Affinity fraud is a type of financial scam that targets specific groups or communities, exploiting the trust and relationships within these groups to defraud their members. Perpetrators of affinity fraud often pose as members of the targeted community or enlist the help of trusted insiders to promote fraudulent investment schemes or other scams. The impact of affinity fraud on communities and individuals can be devastating, resulting in significant financial losses, erosion of trust, and damage to reputations. In many cases, the close-knit nature of the targeted communities can make it difficult for victims to come forward, allowing the fraud to continue unchecked. The key element of affinity fraud is the exploitation of trust and relationships within a community or group. Scammers take advantage of the inherent trust among members, using this trust to gain access to potential victims and convince them to invest in fraudulent schemes. Perpetrators of affinity fraud employ a variety of tactics to deceive their victims, including posing as members of the targeted community, using insider connections to establish credibility, and leveraging shared values or beliefs to gain trust. In many affinity fraud schemes, scammers manipulate shared values and beliefs within the targeted community to make their scams more appealing. For example, they may promote investment opportunities that align with the group's values or beliefs, or claim that the investments are endorsed by respected community leaders. Investment scams are a common form of affinity fraud, with perpetrators offering fraudulent investment opportunities to members of a specific community. These scams may involve stocks, real estate, or other types of investments, and often promise high returns with minimal risk. Pyramid and Ponzi schemes are another type of affinity fraud, in which scammers use funds from new investors to pay returns to earlier investors, creating the illusion of a profitable business. These schemes often target specific communities, using existing relationships to recruit new participants. Charitable donation scams exploit the generosity and goodwill of a targeted community, with scammers posing as representatives of a charity or cause and soliciting donations. In reality, the funds collected are used for the scammer's personal gain. In some cases, affinity fraud may involve the promotion of fraudulent business opportunities, such as franchises or distributorships, to members of a specific community. These scams often involve exaggerated claims about potential earnings and the viability of the business. There are several warning signs that may indicate an affinity fraud scheme, including high-pressure sales tactics, promises of unrealistic returns, and a lack of transparency about the investment or business opportunity. To protect themselves from affinity fraud, individuals must conduct thorough due diligence before investing or participating in any opportunity presented to them. This includes researching the background of the promoter, verifying the legitimacy of the investment or business opportunity, and seeking independent advice from trusted sources. Another crucial aspect of identifying affinity fraud is verifying the credentials and claims of the promoter. This may involve checking their professional licenses, examining their track record, and confirming any endorsements or affiliations with respected community leaders. One of the most effective ways to prevent affinity fraud is by educating community members about the risks and warning signs of these scams. This may involve organizing workshops, distributing informational materials, or hosting guest speakers to raise awareness about affinity fraud and the importance of due diligence. Establishing reporting mechanisms within the community can help identify and address potential affinity fraud schemes more quickly. Encouraging community members to report suspected scams to law enforcement or regulatory agencies can help prevent further victimization and facilitate the apprehension of perpetrators. Promoting open communication and transparency within the community can help create an environment that is less conducive to affinity fraud. Encouraging community members to share information about potential scams and to discuss their concerns openly can make it more difficult for scammers to operate undetected. Perpetrators of affinity fraud can face serious legal consequences, including criminal charges, fines, and imprisonment. The specific penalties depend on the jurisdiction and the nature of the fraud, but they can be substantial in order to deter future scams. In some cases, victims of affinity fraud may be able to recover some or all of their lost funds through legal proceedings or asset forfeiture actions. However, the process can be lengthy and complex, and there is no guarantee that victims will be able to recover their losses. Regulatory agencies, such as the Securities and Exchange Commission (SEC) in the United States, play an essential role in combating affinity fraud. These agencies work to identify and investigate potential scams, and take enforcement actions against perpetrators to protect investors and maintain the integrity of the financial markets. The Madoff Ponzi Scheme was a fraudulent investment scheme orchestrated by Bernard Madoff, a former stockbroker and investment advisor. The scheme started in the 1990s and continued until December 2008, when Madoff confessed to his sons that the investment advisory business he operated was a massive Ponzi scheme. The scheme defrauded thousands of investors of an estimated $65 billion, making it the largest Ponzi scheme in history. Investors were led to believe that their investments were earning returns, but in reality, their money was being used to pay off earlier investors, and there were no actual investments. Madoff was sentenced to 150 years in prison for his crimes, and several of his associates were also convicted for their roles in the scheme. The Madoff Ponzi Scheme had far-reaching consequences, leading to the closure of many charities and financial institutions and causing significant losses for individuals and institutions around the world. Awareness and vigilance are essential in preventing affinity fraud and protecting one's financial well-being. By staying informed about the risks and warning signs, conducting thorough research, and maintaining open communication within the community, individuals can significantly reduce their chances of falling victim to these scams. Ultimately, the fight against affinity fraud depends on the collective efforts of individuals, communities, and regulatory and law enforcement agencies. By working together to educate, support, and protect one another, communities can build resilience against affinity fraud and create a safer environment for all members.What Is Affinity Fraud?

