The Securities Investor Protection Corporation is a nonprofit corporation that was established in 1970 by Congress to protect investors from losses due to the failure of a brokerage firm. It provides insurance coverage up to $500,000 per account, which includes up to $250,000 for cash, in the event of a broker-dealer's insolvency. The coverage applies to securities, such as stocks, bonds, and mutual funds, and cash held in a brokerage account. SIPC is funded by member assessments and is authorized to borrow from the U.S. Treasury if necessary. It is overseen by the Securities and Exchange Commission (SEC). SIPC's mission is to restore funds to investors whose securities or cash are missing or have been stolen because of a broker-dealer's bankruptcy, fraud, or other financial problems. Its primary purpose is to protect investors if their broker-dealer fails. It does not protect investors from losses due to market fluctuations, but it does protect investors from fraud and theft by broker-dealers. All broker-dealers registered with the Securities and Exchange Commission are required to become members of SIPC. SIPC is funded by member assessments, which are based on the amount of securities a broker-dealer holds in its customer accounts. SIPC serves as a form of insurance protection for investors. In the event of a broker-dealer's insolvency, SIPC steps in to facilitate the transfer of securities and cash to another broker-dealer or directly to the investor. If the assets cannot be transferred, SIPC will provide compensation to the investor for their loss, up to the coverage limits. SIPC coverage provides protection up to $500,000 per customer, including up to $250,000 for cash balances held in a brokerage account. However, it is important to note that SIPC coverage does not protect against market losses, nor does it cover investments that are not held in a brokerage account, such as direct investments in mutual funds or individual bonds. To file a claim with SIPC, investors should contact the trustee or receiver appointed to handle the broker-dealer's liquidation. The trustee or receiver will provide instructions on how to submit a claim and what information is required. SIPC also has a website with information on how to file a claim and answers to frequently asked questions. Broker-dealers are required to be members of SIPC. If a broker-dealer fails, SIPC will step in to protect investors. SIPC will work with the trustee appointed by the court to liquidate the failed broker-dealer. SIPC will then provide funds to the trustee to distribute to the investors. The payout process may take several months, and investors may not receive their full amount of assets. Broker-dealers are required to maintain accurate records of their customer accounts and to segregate customer assets from the broker-dealer's own assets. Broker-dealers are also required to maintain a certain level of net capital, which is a measure of their financial strength. In the event of a broker-dealer's insolvency, SIPC works with the trustee or receiver appointed by the court to liquidate the broker-dealer's assets and distribute them to customers. SIPC also assists in the transfer of customer accounts and securities to another broker-dealer or directly to the investor. If a broker-dealer is unable to return customer assets, SIPC will step in to provide compensation. SIPC's payout process is designed to be quick and efficient, and in most cases, investors will receive their assets within a few months. However, the amount of compensation may be reduced if the broker-dealer's assets are insufficient to cover all claims. SIPC and the Federal Deposit Insurance Corporation (FDIC) both provide insurance to protect investors from loss. However, there are some key differences between the two. SIPC provides protection for securities held in a brokerage account, while FDIC provides protection for deposits held in a bank account. In addition, SIPC coverage is limited to $500,000 per customer, while FDIC coverage is up to $250,000 per depositor per account ownership category. SIPC coverage applies to securities, such as stocks and bonds, and cash held in a brokerage account, while FDIC coverage applies to deposits held in a bank account, such as savings accounts and certificates of deposit (CDs). Despite the differences in coverage, SIPC and FDIC share some similarities. Both provide insurance protection to investors, and both are funded by assessments paid by member institutions. Both also play a crucial role in maintaining investor confidence in the financial system. SIPC provides investor education through its website and outreach programs. It offers resources for investors to learn about the risks and benefits of investing, how to choose a broker-dealer, and how to protect their investments. Investor education is crucial to ensure that investors make informed decisions and are aware of the risks associated with investing. In addition to its role in providing insurance protection to investors, SIPC is also involved in investor education. SIPC provides a range of educational resources, including brochures, videos, and online tools, to help investors understand the risks and rewards of investing. Investor education is an important aspect of investor protection. By understanding the risks and rewards of investing, investors are better equipped to make informed investment decisions. This, in turn, can help reduce the likelihood of investment fraud and other forms of financial exploitation. In addition to SIPC's educational resources, there are many other resources available to investors. These include government agencies, such as the SEC and FINRA, as well as nonprofit organizations and financial professionals. SIPC has faced criticisms for its coverage limits and funding. Some critics argue that SIPC's coverage limits are too low, and that investors may not receive full recovery of their assets in the event of a broker-dealer failure. Others argue that SIPC's funding is insufficient to cover all claims in the event of a widespread financial crisis. SIPC has responded to these criticisms by stating that its coverage limits are set by law, and that its funding is sufficient to cover the vast majority of claims. One criticism of SIPC is that its coverage limits are too low. Some argue that the $500,000 coverage limit is not sufficient to protect investors with large brokerage accounts. However, it is important to note that SIPC coverage is meant to provide protection against broker-dealer insolvency, not investment losses. Another criticism of SIPC is that its funding structure is flawed. Critics argue that the current system of member assessments is inadequate to cover the costs of a large-scale broker-dealer failure. However, SIPC has defended its funding structure and maintains that it is sufficient to fulfill its mission. SIPC is an important organization for investor protection in the United States. Its coverage of up to $500,000 in securities and cash provides a safety net for investors in the event of a broker-dealer failure. SIPC coverage applies to a wide range of securities held in a brokerage account, and it is available to both US and foreign investors who are customers of a SIPC member broker-dealer. SIPC also works to promote investor education and awareness, and it has a range of resources available to investors. While SIPC is not without criticism, it remains an important aspect of investor protection. By providing insurance coverage and promoting investor education, SIPC helps to maintain investor confidence in the financial system. As the financial landscape continues to evolve, it will be important for SIPC to adapt and evolve to meet the changing needs of investors and to ensure that its mission of investor protection is fulfilled.What Is the Securities Investor Protection Corporation (SIPC)?

