Filing taxes is a fundamental responsibility that nearly every income-earning individual and business must address. The importance of the tax deadline lies in its role in ensuring a timely flow of funds, which aids the government in managing public resources and services. Furthermore, adhering to these set deadlines is not only a legal obligation but also a reflection of one's financial discipline. Tax deadlines, though seemingly straightforward, have implications that every taxpayer should be aware of. A clear understanding of these dates ensures compliance, aids in financial planning, and prevents unintended consequences like penalties or legal repercussions. Therefore, knowing the when and why of these deadlines is crucial for individuals and businesses alike. Tax deadlines are pivotal for individual taxpayers and businesses to ensure compliance with the Internal Revenue Service (IRS) regulations. Understanding these dates and their intricacies is essential to avoid penalties and maximize fiscal responsibility. The cornerstone of U.S. tax deadlines is the Federal Income Tax Deadline. Traditionally, this is set for April 15th. However, there are implications to consider: Weekends and Holidays: If April 15th falls on a Saturday or Sunday, the tax deadline automatically shifts to the next working day. Extensions: The IRS, in its discretion, can and has extended tax deadlines during significant natural disasters, such as hurricanes, wildfires, or floods. While the federal tax deadline serves as a general benchmark, state tax deadlines bring their set of variations: Varied Dates: Not all states conform to the federal tax deadline. For instance, while many states might observe April 15th, others could have a completely different date based on their administrative decisions. Different Requirements: Some states may have distinct tax forms, payment thresholds, or even tax credits that can affect the filing process and timeline. Beyond the primary federal and state deadlines, there are specific tax responsibilities that have their own timelines: Quarterly Estimated Taxes: Individuals, including self-employed persons or those with significant side income, might be required to pay quarterly estimated taxes. Foreign Income Deadlines: U.S. citizens or resident aliens who live and work abroad are granted an automatic two-month extension to file their federal income tax return, pushing their deadline to June 15th. The IRS implements a structured penalty system to ensure compliance, and understanding this system is crucial for taxpayers to gauge the real cost of any delays or oversights. The distinction between late filing and late payment is essential. Even if one cannot pay the due taxes on time, filing the return by the deadline can mitigate some penalties. Late Filing: If you file your return after the due date and owe taxes, the late filing penalty is usually 5% of the unpaid taxes for each month or part of a month that a tax return is late. Late Payment: If you file on time but don't pay all amounts due, a late payment penalty applies. This is typically 0.5% per month of the outstanding tax amount. It can inflate up to 25% of the unpaid tax. Beyond penalties, interest is charged on any unpaid tax from the due date of the return until the date of payment. The interest rate is the federal short-term rate plus 3%. It compounds daily, meaning the unpaid amount, including previously accrued interest and penalties, accrues interest. Consistent lapses in tax compliance, such as habitual late payments or filings, can red-flag a taxpayer's account. This increased scrutiny can result in: Audits: The IRS may decide to take a closer look at one's financial records, verifying accuracy and compliance. Collection Actions: In severe cases, the IRS can initiate collection actions. This could include tax liens on property, wage garnishments, or even seizing assets to cover the owed amounts. With complexities in tax codes and diverse sources of income, planning is essential. Here are detailed strategies to ensure a stress-free tax season: Preparation Checklist: Create a comprehensive checklist of all necessary documents, forms, and receipts you'll need. Address Discrepancies: With more time at hand, you can spot inconsistencies or missing information in your financial records. This proactive identification allows for resolution well ahead of the deadline. Monthly Finance Review: Dedicate a day each month to go over bank statements, invoices, and receipts. This regular review not only keeps financial records up-to-date but also instills a sense of fiscal responsibility. Digital Documentation: Platforms like QuickBooks, Mint, or even cloud storage solutions like Dropbox can store digital copies of receipts, invoices, and tax-related documents. Tax Software: Multiple software options offer user-friendly interfaces that guide individuals through the filing process. Many come with features that highlight potential deductions, calculate taxes, and even directly e-file the returns. Tax Professionals: Seeking help from a certified public accountant (CPA) or a tax preparer can be invaluable, especially if your financial situation is complex. They bring to the table expertise on tax codes, and potential deductions, and can provide tailored advice. The significance of tax filing is essential, impacting individuals and businesses alike. Meeting tax deadlines not only ensures the smooth inflow of funds for effective public resource management but also reflects financial responsibility. Understanding these dates is essential, safeguarding against penalties, legal ramifications, and enabling strategic financial planning. Important tax deadlines include Federal Income Tax Deadlines, state-specific variations, and extensions due to extraordinary circumstances. Penalties for late filing and payment, coupled with interest on unpaid taxes, underscore the importance of compliance. Moreover, the potential for heightened IRS scrutiny serves as a reminder of the consequences of consistent non-compliance. Actionable strategies like meticulous preparation, discrepancy resolution, regular financial reviews, digital record-keeping, and leveraging tax software or professionals are also essential. Thus, grasping tax deadlines and responsibilities empowers individuals and businesses to effectively manage their tax obligations.Importance of Filing Taxes