Characteristics of Affinity Fraud

Exploitation of Trust and Relationships

Common Tactics Used by Perpetrators

Manipulation of Shared Values and Beliefs

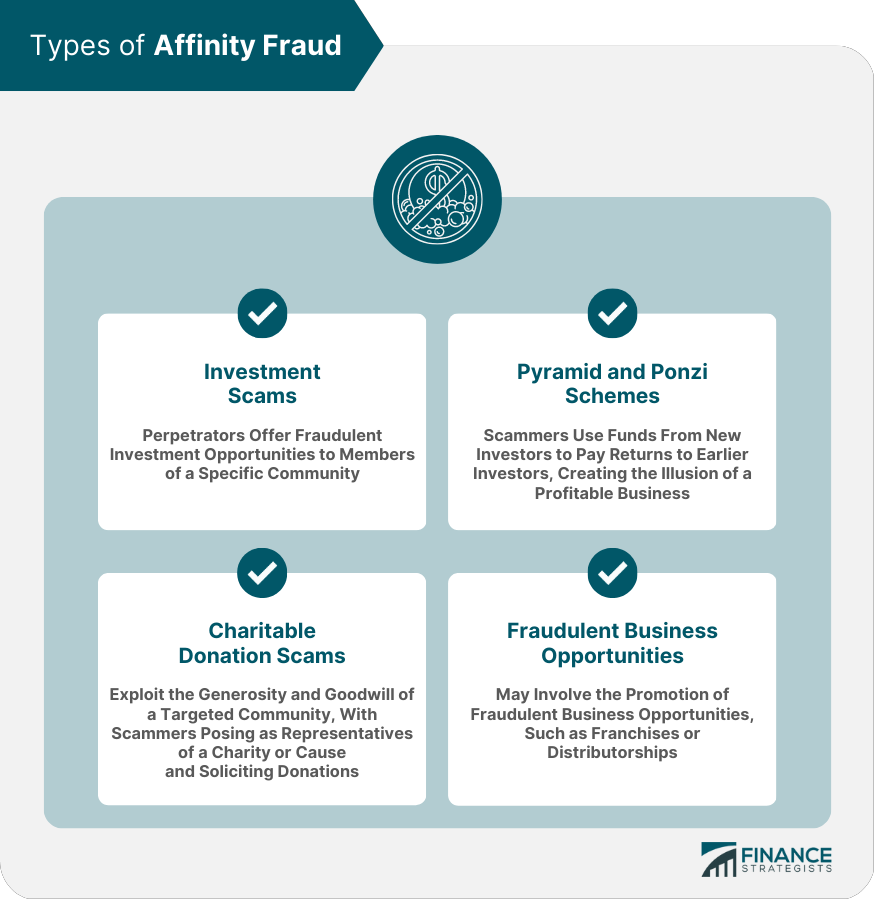

Types of Affinity Fraud

Investment Scams

Pyramid and Ponzi Schemes

Charitable Donation Scams

Fraudulent Business Opportunities

Identifying Affinity Fraud

Warning Signs of Affinity Fraud

The Importance of Due Diligence

Verifying Credentials and Claims

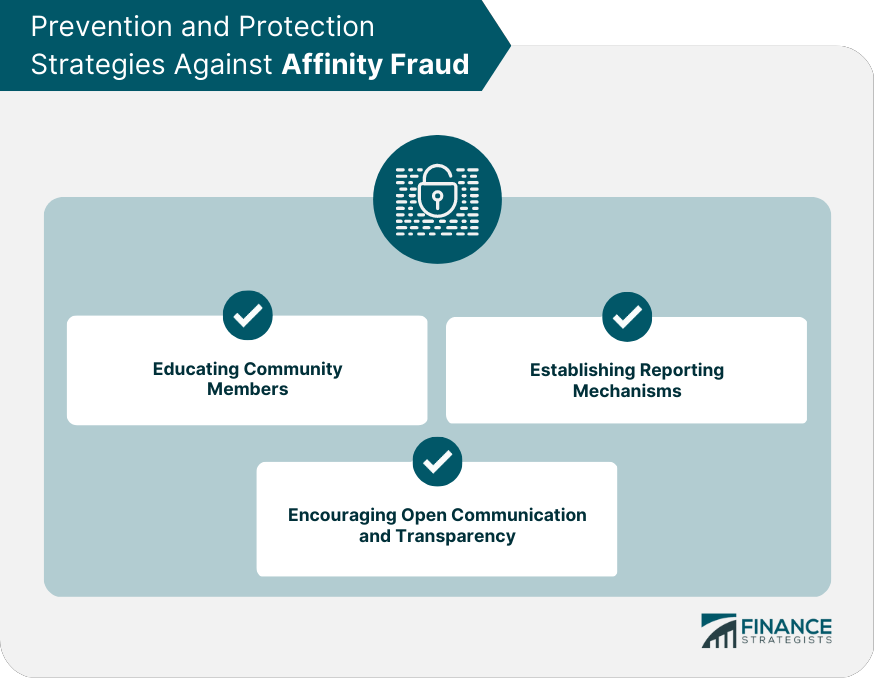

Prevention and Protection Strategies Against Affinity Fraud

Educating Community Members

Establishing Reporting Mechanisms

Encouraging Open Communication and Transparency

Legal Consequences and Enforcement Actions

Prosecution of Affinity Fraud Perpetrators

Recovery of Lost Funds

Regulatory Measures to Combat Affinity Fraud

Example of High-Profile Affinity Fraud Case

Conclusion

Affinity Fraud FAQs

Affinity fraud is a type of investment scam in which the perpetrator targets members of a particular group, such as a religious community, ethnic group, or professional association, by exploiting their trust and shared identity.

Affinity fraud typically involves the perpetrator gaining access to a group of potential victims by joining the group or posing as a member, and using their shared identity and trust to gain credibility and lure them into an investment scheme. The perpetrator often makes false or exaggerated claims about the investment, and may use high-pressure tactics to persuade victims to invest.

Any group that shares a strong sense of identity and trust, such as religious communities, ethnic groups, or professional associations, may be at risk of falling victim to affinity fraud.

To protect themselves from affinity fraud, one should be cautious of unsolicited investment opportunities, carefully research any investment opportunities and the people behind them, verify the credentials of any financial professional, and be skeptical of claims of guaranteed returns or high profits.

If one suspects they have been a victim of affinity fraud, they should immediately stop investing any more money, report the fraud to law enforcement agencies, and seek assistance from a reputable consumer protection agency or financial professional. They may also consider contacting a lawyer to explore legal options for recovering lost funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.