Insurance fraud is a serious crime that can affect both consumers and insurance companies. It involves making false or misleading claims to obtain insurance benefits or money. Insurance fraud can take many forms and can be committed by both individuals and organized groups. It can occur at any stage of the insurance process, from application to claim settlement. Insurance fraud is estimated to cost billions of dollars annually, and its impact is felt across the entire insurance industry. This can lead to financial loss, increased premiums, and reputational damage. It is, therefore, essential to understand the types of insurance fraud and take steps to prevent them. Consumers who fall victim to these frauds can suffer financial loss, damage to their reputation, and may even face legal consequences. The following are the different types of insurance fraud committed against consumers: The perpetrators of this fraud deliberately cause an accident and make false claims about its severity and the injuries sustained to obtain a larger payout from the insurance company. In some cases, staged accidents may involve multiple vehicles and drivers who collaborate to defraud the insurance company. One of the most common types of staged accidents is the "swoop and squat" scheme. In this scheme, two vehicles will position themselves in front of the victim's car, and one of them will suddenly brake, causing the victim to rear-end them. The perpetrators will then say that the victim was at fault for the accident and file a false claim against the victim's insurance company. In this type of fraud, the perpetrator obtains the victim's personal information, such as social security numbers, driver's license numbers, and credit card information, and uses it to file false claims or obtain insurance benefits. Identity theft can be particularly harmful as it can result in significant financial loss, damage to credit history, and the potential for long-term reputational damage. It can occur through various means, including phishing scams, data breaches, and theft of personal information. For example, the perpetrator may use the victim's identity to file false claims for medical treatment or to collect insurance benefits for injuries they never sustained. Criminals may also use the victim's identity to obtain insurance coverage, leaving the victim with a damaged credit history and potentially leaving them uninsured Phantom claims involve filing a claim for a loss that did not occur. This type of fraud is prevalent in the automotive industry, with individuals filing phantom claims for damages that were present before the accident occurred. In some cases, perpetrators may also file claims for non-existent damages to collect insurance benefits, leading to significant financial losses for insurance companies and increased premiums for honest policyholders. One of the main reasons phantom claims are so difficult to detect is that they often involve small amounts of money. Perpetrators may file claims for minor damages or losses, making it less likely that insurance companies will investigate the claims thoroughly. Consumers can prevent phantom claims by maintaining detailed records of their vehicles' condition before and after an accident. It can include taking photographs and notes of any existing defects to the vehicle, as well as any damages incurred during the accident. These agents may collect premiums and just disappear, leaving the policyholders without insurance coverage. In some cases, unlicensed agents may also sell fraudulent policies to unsuspecting customers, leading to significant financial losses and reputational damage. Unlicensed agents may offer insurance policies at lower premiums than licensed ones. Consumers may be attracted to these lower premiums, not realizing that the agent is not legally qualified and that the policy they are purchasing may be fraudulent. Additionally, unlicensed agents may use high-pressure tactics to convince consumers to purchase policies quickly, without giving them time to consider the terms and conditions of the policy. To prevent falling victim to unlicensed agents, consumers can contact the state insurance department or check the agent's license status on the National Association of Insurance Commissioners' (NAIC) website. Fictitious claims, premium fraud, arson, worker’s compensation fraud, and healthcare fraud are the most common types committed against insurance providers. Fictitious claims happen when someone files a claim for a loss that did not occur or that they were not entitled to receive. These can take many forms, like claiming to have suffered an injury or property damage when none existed, or claiming to have lost an item that was never owned. The consequences of fictitious claims for insurance companies can be significant. They can result in financial losses due to the payment of illegitimate claims, which in turn can lead to higher premiums for policyholders. Insurance companies may also face reputational damage, legal consequences, fines, and other penalties if they are unable to detect and prevent fraudulent activity. To prevent fictitious claims, insurance companies use various methods to verify the legitimacy of claims, such as using forensic data analysis, machine learning, artificial intelligence (AI), special investigation units (SIUs) and working closely with law enforcement agencies. This type of insurance fraud involves someone intentionally providing false information to obtain lower premiums. It can occur in various types of