The process of filing tax returns, for many, is an annual ritual. In the United States, the IRS provides a general guideline for taxpayers who might be late. If you're seeking a refund, you typically have up to three years from the original due date to submit your return. However, if you owe taxes, there's no time limit. This means that the IRS can pursue collection indefinitely. Taxes come in various forms, with personal and business taxes being the most common categories. Personal taxes, often referred to as individual income taxes, apply to earnings made by individuals. These have their set of deadlines and penalties for delays. In contrast, business taxes are for enterprises, both small and large. Their filing procedures and deadlines may differ, especially depending on the business structure, like sole proprietorships, partnerships, or corporations. While the federal guidelines might provide a foundational understanding, state tax rules can differ significantly. Each state has its own revenue department with its own set of rules, deadlines, and penalties. For instance, some states might offer longer or shorter windows for claiming refunds. Therefore, it's crucial to be aware of both federal and state rules when determining how far back you can file. Late tax filings occur for various reasons, and it's crucial to understand them to prevent recurrence or mitigate consequences. Sometimes, people simply forget. Between juggling work, family, and other responsibilities, the tax deadline might slip through the cracks. This is particularly common among new taxpayers or those who've recently undergone significant life changes. Financial difficulties can hinder an individual's ability to pay their due taxes. A sudden job loss, medical emergency, or any unforeseen expense can push the tax deadlines to the back burner. Taxes require thorough documentation. From W-2s to receipts, if significant paperwork goes missing or is delayed, it can stall the filing process. Events like hurricanes, wildfires, or pandemics can disrupt regular tax filing. The IRS often provides extensions or relief during such events, but not everyone might be aware or avail of them in time. When you miss the deadline for filing your taxes, one of the primary repercussions is financial in nature. Not only do late filings accumulate penalties, but they also gather interest. Over time, this combination can significantly inflate the amount you owe, creating a more substantial burden on your finances. It's worth noting that these charges can compound, meaning the longer you wait, the steeper the cost. Proactively addressing any delays can minimize these additional costs. Tax evasion, or a consistent pattern of neglecting to file taxes, is not taken lightly by authorities. Such behavior can quickly escalate into serious legal troubles. Actions taken against defaulters can vary from imposing heavy fines to initiating lawsuits. In more severe cases, particularly where vast sums are involved, individuals may even face imprisonment. Being transparent and timely with tax obligations is vital to avoid these severe consequences. Tax obligations is not isolated from other financial aspects of one's life. If taxes remain unpaid, the government can place liens against the taxpayer. These liens are public records, and their presence can tarnish an individual's credit history. A lowered credit score resulting from such liens can jeopardize future financial endeavors. Whether it's securing a mortgage, applying for a personal loan, or even obtaining a new credit card, a compromised credit score can pose significant challenges. The IRS keeps a vigilant eye on tax filings, and discrepancies or consistent late filings can raise red flags. Accounts showing significant owed amounts or patterns of irregularities are more susceptible to audits. An audit is a thorough review of financial records by the IRS to ensure accuracy and compliance. Not only is the process meticulous and time-consuming, but it can also unearth other discrepancies, leading to additional penalties and potential legal complications. Maintaining accurate records and punctual filings can help taxpayers sidestep these intensive reviews. 1. Determining How Many Years You Need to File: Begin by ascertaining the number of years you've missed. This helps in collecting the right documents and forms. 