Ponzi schemes typically lure in investors by promising high returns with little to no risk. Because initial investors often see high returns at first, early Ponzi schemes often gain investor interest and confidence. Ponzi schemes eventually unravel when the stream of new investor capital slows down enough that investors can't be paid anymore. Ponzi schemes commonly share the following characteristics: A "guarantee" of high return with no risk The returns are consistent regardless of market conditions Investments are not registered with the SEC. "Secret" or undisclosed investment strategies which are "too complicated" to explain Official documentation is hidden from investors Clients have a difficult time withdrawing their funds A Ponzi scheme (or a "Ponzi scam" ) is an investment scam in which early investors are paid returns from funds contributed by later investors, although it has taken on a broader definition in recent years. A Ponzi scheme often conducts no actual business while the orchestrator pockets a cut of the money. The term originated with Charles Ponzi, who orchestrated the first of this type of scam in 1920. Operators of such schemes lure potential investors by promising them high returns on their investment, often far exceeding the average market rate. These returns, although enticing, are unrealistic and not backed by genuine profit-making activities. In many cases, these promised returns are used as bait, drawing unsuspecting victims into the scheme. The overly optimistic and consistent return rates act as a smokescreen, masking the nefarious undertakings of the fraudsters behind the scene. Unlike legitimate business ventures that generate revenue through genuine operations, Ponzi schemes rely on a continuous influx of new money to stay afloat. Once the influx of new investors slows down or stops, the scheme begins to crumble. Since there isn't a real investment strategy in place, the scheme lacks the resilience to sustain itself in the long run. As such, all Ponzi schemes are doomed to fail eventually, leaving a trail of financial devastation in their wake. Central to a Ponzi scheme's operation is the continuous recruitment of new investors. The scheme depends heavily on this constant influx of fresh funds to pay returns to earlier investors. This creates an illusion of a profitable business venture. However, this system creates a perilous cycle. As more investors join and the demand for returns grows, the need for even more new investors intensifies. This escalating cycle speeds up the eventual collapse of the scheme, as it becomes harder to attract enough new participants to fund the ever-growing liabilities. A genuine investment opportunity involves putting money into assets or ventures that have the potential for profit. In contrast, Ponzi schemes rarely, if ever, make genuine investments. Instead, they shuffle money from new participants to pay returns to earlier ones. This lack of legitimate investment means that no real value is created. Instead, the scheme simply circulates money, creating an illusion of profit where none genuinely exists. In the beginning, operators of a Ponzi scheme focus on attracting as many investors as possible. They employ aggressive marketing tactics, testimonials, and sometimes even fake business operations to lend an air of legitimacy to their scheme. During this phase, the scheme may appear robust and profitable. Early investors might see the promised returns, further validating the scheme's supposed legitimacy. This success often prompts these early participants to reinvest or rope in friends and family, further fueling the scheme's growth. As the scheme gains momentum, it enters the mid-phase. Here, the focus shifts from attracting new investors to maintaining the illusion of profitability. This is done by using the funds from new investors to pay returns to the earlier ones. The cycle of recruiting new investors to pay previous ones gives the appearance of a thriving investment. However, behind the scenes, the scheme's liabilities are mounting. Without a genuine source of revenue, it becomes increasingly challenging to keep up with the growing payout demands. All Ponzi schemes inevitably reach a breaking point. As the pool of potential new investors dries up, the scheme can no longer meet its payout obligations. Delays in payments become frequent, leading to growing suspicion among participants. Often, this phase is marked by desperate attempts by the operators to recruit new investors or convince current ones to reinvest. However, once trust erodes and the inflow of fresh funds stops, the scheme collapses. It's usually at this point that law enforcement steps in, uncovering the fraud. Charles Ponzi, the namesake of the scheme, promised investors a 50% return within 45 days, or a 100% return within 90 days, by buying discounted postal reply coupons in other countries and redeeming them at face value in the U.S. This was in the 1920s, and while the initial returns were paid to investors as promised, it was merely a ruse to attract more participants. The strategy proved unsustainable. Within a year, his scheme had collapsed, leading to financial ruin for many and resulting in Ponzi's imprisonment. Despite the simplicity of his operation, it set the precedent for countless similar frauds in the decades to come. Perhaps the most infamous of modern Ponzi schemes was orchestrated by Bernie Madoff. For decades, Madoff led investors to believe they were achieving consistent returns. In reality, he was shuffling funds from new investors to pay older ones. By the time his scheme was exposed in 2008, it had grown to an estimated $65 billion. The revelation sent shockwaves through the financial world, affecting thousands of investors and leading to Madoff's arrest and life imprisonment. Ponzi schemes are, unfortunately, not rare. Throughout history, numerous other notable schemes have emerged around the world. From the Zeek Rewards scheme, which touted a revolutionary penny auction site, to the Stanford