Negative arbitrage occurs when the cost of borrowing money is higher than the return earned on investments made with the borrowed funds. This situation can lead to financial losses for investors and is generally considered an unfavorable investment scenario. Negative arbitrage plays a significant role in the world of finance, as it directly affects the profitability of investments. When negative arbitrage occurs, it can erode investment returns and, in severe cases, lead to substantial losses. In some cases, negative arbitrage can be an intentional strategy, but more often, it results from changes in market conditions, interest rates, or currency values. As such, it's essential for investors to closely monitor their investments and adjust their strategies as needed to avoid or minimize the impact of negative arbitrage. One of the primary causes of negative arbitrage is interest rate differentials between borrowing and investment rates. When the cost of borrowing exceeds the return on an investment, negative arbitrage occurs. This can happen due to changes in market interest rates, central bank policies, or shifts in the overall economic environment. For example, if an investor borrows funds at a 5% interest rate and invests those funds in a bond yielding 4%, the investor is effectively experiencing negative arbitrage. In this scenario, the investor would be better off not engaging in the investment, as the cost of borrowing exceeds the return on the investment. Market inefficiencies can also contribute to negative arbitrage. In an efficient market, arbitrage opportunities would not exist, as prices would always accurately reflect the underlying value of assets. However, markets are not always efficient, and price discrepancies can arise due to information asymmetry, market sentiment, or other factors. When an investor takes advantage of a perceived market inefficiency by borrowing funds to invest in an asset they believe to be undervalued, they may inadvertently expose themselves to negative arbitrage if the market fails to correct the perceived inefficiency. Some investors may intentionally engage in negative arbitrage strategies, believing that the potential gains from the investment will outweigh the costs of borrowing. This approach typically involves borrowing funds at a higher interest rate than the expected return on the investment. The rationale behind this strategy is that the investment will appreciate in value over time, eventually compensating for the higher borrowing costs. However, this strategy comes with significant risks. If the investment does not perform as expected or if borrowing costs rise further, the investor may end up incurring substantial losses. Moreover, the longer the investment takes to appreciate, the greater the impact of negative arbitrage on the overall return. An investor may borrow funds to invest in a particular asset, hoping that the increased investment exposure will lead to higher returns. This is often seen in the context of margin trading or using leverage in the derivatives market. While leveraging investments can amplify returns, it also magnifies the potential losses if the investment does not perform as expected. The increased borrowing costs associated with leverage can further exacerbate the negative arbitrage effect, leading to even greater losses. As a result, leveraging investments with higher borrowing costs can be a high-risk strategy and should be approached with caution. Currency carry trades are another example of a negative arbitrage strategy. In this case, an investor borrows money in a low-interest-rate currency and invests it in a higher-interest-rate currency, hoping to profit from the interest rate differential. However, if the exchange rate between the two currencies moves unfavorably, the investor may experience negative arbitrage. In such a scenario, the cost of borrowing in the low-interest-rate currency may exceed the return earned on the investment in the high-interest-rate currency. This can result in losses for the investor, particularly if the exchange rate continues to move against their position. As with other negative arbitrage strategies, currency carry trades with unfavorable exchange rates carry significant risks and should be carefully considered before being undertaken. One of the most significant risks associated with negative arbitrage is the potential for financial losses and reduced profitability. When the cost of borrowing exceeds the return on investment, investors may end up incurring losses instead of earning profits. This can have a detrimental impact on an investor's overall portfolio and financial health. Moreover, even if an investment ultimately generates a positive return, the impact of negative arbitrage can significantly reduce the overall profitability of the investment. In some cases, the costs associated with negative arbitrage may be so high that the investment is no longer worth pursuing, even if it would have otherwise generated a positive return. Negative arbitrage often involves borrowing funds to finance investments, which can lead to increased financial leverage. Higher leverage can magnify potential losses, making an investment much riskier than it would have been without borrowed funds. Additionally, higher borrowing costs can result in increased interest expenses, further eroding the profitability of an investment. Increased financial leverage also puts additional pressure on an investor's cash flow and liquidity, as they must meet ongoing interest payments and debt obligations. This can be particularly problematic if the investment does not generate sufficient cash flow to cover these expenses, leading to potential financial distress or even default. Negative arbitrage strategies are often exposed to market volatility and liquidity risks. Market volatility