In the realm of trading, a hard stop is an order to buy or sell a security once its price reaches a specified level, known as the stop price. When this stop price is reached, the stop order becomes a market order, and the trade is executed at the next available price. The term 'hard' in a hard stop refers to the fact that this stop price is set at a fixed, specific value. A hard stop is a critical tool in risk management for traders. It allows them to set the maximum amount they are willing to lose on a trade without the need for constant market monitoring. A hard stop is designed to limit an investor's loss and prevent their portfolio from significant damage. A hard stop order remains inactive until the market price reaches the specified stop price. Once this price is reached, the stop order turns into a market order and is filled at the next available price. This ensures that the order will be executed, but it does not guarantee that it will be executed at the exact stop price. A hard stop differs from a mental stop, where an investor mentally decides to sell a security when it reaches a certain price. The advantage of a hard stop is that it removes emotional decision-making from the trading process, thereby potentially improving investment outcomes. It is the price level at which the hard stop order will be activated and turned into a market order. The trigger price should be carefully determined to balance the desire to limit losses with the need to avoid premature selling due to market volatility. Order duration specifies how long the hard stop order will be in effect. This can range from a single trading day (a day order) to indefinitely until the order is filled or cancelled (a good 'til cancelled order). Market conditions can significantly influence the effectiveness of a hard stop. In a highly volatile market, a hard stop might get triggered more often, while in a less volatile market, it might not get triggered as frequently. The primary benefit of utilizing a hard stop is its ability to restrict losses to a predefined amount. For instance, a trader can establish a hard stop at a price level that represents a 5% loss. By doing so, the trader knows in advance the maximum amount they stand to lose on the trade, which could protect their investment portfolio from significant downturns. Furthermore, by specifying the maximum amount a trader is willing to lose on a trade, a hard stop can prevent a string of losses from depleting the trader's capital. This function of hard stops is especially beneficial in scenarios where multiple trades go wrong in succession, shielding traders from disastrous outcomes. Trading can stir up strong emotions like fear and greed, which can lead to poor decision-making. A hard stop is beneficial as it ensures decision-making is based on a predetermined strategy rather than an emotional reaction to market movements. When markets take a downturn, a trader's instinct might be to hold on to the losing position in the hope it will rebound. Conversely, during a bull run, fear of missing out might prompt traders to jump into trades without adequate risk control. With a hard stop in place, the trade will automatically be executed when the price reaches the predetermined level, without any additional action required by the trader. This automated nature of hard stops can be particularly advantageous during market hours when the trader might not be monitoring the markets, or during significant economic events causing rapid price changes. Whipsaws occur when the market price of a security fluctuates rapidly in a short period, causing the hard stop to be triggered prematurely. For example, suppose a trader sets a hard stop for a stock at $20. If the stock momentarily dips to $20 and then quickly rebounds to $25, the hard stop order would have been triggered, causing the trader to sell at $20 and miss out on potential gains. This occurs when the stop price is set too close to the purchase price of the security. If the stop price is reached soon after purchase due to normal market fluctuations, the security may be sold before it has a chance to appreciate in value, limiting the trader's potential profit. This could potentially result in numerous trades that realize small losses, which could significantly impact overall portfolio performance over time. When the stop price is reached, the hard stop order becomes a market order. In a rapidly falling market, this could mean that the execution price is much lower than the stop price. For example, if a stock's price is plummeting, the trader might place a hard stop order at $50. However, by the time the order is executed, the price may have fallen to $45. This would result in a larger loss than the trader had intended when placing the stop order. Thus, while a hard stop can provide some control over potential losses, it cannot guarantee an exact exit price. If a stop level is too close to the current price, the hard stop may be triggered too often, resulting in unnecessary trades and potentially limiting profits. On the other hand, if the stop level is set too far away, the hard stop may not effectively limit losses. Just as the financial markets are dynamic, so too should be the use of hard stops. They are not set-and-forget mechanisms. Instead, they require regular reviewing and appropriate adjusting to keep up with the fluctuating market environment and the evolving value of your holdings. As the market price of a security increases, moving the hard stop price upwards accordingly allows for the locking in of potential profits, whilst still maintaining an effective risk management strategy. A lack of adjustment in a rising market could potentially leave more at risk than initially intended. A common method is to utilize a risk/reward ratio, a tool that aids in setting a stop level that corresponds to a realistic and acceptable potential loss for a given potential gain. A risk/reward ratio of 1:3, for example, indicates a willingness to risk $1 of potential loss for the opportunity of $3 of potential gain. This ratio assists traders in establishing a hard stop that equates to an acceptable level of loss, in light of the prospective returns of the trade. A hard stop order allows traders to set a maximum loss they are willing to accept on a trade without constant monitoring. By automatically converting to a market order when the stop price is reached, hard stops help limit losses and protect investment portfolios. They provide convenience during market hours, protect against market volatility, and promote emotional control by removing the influence of emotions on trading decisions. Traders can set predetermined stop prices and know their maximum potential loss in advance, preventing significant downturns and preserving capital. However, it is important to consider the potential drawbacks of hard stops. Whipsaws, where rapid market fluctuations trigger the stop prematurely, can lead to missed gains. Setting stop prices too close to the purchase price may limit potential profits, and hard stops cannot guarantee an exact execution price. To use hard stops effectively, traders should set realistic stop levels, regularly review and adjust them as market conditions change, and balance the risk and reward by considering the risk/reward ratio.What Is a Hard Stop?

