Soft dollars refer to the practice in which investment managers receive research, analytical tools, and other services from broker-dealers in exchange for directing client trades to those brokers. This arrangement allows investment managers to access valuable resources without incurring direct costs, while broker-dealers benefit from increased trading volume. Soft dollar arrangements are common in the financial industry and can provide benefits to both investment managers and broker-dealers. However, these arrangements can also lead to potential abuses that harm investors and undermine the integrity of the financial markets. Soft dollar abuse occurs when investment managers or broker-dealers exploit soft dollar arrangements to their advantage, often at the expense of investors. This article will explore different types of soft dollar abuse, their effects, and the regulatory framework in place to prevent and mitigate such abuse. Investment managers are responsible for making investment decisions on behalf of their clients. They often rely on research and other services provided by broker-dealers to make informed decisions. In soft dollar arrangements, investment managers direct client trades to specific broker-dealers in exchange for these services. Broker-dealers benefit from soft dollar arrangements by receiving increased trading volume from investment managers. This increased volume can lead to higher revenues and profits for broker-dealers. Services provided in exchange for soft dollars can include research reports, analytical tools, access to analysts, and other valuable resources that help investment managers make informed investment decisions. One form of soft dollar abuse occurs when investment managers direct client trades to broker-dealers who charge higher commissions or fees in exchange for more valuable services. In this case, clients may be overcharged for the execution of their trades. Investment managers may fail to adequately disclose soft dollar arrangements to their clients, leaving investors unaware of potential conflicts of interest or the true costs associated with their investments. Soft dollar abuse can also involve the misallocation of resources, such as investment managers using soft dollar services for their personal benefit or for purposes unrelated to the management of client portfolios. Conflicts of interest can arise when investment managers direct client trades to broker-dealers based on the value of soft dollar services received, rather than selecting the broker-dealer that offers the best execution for the client's trades. Industry organizations and professional associations, such as the CFA Institute, also provide best practices and ethical guidelines for investment managers and broker-dealers to follow in their soft dollar arrangements. These guidelines emphasize transparency, disclosure, and the need to act in the best interest of clients. Regulatory authorities, such as the SEC, are responsible for monitoring and enforcing compliance with soft dollar regulations. This may involve conducting audits, investigations, and taking enforcement actions against firms that engage in soft dollar abuse. To prevent soft dollar abuse, investment managers should provide clear and comprehensive disclosure of their soft dollar arrangements to clients. This can help ensure that clients are aware of any potential conflicts of interest and can make informed decisions about their investments. Investment managers should implement policies and procedures to ensure that resources obtained through soft dollar arrangements are allocated fairly among clients and used solely for the benefit of clients' portfolios. Firms should conduct regular audits and monitoring of their soft dollar arrangements to ensure compliance with regulatory requirements and internal policies. This can help identify potential abuses and address them before they escalate. Investment managers and broker-dealers should establish robust internal policies and controls to govern their soft dollar arrangements. These policies should outline the types of services that can be received in exchange for soft dollars, the process for selecting broker-dealers, and the criteria for determining the value of soft dollar services. Investment professionals should receive training and education on the ethical use of soft dollars and the potential risks associated with soft dollar abuse. This can help promote a culture of compliance and ethical behavior within firms. Addressing soft dollar abuse is essential for maintaining the integrity of the financial markets and protecting the interests of investors. By understanding the potential abuses and implementing strategies to prevent and mitigate them, investment managers and broker-dealers can contribute to a more transparent and fair financial industry. Regulators, investment managers, and broker-dealers all have a crucial role to play in combating soft dollar abuse. Through effective regulation, oversight, and adherence to ethical standards, these stakeholders can work together to ensure that soft dollar arrangements benefit all parties involved without compromising the interests of investors. As the financial industry continues to evolve, the need for transparency and ethical practices remains paramount. By staying vigilant against soft dollar abuse and fostering a culture of compliance and responsibility, firms can ensure that they operate in the best interest of their clients and maintain the trust of investors.Definition of Soft Dollars

