Understanding one's tax obligations while working abroad is more than just a bureaucratic necessity—it's a foundation for financial well-being and peace of mind. Filing taxes correctly and on time is crucial because it ensures compliance with both your home country's regulations and the tax laws of the country you're working in. Neglect in this area can lead to severe penalties, legal complications, and financial burdens. Furthermore, prompt and accurate tax filings can often open the door to certain benefits, refunds, or deductions that can be advantageous to an expatriate. In a foreign setting where tax structures might differ significantly from what one is accustomed to, being well-informed is a protective shield against unforeseen liabilities and ensures that one's global professional journey is both rewarding and legally sound. Filing your taxes when working overseas doesn't have to be daunting. Here's a step-by-step guide to help you navigate the process: Before diving into any forms or numbers, figure out your tax residency status. Each country has its criteria, but often, it's based on how many days you've spent there or the nature of your stay. It's essential to be clear on this to avoid potential tax mishaps. Remember, even if you're considered a resident in a foreign country for tax purposes, you might still be a tax resident in your home country, which can have implications for where and how you file. Check if your home country and your host country have a tax treaty. These treaties can prevent you from being taxed on the same income in both countries. They can significantly influence your overall tax liability, and understanding them can save you from overpaying. Account for every penny you've earned abroad. This includes wages, rental income, dividends, and even some pensions. Keeping detailed records is crucial to ensure accuracy in your tax filings. Remember, even if you earn below the tax-free threshold, you might still need to file a tax return, and consistent documentation will make this process smoother. Some countries offer exclusions, credits, or deductions for foreign-earned income. The U.S. has the Foreign Earned Income Exclusion (FEIE), which allows qualifying citizens to exclude a certain amount of foreign-earned income from U.S. taxes. Familiarizing yourself with these can reduce your tax burden and ensure you're not missing out on any benefits. If you have foreign bank accounts or other financial assets, you might need to report them, especially if they exceed certain thresholds. Transparency is vital to avoid potential penalties. The U.S. requires the filing of an FBAR if overseas financial assets surpass $10,000 at any time during the year, so keeping track of your foreign financial activities is essential. You might need to use special tax forms or schedules when reporting foreign-earned income. Always refer to the tax guidelines of both your home country and the country where you're working. This ensures that you're abiding by all relevant regulations and not inadvertently making errors in your submission. International tax laws can be intricate. Consider hiring a tax services professional familiar with expatriate taxation. They can guide you through the complexities and ensure you benefit from all possible deductions and credits. Their expertise can be invaluable, especially if you're navigating this terrain for the first time. Often, expatriates are given extended deadlines to file their taxes. However, ensure you're aware of these dates to avoid late penalties. Missing a deadline can be costly, so setting reminders or marking your calendar can be a practical approach. Tax laws can change. Keep yourself updated with the latest tax regulations in both your home and host countries. This proactive approach ensures that you're always compliant and aware of your rights and responsibilities. Always keep a copy of your filed tax returns, supporting documents, and any correspondence related to taxes. They might come in handy for future references or in case of audits. Organized record-keeping can also make subsequent tax filings more straightforward and less stressful. Navigating the complexities of international work, one quickly realizes the profound benefits of timely and accurate tax filings. By fulfilling your tax obligations in a timely and accurate manner, you protect yourself from potential penalties, fines, or legal actions. Countries often have stringent regulations and penalties for non-compliance, and by filing correctly, you ensure you're on the right side of the law. Many countries, recognizing the unique financial situation of expatriates, offer certain exclusions, deductions, or credits on foreign-earned income. Properly filing your taxes can help you leverage these benefits, reducing your overall tax liability and potentially increasing your take-home pay. By understanding and complying with your tax obligations abroad, you gain a clearer picture of your financial status and future obligations. This knowledge can be empowering, providing a sense of security and allowing you to make more informed financial decisions while abroad. Consistently meeting your tax obligations can enhance your financial reputation in your host country, making it easier to engage in other financial activities like securing loans, renting properties, or making significant purchases. It showcases responsibility and trustworthiness to foreign financial institutions. If you ever decide to return to your home country, having a clean tax record from your time abroad can simplify the repatriation process. It ensures there are no lingering tax obligations or complications that might arise upon your return, facilitating a smoother transition back home. The significance of adhering to tax obligations while working abroad cannot be overstated. Beyond the bureaucratic requirements, this practice forms the core of financial stability and peace of mind. Filing taxes accurately and promptly safeguards compliance with both native and host country regulations averting severe penalties and legal entanglements that negligence may entail. Understanding double taxation agreements, documenting all income sources, capitalizing on exclusions and deductions, and seeking professional assistance all contribute to the tax filing process. The advantages of timely and precise tax filings encompass shielding against penalties, capitalizing on tax benefits, gaining financial clarity, enhancing your financial reputation, and preparing for future repatriation. Ultimately, embracing these strategies for tax management while working abroad ensures compliance, safeguards financial well-being, and facilitates a smooth transition through the complexities of international work experiences.Importance of Filing Taxes

