The Kijun-Sen, commonly referred to as the Base Line, is a pivotal element of the Ichimoku Kinko Hyo trading system. Computed by averaging the highest high and the lowest low for a particular period, typically the past 26 periods, it is designed to represent the midpoint of a market's price range, thereby offering insight into potential future price movement. It is highly valued for its capabilities in trend identification, dynamic support and resistance levels establishment, and generation of entry and exit signals. However, the Base Line is not infallible. Its effectiveness may diminish in strong trending markets due to lagging signals or in range-bound markets due to false signals. Consequently, for optimal use, the Base Line should be employed in conjunction with other technical analysis tools as part of a broader, well-considered trading strategy. The origins of the Kijun-Sen lie within the Japanese form of technical analysis, Ichimoku Kinko Hyo, pioneered by Goichi Hosoda. The Ichimoku system provides more data points compared to the standard candlestick charting, offering traders a more comprehensive view of market conditions. Over the years, the Kijun-Sen has become an integral part of this method, used by traders across the globe. The Kijun-Sen holds significant importance in technical analysis. Its function as a dynamic support and resistance line and its ability to indicate trend direction make it a powerful tool for traders. Additionally, it plays a crucial role in generating potential buy and sell signals, facilitating effective decision-making in various market scenarios. The Kijun-Sen, or Base Line, comprises the median price over a defined period, often set to 26 periods by default. This typically translates to 26 days for daily charts, 26 weeks for weekly charts, and so forth. Its calculation, though simple, provides meaningful insight into the prevailing market trends. The Kijun-Sen is calculated as the average of the highest high and the lowest low over a specified period. The result creates a line that offers key insights into potential future support and resistance levels, serving as a dynamic price threshold. A price above the Kijun-Sen is typically seen as bullish, indicating positive momentum. Conversely, a price below the Kijun-Sen is usually viewed as bearish, suggesting negative momentum. A flat Kijun-Sen suggests a range-bound market, with the price oscillating around the line. The Kijun-Sen is part of the Ichimoku Cloud structure, which also includes the Tenkan-Sen (Conversion Line), Senkou Span A and B (Leading Span), and the Chikou Span (Lagging Span). The interaction of these lines delivers a holistic view of the market's trends and potential reversals. For example, a cross of the Tenkan-Sen (Conversion Line) above the Kijun-Sen is considered a bullish signal, while a cross below is bearish. This holistic view aids traders in making comprehensive trading decisions. In trend identification, the Kijun-Sen plays a critical role. Its positioning in relation to the price gives traders a quick understanding of the market direction. When the price is above the Base Line, it signifies a bullish trend, suggesting that it might be a good time to consider long positions. Conversely, if the price is below the Base Line, a bearish trend is indicated, and traders may want to consider short positions or exiting long positions. The Base Line also acts as a dynamic support and resistance level, changing with the ebb and flow of market prices. When the market is in a bullish phase, the Base Line serves as a support level – a point at which prices tend to bounce back. Conversely, in a bearish phase, the Base Line acts as resistance – a level that prices struggle to break through. This flexible nature of the Base Line makes it a valuable tool for assessing market strength and potential price reversal points. The Kijun-Sen is not just a passive indicator; it's also actively used in generating trading signals. A common strategy involves using the crossover of the Base Line and the Conversion Line (Tenkan-Sen). When the Conversion Line crosses above the Base Line, it indicates bullish momentum, suggesting a potential buy signal. On the other hand, when the Conversion Line crosses below the Base Line, it signals bearish momentum, implying a potential sell signal. This simple yet effective strategy allows traders to time their entries and exits to align with the prevailing market momentum. The Base Line comes with several distinct advantages. It provides a quick visualization of market trends, support and resistance levels, and potential buy and sell signals. This versatile use across different aspects of trading gives it an edge over many traditional indicators. Moreover, its applicability across different time frames and markets adds to its usefulness for various types of traders, from day traders to long-term investors. Despite its many advantages, the Kijun-Sen is not without limitations. One major drawback is that in periods of strong trends, the Base Line may lag, potentially leading to late entry or exit signals. Also, it might not provide accurate signals in range-bound or choppy markets. Therefore, like many other technical indicators, the Base Line should not be used in isolation but should be combined with other indicators and market analysis methods for a more holistic trading approach. Trading, in any form, comes with inherent risks, and using the Kijun-Sen is no exception. While it provides valuable market insights, it does not guarantee profitability. It's crucial for traders to understand these risks and to use risk management techniques such as stop-loss orders and position sizing to mitigate potential losses. In the stock market, the Kijun-Sen is widely used as a tool for trend identification and trading signal generation. For instance, traders often look for crossovers between the Base Line and the Conversion Line as potential buy or sell signals. Furthermore, the Base Line can provide dynamic support and resistance levels, helping traders understand where the price might encounter an obstacle or find support. Given the wide-ranging conditions in the stock market, from highly volatile stocks to more stable blue-chip stocks, the Base Line's adaptability makes it a versatile tool. The Forex market, characterized by high liquidity and 24-hour trading, offers unique opportunities and challenges. Here, the Base Line proves beneficial in identifying overall trends and potential reversals, helping traders navigate this volatile market. Traders often use the Base Line in combination with other Ichimoku elements to generate trading signals, adding another layer of confirmation and thereby increasing the probability of successful trades. Just like in the stock and forex markets, the Kijun-Sen is a valuable tool in commodity and futures trading. These markets often exhibit strong trends due to various factors such as seasonality in agricultural commodities or macroeconomic indicators affecting energy or metal commodities. The Base Line can provide valuable clues about the direction of these trends, and its dynamic support and resistance levels can assist traders in planning their trades effectively. The Kijun-Sen, or Base Line, is a fundamental component of the Ichimoku Kinko Hyo system, calculated as the midpoint of the highest high and the lowest low over a set period. It serves as a vital tool for understanding market trends, identifying potential support and resistance levels, and generating trading signals. The Base Line offers numerous advantages, including its versatility across different markets and its adaptability to evolving trading strategies. However, it's not without limitations, as it can occasionally lag in strong trends, leading to potentially delayed signals, and its effectiveness can diminish in range-bound markets. Therefore, while the Kijun-Sen is a powerful tool, it's crucial to understand its capabilities and shortcomings and to use it as part of a comprehensive, balanced trading strategy.Definition of Kijun-Sen (Base Line)

