ERISA Section 404(c) is a provision of the Employee Retirement Income Security Act of 1974 (ERISA) that provides certain protections to fiduciaries of participant-directed individual account plans, such as 401(k) plans, when plan participants exercise control over the investments in their accounts. Under Section 404(c), if a plan meets certain requirements, the plan's fiduciaries are generally not liable for losses that result from the investment decisions made by participants. This means that if participants choose to invest their retirement savings in certain investment options and those investments perform poorly, the plan's fiduciaries are not responsible for the resulting losses as long as the plan complies with the requirements of Section 404(c). To qualify for Section 404(c) protections, a plan must meet several criteria, including providing participants with a broad range of investment options, allowing them to exercise control over their accounts, and providing sufficient information about the investment options available to them. Additionally, participants must be allowed to change their investment choices at least quarterly. If a plan meets these requirements and operates in accordance with Section 404(c), the plan's fiduciaries are generally shielded from liability for the investment decisions made by participants. However, it's important to note that Section 404(c) does not absolve fiduciaries of their overall duty to prudently select and monitor the investment options offered under the plan. A fiduciary is a person or entity responsible for managing a retirement plan's assets in the best interests of the plan participants and beneficiaries. Under ERISA, a fiduciary has several duties, including: Acting solely in the interest of plan participants and their beneficiaries, Acting prudently by exercising the care, skill, and diligence that a prudent person would use when managing a retirement plan, Diversifying investments to minimize the risk of significant losses, Following the plan documents, and Ensuring that plan expenses are reasonable. Fiduciaries must adhere to these duties to fulfill their responsibilities and avoid potential liability. A plan to comply with ERISA Section 404(c) must meet certain requirements. Some of the critical plan requirements include the following: Written Plan Document: The retirement plan must have a written document outlining the plan's provisions, such as eligibility requirements, vesting schedules, and distribution rules. Diversification and Investment Options: The plan must offer a broad range of investment options to allow participants to diversify their portfolios and minimize risk. Individual Account Plans: ERISA Section 404(c) applies to individual account plans, such as 401(k) and 403(b) plans, where participants have individual accounts and exercise control over their investments. Participant Control: Participants must have the ability to exercise control over their investment choices, and plan fiduciaries must provide them with adequate information to make informed decisions. Plan fiduciaries must provide participants with adequate investment information, which includes disclosures about the plan's investment options, fees, and expenses. A description of each investment option, including its objectives, risk and return characteristics, and historical performance. Information on any fees and expenses associated with each investment option, such as management fees, transaction costs, and other expenses. An explanation of how participants can give investment instructions and any restrictions or limitations on investment changes. A statement that the plan is intended to comply with ERISA Section 404(c) and that plan fiduciaries may be relieved of liability for participant-directed investment decisions. A plan must offer a broad range of investment options to allow participants to diversify their portfolios. Typically, this means providing at least three core investment alternatives with different risk and return characteristics, such as a stock fund, a bond fund, and a stable value or money market fund. In addition, the plan should offer additional investment options to enable participants to diversify their investments further and tailor their portfolios according to their risk tolerance and investment goals. Participants must have the ability to exercise control over their investments. This includes having the right to: Direct the investment of their account among the plan's investment options, Exercise voting rights and tender offers associated with their investments, and Change their investment options at least quarterly, or more frequently if the plan permits. Providing participants with control over their investments is crucial for complying with ERISA Section 404(c) and