Revenue sharing is a business model in which the profits or revenue generated from a particular activity, product, or service are distributed among various stakeholders, such as employees, partners, or content creators. The distribution can be based on a predetermined percentage, agreement, or performance metrics. Revenue sharing is used to incentivize collaboration, align interests, and promote better performance across a range of industries, including online content creation, e-commerce, technology, and more. Revenue sharing can take many forms, depending on the nature of the business and the relationships between involved parties. Here, we will outline four common models: profit sharing, ad revenue sharing, affiliate marketing, and subscription-based revenue sharing. Profit sharing involves distributing a portion of a company's profits among its employees, partners, or other stakeholders. This can take the form of cash bonuses, stock options, or other incentives. Common examples of profit sharing include employee bonus programs, partnership agreements, and shareholder dividends. Advantages of profit sharing include increased employee motivation, better alignment of interests between stakeholders, and improved company performance. However, disadvantages may include potential conflicts of interest, complexity in calculating and distributing profits, and fluctuations in payouts due to business performance. Ad revenue sharing involves distributing revenue generated from advertisements among various parties. This model is commonly used in online content creation, such as blogging, YouTube, and podcasting. Content creators typically receive a percentage of the revenue generated from ads displayed on their platform. Advantages of ad revenue sharing include incentivizing content creators to produce high-quality content, providing a passive income stream, and encouraging collaboration between advertisers and content creators. However, disadvantages may include reliance on third-party platforms, fluctuations in ad revenue, and potential ad-blocker usage. Affiliate marketing involves promoting and selling products or services on behalf of another company in exchange for a commission. Examples of affiliate marketing include product reviews, sponsored content, and referral links on websites or social media platforms. Advantages of affiliate marketing include low start-up costs, scalability, and the ability to focus on niche markets. However, disadvantages may include high competition, reliance on third-party platforms, and potential damage to reputation due to promoting low-quality products. Subscription-based revenue sharing involves distributing revenue generated from subscription fees among various parties. This model is commonly used in software as a service (SaaS) platforms, app stores, and online content platforms. Examples include revenue sharing between app developers and app stores, or between content creators and subscription-based platforms like Patreon. Advantages of subscription-based revenue sharing include predictable income, increased customer loyalty, and potential for long-term growth. However, disadvantages may include high competition, difficulty in acquiring and retaining subscribers, and potential loss of revenue due to free alternatives. Different industries can adopt revenue-sharing models to foster collaboration, enhance business performance, and create opportunities for stakeholders. Revenue sharing can incentivize bloggers and website owners to create high-quality content by providing a share of ad revenue or subscription fees. Video platforms like YouTube often share ad revenue with content creators, encouraging them to produce engaging videos and build audiences. Podcasters can also benefit from revenue sharing through ad revenue or subscription fees, providing a sustainable income stream for quality content production and audience engagement. Revenue sharing can facilitate collaboration between online marketplaces, such as Amazon or eBay, and sellers, as a percentage of each sale goes to the marketplace. Dropshipping businesses can utilize revenue sharing by partnering with suppliers and sharing a portion of profits from each sale. Retailers can collaborate with other businesses or influencers through revenue sharing, promoting products and services in exchange for a share of the profits. App stores, such as Apple's App Store or Google Play, share revenue from app sales and in-app purchases with developers, encouraging innovation and growth in the app ecosystem. SaaS platforms can implement revenue sharing by distributing subscription fees among software developers, partners, and other stakeholders. Open-source projects can use revenue sharing to reward contributors or maintainers, providing an incentive for ongoing development and support. When implementing a revenue-sharing model, it is essential to consider the legal and regulatory implications. Revenue-sharing agreements may have tax implications for both parties, such as income taxes, sales taxes, or value-added taxes. Consulting with a tax professional can help ensure compliance with tax laws and regulations. Creating clear, legally binding contracts is crucial for outlining revenue-sharing terms, roles, and responsibilities. A well-drafted contract can help prevent disputes and protect the interests of all parties involved. Businesses must ensure their revenue-sharing agreements comply with applicable local and international regulations, such as antitrust laws, consumer protection laws, and industry-specific regulations. To maximize the benefits of revenue sharing, it's essential to follow best practices. Clearly defining revenue-sharing terms and conditions, such as percentages, payment schedules, and performance metrics, can help prevent misunderstandings and disputes. Maintaining open lines of communication and being transparent about revenue-sharing arrangements can build trust and foster collaboration among stakeholders. Regularly monitoring and adjusting revenue-sharing models can help optimize their effectiveness and ensure alignment with business objectives and stakeholder interests. Using data-driven performance and success metrics can help businesses evaluate their revenue-sharing models' effectiveness and identify improvement areas. As businesses and technologies continue to evolve, revenue-sharing models are likely to adapt and offer new opportunities. Emerging technologies, such as blockchain and artificial intelligence, may create new revenue-sharing models and opportunities for decentralized and automated revenue distribution. Innovative business models and collaborations may lead to novel revenue-sharing arrangements, benefiting a broader range of stakeholders. Future challenges in revenue sharing may include increased competition, regulatory changes, and evolving consumer preferences. By staying adaptable and exploring innovative solutions, businesses can navigate these challenges and capitalize on new opportunities. Revenue sharing is a versatile and powerful tool that benefits businesses, stakeholders, and consumers. By understanding different models, applying them across various industries, addressing legal and regulatory considerations, and following best practices, businesses can unlock the full potential of revenue sharing. As we look to the future, continued innovation in business models and technology will undoubtedly drive new opportunities and challenges in the world of revenue sharing. By staying informed and adaptable, businesses can harness the power of revenue sharing to foster collaboration, boost performance, and create lasting value for all stakeholders involved. Given the complex tax implications that may arise from revenue-sharing agreements, consulting with a tax services expert is highly recommended. These professionals can ensure compliance with tax laws and regulations while also providing valuable insights to maximize the benefits of your revenue-sharing arrangements. Do not leave your business's financial health to chance—contact a tax services expert today to help you navigate the world of revenue sharing and secure a prosperous future for your business and its stakeholders.What Is Revenue Sharing?