insurance, including car, home, and life insurance. One of the most common forms of premium fraud is in the car insurance industry. A person may provide false information about their driving history, such as claiming to have a better driving record than they actually do, to obtain lower car insurance premiums. This type of fraud is not only illegal but also puts decent policyholders at a disadvantage as they end up paying higher premiums. Insurance companies may conduct audits of policyholders' information to verify the accuracy of the data provided. Audits may include reviewing policyholders' driving records, credit reports, and other sources of information to verify the accuracy of the information provided. It is a type of insurance fraud committed against insurance companies, where someone intentionally sets fire to a property for financial gain. This type of fraud can occur in various types of insurance, including property and business insurance. Arson is a serious crime that can result in significant financial losses for insurance companies, as well as potential loss of life or injury. Insurance companies may use fire investigation units to investigate arson claims and determine the cause of the fire. Fire investigation units typically consist of trained professionals, including firefighters and law enforcement officials, who have expertise in investigating fires and determining the cause of the fire. To prevent arson, insurance companies may require that fire alarms and sprinkler systems be installed in buildings and that regular safety inspections be conducted to ensure that the systems are functioning properly. This type of fraud can occur when an employee falsely claims to have suffered an injury while on the job or exaggerates the severity of a real injury to obtain higher compensation benefits. Workers' compensation fraud can also occur when an employee continues to receive benefits after they have recovered from their injury. Aside from being illegal, it can lead to financial losses for the insurance company, higher premiums for other policyholders, and criminal and other financial penalties for the employee who committed the fraud. To prevent workers' compensation fraud, insurance companies review medical records, conduct interviews with employees and other witnesses, and use insurance fraud investigators to check suspicious claims and identify fraudulent activities. This is a type of insurance fraud that occurs in the healthcare industry, where someone intentionally submits false or misleading information to obtain healthcare benefits or payments from insurance companies. For example, a healthcare provider may submit a bill for a more expensive service or complex procedure than was actually provided, also known as upcoding. Sometimes, providers may also perform procedures that are not medically urgent, like unnecessary diagnostic tests or surgery. Another common healthcare fraud is kickbacks, which occur when a healthcare provider receives payment or other incentives in exchange for referring patients to a specific provider or service. This type of fraud is illegal under the federal Anti-Kickback Statute. Sometimes, insurance fraud may also be committed by agents, brokers, adjusters, and underwriters. Consider the following: These licensed professionals work in the insurance industry to help customers choose and purchase insurance policies. Unfortunately, some agents and brokers engage in fraudulent activities to make a profit. One of the most common forms is selling fake insurance policies. An agent or broker collects premium payments from customers but does not actually provide them with a legitimate insurance policy. Some agents or brokers may also misrepresent insurance policies. This can occur when an agent or broker intentionally provides false or misleading information about a policy to make a sale. For example, an agent may claim that a policy covers certain services when it does not. Others may engage in embezzlement of premium payments. This occurs when an agent or broker collects premium payments from customers but then keeps the money for themselves instead of forwarding it to the insurance company. To prevent agents and brokers fraud, insurance companies must thoroughly vet and monitor the activities of their agents and brokers, such as conducting background checks, requiring periodic training and certification, and performing regular audits of their activities. Insurance adjusters are professionals who work for insurance companies to investigate and evaluate insurance claims. Some adjusters engage in fraudulent activities to manipulate the outcome of claims. One of the most common forms of adjusters fraud is intentionally misrepresenting the facts of a claim to manipulate the outcome in favor of the insurance company. For example, an adjuster may claim that a policyholder was at fault for an accident when they were not. Some adjusters may also delay the processing of a claim to pressure the policyholder into accepting a lower settlement. This type of fraud can result in significant financial losses for policyholders and reputational damage for insurance companies. Another common adjuster fraud involves receiving kickbacks from contractors for recommending their services to policyholders. This type of fraud can result in inflated repair costs for policyholders and financial losses for insurance companies. Underwriters evaluate and price insurance policies. One of the most common forms of underwriters fraud is misrepresenting the risk of a