Structured products are financial instruments designed to offer customized risk-return profiles that can meet the unique needs of individual investors. These products are created by combining traditional securities, such as stocks and bonds, with derivatives, such as options and swaps. The popularity of structured products has grown significantly in recent years as investors seek innovative ways to achieve their financial goals. There are numerous types of structured products available in the market, each with different underlying assets, payoff structures, and risk profiles. Some common types include equity-linked notes, reverse convertible bonds, structured investment products, credit-linked notes, and collateralized debt obligations. Structured products are issued by financial institutions such as investment banks, asset management firms, and insurance companies. These institutions act as intermediaries, creating and marketing the products to investors. The investors in structured products can range from retail investors to large institutional clients, such as pension funds and hedge funds. Structured products can be linked to a variety of underlying assets, such as equities, fixed income, commodities, foreign exchange, and indices. These underlying assets determine the performance and risk characteristics of the structured product. Derivative instruments, such as swaps, forwards, futures, and options, are often used in the construction of structured products. These derivatives allow issuers to create customized payoff structures and risk profiles tailored to specific investment objectives and market conditions. Structured products can have various payoff structures, depending on the investor's goals and risk tolerance. Some common structures include principal protected, yield enhancement, leveraged participation, and absolute return products. Each of these structures offers different levels of potential returns and risk exposure. Equity-linked notes are structured products that offer investors exposure to the performance of one or more underlying equities, often through the use of options. These products can provide investors with the potential for capital appreciation and income generation, depending on the specific structure. Reverse convertible bonds are structured products that combine a traditional bond with a short put option on an underlying asset, typically a stock. These products offer investors the potential for higher coupon payments but may result in the investor receiving the underlying asset if the asset's value falls below a predetermined level. Structured investment products are a broad category of structured products that can include a wide range of underlying assets and payoff structures. These products are designed to offer investors tailored risk-return profiles and access to unique investment opportunities. Credit-linked notes are structured products that provide investors with exposure to the credit risk of one or more reference entities, such as corporations or governments. These products often pay a higher yield than traditional bonds but carry additional risk related to the creditworthiness of the reference entities. Collateralized debt obligations are structured products that pool together various fixed-income assets, such as bonds or loans, and then issue new securities backed by the pool. These securities are typically divided into tranches with different risk and return profiles, allowing investors to select a level of risk and return that matches their investment objectives. One of the main benefits of structured products is their ability to be tailored to meet specific investment objectives and risk tolerance levels. This customization allows investors to potentially achieve more attractive returns than traditional investment vehicles or create a more diversified portfolio. Structured products can offer exposure to a wide range of underlying assets, such as equities, fixed income, commodities, and foreign exchange. This exposure can provide diversification benefits, potentially reducing portfolio risk and enhancing overall returns. Investors can gain exposure to various asset classes and market sectors through structured products. This access allows investors to potentially benefit from unique investment opportunities that may not be available through traditional investment vehicles. Structured products can be designed to provide enhanced returns under specific market conditions. For example, some products may offer leveraged participation in the performance of an underlying asset, resulting in potentially higher returns than a direct investment in the asset. Structured products are often complex, making it difficult for investors to fully understand the risks associated with these investments. This complexity may result in investors assuming more risk than they initially intended. Structured products may not be easily traded in the secondary market, resulting in limited liquidity. This lack of liquidity may make it difficult for investors to sell their structured product investments when needed, potentially leading to losses. Investors in structured products are exposed to the credit risk of the issuing financial institution. If the issuer experiences financial difficulties or defaults, investors may suffer losses on their investments. There may be limited demand for structured products in the secondary market, making it challenging for investors to sell their investments at a favorable price. This limited secondary market can result in reduced liquidity and increased risk for investors. Issuers of structured products must comply with various disclosure requirements to ensure that investors have access to the information necessary to make informed investment decisions. These requirements typically include providing a detailed description of the product's structure, risks, fees, and potential returns. Financial institutions and advisors involved in the marketing and sale of structured products must ensure that these investments are suitable for their clients, considering factors such as the client's investment objectives, risk tolerance, and financial situation. This process may involve conducting a thorough risk assessment and providing appropriate guidance to clients. Structured products are subject to various securities regulations, depending on the jurisdiction in which they are issued and sold. These regulations may include registration requirements, reporting obligations, and restrictions on marketing and sales practices. The regulatory landscape for structured products varies across different countries and regions, with each jurisdiction having its own set of rules and requirements. Investors and issuers must be aware of and comply with the relevant regulations in their respective jurisdictions. Before investing in structured products, investors should carefully consider their investment objectives, risk tolerance, and financial situation. This process may involve consulting with a financial advisor to determine whether structured products are appropriate for their specific needs and goals. Investors should carefully evaluate the credit risk of the issuer when considering an investment in structured products. This assessment may involve reviewing the issuer's financial statements, credit ratings, and overall financial health to determine the likelihood of default or financial distress. It is essential for investors to thoroughly understand the structure and payoff profile of a structured product before investing. This analysis may include reviewing the product's prospectus, payoff diagrams, and other documentation to ensure that the investor is comfortable with the potential risks and returns associated with the product. Investors should actively monitor and manage their structured product investments, taking into account changes in market conditions, the issuer's creditworthiness, and their own investment objectives and risk tolerance. This process may involve regularly reviewing the performance of the structured product, adjusting portfolio allocations, and consulting with a financial advisor as needed. As technology continues to advance, the structured products market is expected to see increased automation and digitization, potentially resulting in more efficient pricing, risk management, and product development processes. Investor interest in sustainable and socially responsible investments is on the rise, and the structured products market is likely to see increased demand for products that cater to these preferences. This trend may lead to the development of new structured products linked to environmental, social, and governance (ESG) factors or impact investing themes. As financial markets evolve and new asset classes emerge, structured products will likely adapt to provide exposure to these new opportunities. For example, the growing popularity of cryptocurrencies and digital assets may lead to the development of structured products linked to these assets. The regulatory landscape for structured products is continually changing, with regulators around the world seeking to balance investor protection and market innovation. As new rules and guidelines are introduced, issuers and investors will need to stay informed and adapt to these changes to ensure compliance and manage risks effectively. Structured products offer investors a unique opportunity to access customized risk-return profiles and diversify their investment portfolios. These innovative financial instruments can provide exposure to a wide range of underlying assets and market sectors, potentially enhancing overall returns. However, the complexity and potential risks associated with structured products require careful consideration and due diligence by investors. When evaluating and investing in structured products, it is crucial for investors to understand their investment objectives, risk tolerance, and the specific features of the product in question. Moreover, staying informed about the evolving regulatory landscape and market trends is essential for managing investments effectively and capitalizing on new opportunities in the structured products space. As technology continues to advance and the demand for sustainable and socially responsible investments grows, structured products are expected to evolve and adapt to meet the changing needs of investors. By staying informed and working with experienced financial advisors, investors can navigate the complex world of structured products and potentially benefit from the unique opportunities they offer. Consult a wealth management professional or certified financial advisor for further information on structured products.What Are Structured Products?

