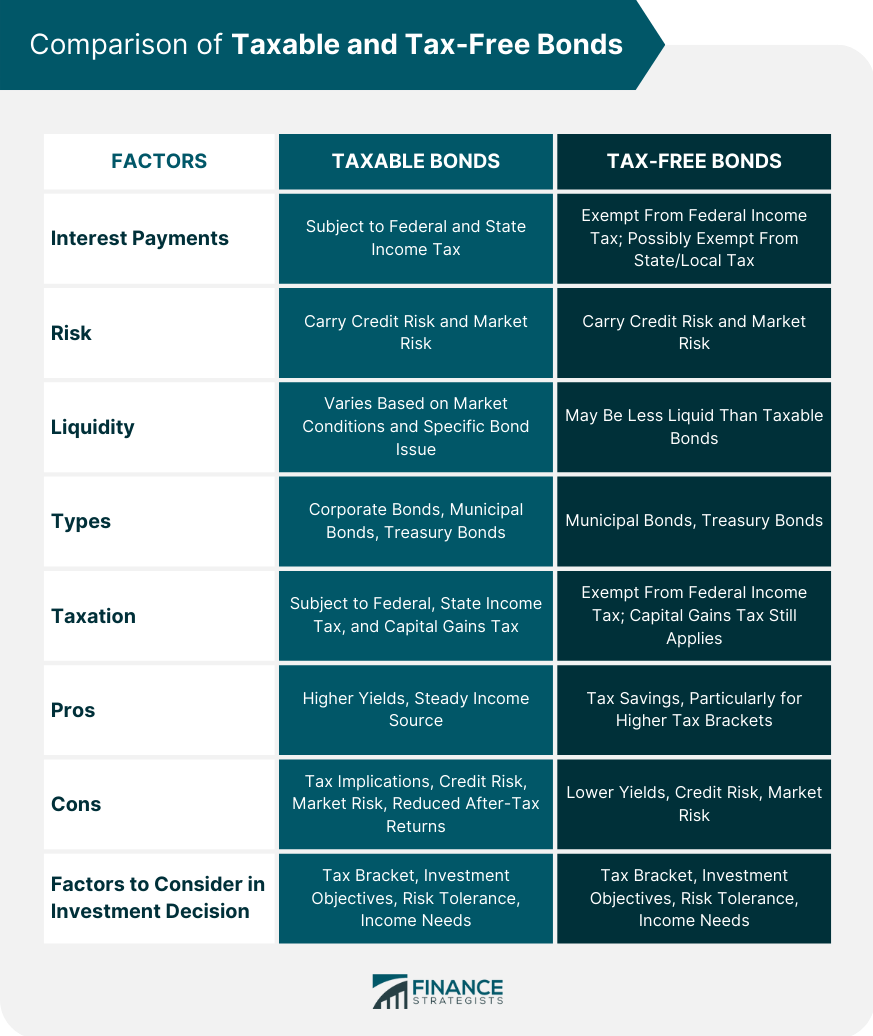

Taxable bonds are bonds on which the interest earned is subject to federal, state, and local income taxes. The income earned from taxable bonds is fully taxable at the investor's marginal tax rate. On the other hand, tax-free bonds, also known as municipal bonds, are issued by state and local governments and are exempt from federal income tax and sometimes state and local income taxes. The main difference between taxable and tax-free bonds is their tax treatment. The income earned from taxable bonds is subject to income tax, while the income earned from tax-free bonds is exempt from income tax. Investors should keep in mind that tax-free bonds may not always be entirely tax-free, depending on the specific bond and the investor's tax bracket. Taxable bonds are issued by corporations and the federal government, and their interest rates are typically higher than tax-free bonds due to the tax treatment. In contrast, tax-free bonds are issued by state and local governments and have lower interest rates than taxable bonds. However, tax-free bonds are often more appealing to investors in higher tax brackets because they can offer a higher after-tax return than taxable bonds. Taxable bonds generate interest income that is subject to federal and state income tax. The tax rate on interest income depends on the investor's tax bracket, with higher-income investors facing higher tax rates. Interest income from taxable bonds is typically paid out semi-annually. Taxable bonds carry credit risk, which is the risk that the bond issuer may default on its payments. Additionally, the market value of bonds can fluctuate based on changes in interest rates, inflation, and other economic factors. Investors should carefully evaluate the creditworthiness of bond issuers and monitor their bond investments for changes in market conditions. Taxable bonds can be bought and sold on secondary markets, but their liquidity can vary based on market conditions and the specific bond issue. Some bonds may be more easily traded than others, and investors may face challenges selling their bonds in times of market stress. There are several types of taxable bonds, including corporate bonds, municipal bonds, and treasury bonds. Corporate bonds are issued by corporations and typically offer higher yields than government bonds. Municipal bonds are issued by state and local governments and are typically exempt from federal income tax. Treasury bonds are issued by the federal government and are considered to be the safest type of bond. Interest income from taxable bonds is subject to federal and state income tax. Additionally, capital gains realized from the sale of taxable bonds are subject to capital gains tax. Investors should be aware of the potential tax implications of their bond investments and consider tax-efficient investment strategies. Tax-free bonds generate interest income that is exempt from federal income tax. Some tax-free bonds may also be exempt from state and local income tax, depending on the bond issuer and the investor's state of residence. Interest income from tax-free bonds is typically paid out semi-annually. Tax-free bonds carry credit risk, similar to taxable bonds. Additionally, the market value of tax-free bonds can fluctuate based on changes in interest rates and other economic factors. Investors should carefully evaluate the creditworthiness of bond issuers and monitor their bond investments for changes in market conditions. Tax-free bonds can be bought and sold on secondary markets, but their liquidity can vary based on market conditions and the specific bond issue. Some tax-free bonds may be less liquid than taxable bonds, and investors may face challenges selling their bonds in times of market stress. The two main types of tax-free bonds are municipal bonds and treasury