can cause rapid fluctuations in asset prices, potentially leading to losses for investors engaged in negative arbitrage strategies. Additionally, liquidity risks may arise if an investor needs to exit their investment quickly but is unable to do so due to a lack of buyers or sellers in the market. In such cases, the investor may be forced to sell their investment at a loss, further exacerbating the impact of negative arbitrage. As a result, investors engaged in negative arbitrage strategies should be prepared to withstand market volatility and liquidity risks, and have contingency plans in place to manage these risks effectively. A classic example of negative arbitrage can be found in the bond market. If an investor borrows funds at a higher interest rate to invest in bonds with a lower yield, they are effectively experiencing negative arbitrage. This can occur when interest rates decline, causing bond yields to fall while borrowing costs remain relatively high. In this scenario, the investor would be better off not engaging in the investment, as the cost of borrowing exceeds the return on the investment. Moreover, if interest rates continue to decline, the negative arbitrage effect can become even more pronounced, leading to substantial losses for the investor. It is important for investors to carefully assess the interest rate environment and the potential for negative arbitrage before engaging in bond investments that require borrowing funds. Another example of negative arbitrage can be found in foreign exchange trading. As previously mentioned, currency carry trades involve borrowing funds in a low-interest-rate currency and investing them in a higher-interest-rate currency. However, if the exchange rate between the two currencies moves unfavorably, the investor may experience negative arbitrage. In this case, the cost of borrowing in the low-interest-rate currency may exceed the return earned on the investment in the high-interest-rate currency. This can result in losses for the investor, particularly if the exchange rate continues to move against their position. As with other examples of negative arbitrage, investors should carefully consider the potential risks and rewards of such strategies before engaging in foreign exchange trading. Negative arbitrage can also occur in the context of financial derivatives, such as options and futures contracts. If an investor purchases a derivative contract at a price that is higher than the contract's underlying value, they may be engaging in negative arbitrage. This can happen when there are pricing disparities between different markets or when market inefficiencies cause the derivative contract to be mispriced. In these situations, the investor may incur losses if the market does not correct the pricing disparity or if the underlying asset's value does not rise sufficiently to offset the higher cost of the derivative contract. Investors should carefully evaluate the potential for negative arbitrage when trading financial derivatives, particularly when there are significant pricing disparities or market inefficiencies at play. One of the most effective ways to mitigate and manage the risks associated with negative arbitrage is to implement strict risk management policies. This can include setting limits on leverage, monitoring interest rate differentials, and regularly assessing the potential for negative arbitrage in the context of an investor's overall portfolio. By having clear risk management policies in place, investors can minimize the likelihood of incurring significant losses due to negative arbitrage and make more informed decisions about their investments. Another important aspect of managing negative arbitrage is closely monitoring investment positions and making adjustments as needed. This may involve exiting an investment when negative arbitrage becomes too pronounced or adjusting an investor's exposure to a particular asset or market. By actively monitoring and adjusting investment positions, investors can minimize the impact of negative arbitrage on their overall portfolio and reduce the likelihood of incurring significant losses. In some cases, investors may be able to utilize hedging strategies to offset potential losses associated with negative arbitrage. This can involve taking offsetting positions in related assets or markets, or using financial derivatives to hedge against specific risks, such as interest rate or currency fluctuations. While hedging strategies can help to mitigate the impact of negative arbitrage, they may also involve additional costs and risks. As such, investors should carefully consider the potential benefits and drawbacks of hedging strategies before implementing them as part of their overall investment approach. Negative arbitrage is a critical concept in finance that occurs when the cost of borrowing money is higher than the return on investments made with the borrowed funds. It is crucial for investors and financial professionals to be aware of the potential for negative arbitrage and actively work to prevent or mitigate its effects on their investment portfolio. Identifying and managing negative arbitrage risks is essential for maintaining profitability and reducing the likelihood of incurring significant losses. Moreover, understanding the strategies and risks associated with negative arbitrage can help investors make more informed decisions and better navigate the complex world of finance. By employing effective risk management policies, monitoring investment positions, and utilizing hedging strategies when necessary, investors can minimize the impact of negative arbitrage on their overall portfolio. Ultimately, a comprehensive understanding of negative arbitrage can contribute to smarter investment choices and a more resilient financial future.What Is Negative Arbitrage?

