The workout market refers to a financial market where distressed assets, such as non-performing loans or distressed securities, are bought and sold at discounted prices. These assets typically belong to companies or individuals facing financial distress or insolvency. The importance of the workout market lies in its role in facilitating the resolution of distressed situations. By providing a platform for investors and financial institutions to acquire these distressed assets, the workout market helps in the restructuring or recovery of troubled businesses, promotes efficient allocation of capital, and mitigates systemic risks. It offers opportunities for investors to potentially generate significant returns by turning around distressed assets. Additionally, the workout market contributes to overall market stability by assisting in the resolution of financial distress and supporting economic recovery. The roots of the workout market can be traced back to the early 20th century, with its formalization occurring during the Great Depression. At this time, banks started to actively manage and sell off the distressed assets that they had accumulated. Over time, various events, such as the recession of the early 1980s, the dot-com bubble in the late 1990s, and the Global Financial Crisis of 2008, have had a profound influence on the workout market. Today, the workout market is a mature and sophisticated industry with various key players, including debtor companies, creditors, specialized banks, law firms, consulting firms, and regulatory bodies. The workout market involves key players who specialize in the acquisition and restructuring of distressed assets. Debtor Companies: These are entities in financial distress seeking debt restructuring to avoid bankruptcy. Creditors: Typically, financial institutions or bondholders hold the debt of financially distressed entities. Workout Market Specialists: Banks, Law Firms, and Consulting Firms: These firms provide the specialized skills necessary for the complex negotiations and restructuring processes involved in workouts. Role of Government and Regulators in the Workout Market: Governments and regulators are critical in overseeing the workout market, ensuring fair practices, and maintaining market stability. The first step in the process involves identifying companies that are in financial distress and could benefit from a workout. Once identified, negotiations between the debtor and creditors begin to determine the terms of a potential workout deal. The specifics of the deal are then formalized in a legally binding agreement, specifying the new terms of the debt. The plan is then executed, with the debtor company working to meet its obligations under the restructured debt terms and the situation monitored to ensure compliance. Financial instruments in the workout market encompass a range of specialized securities and contracts designed to facilitate the resolution of distressed assets. Debt Restructuring: This is a common method used in the workout market where the terms of the debt are renegotiated. Equity Swaps: In an equity swap, a portion of the debt is exchanged for equity in the debtor company. Debt-For-Debt Swaps: The existing debt is exchanged for new debt with different terms. Distressed Asset Sales: Involve selling off assets of the debtor company to repay creditors. There are various risks involved for both creditors and debtors, including the risk of the debtor's further financial deterioration or the possibility of not recovering the full value of the debt for creditors. Despite the risks, there are potential rewards for both parties. Debtors can avoid bankruptcy, and creditors can recover more than they would in a bankruptcy scenario. Risk management strategies are vital in the workout market. These can involve diversification, due diligence, and carefully structuring workout deals. The workout market contributes to overall financial stability by providing a mechanism for debt restructuring that can prevent the shock and ripple effects that bankruptcy can have on the broader economy. Workouts can help to preserve jobs that might otherwise be lost in bankruptcy, thereby mitigating the impact on the job market and the employees of distressed entities. Numerous case studies highlight the potential outcomes of workout processes. For example, the successful workout of General Motors following the 2008 financial crisis stands in contrast to the unsuccessful workout and eventual bankruptcy of Lehman Brothers. The workout market is a financial market where distressed assets are bought and sold at discounted prices, benefiting companies and individuals facing financial distress or insolvency. It plays a crucial role in facilitating the resolution of distressed situations, promoting capital allocation, and mitigating systemic risks. Key players in the market include debtor companies, creditors, specialized banks, law firms, consulting firms, and regulatory bodies. The process involves early identification of distressed entities, negotiation, structuring workout deals, and implementation and monitoring of the workout plan. Financial instruments in the market include debt restructuring, equity swaps, debt-for-debt swaps, and distressed asset sales. While risks exist for both creditors and debtors, the workout market offers rewards such as avoiding bankruptcy and recovering more than in a bankruptcy scenario. Its impact on the economy includes preserving jobs and contributing to overall financial stability.Workout Market Overview