empowering them to make informed decisions. ERISA Section 404(c) limits the liability of plan fiduciaries for investment decisions made by participants as long as the plan complies with the section's requirements. However, there are exceptions to this limitation, such as fiduciary breaches or improper investment advice. By complying with ERISA Section 404(c), plan fiduciaries can reduce their liability for the investment performance of participant-directed investments. This encourages fiduciaries to make prudent investment decisions, provide diverse investment options, and fulfill their fiduciary duties, ultimately benefiting the plan participants. Compliance with ERISA Section 404(c) can increase participant involvement in retirement planning and provide opportunities for financial education. When participants are given control over their investments and access to essential information, they are more likely to engage in retirement planning actively. This increased engagement can lead to better long-term investment outcomes for participants, as they become more knowledgeable about their investment choices and more proactive in managing their retirement accounts. Ensuring compliance with ERISA Section 404(c) can be complex, as plan fiduciaries must provide adequate disclosures and maintain a broad range of participant investment options. The process of selecting and monitoring investment options and preparing and distributing disclosures requires significant time and effort on the part of plan fiduciaries. While ERISA Section 404(c) encourages participant involvement, it also places responsibility for investment decisions on participants, who may need more financial knowledge or experience to make optimal choices. This can lead to participants making poor investment decisions, such as choosing investments that are too risky or not diversified enough, which could result in significant losses. Plan fiduciaries should regularly assess their investment options and participant engagement to ensure ongoing compliance with ERISA Section 404(c) requirements. This may involve reviewing the plan's investment options to ensure they continue to meet the needs of participants and provide adequate diversification opportunities. In addition, fiduciaries should evaluate the effectiveness of the plan's disclosures and educational materials to determine if any improvements are needed. Providing educational resources and offering investment advice can help participants make informed investment decisions, supporting compliance with ERISA Section 404(c). Some ways to provide employee education include: Distributing educational materials, such as brochures and videos, that cover investment basics and explain the plan's investment options. Offering investment advice through a qualified investment advisor, either in-person or online. Hosting financial education workshops or webinars to teach participants about retirement planning and investing. Selecting and evaluating service providers and ensuring they meet ERISA requirements is crucial for maintaining compliance with ERISA Section 404(c). Plan fiduciaries should: Carefully vet and select service providers, such as investment managers and recordkeepers, based on their qualifications, experience, and fees. Regularly monitor the performance and fees of service providers to ensure they continue to meet the plan's needs and comply with ERISA requirements. Establish a formal process for reviewing and, if necessary, replacing service providers that are not meeting the plan's expectations or ERISA standards. By diligently managing service providers, plan fiduciaries can help ensure that the plan remains compliant with ERISA Section 404(c) and continues to serve participants' best interests. ERISA Section 404(c) provides protections to fiduciaries of participant-directed individual account plans, such as 401(k) plans, when plan participants exercise control over the investments in their accounts. Compliance with Section 404(c) requires plans to provide participants with a broad range of investment options, allow them to exercise control over their accounts, and provide sufficient information about the investment options available to them. ERISA Section 404(c) Compliance can benefit both plan fiduciaries and participants, by reducing fiduciary liability and increasing participant engagement in retirement planning. However, ensuring compliance can be complex and may require regular plan reviews, employee education, and monitoring and managing service providers. Overall, ERISA Section 404(c) can provide important protections and opportunities for participants, but requires diligent effort on the part of plan fiduciaries to ensure compliance and promote positive outcomes for all involved..What Is ERISA Section 404(c)?