International Bank scam promising high returns on certificates of deposit. These fraudulent operations have varied in complexity and scale but have always left devastation in their wake. One of the biggest red flags of a Ponzi scheme is the promise of consistently high returns. No investment is free of risk, and it's rare for any venture to yield high returns regularly. If an opportunity seems too good to be true, it probably is. Furthermore, the consistency of these returns can be telling. Legitimate investments fluctuate with market conditions. A venture that promises steady returns regardless of economic downturns or other external factors should be approached with skepticism. A lack of clarity or transparency about how an investment achieves its returns is another warning sign. Ponzi schemes often shroud their operations in mystery, providing vague or convoluted explanations for their success. Investors should be wary of operations that are reluctant to provide detailed information about their investment strategies, business model, or financial statements. Transparency is a hallmark of legitimate businesses, and any reluctance to share vital information should raise suspicions. Regulatory bodies exist to protect investors from fraudulent activities. Investments that are not registered with these bodies or that operate outside their oversight are risky. It's crucial for potential investors to ensure that any investment opportunity is registered with the relevant regulatory authorities. Moreover, it's not just the investments that need to be registered; the people selling them should be licensed and registered too. Before investing, individuals should verify the credentials of both the investment and the person offering it. The most immediate impact of a Ponzi scheme is the financial loss borne by the investors. Many people lose their life savings, with some facing complete financial ruin. The depth of these losses can be devastating, affecting not just the individual investors but also their families. Beyond the personal tragedies, these schemes can also wreak havoc on a larger scale. When large Ponzi schemes collapse, they can destabilize financial institutions, lead to significant job losses, and even have broader economic implications. Ponzi schemes lead to a myriad of legal and regulatory consequences. Operators of these schemes face significant jail time and hefty fines. However, it's not just the perpetrators who face legal repercussions. Unwitting participants, especially those who profited from the scheme, can also face lawsuits or other legal actions. The legal process to untangle the web of transactions and determine restitution can be long and complex, adding to the woes of the victims. Every time a Ponzi scheme is uncovered, it shakes the public's trust in investment opportunities and the financial system as a whole. The erosion of investor confidence can have long-term repercussions, with individuals becoming wary of genuine investment opportunities. This lack of trust can impede economic growth, as wary investors hold onto their money rather than investing it. Moreover, the loss of faith can lead to increased scrutiny and regulation, potentially hampering legitimate business operations. The first line of defense against falling victim to a Ponzi scheme is thorough research and due diligence. Before investing, individuals should scrutinize the opportunity, understand the business model, and verify its legitimacy. It's essential to be proactive. Reach out to regulatory bodies to verify registration, check with industry professionals for opinions, and be wary of investments that rely heavily on recruiting new participants rather than genuine profit-making activities. Awareness is a powerful tool in the fight against Ponzi schemes. By educating investors about the hallmarks of these fraudulent operations, they can be better equipped to spot and avoid them. Financial literacy programs, seminars, and public awareness campaigns can go a long way in preventing these schemes from taking root. An informed investor community is less likely to fall prey to the alluring promises of Ponzi operators. Strong regulatory oversight is vital in curbing Ponzi schemes. Regulatory bodies must be vigilant in monitoring investment opportunities, ensuring their legitimacy, and taking swift action against suspicious operations. Furthermore, these bodies must be empowered to enforce strict penalties against those found operating Ponzi schemes. A robust regulatory framework combined with aggressive enforcement can deter potential fraudsters and protect unsuspecting investors. A Ponzi scheme is a type of pyramid scheme. All pyramid schemes require new recruits to provide funding, but with a Ponzi scheme, only the orchestrator knows about the scheme. Those in a pyramid scheme recruit knowing it will benefit them, whereas those in a Ponzi scheme may legitimately recommend the opportunity after receiving high returns. The Bernie Madoff scandal was an orchestration of the largest Ponzi scheme which took almost 20 years for the scheme to be revealed, and defrauded investors more than $15 billion. A Ponzi scheme is a deceptive investment scam that relies on attracting new investors to pay returns to earlier participants. The scheme's promise of high returns with little to no risk lures unsuspecting victims, and initial investors often receive returns to build investor confidence. However, Ponzi schemes eventually collapse when new investor capital slows down, leading to a devastating financial loss for many. Characteristics such as guaranteed high returns, lack of transparency, and reliance on new investors distinguish Ponzi schemes. To protect against Ponzi schemes, individuals must conduct thorough research and due diligence, be financially literate, and support strong regulatory oversight and enforcement. Educating investors about the warning signs of Ponzi schemes can help prevent future scams and foster a more trustworthy investment environment.What Is a Ponzi Scheme?