History and Evolution of the Workout Market

Key Players in the Workout Market

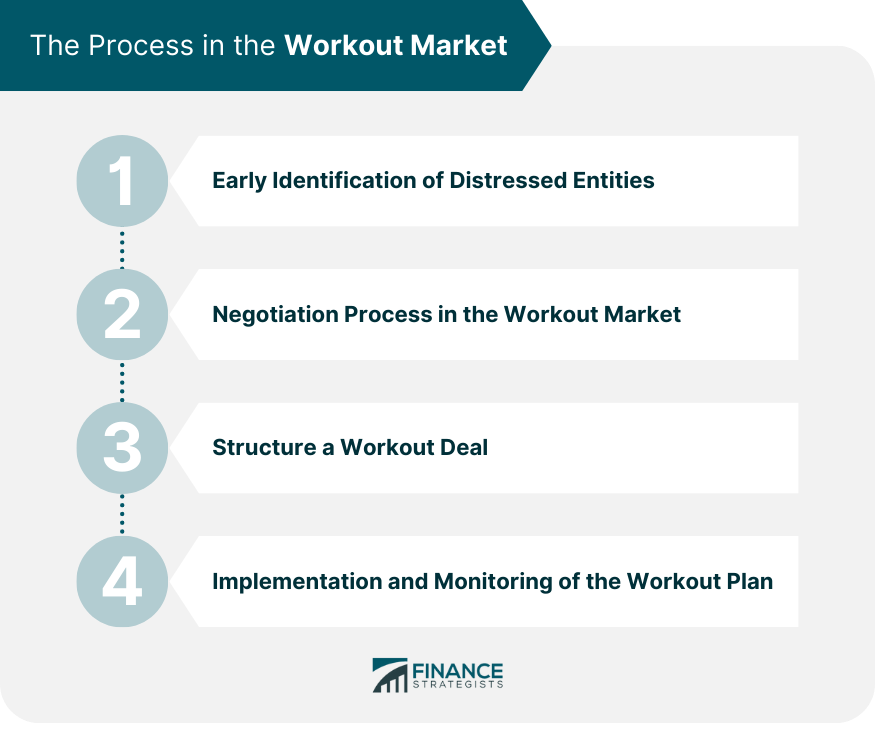

Process in the Workout Market

Early Identification of Distressed Entities

Negotiation Process in the Workout Market

Structuring a Workout Deal

Implementation and Monitoring of the Workout Plan

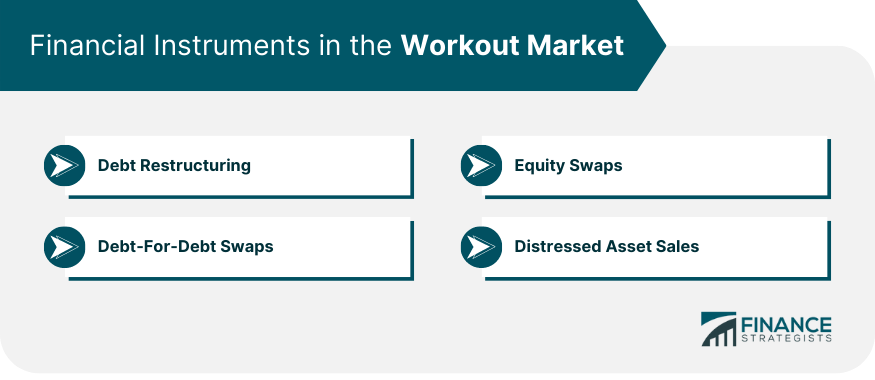

Financial Instruments in the Workout Market

Risk and Reward in the Workout Market

Impact of the Workout Market on the Economy

Conclusion

Workout Market FAQs

The workout market, also known as the distressed debt market, is an economic sector where the buying and selling of debt of companies or government entities occur. These entities are either already in default, under bankruptcy protection, or in serious financial distress.

The key players in the workout market include debtor companies (entities in financial distress), creditors (financial institutions or bondholders), workout market specialists like banks, law firms, and consulting firms that provide specialized skills, and government and regulators who oversee the market.

The processes in the workout market involve early identification of distressed entities, negotiation between the debtor and creditors, structuring a workout deal, and implementing and monitoring the workout plan.

In the workout market, there are potential risks for both creditors and debtors, such as further financial deterioration of the debtor or not recovering the full value of the debt for creditors. However, the rewards can include debtors avoiding bankruptcy and creditors potentially recovering more than they would in a bankruptcy scenario.

The future of the workout market is expected to be influenced by emerging trends like sustainability, technological advancements like artificial intelligence and data analytics, and potential changes in regulations. Cross-border workouts might also increase due to globalization.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.