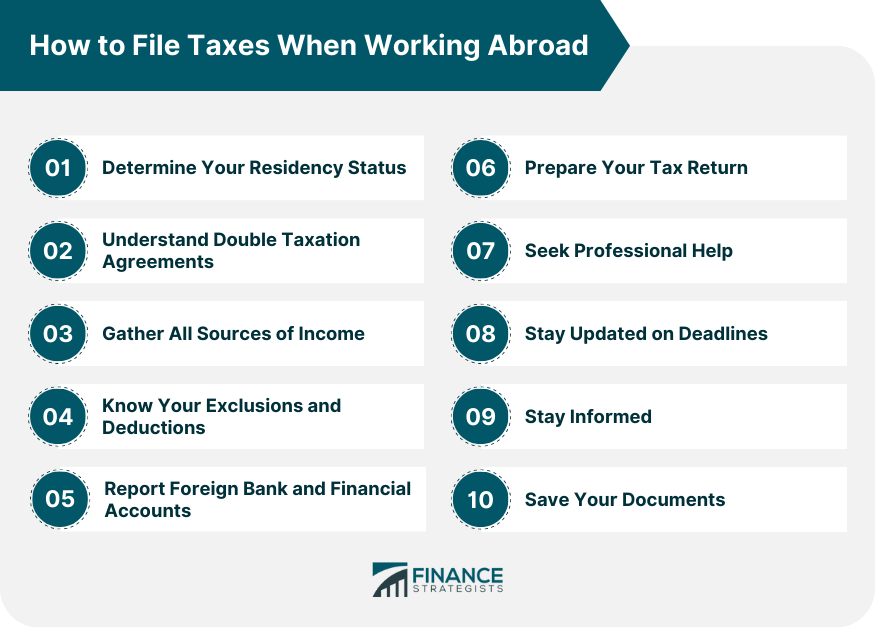

How to File Taxes When Working Abroad

Determine Your Residency Status

Understand Double Taxation Agreements

Gather All Sources of Income

Know Your Exclusions and Deductions

Report Foreign Bank and Financial Accounts

Prepare Your Tax Return

Seek Professional Help

Stay Updated on Deadlines

Stay Informed

Save Your Documents

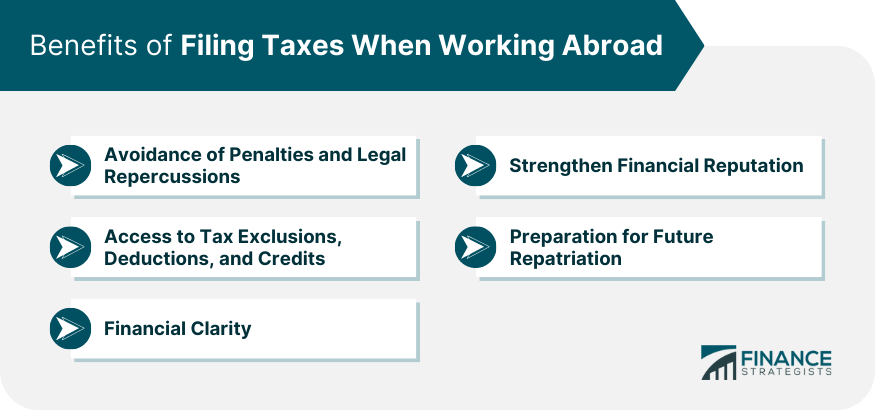

Benefits of Filing Taxes When Working Abroad

Avoidance of Penalties and Legal Repercussions

Access to Tax Exclusions, Deductions, and Credits

Financial Clarity

Strengthen Financial Reputation

Preparation for Future Repatriation

Conclusion

How to File Taxes When Working Abroad FAQs

To file taxes when working abroad, start by determining your tax residency status, understanding double taxation agreements, gathering all sources of income, knowing available exclusions and deductions, and preparing your tax return following both home and host country guidelines.

The first step is to determine your tax residency status, which varies by country and can influence where and how you file your taxes.

Yes, tax treaties between your home and host countries can prevent double taxation and influence your overall tax liability, potentially saving you from overpaying.

Yes, in many cases, you need to report foreign bank accounts and financial assets, especially if they exceed certain thresholds, to ensure transparency and avoid penalties.

A tax professional familiar with expatriate taxation can guide you through complex international tax laws, ensuring accurate filings, maximizing deductions, and minimizing your tax burden.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.