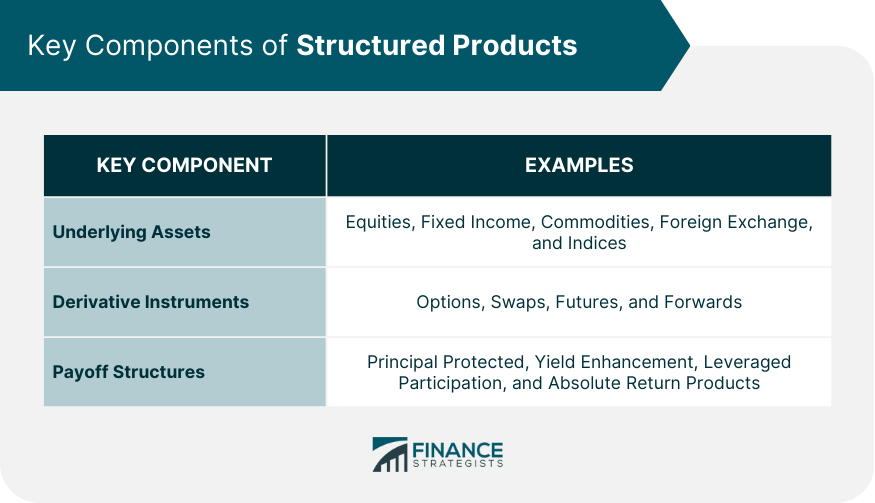

Key Components of Structured Products

Underlying Assets

Derivative Instruments

Payoff Structures

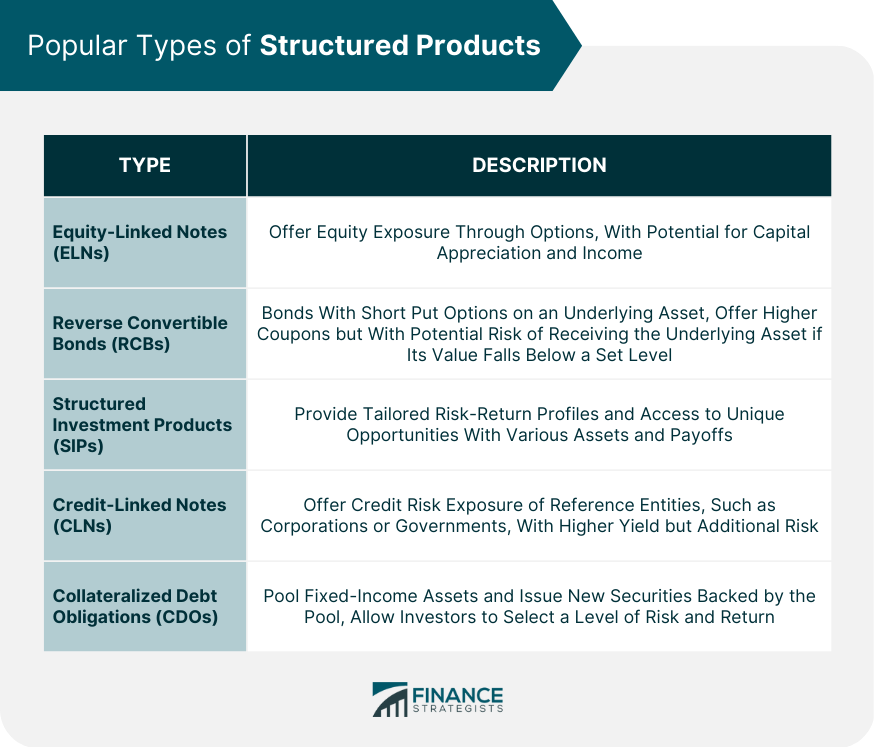

Popular Types of Structured Products

Equity-Linked Notes (ELNs)

Reverse Convertible Bonds (RCBs)

Structured Investment Products (SIPs)

Credit-Linked Notes (CLNs)

Collateralized Debt Obligations (CDOs)

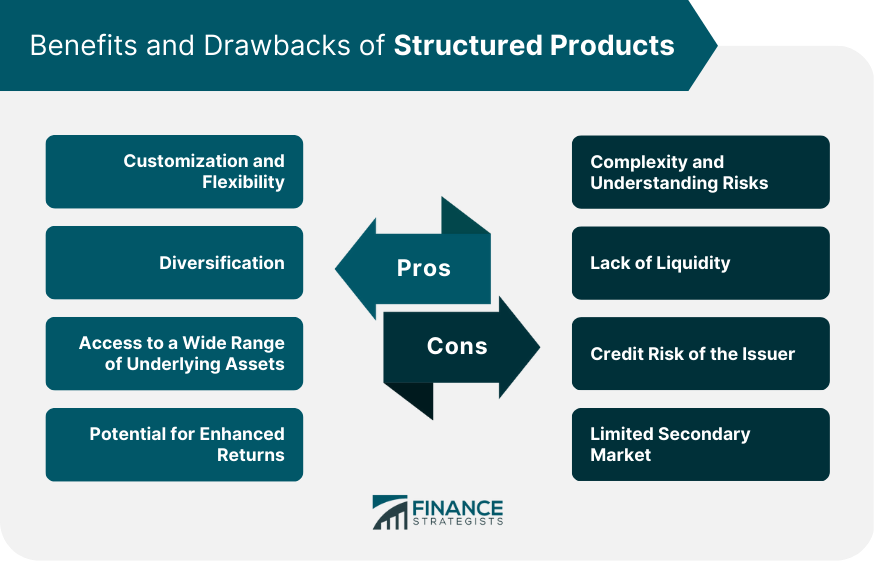

Advantages of Structured Products

Customization and Flexibility

Diversification

Access to a Wide Range of Underlying Assets

Potential for Enhanced Returns

Disadvantages of Structured Products

Complexity and Understanding Risks

Lack of Liquidity

Credit Risk of the Issuer

Limited Secondary Market

Regulatory and Compliance Considerations

Disclosure Requirements

Suitability and Risk Assessment

Compliance with Securities Regulations

Global Regulatory Landscape

Tips for Evaluating and Investing in Structured Products

Understand Investment Objectives and Risk Tolerance

Assess the Issuer’s Credit Risk

Analyze the Product's Structure and Payoff Profile

Monitor and Manage Structured Product Investments

Future Trends and Developments in Structured Products

Technological Advancements and Automation

Growing Demand for Sustainable and Socially Responsible Investments

Emergence of New Asset Classes

Evolving Regulatory Landscape

Final Thoughts

Structured Products FAQs

Structured products are financial instruments that combine traditional securities with derivatives to offer customized risk-return profiles for investors. Unlike traditional investment vehicles, structured products provide more flexibility, access to a wide range of underlying assets, and the potential for enhanced returns based on specific market conditions.

Common types of structured products include equity-linked notes (ELNs), reverse convertible bonds (RCBs), structured investment products (SIPs), credit-linked notes (CLNs), and collateralized debt obligations (CDOs). Each type has its own unique features, underlying assets, and risk-return characteristics.

Structured products offer advantages such as customization, diversification benefits, access to various underlying assets, and potentially enhanced returns. However, they also have drawbacks, including complexity, limited liquidity, credit risk of the issuer, and a limited secondary market.

Investors should carefully assess their investment objectives and risk tolerance before investing in structured products. They should also analyze the product's structure, payoff profile, and the credit risk of the issuer. Once invested, monitoring and managing structured product investments regularly is essential to adapt to changes in market conditions and the investor's objectives.

The future of structured products is likely to be influenced by technological advancements, leading to increased automation and digitization in pricing, risk management, and product development. Additionally, growing demand for sustainable and socially responsible investments may result in the creation of new structured products linked to environmental, social, and governance (ESG) factors or impact investing themes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.