Causes of Negative Arbitrage

Interest Rate Differentials

Market Inefficiencies

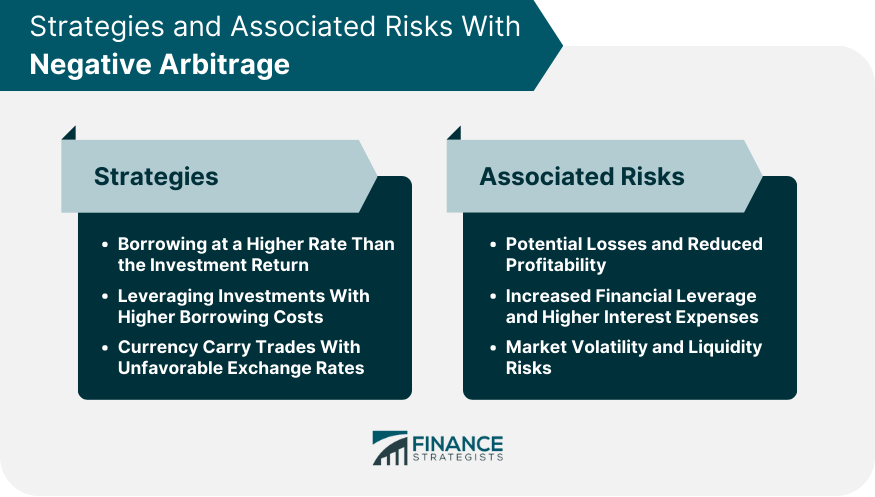

Negative Arbitrage Strategies

Borrowing at a Higher Rate Than the Investment Return

Leveraging Investments With Higher Borrowing Costs

Currency Carry Trades With Unfavorable Exchange Rates

Risks Associated With Negative Arbitrage

Potential Losses and Reduced Profitability

Increased Financial Leverage and Higher Interest Expenses

Market Volatility and Liquidity Risks

Examples of Negative Arbitrage

Bond Investments With Declining Interest Rates

Foreign Exchange Trading With Unfavorable Interest Differentials

Financial Derivatives With Negative Pricing Disparities

Mitigation and Management of Negative Arbitrage

Strict Risk Management Policies

Monitoring and Adjusting Investment Positions

Utilizing Hedging Strategies to Offset Losses

Conclusion

Negative Arbitrage FAQs

Negative arbitrage refers to a situation where the cost of borrowing exceeds the return on an investment, resulting in financial losses.

Negative arbitrage can be caused by interest rate differentials, market inefficiencies, and unfavorable currency fluctuations.

Strategies related to negative arbitrage include borrowing at a higher rate than the investment return, leveraging investments with higher borrowing costs, and engaging in currency carry trades with unfavorable exchange rates.

Negative arbitrage poses risks such as potential losses and reduced profitability, increased financial leverage and higher interest expenses, and exposure to market volatility and liquidity risks.

Negative arbitrage can be mitigated through strict risk management policies, continuous monitoring and adjustment of investment positions, and utilizing hedging strategies to offset potential losses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.