policy. For example, an underwriter may claim that a policyholder has a lower risk of filing a claim than they actually do. Another form of underwriter fraud is inflating the cost of a policy. It occurs when an underwriter intentionally sets a higher price for a policy than is justified based on the actual risk involved. Some underwriters also accept bribes from policyholders to price a policy more favorably. This type of fraud can result in financial losses for insurance companies and reputational damage for the industry as a whole. To protect against insurance fraud, policyholders and insurance companies must remain vigilant. Policyholders can take several steps to detect and prevent insurance fraud: Policyholders should carefully read and understand their insurance policy to ensure that they are familiar with the terms and conditions of their coverage. It can help prevent them from inadvertently filing a fraudulent claim. Policyholders should carefully watch out for signs that may indicate fraudulent activity. These can include claims for unusually high amounts, claims filed shortly after a policy is purchased, or claims for injuries or damages that are not consistent with the accident or incident that occurred. Policyholders should maintain and keep detailed and exact records of all their interactions with their insurance company, including all correspondence and conversations. Doing so can help them identify discrepancies or errors in their policy and claims. Policyholders should safeguard their personal, financial, and other pertinent information to prevent identity theft. It can include securing their physical documents, such as their driver's license or Social Security card, as well as their digital information, such as passwords and account information. If policyholders suspect fraudulent activity, they should report it to their insurance company or government authorities as soon as possible. It can help prevent further fraudulent activity and protect other policyholders. If policyholders are unsure about the validity of a claim or policy, they should consult legal professionals. An attorney can help them understand their rights and obligations under their policy and can advise them on the best course of action to take. Here are some of the ways insurance companies can protect themselves and their customers from insurance fraud: Insurance companies should be meticulous and comprehensive in vetting and monitoring the activities of their agents, brokers, adjusters, and underwriters to prevent fraudulent activities. It can include conducting background checks, requiring certification, and reviewing their activities on an ongoing basis. Insurance companies should conduct periodic and surprise audits of their policies and claims to identify suspicious activity. Companies can analyze claims for unusual patterns or high frequency and review documentation for accuracy and consistency. Insurance companies should take advantage of developments in computer technology to identify patterns of fraudulent activities and flag suspicious claims. These tools can help detect fraud that may be difficult to recognize using traditional methods. Policyholders must be informed about the risks of insurance fraud and how to avoid becoming a victim. It can include providing materials and seminars about common types of insurance fraud, as well as tips for protecting personal information. Insurance companies should work closely with federal and state law enforcement agencies to investigate and prosecute those responsible for insurance fraud to help deter fraudulent activities and protect the integrity of the insurance industry. Insurance companies should develop comprehensive fraud prevention rules and regulations that outline procedures for detecting and preventing fraudulent activities. These policies should be regularly reviewed and updated to ensure they remain effective. Insurance fraud is a pervasive problem that affects both consumers and insurance companies. It takes many forms, from staged accidents, identity theft, and phantom claims, to workers' compensation fraud, arson, premium fraud, and healthcare fraud. Some professionals like agents, brokers, adjusters, and underwriters may also commit insurance fraud like selling fake policies, embezzling premiums, manipulating facts to favor an insurance company, or taking bribes from policyholders for favorable pricing. Insurance fraud can lead to significant financial losses, increased premiums, and reputational damage for consumers, insurance companies, and the insurance industry as a whole. Policyholders and insurance companies must remain vigilant in detecting and preventing insurance fraud. Policyholders can protect themselves by understanding their policies, keeping accurate records, reporting suspicious activity, and seeking legal advice. Insurance companies can protect themselves by thoroughly vetting and monitoring their professionals, conducting regular audits, using data analytics and machine learning algorithms to detect fraudulent activity, and formulating fraud detection systems. Preventing insurance fraud requires a collaborative effort between policyholders, insurance companies, and law enforcement agencies. Consult a qualified insurance broker or financial advisor for further information and guidance. By working together, stakeholders can reduce the occurrence of insurance fraud, protect the integrity of the insurance industry, and ensure that consumers receive the benefits and coverage they deserve.What Is Insurance Fraud?

