Multi-asset income portfolios are investment vehicles that combine a variety of asset classes in order to generate income while maintaining diversification. These portfolios are designed to provide investors with a steady stream of income while minimizing risk and potentially providing capital appreciation. The common investor profiles for multi-asset income portfolios include retirees seeking a stable source of income, conservative investors looking to preserve their capital, and individuals seeking to diversify their investment portfolios. Fixed-income securities are essential components of multi-asset income portfolios. These investments provide a predictable income stream and typically have lower volatility than equities. The most common types of fixed-income securities in multi-asset income portfolios include: Government bonds are issued by national governments and are considered relatively low-risk investments. They provide interest payments to investors, and the principal is returned upon maturity. Government bonds are often included in multi-asset income portfolios to provide stability and income. Corporate bonds are debt securities issued by companies to raise capital. They typically offer higher interest rates compared to government bonds, as they carry more risk. In a multi-asset income portfolio, corporate bonds can help to increase overall yield. Municipal bonds are issued by state, local, or regional governments to fund public projects. These bonds can be tax-exempt, providing a tax advantage for investors. They may also offer competitive yields compared to other fixed-income securities, making them suitable for multi-asset income portfolios. High-yield bonds, also known as junk bonds, are issued by companies with lower credit ratings. These bonds offer higher yields compared to investment-grade bonds due to their higher risk. Although they can be more volatile, high-yield bonds can enhance the income generation potential of a multi-asset income portfolio. Equities, or stocks, can also be an important component of multi-asset income portfolios. Equities refer to ownership shares or stocks in a company, representing a proportional ownership interest and entitlement to its assets and profits. Investors can focus on dividend-paying stocks, real estate investment trusts (REITs), master limited partnerships (MLPs), and preferred stocks to generate income. Dividend-paying stocks are issued by companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks can provide a steady source of income and potential capital appreciation. Dividend-paying stocks are an essential component of multi-asset income portfolios, as they can help to increase overall yield and provide diversification. Real Estate Investment Trusts (REITs) are companies that invest in and manage income-producing real estate properties. They are required by law to distribute a significant portion of their taxable income to shareholders in the form of dividends. REITs can provide a reliable source of income and diversification for multi-asset income portfolios. Master Limited Partnerships (MLPs) are publicly traded partnerships that typically invest in energy infrastructure, such as pipelines and storage facilities. They must distribute most of their income to investors, which can result in attractive yields. MLPs can be valuable to multi-asset income portfolios, as they offer income generation and diversification. Preferred stocks are hybrid securities that have features of both stocks and bonds. They pay fixed dividends and have priority over common stock in the event of a company's liquidation. Preferred stocks can provide a steady source of income with lower volatility compared to common stocks, making them a suitable addition to multi-asset income portfolios. Alternative investments provide additional diversification and income generation opportunities for multi-asset income portfolios. Alternative investments include infrastructure, private equity, hedge funds, and royalty trusts. Infrastructure investments involve assets such as transportation networks, energy systems, and communication networks. These investments can provide steady income through user fees, tolls, or long-term contracts, making them a suitable addition to multi-asset income portfolios. Private equity investments involve ownership stakes in private companies or buyout funds. These investments have the potential to generate significant income and capital appreciation, though they also come with higher risk and illiquidity. As a part of a multi-asset income portfolio, private equity can provide diversification and additional income generation potential. Hedge funds are pooled investment vehicles that use various strategies, such as long/short equity, event-driven, or arbitrage strategies, to generate returns. They can provide income and diversification in a multi-asset income portfolio, though they typically come with higher fees and may require a significant initial investment. Royalty trusts are investment vehicles that hold interests in mineral or natural resource properties, such as oil and gas fields or mines. These trusts distribute the income generated from the sale of these resources to investors. They can offer attractive yields and diversification for multi-asset income portfolios. Cash and cash equivalents, such as money market funds or short-term certificates of deposit, can provide liquidity and safety in a multi-asset income portfolio. They may not offer high yields but can act as a buffer during market downturns and provide flexibility for portfolio rebalancing. Asset allocation is a critical aspect of constructing a multi-asset income portfolio. Factors to consider when determining the appropriate allocation include: Investors should consider their risk tolerance when constructing a multi-asset income portfolio. Those with a lower risk tolerance may want to allocate more to fixed-income securities and cash equivalents. In contrast, those with a higher risk tolerance may prefer a higher allocation to equities and alternative investments. The investment horizon, or the length of time an investor plans to hold the portfolio, should also be considered when determining asset allocation. Investors with a longer investment horizon may be able to take on more risk, while those with a shorter horizon may need to prioritize stability and income generation. The desired level of income generation should also be considered when determining asset allocation. Investors with higher income requirements may need to allocate more to higher-yielding assets, while those with lower income needs may prioritize stability and capital preservation. Diversification is essential in a multi-asset income portfolio to spread risk across different asset classes and investments. A well-diversified portfolio can help to reduce overall portfolio volatility and improve long-term performance. Rebalancing is the process of adjusting a portfolio's asset allocation to maintain the desired risk and return