Mission and Purpose of SIPC

SIPC Membership and Funding

SIPC’s Role in Investor Protection

SIPC’s Coverage Limits

How to File a Claim With SIPC

SIPC's Relationship With Broker-Dealers

Broker-Dealer Responsibilities

SIPC’s Role in the Liquidation of a Broker-Dealer

SIPC’s Payout Process

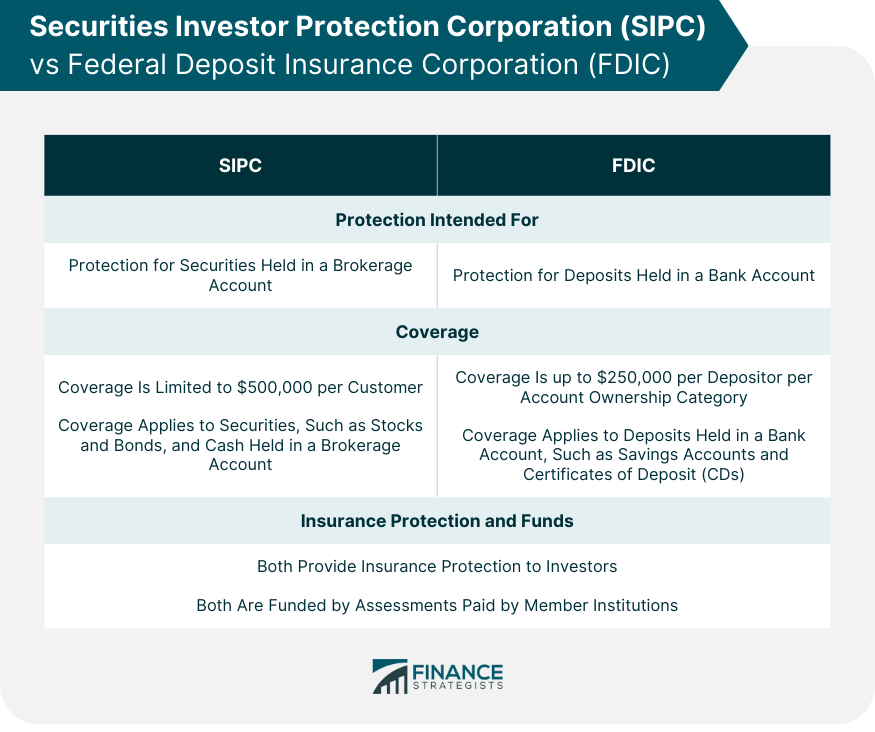

SIPC vs FDIC

SIPC and Investor Education

SIPC's Education Initiatives

Importance of Investor Education

Resources for Investor Education

Criticisms of SIPC

Criticisms of SIPC's Coverage Limits

Criticisms of SIPC's Funding

Conclusion

Securities Investor Protection Corporation (SIPC) FAQs

The Securities Investor Protection Corporation (SIPC) is a nonprofit organization that provides protection for investors' cash and securities in the event of a brokerage firm's failure.

SIPC provides up to $500,000 in protection for cash and securities held by a brokerage firm. If the firm fails, SIPC will work to return investors' assets as quickly as possible.

No, SIPC only protects investors against the loss of cash and securities held by a brokerage firm in the event of the firm's failure. SIPC does not protect against market fluctuations or bad investment decisions.

No, investors do not have to pay for SIPC protection. The cost of SIPC protection is paid for by the brokerage firms that are members of SIPC.

If your brokerage firm fails, you should contact SIPC as soon as possible to begin the claims process. SIPC will work with you to recover your assets, up to the $500,000 protection limit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.