Understanding How a Hard Stop Works

Execution of a Hard Stop

Hard Stop vs Mental Stop

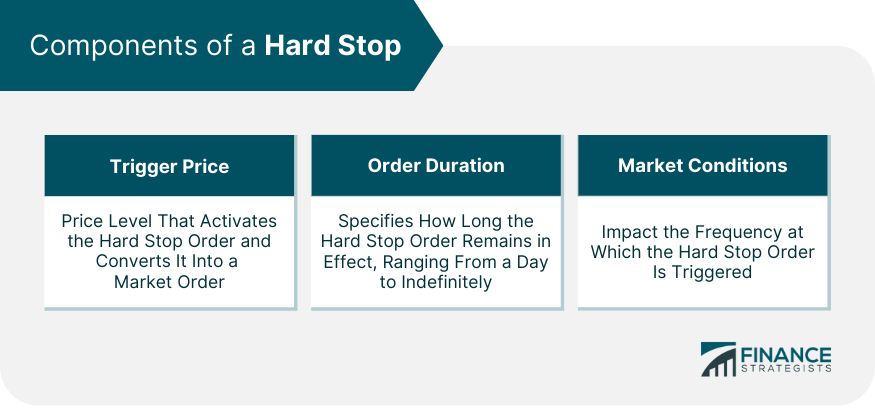

Components of a Hard Stop

Trigger Price

Order Duration

Market Conditions

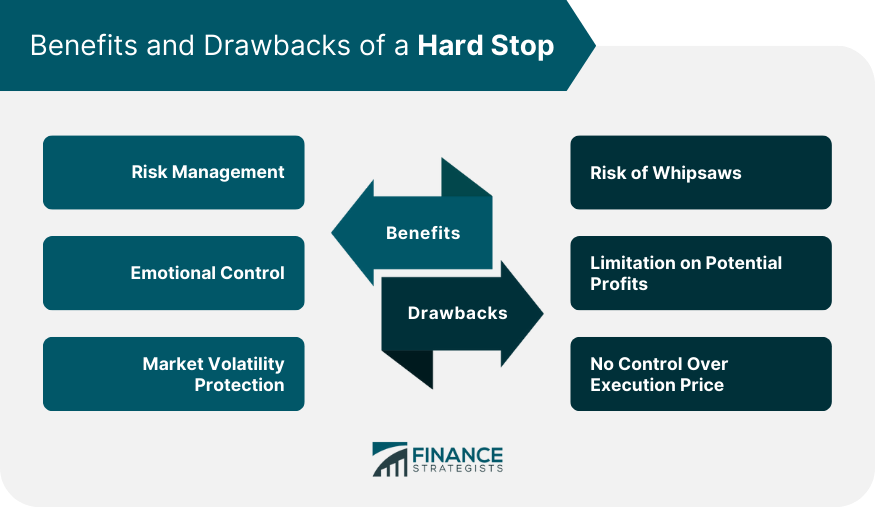

Benefits of a Hard Stop

Risk Management

Emotional Control

Market Volatility Protection

Drawbacks of a Hard Stop

Risk of Whipsaws

Limitation on Potential Profits

No Control Over Execution Price

Best Practices When Using a Hard Stop

Setting Realistic Stop Levels

Regularly Reviewing and Adjusting Hard Stops

Balancing Risk and Reward

Final Thoughts

Hard Stop FAQs

A hard stop is an order placed by a trader to buy or sell a security at a specified price level. When the market price reaches the stop price, the order is automatically executed at the next available price.

A hard stop is different from a regular stop order because it is set at a fixed, specific value. Once the stop price is reached, the order becomes a market order and is filled immediately, regardless of the prevailing market conditions.

A hard stop is crucial for risk management as it allows traders to limit their potential losses on a trade. By setting a maximum loss they are willing to accept, traders can protect their portfolios from significant downturns and prevent emotional decision-making during volatile market conditions.

No, a hard stop cannot guarantee an exact execution price. When the stop price is reached, the order becomes a market order and is filled at the next available price, which may be different from the stop price. Market conditions and price fluctuations can impact the execution price.

The determination of the stop price depends on your risk tolerance and trading strategy. It is important to set a stop price that allows for potential market fluctuations while still protecting against excessive losses. Consider factors such as market volatility, historical price movements, and your desired risk-reward ratio when setting the stop price for a hard stop.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.