characteristics. Common rebalancing strategies for multi-asset income portfolios include: Calendar-based rebalancing involves adjusting the portfolio's asset allocation at regular intervals, such as quarterly or annually. This approach helps to maintain a consistent level of risk and can potentially capture gains from assets that have appreciated in value. Threshold-based rebalancing involves adjusting the portfolio's asset allocation when the allocations deviate from their target percentages by a specified amount. This approach can help keep the portfolio's risk profile in line with the investor's preferences and potentially take advantage of market movements. Tactical asset allocation is a more active rebalancing approach involving making strategic adjustments to the portfolio's asset allocation based on market conditions or economic trends. This approach aims to capitalize on short-term opportunities and requires a higher level of active management compared to other rebalancing strategies. Tax efficiency is an important consideration for investors seeking to maximize the after-tax returns of their multi-asset income portfolios. Some tax-efficient strategies include: Tax-loss harvesting involves selling investments that have experienced losses to offset gains realized on other investments. This strategy can help reduce the investor's tax liability and improve after-tax returns. Asset location refers to the placement of investments within taxable or tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k) plans. Allocating assets strategically across these accounts can help to minimize taxes and maximize after-tax returns. Municipal bonds are often exempt from federal income taxes and, in some cases, state and local taxes as well. Including these bonds in a multi-asset income portfolio can help to improve tax efficiency for investors in higher tax brackets. Evaluating the performance of a multi-asset income portfolio requires comparing it to appropriate benchmarks. Common benchmarks include: Comparing the portfolio's performance to relevant indices, such as a broad market index or a composite index that includes multiple asset classes, can provide insight into how the portfolio is performing relative to the market. Comparing the portfolio's performance to a group of similar portfolios or funds can provide additional context on how the portfolio is performing relative to its peers. Risk-adjusted performance metrics can help evaluate the performance of a multi-asset income portfolio while considering the level of risk involved. Common risk-adjusted performance metrics include: The Sharpe ratio measures the excess return of a portfolio relative to its risk, as measured by standard deviation. A higher Sharpe ratio indicates better risk-adjusted performance. The Sortino ratio is similar to the Sharpe ratio but focuses on downside risk or the risk of negative returns. A higher Sortino ratio indicates better downside risk management. The Treynor ratio measures the excess return of a portfolio relative to its systematic risk, as measured by beta. A higher Treynor ratio indicates better risk-adjusted performance in relation to the overall market. Evaluating the income generation of a multi-asset income portfolio involves assessing the yield and income distributions. Key metrics include: Dividend yield is the annual dividend income from a stock or equity investment expressed as a percentage of the investment's value. A higher dividend yield indicates a more attractive income investment. Yield on cost is the annual income generated by an investment divided by the initial investment cost. This metric provides insight into the income generation potential of the investment over time. Distribution yield is the annual income generated by a fixed income or alternative investment expressed as a percentage of the investment's value. A higher distribution yield indicates a more attractive income investment. Investors should be aware of the risks and challenges associated with multi-asset income portfolios, including: Interest rate risk refers to the potential for interest rate changes to negatively impact the value of fixed-income investments. As interest rates rise, the prices of existing bonds tend to fall, which can result in capital losses for fixed-income investors. Credit risk refers to the possibility that an issuer of a bond or other fixed-income security may default on their interest payments or principal repayment. To mitigate credit risk, investors should consider the credit ratings of the securities they include in their multi-asset income portfolios. Market risk, also known as systematic risk, is the risk of loss due to factors that affect the entire market, such as economic conditions, geopolitical events, or changes in investor sentiment. Diversifying across different asset classes and investments can help to mitigate market risk in a multi-asset income portfolio. Liquidity risk refers to the potential difficulty in quickly buying or selling an investment without significantly impacting its price. Some investments, such as private equity or certain alternative investments, may have limited liquidity, which can make it challenging for investors to access their capital when needed. Currency risk, also known as exchange rate risk, arises when an investor holds investments denominated in foreign currencies. Fluctuations in currency exchange rates can impact the value of these investments and the income they generate. To manage currency risk, investors may consider using currency hedging strategies or limiting their exposure to foreign currency-denominated investments. Multi-asset income portfolios offer diverse investors the potential for long-term income generation and capital appreciation while managing risk through diversification across various asset classes. By considering factors such as risk tolerance, investment horizon, income requirements, and diversification, investors can construct and manage a multi-asset income portfolio tailored to their specific needs and objectives. A disciplined approach to portfolio construction, management, and performance evaluation is crucial to ensure the portfolio remains aligned with the investor's goals and risk preferences. By employing tax-efficient strategies, rebalancing techniques, and carefully monitoring risks, investors can optimize the performance of their multi-asset income portfolios and work towards achieving their financial goals. To help you make the most of your multi-asset income portfolio and navigate the complexities of investing, consider seeking the expertise of a professional wealth management service. These services can provide personalized advice, access to a wide range of investment options, and ongoing support to help you achieve your financial objectives. Don't leave your financial future to chance—reach out to a wealth management professional today and start building a more secure future with a well-structured multi-asset income portfolio.What Are Multi-Asset Income Portfolios?