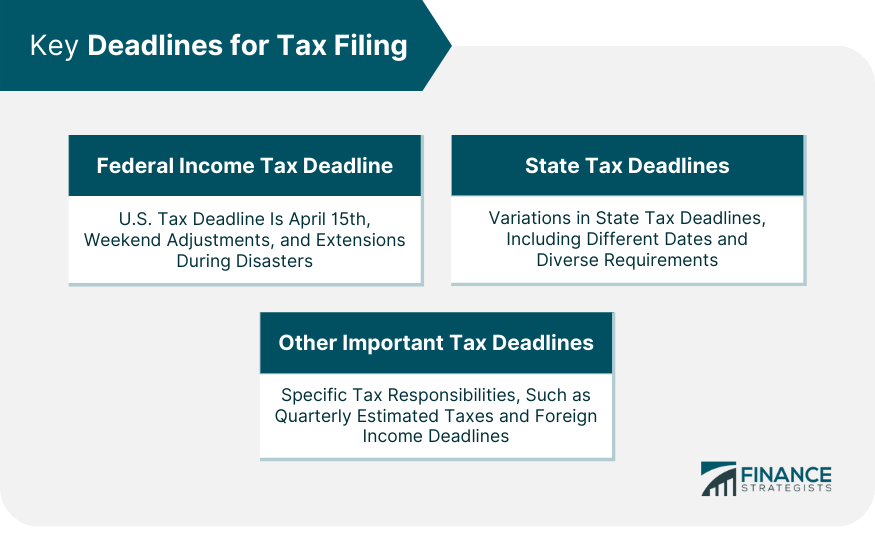

Key Deadlines for Tax Filing

Federal Income Tax Deadline

Similarly, if April 15th coincides with a public holiday, the deadline will again be adjusted to the following business day.

For taxpayers residing in federally declared disaster areas, this flexibility helps alleviate some of the stress and challenges tied to restoring normalcy.State Tax Deadlines

Other Important Tax Deadlines

These are typically due on April 15th, June 15th, September 15th, and January 15th of the following year.

However, any owed taxes should still ideally be paid by April 15th to avoid accruing interest.

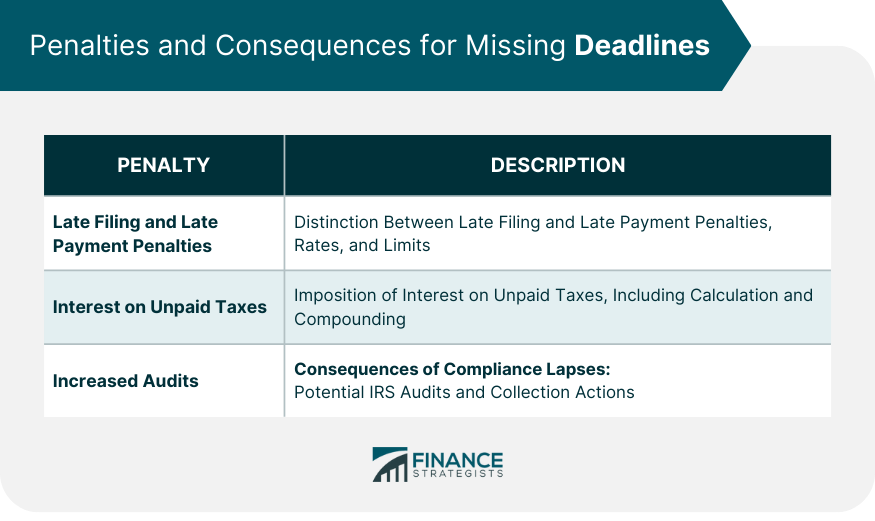

Penalties and Consequences for Missing Deadlines

Late Filing and Late Payment Penalties

This penalty starts accruing the day after the tax filing due date and will not exceed 25% of your unpaid taxes.Interest on Unpaid Taxes

Increased Audits

Audits can range from a simple document verification to a more detailed examination of one's financial records, transactions, and other related documents.

Preparation Strategies for On-Time Filing

This might include W-2s from employers, 1099s for other income types, and statements of interest or dividends from banks.

Many of these platforms also offer automated reminders for important financial dates.

Conclusion

Deadline to File Taxes FAQs

The deadline to file taxes for most individuals is April 15th.

Missing the deadline to file taxes can result in penalties and interest on unpaid taxes, which can add up over time.

Yes, the IRS sometimes grants extensions for special circumstances. However, it's important to request an extension before the original deadline.

While federal tax deadlines are generally consistent, state tax deadlines can vary, so it's essential to check your state's specific deadline.

Yes, there are consequences for filing taxes after the deadline. You may face late filing penalties and accrue interest on unpaid taxes, impacting your overall tax liability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.