Key Components of ERISA Section 404(c)

Fiduciary Responsibilities

Plan Requirements

Compliance With ERISA Section 404(c)

Providing Investment Information

These disclosures should be provided regularly to ensure participants can make informed investment decisions. Some of the specific disclosure requirements include:Investment Options

Participant Control

Plan Fiduciary Limitations

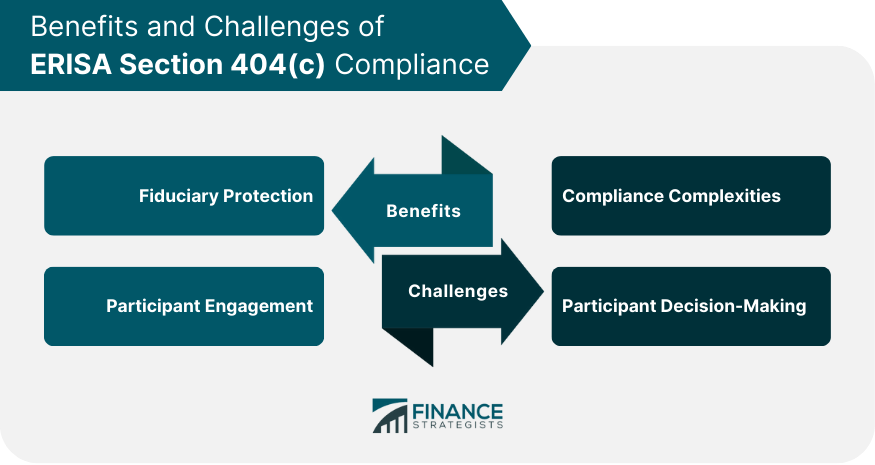

For instance, if a fiduciary selects an investment option that is unsuitable for the plan or fails to monitor the plan's service providers adequately, they may still be held liable for any resulting losses.Benefits of ERISA Section 404(c) Compliance

Fiduciary Protection

Participant Engagement

Potential Challenges of ERISA Section 404(c) Compliance

Compliance Complexities

Participant Decision-Making

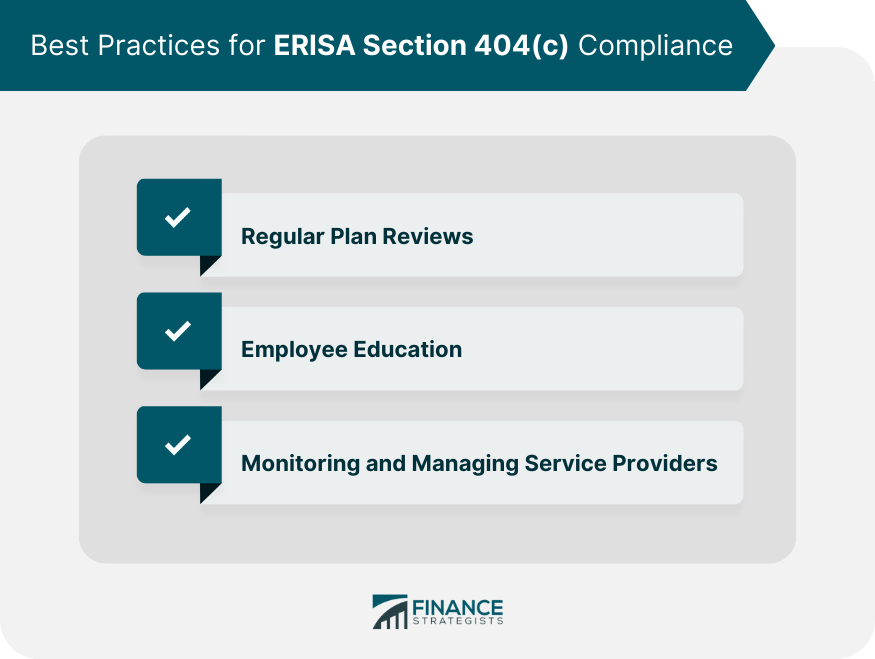

Best Practices for ERISA Section 404(c) Compliance

Regular Plan Reviews

Employee Education

Monitoring and Managing Service Providers

Conclusion

ERISA Section 404(c) FAQs

ERISA Section 404(c) is a provision that provides certain protections to fiduciaries of participant-directed retirement plans, such as 401(k) plans, from liability for losses resulting from participant investment decisions.

ERISA Section 404(c) applies to defined contribution plans, such as 401(k) plans, allowing participants to direct their account balances' investment.

Plan fiduciaries must provide participants with sufficient information about the investment options available in the plan and the risks associated with each option. They must also ensure that the investment options are diversified and that participants can change their investments as needed.

Yes, plan fiduciaries can still be held liable for losses resulting from their own actions or omissions, such as failing to prudently select and monitor the investment options offered in the plan.

Plan sponsors should work with their plan advisors and legal counsel to develop and implement procedures for complying with ERISA Section 404(c), including providing participants with sufficient information about investment options, monitoring the performance of investment options, and maintaining proper records.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.