Components of Multi-Asset Income Portfolios

Fixed-Income Securities

Government Bonds

Corporate Bonds

Municipal Bonds

High-Yield Bonds

Equities

Dividend-Paying Stocks

Real Estate Investment Trusts (REITs)

Master Limited Partnerships (MLPs)

Preferred Stocks

Alternative Investments in Multi-Asset Income Portfolios

Infrastructure Investments

Private Equity

Hedge Funds

Royalty Trusts

Cash and Cash Equivalents

Portfolio Construction and Management for Multi-Asset Income Portfolios

Asset Allocation

Risk Tolerance

Investment Horizon

Income Requirements

Diversification

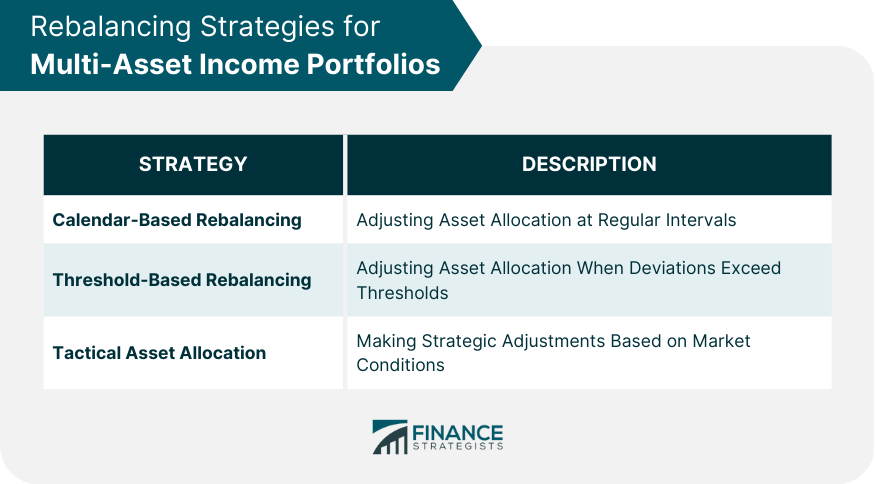

Rebalancing Strategies

Calendar-Based Rebalancing

Threshold-Based Rebalancing

Tactical Asset Allocation

Tax-Efficient Strategies

Tax-Loss Harvesting

Asset Location

Municipal Bond Investments

Performance Measurement and Evaluation of Multi-Asset Income Portfolios

Benchmarks for Multi-Asset Income Portfolios

Index Comparisons

Peer Group Comparisons

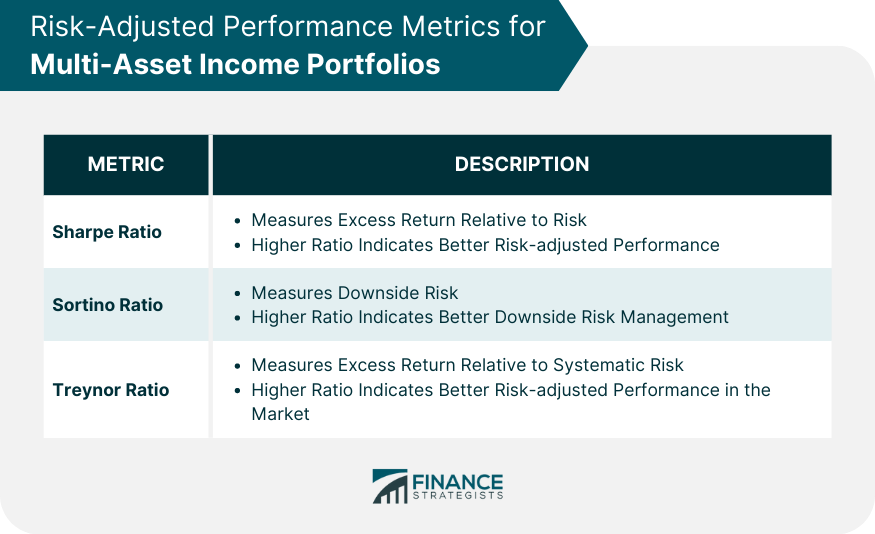

Risk-Adjusted Performance Metrics for Multi-Asset Income Portfolios

Sharpe Ratio

Sortino Ratio

Treynor Ratio

Income Generation and Portfolio Yield in Multi-Asset Income Portfolios

Dividend Yield

Yield on Cost

Distribution Yield

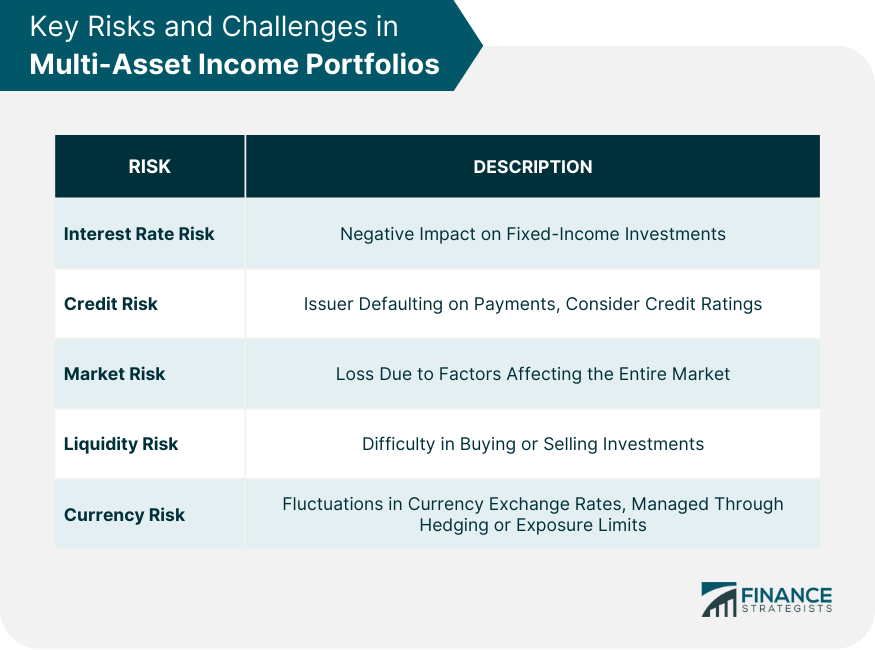

Key Risks and Challenges in Multi-Asset Income Portfolios

Interest Rate Risk

Credit Risk

Market Risk

Liquidity Risk

Currency Risk

Final Thoughts

Multi-Asset Income Portfolios FAQs

Multi-asset income portfolios are investment vehicles that combine various asset classes, including fixed-income securities, equities, alternative investments, and cash and cash equivalents, to generate income while maintaining diversification.

The components of multi-asset income portfolios include fixed-income securities such as government, corporate, municipal, and high-yield bonds, equities such as dividend-paying stocks, REITs, MLPs, and preferred stocks, alternative investments such as infrastructure, private equity, hedge funds, and royalty trusts, and cash and cash equivalents.

Multi-asset income portfolios are constructed and managed through asset allocation, diversification, and rebalancing strategies that consider factors such as risk tolerance, investment horizon, income requirements, and tax efficiency. Common rebalancing strategies include calendar-based rebalancing, threshold-based rebalancing, and tactical asset allocation.

The performance of multi-asset income portfolios is evaluated using benchmarks such as index comparisons and peer group comparisons, as well as risk-adjusted performance metrics such as the Sharpe ratio, Sortino ratio, and Treynor ratio. Income generation and portfolio yield are assessed through metrics such as dividend yield, yield on cost, and distribution yield.

The risks and challenges associated with multi-asset income portfolios include interest rate risk, credit risk, market risk, liquidity risk, and currency risk. To mitigate these risks, investors should diversify across different asset classes and investments and consider the credit ratings of fixed-income securities, as well as employing tax-efficient strategies and careful monitoring of portfolio risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.