Overview of Soft Dollar Arrangements

The Potential for Soft Dollar Abuse

Understanding Soft Dollar Arrangements

The Role of Investment Managers

Benefits for Broker-Dealers

Services Provided in Exchange for Soft Dollars

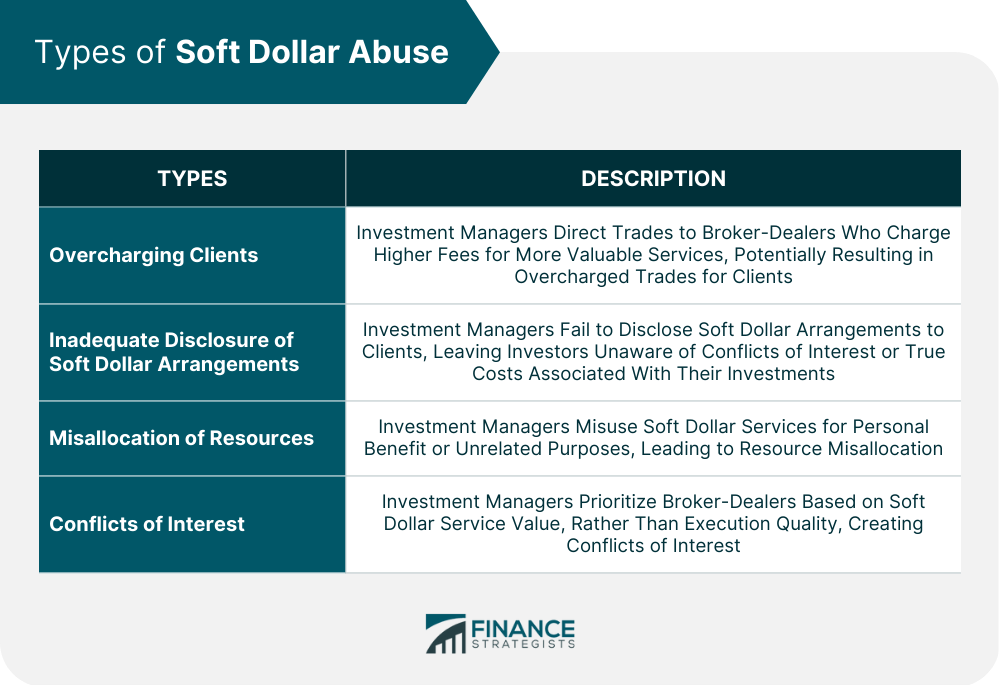

Types of Soft Dollar Abuse

Overcharging Clients

Inadequate Disclosure of Soft Dollar Arrangements

Misallocation of Resources

Conflicts of Interest

Industry Best Practices and Ethical Standards

Monitoring and Enforcement

Prevention and Mitigation of Soft Dollar Abuse

Proper Disclosure of Soft Dollar Arrangements

Ensuring Fair Allocation of Resources

Regular Audits and Monitoring

Establishing Internal Policies and Controls

Training and Education for Investment Professionals

Conclusion

Soft Dollar Abuse FAQs

Soft dollar abuse occurs when an investment adviser uses client commissions to pay for goods or services that are not directly related to investment research or brokerage services.

Soft dollars are credits that investment advisers receive from brokerage firms for directing trades to them.

Soft dollar abuse can harm investors by reducing the amount of money that is available for investment research or by increasing the cost of investment products and services.

Soft dollar abuse is not necessarily illegal, but it is considered unethical and can lead to regulatory scrutiny or legal action if it violates securities laws or fiduciary obligations.

Investors can protect themselves from soft dollar abuse by carefully reviewing their investment advisers' practices and disclosures regarding soft dollar arrangements. They can also consider working with advisers who prioritize transparency and ethical practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.