2. Gathering Necessary Tax Documentation: Collect all relevant forms, receipts, and documents. This might involve contacting employers, banks, or other financial institutions. 3. Consulting With a Tax Professional: A tax expert can guide you on the nuances of late filing, ensuring that you don't miss out on any potential deductions and help you navigate penalties. 4. Utilizing Appropriate Tax Forms for the Specific Year: Ensure you're using the correct forms for each year you're filing. Using the wrong year's forms can lead to processing delays. 5. Understanding Possible Penalty Abatement Options: In some cases, the IRS might offer penalty relief or abatement, especially if you can prove a genuine reason for the delay, like a natural disaster or serious illness. Combat Zone Taxpayers: Those serving in combat zones receive extensions, giving them ample time post their service to address tax matters without penalties. Victims of Natural Disasters: Regions hit by significant natural disasters might get IRS-granted extensions or relief measures, easing the burden on affected taxpayers. Individuals With Specific Hardships: In cases of severe financial hardships, the IRS may provide assistance, allowing taxpayers to set up installment plans or offer compromises. Tax Treaties and Foreign Tax Scenarios: For U.S. citizens working abroad or foreigners working in the U.S., there are specific tax treaties and provisions that might alter regular filing rules. Maintaining an organized financial record system is pivotal for hassle-free tax filing. By collating and storing relevant documents as they come in throughout the year, you not only simplify the process at tax time but also reduce the likelihood of overlooking vital information. Having a designated folder or digital space for these records can further streamline this effort. This practice ensures that when the tax season arrives, you're not scrambling to find necessary papers. Utilizing calendar alerts or app notifications ensures that tax deadlines don't sneak up on you. Setting multiple reminders leading up to the deadline can provide additional assurance. Furthermore, marking these dates prominently on physical calendars or planners acts as an extra layer of reminder, ensuring punctual filing. Tax laws and regulations are ever-evolving. Engaging with tax professionals on a routine basis not only provides clarity on these changes but also offers personalized guidance tailored to your financial situation. These experts can also introduce you to potential deductions or credits you might be eligible for. Their insights can aid in more accurate and beneficial tax filings, mitigating the risks of errors or oversights. The digital age offers a myriad of tools designed to simplify tax-related tasks. Leveraging tax apps can be a game-changer. Not only do they send reminders as deadlines approach, but they also offer features to assist in the actual filing process. Many of these applications can auto-fill certain fields, track deductible expenses, and even provide tax-saving tips, making them invaluable allies during tax season. Integrating these tools into your financial routine can drastically reduce the challenges associated with tax preparations. Navigating the intricacies of past-due taxes requires a comprehensive understanding of both federal and state guidelines. It's vital to recognize the distinction between deadlines for claiming refunds and the enduring nature of tax debts. While personal and business taxes have their unique requirements, each state further brings its own nuances to tax rules. It's not uncommon for individuals to miss tax deadlines due to varied reasons like financial hardships, unawareness, or unprecedented events. Nevertheless, the consequences of delayed filings can be severe, ranging from financial penalties and credit score impacts to potential legal ramifications and IRS audits. To minimize such outcomes, a proactive approach, aided by regular consultations with tax professionals and the utilization of digital tools, can ensure punctual and accurate tax submissions. By staying informed and organized, taxpayers can both mitigate the risks associated with past-due filings and set a course for smoother financial horizons.Duration for Filing Past-Due Taxes