bonds. Municipal bonds are issued by state and local governments and are typically exempt from federal income tax. Some municipal bonds may also be exempt from state and local income tax, depending on the bond issuer and the investor's state of residence. Treasury bonds, as previously mentioned, are issued by the federal government and are exempt from state and local income tax. Interest income from tax-free bonds is generally exempt from federal income tax. Some tax-free bonds may also be exempt from state and local income tax, depending on the bond issuer and the investor's state of residence. However, investors should be aware that capital gains realized from the sale of tax-free bonds are still subject to capital gains tax. Taxable bonds offer higher yields than tax-free bonds and can provide a source of steady income for investors. However, taxable bonds are subject to federal and state income tax, which can significantly reduce an investor's after-tax returns. Additionally, taxable bonds may carry credit risk and market risk, which can affect their value and liquidity. Tax-free bonds offer income that is exempt from federal income tax and, in some cases, state and local income tax. This can provide tax savings for investors, particularly those in higher tax brackets. However, tax-free bonds may offer lower yields than taxable bonds and may carry credit risk and market risk. Investors should consider several factors when choosing between taxable and tax-free bonds, including their tax bracket, investment objectives, risk tolerance, and income needs. Those in higher tax brackets may benefit more from investing in tax-free bonds, while those in lower tax brackets may prefer the higher yields of taxable bonds. Additionally, investors should carefully evaluate the creditworthiness of bond issuers and monitor their bond investments for changes in market conditions. Taxable bonds and tax-free bonds are two types of investments that offer income to investors. Taxable bonds generate interest income that is subject to federal and state income tax, while tax-free bonds generate income that is exempt from federal income tax and, in some cases, state and local income tax. Investors should carefully evaluate the risks, liquidity, and tax implications of both types of bonds and consider their personal financial situation and investment objectives before making investment decisions. By understanding the differences between taxable and tax-free bonds, investors can make informed investment choices that align with their financial goals.Overview of Taxable vs Tax-Free Bonds

Taxable Bonds

Interest Payments

Risk

Liquidity

Types of Taxable Bonds

Taxation of Taxable Bonds

Tax-Free Bonds

Interest Payments

Risk

Liquidity

Types of Tax-Free Bonds

Taxation of Tax-Free Bonds

Comparison of Taxable and Tax-Free Bonds

Pros and Cons of Taxable Bonds

Pros and Cons of Tax-Free Bonds

Factors to Consider When Choosing Between Taxable and Tax-Free Bonds

Conclusion

Taxable vs Tax-Free Bonds FAQs

Taxable bonds are bonds on which the interest earned is subject to federal, state, and local income taxes.

Tax-free bonds, also known as municipal bonds, are bonds issued by state and local governments that are exempt from federal income tax and sometimes state and local income taxes.

The risks associated with taxable bonds include credit risk, interest rate risk, inflation risk, and liquidity risk.

The benefits of tax-free bonds include exemption from federal income tax and sometimes state and local income taxes, potential for higher after-tax returns, and lower credit risk.

Factors to consider when choosing between taxable and tax-free bonds include your tax bracket, the interest rates offered, the creditworthiness of the issuer, and the investment time horizon.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.