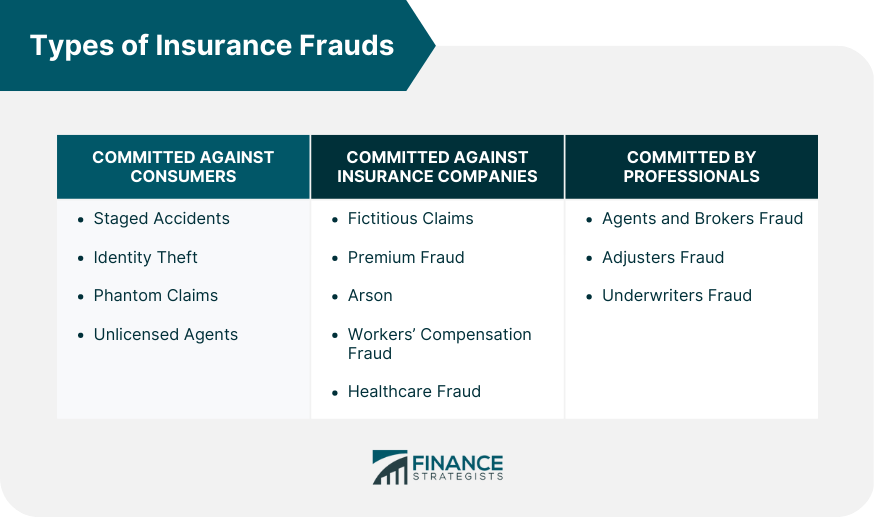

Types of Insurance Frauds Committed Against Consumers

Staged Accidents

Identity Theft

Phantom Claims

Unlicensed Agents

Types of Insurance Frauds Committed Against Insurance Companies

Fictitious Claims

Premium Fraud

Arson

Workers’ Compensation Fraud

Healthcare Fraud

Types of Insurance Fraud Committed by Professionals

Agents and Brokers Fraud

Adjusters Fraud

Underwriters Fraud

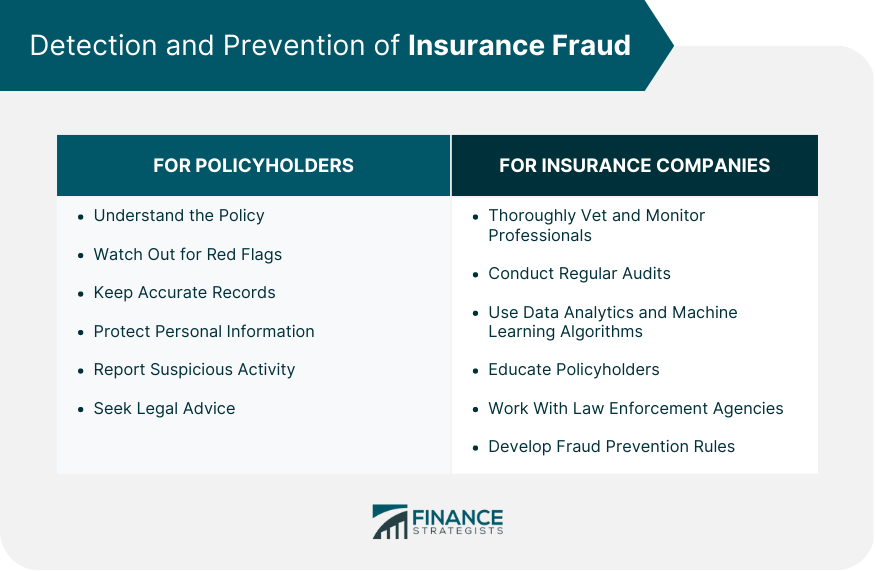

Detection and Prevention of Insurance Frauds

For Policyholders

Understand the Policy

Watch Out for Red Flags

Keep Accurate Records

Protect Personal Information

Report Suspicious Activity

Seek Legal Advice

For Insurance Companies

Thoroughly Vet and Monitor Professionals

Conduct Regular Audits

Use Data Analytics and Machine Learning Algorithms

Educate Policyholders

Work with Law Enforcement Agencies

Develop Fraud Prevention Rules

Final Thoughts

Types of Insurance Fraud FAQs

The common types of insurance fraud committed against consumers include staged accidents, identity theft, phantom claims, and unlicensed agents.

The most common types of insurance fraud committed against insurance companies include fictitious claims, premium fraud, arson, workers' compensation fraud, and healthcare fraud.

Insurance fraud can be committed by both individuals and organized groups, including policyholders and insurance companies. Professionals like agents, brokers, adjusters, and underwriters, may also be involved in fraudulent activities.

Insurance companies can prevent fraud by thoroughly vetting and monitoring professionals, conducting regular audits, using data analytics and machine learning algorithms, educating policyholders, working with law enforcement agencies, and developing comprehensive fraud prevention rules and regulations.

Policyholders should watch out for red flags that may indicate fraudulent activity, including claims for unusually high amounts, claims filed shortly after a policy is purchased, or claims for injuries or damages that are not consistent with the accident or incident that occurred.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.