Origin and Development of Kijun-Sen

Importance of Kijun-Sen in Technical Analysis

Understanding Kijun-Sen

Elements of Kijun-Sen

Calculation and Interpretation of Kijun-Sen

Kijun-Sen in Relation to Other Ichimoku Cloud Elements

Kijun-Sen in Trading Strategies

Role of Kijun-Sen in Trend Identification

Kijun-Sen as a Support and Resistance Level

Using Kijun-Sen for Entry and Exit Signals

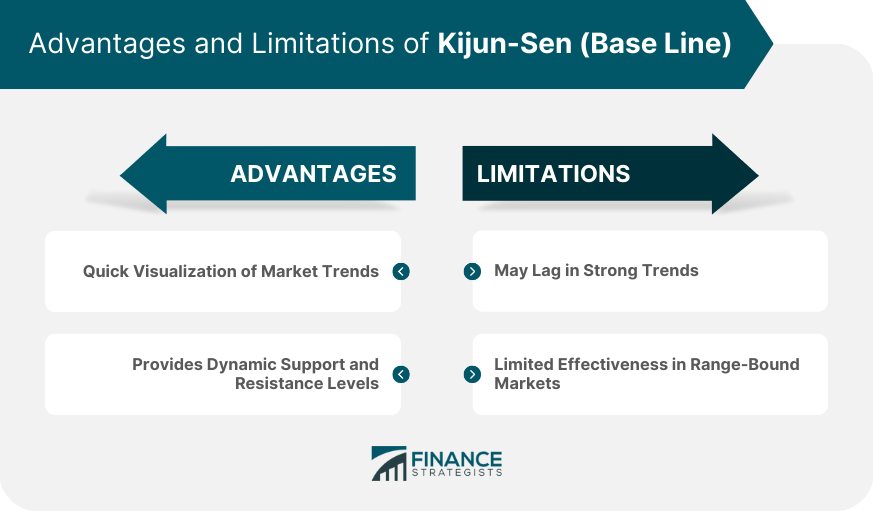

Advantages and Limitations of Kijun-Sen

Advantages of Using Kijun-Sen in Trading

Limitations of Kijun-Sen as a Trading Tool

Understanding the Risks Involved in Kijun-Sen Based Trading

Kijun-Sen in Different Markets

Kijun-Sen in the Stock Market

Kijun-Sen in the Forex Market

Kijun-Sen in Commodity and Futures Trading

Conclusion

Kijun-Sen (Base Line) FAQs

The Kijun-Sen, also known as the Base Line, is a key component of the Ichimoku Kinko Hyo system. It's calculated as the average of the highest high and the lowest low over a specific period, providing insight into market trends and potential support and resistance levels.

The Kijun-Sen (Base Line) is used for identifying market trends, serving as a dynamic support and resistance level, and generating trading signals. For instance, when the price crosses the Base Line, it can signal a change in market direction.

The Base Line offers quick visualization of market trends, provides dynamic support and resistance levels, generates clear buy and sell signals, and is versatile across different time frames and markets.

While the Kijun-Sen (Base Line) offers many benefits, it can sometimes lag in strong trends, potentially leading to delayed signals. Also, its effectiveness can be limited in range-bound markets.

Yes, the Kijun-Sen (Base Line) is a versatile tool that can be used in different markets, including the stock, forex, and commodities markets. Its principles remain valid, regardless of the market or asset class.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.