General Rule for Filing Past-Due Federal Tax Returns in the US

Variances Based on the Type of Taxes

Distinctions Between Federal and State Tax Rules

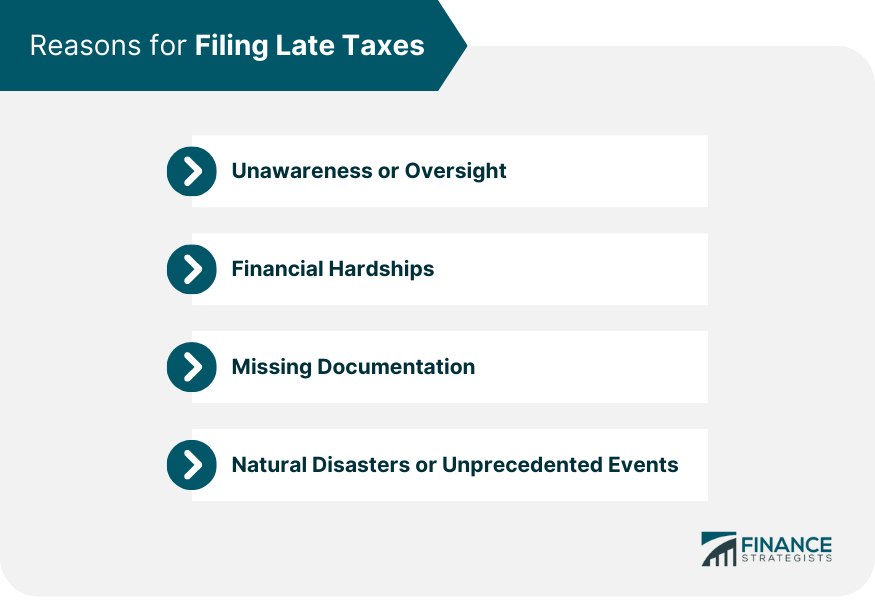

Reasons for Filing Late Taxes

Unawareness or Oversight

Financial Hardships

Missing Documentation

Natural Disasters or Unprecedented Events

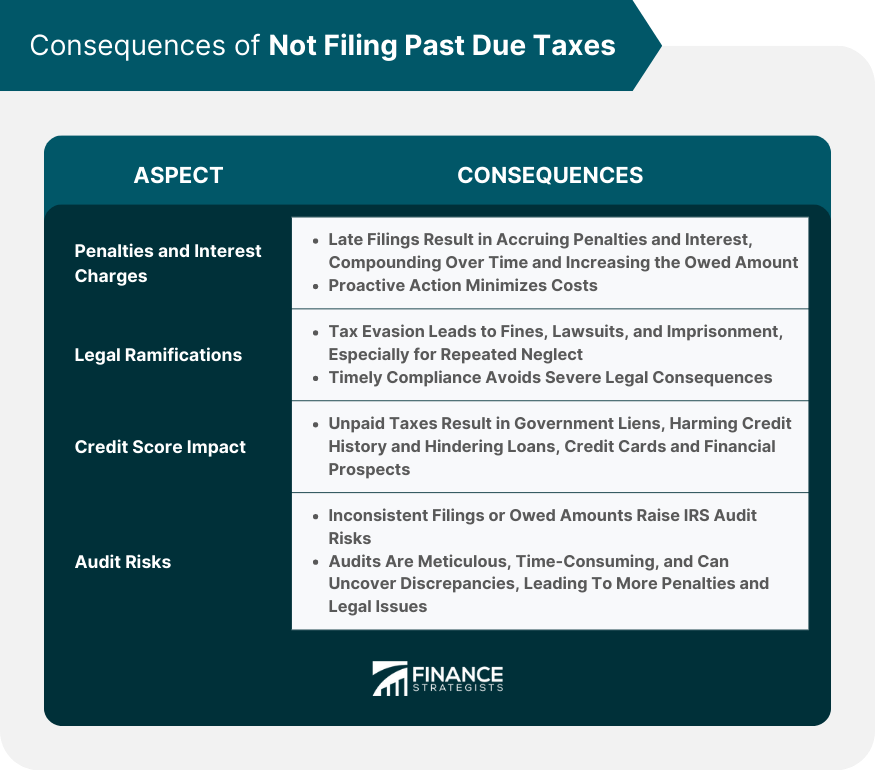

Consequences of Not Filing Past Due Taxes

Penalties and Interest Charges

Legal Ramifications

Impact on Credit Scores

Potential Audit Risks

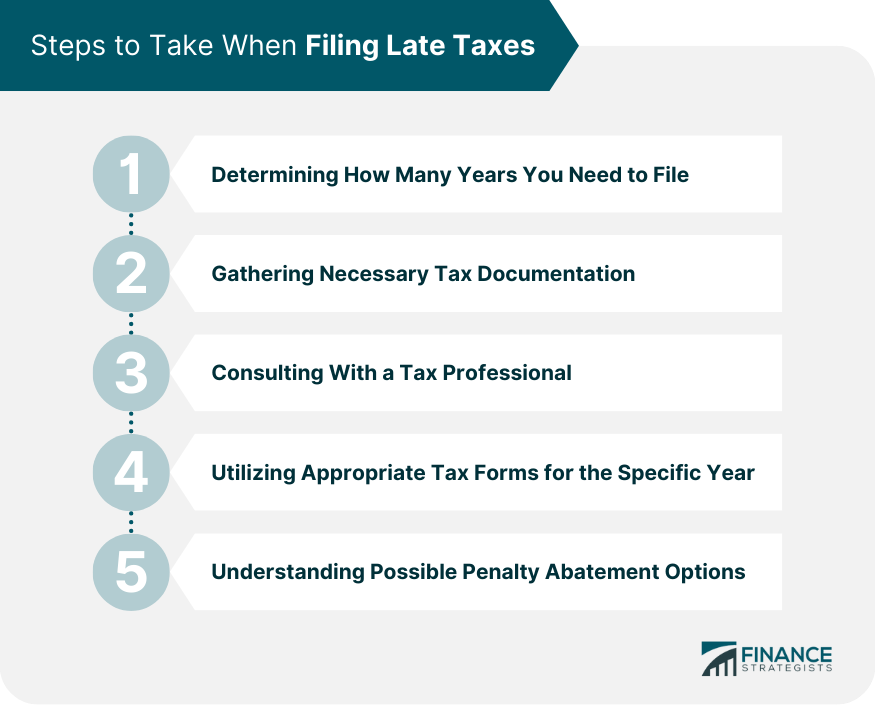

Steps to Take When Filing Late Taxes

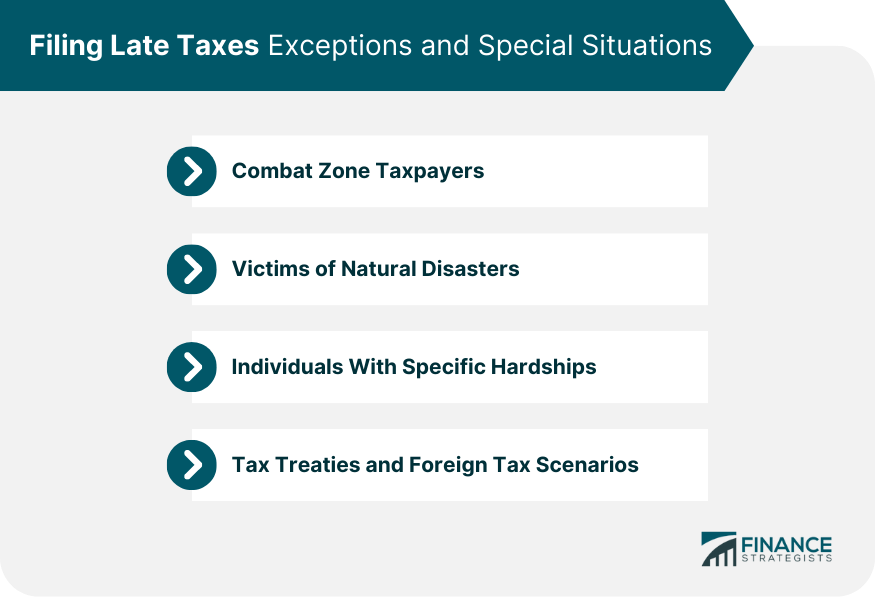

Filing Late Taxes Exceptions and Special Situations

Tips for Preventing Future Late Tax Filings

Organizing Financial Records Annually

Setting Reminders for Tax Deadlines

Consulting With Tax Professionals Regularly

Using Technology and Apps

Conclusion

How Far Back Can I File Taxes? FAQs

You typically have up to three years from the original due date to file your return and claim a refund.

There's no time limit for owing taxes, meaning the IRS can pursue collection indefinitely. You'll likely incur penalties, interest charges, potential legal actions, and an adverse effect on your credit score.

Yes, the IRS often provides extensions or relief measures for regions hit by significant natural disasters, which can ease the tax filing burden on affected taxpayers.

Begin by determining how many years you've missed. Gather all necessary tax documentation, consult with a tax professional, and use the appropriate tax forms for each year you're filing.

Absolutely! Many tax apps not only remind you of upcoming deadlines but also assist in the tax filing process. Regularly consulting with tax professionals and setting calendar alerts are also helpful practices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.