Who Was Charles Ponzi?

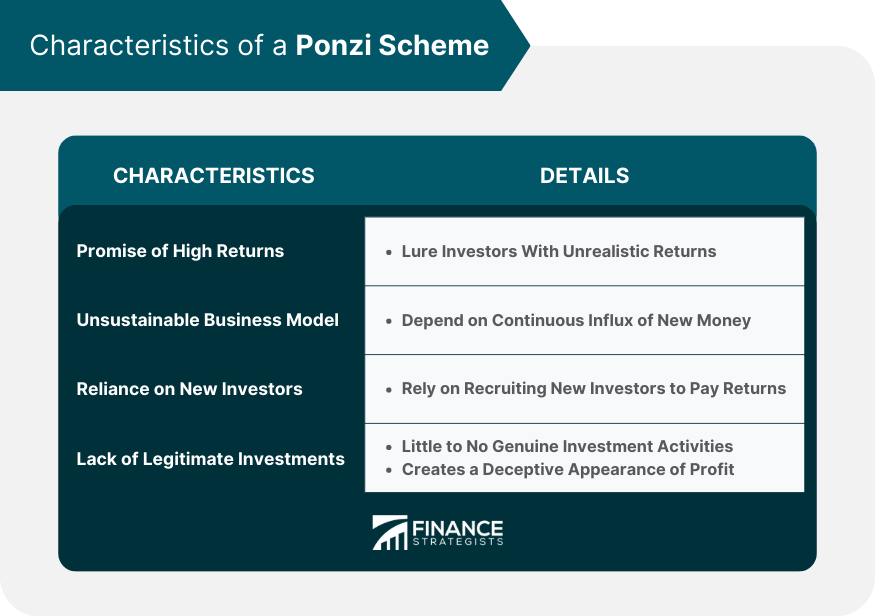

Characteristics of a Ponzi Scheme

Promise of High Returns

Unsustainable Business Model

Reliance on New Investors

Lack of Legitimate Investments

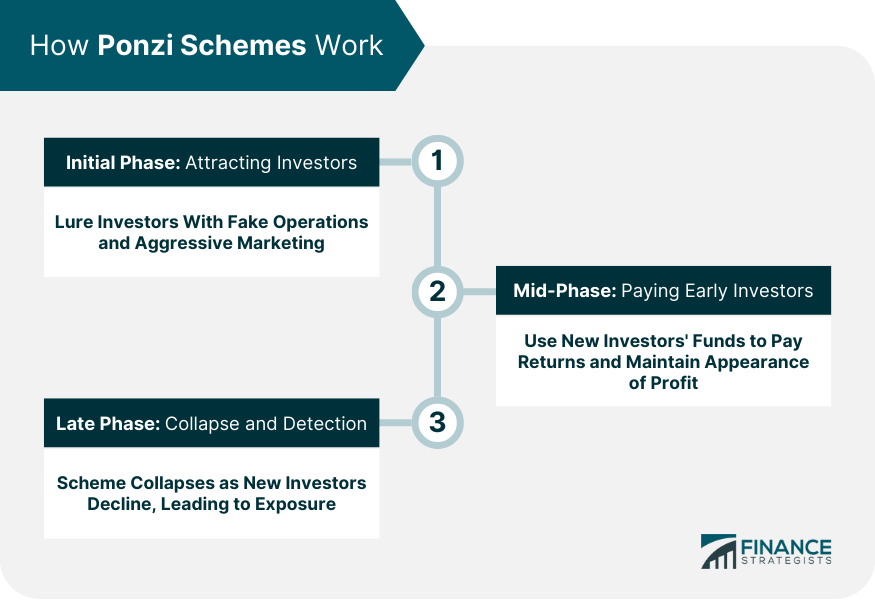

How Ponzi Schemes Work

Initial Phase: Attracting Investors

Mid-Phase: Paying Early Investors

Late Phase: Collapse and Detection

Notorious Ponzi Scheme Examples

Charles Ponzi's Scheme

Bernie Madoff's Ponzi Scheme

Other Prominent Ponzi Schemes

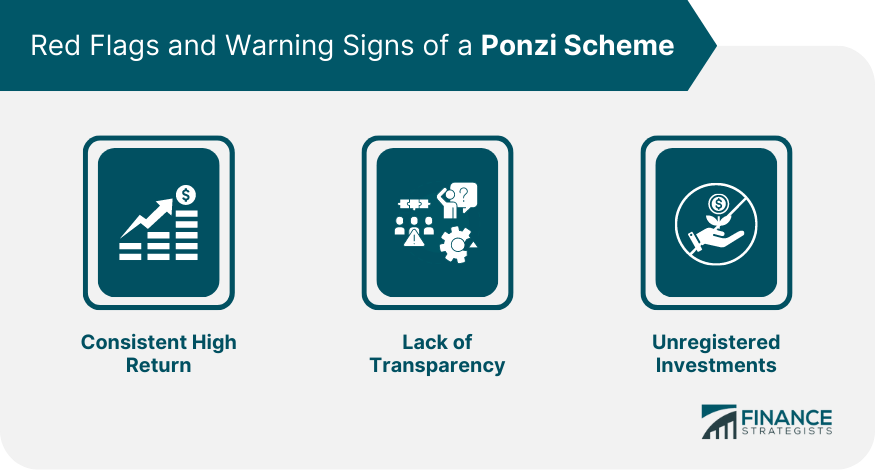

Red Flags and Warning Signs of a Ponzi Scheme

Consistent High Returns

Lack of Transparency

Unregistered Investments

Impact of a Ponzi Scheme on Investors and Society

Financial Losses

Legal and Regulatory Consequences

Erosion of Investor Confidence

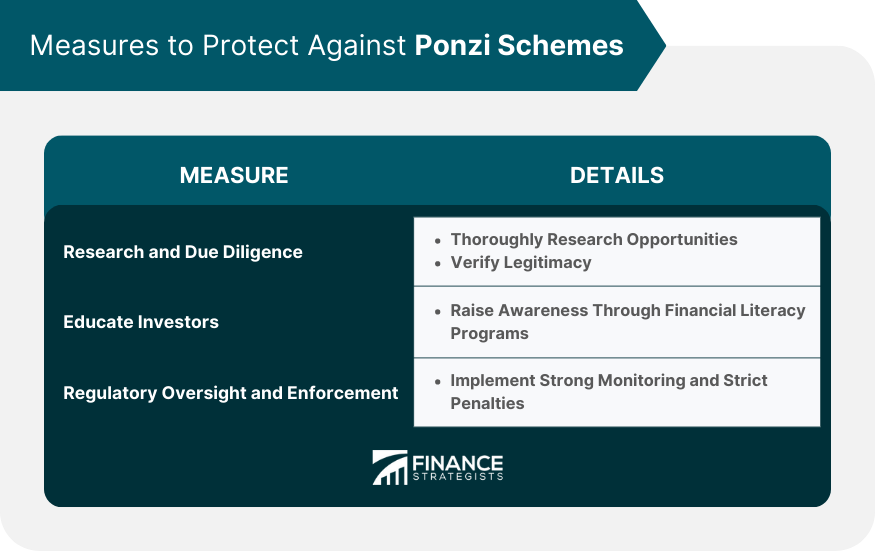

Measures to Protect Against Ponzi Schemes

Research and Due Diligence

Educate Investors

Regulatory Oversight and Enforcement

Ponzi Scheme vs Pyramid Scheme

Conclusion

Ponzi Scheme FAQs

A Ponzi scheme (or a “Ponzi scam”) is an investment scam in which early investors are paid returns from funds contributed by later investors.

A Ponzi scheme often conducts no actual business while the orchestrator pockets a cut of the money.

Ponzi schemes typically lure in investors by promising high returns with little to no risk.

Ponzi schemes eventually unravel when the stream of new investor capital slows down enough that early investors can’t be paid anymore and get suspicious.

The term originated with Charles Ponzi, who orchestrated the first recognized instance of this type of scam in 1920.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.