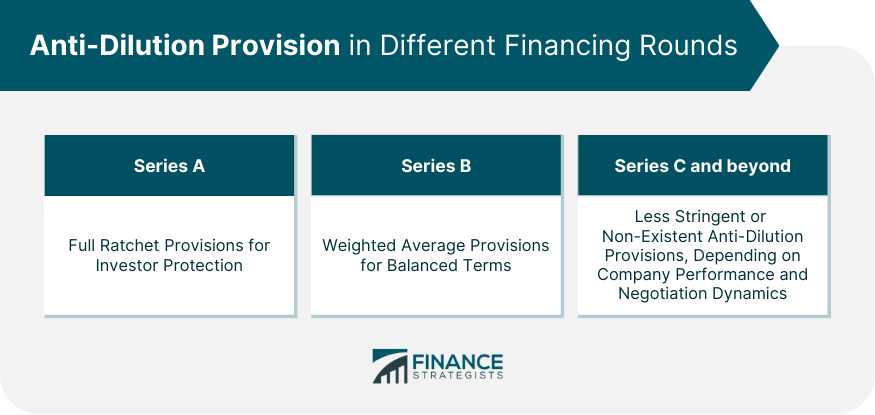

Anti-Dilution Provision in Different Financing Rounds

Series A

Series B

Series C and Beyond

Negotiating Anti-Dilution Provisions

Key Considerations for Investors

Key Considerations for Companies

Conclusion

Anti-Dilution Provision FAQs

An Anti-Dilution Provision is a clause in investment agreements that protects investors from equity dilution by adjusting their ownership stakes in the event of future equity issuances.

Two main types of Anti-Dilution Provisions are Full Ratchet and Weighted Average. Full Ratchet provides more significant protection to investors, while Weighted Average offers a more balanced approach.

Anti-Dilution Provisions safeguard investors' ownership percentages by ensuring they are not significantly diluted during subsequent financing rounds, thereby preserving their investment value.

Anti-Dilution Provisions have legal implications as they need to comply with relevant laws and regulations. Violations or disputes regarding these provisions can lead to legal challenges and potential financial consequences.

When negotiating Anti-Dilution Provisions, companies should consider investors' interests while safeguarding their growth prospects. It's crucial to consult legal experts and find a fair balance that satisfies both parties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.