Commodities futures are a form of investment that involve buying and selling contracts for the future delivery of commodities such as oil, gold, and agricultural products. Futures trading can be used to hedge against price volatility or to speculate on the future price movements of commodities. This type of trading allows investors to profit from price movements in commodities without actually taking physical possession of the underlying asset. Commodities futures trading can be complex, and it is important to have a good understanding of the market before investing. This includes knowledge of the factors that can influence commodity prices, such as supply and demand, geopolitical events, and weather patterns. Buying commodities futures requires several steps, including choosing a commodity to trade, selecting a futures broker, opening a futures trading account, funding the account, and placing an order. The first step in buying commodity futures is to decide which commodity to trade. There are a variety of commodities that can be traded on futures exchanges, including metals, energy products, agricultural products, and more. Once you have decided on a commodity to trade, you must select a futures broker. A futures broker is a firm that provides access to futures markets and helps investors execute trades. To start trading commodity futures, you will need to open a futures trading account with your chosen broker. There are different types of accounts available, including individual accounts and managed accounts. Once you have opened a futures trading account, you will need to fund the account in order to start trading. This can typically be done through bank transfers, wire transfers, or credit card payments. Once your account is funded, you can place orders to buy and sell commodities futures. There are several types of orders available, including market orders, limit orders, and stop orders. Buying commodities futures can offer several benefits for investors, including: Commodities futures can provide investors with the potential for high returns, especially during times of market volatility. This is because commodity prices can be highly volatile, creating opportunities for investors to profit from price movements. Investing in commodities futures can help to diversify an investor's portfolio beyond traditional stocks and bonds, potentially reducing overall portfolio risk and improving long-term returns. Commodities futures can be used as a hedging tool to manage risk associated with price fluctuations in underlying commodities. For example, a farmer may use futures contracts to lock in the price of a crop ahead of the harvest season, reducing exposure to price fluctuations. Commodities futures often have a low correlation with other asset classes, meaning they can provide diversification benefits that may not be achievable with traditional investments. Commodities futures are traded on highly liquid futures exchanges, providing investors with a transparent and efficient marketplace for buying and selling contracts. The futures markets are highly regulated, providing investors with transparency and a level playing field. Market data and information are readily available to all market participants, helping to ensure fair pricing. Commodities futures trading allows investors to use leverage, which means they can control a larger position in a commodity than their account balance would otherwise allow. This can amplify potential gains, but it also increases the risk of losses. While buying commodities futures can offer potential benefits for investors, there are also several drawbacks to consider, including: Commodities futures are a high-risk investment, as they are highly volatile and subject to sudden price fluctuations. The potential for high returns also means that there is a corresponding potential for significant losses. Commodities futures contracts have expiration dates, which means that investors must sell or roll over their positions before the contract expires. This limits the time horizon for investment and can make it difficult to hold onto a position over the long term. Commodities futures trading can be complex and requires a good understanding of the underlying commodities, futures markets, and trading strategies. This complexity can make it difficult for individual investors to navigate the market successfully. Commodities futures prices are influenced by a variety of factors, including supply and demand, geopolitical events, and weather patterns. Investors have little control over these factors and may find it difficult to predict price movements accurately. Commodities futures contracts are traded on exchanges and are subject to counterparty risk. This means that if a counterparty defaults on its obligations, it can lead to significant losses for investors. Buying commodities futures can be a high-risk investment due to the inherent volatility of the market. Therefore, it is essential to have a well-planned risk management strategy in place to mitigate potential losses and protect your investment capital. Effective risk management can give investors peace of mind and allow them to focus on achieving their long-term investment objectives. It can protect against losses, control leverage, diversify investments, maximize returns, and provide peace of mind for investors. Investors should approach commodities futures trading with a careful and disciplined approach to risk management. Buying commodities futures can be a complex and risky investment, but it can also be a way to diversify your portfolio and potentially generate significant returns. By following the steps outlined in this guide and managing your risks effectively, you can potentially profit from price movements in commodities. However, it is important to do your research before investing in commodity futures, as the market can be unpredictable and requires a certain level of knowledge and expertise. Consult a qualified financial advisor or wealth management professional for further guidance on buying commodity futures. With a good understanding of the basics of commodities futures trading and a careful approach to risk management, you can potentially succeed in this exciting and lucrative market.Commodities Futures: Overview

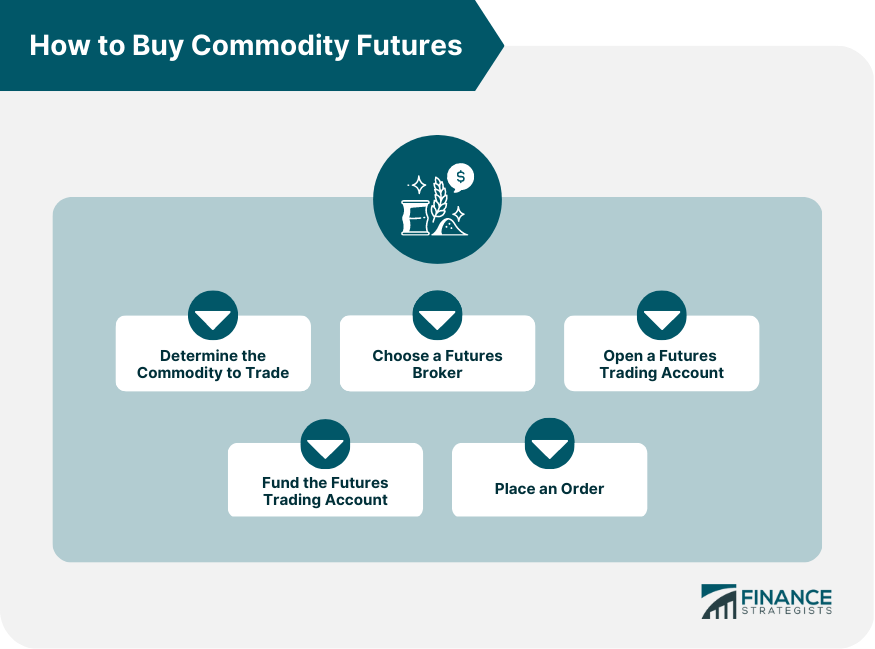

How to Buy Commodities Futures

Determine the Commodity to Trade

Choose a Futures Broker

Open a Futures Trading Account

Fund the Futures Trading Account

Place an Order

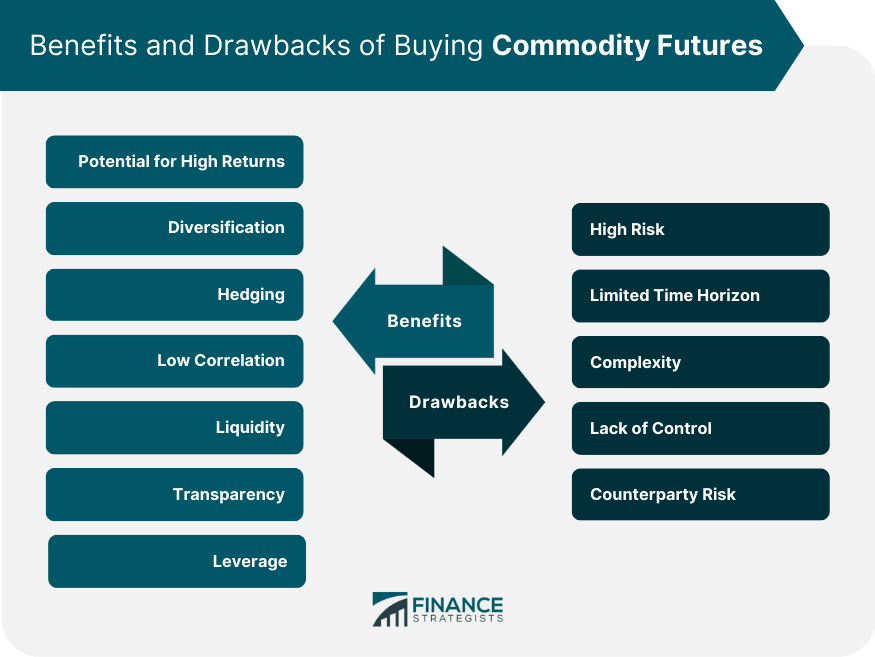

Benefits of Buying Commodities Futures

Potential for High Returns

Diversification

Hedging

Low Correlation

Liquidity

Transparency

Leverage

Drawbacks of Buying Commodity Futures

High Risk

Limited Time Horizon

Complexity

Lack of Control

Counterparty Risk

Risk Management and Buying Commodities Futures

Final Thoughts

How to Buy Commodities Futures FAQs

Commodities futures are contracts that allow investors to buy or sell a specified quantity of a particular commodity at a future date and at a predetermined price. These contracts can be traded on futures exchanges, providing investors with a way to speculate on the future price of commodities.

Buying commodities futures can offer several benefits for investors, including diversification, liquidity, leverage, transparency, the ability to hedge against risk, and the potential for high returns.

Commodities futures trading carries a significant amount of risk, including price volatility, leverage, counterparty risk, limited time horizon, complexity, and lack of control.

Effective risk management strategies for buying commodities futures include using stop-loss orders to limit potential losses, diversifying investments across different commodities and markets, controlling leverage, and staying disciplined and focused on long-term investment objectives.

No, commodities futures trading is not suitable for everyone. Commodities futures trading requires a certain level of knowledge, expertise, and risk tolerance. Investors should carefully consider their investment goals, risk tolerance, and financial situation before investing in commodities futures. Additionally, it is important to seek professional advice and conduct thorough research before investing in the market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.