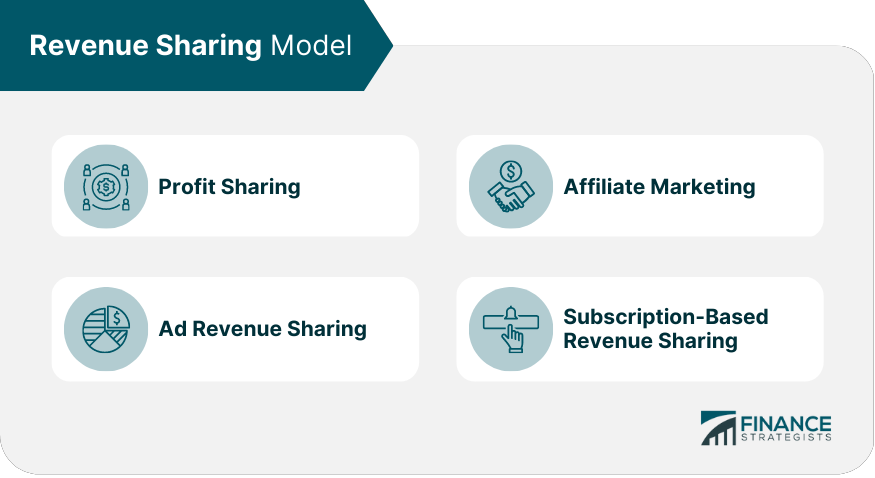

Revenue Sharing Models

Profit Sharing

Description and Examples

Advantages and Disadvantages

Ad Revenue Sharing

Description and Examples

Advantages and Disadvantages

Affiliate Marketing

Description and Examples

Advantages and Disadvantages

Subscription-Based Revenue Sharing

Description and Examples

Advantages and Disadvantages

Implementing Revenue Sharing in Various Industries

Online Content Creation

Blogging and Websites

YouTube and Video Platforms

Podcasting

E-commerce and Retail

Online Marketplaces

Dropshipping

Retail Partnerships

Technology and Software Development

App Stores

Software as a Service (SaaS) Platforms

Open-Source Projects

Legal and Regulatory Considerations

Tax Implications

Contractual Agreements

Compliance With Local and International Regulations

Best Practices for Revenue Sharing

Establishing Clear Terms and Conditions

Transparency and Communication

Monitoring and Adjusting Revenue Sharing Models

Evaluating Performance and Success Metrics

Future Trends and Opportunities in Revenue Sharing

Impact of Emerging Technologies

New Business Models and Opportunities

Challenges and Potential Solutions

Conclusion

Revenue Sharing FAQs

Revenue sharing is a business model where profits or revenue generated are distributed among various stakeholders, such as employees, partners, or content creators. It plays a vital role in promoting collaboration, aligning interests, and incentivizing performance, making it an essential tool in today's competitive business landscape.

The article outlines four main revenue-sharing models: profit sharing, ad revenue sharing, affiliate marketing, and subscription-based revenue sharing. Each model has unique applications, advantages, and disadvantages, making it essential to understand their nuances and select the best fit for your business.

In online content creation, revenue sharing can be used to incentivize content creators by sharing ad revenue or subscription fees. In e-commerce, revenue sharing can foster collaboration between online marketplaces, drop shippers, and retailers. In technology, revenue sharing can encourage innovation by distributing app sales revenue, subscription fees, or supporting open-source projects.

When implementing a revenue-sharing model, businesses should consider tax implications, create clear contractual agreements, and ensure compliance with local and international regulations. Consulting with legal and tax professionals can help businesses navigate these considerations and protect their interests.

To stay adaptable and capitalize on future revenue-sharing opportunities, businesses should keep an eye on emerging technologies, explore new business models and collaborations, and stay informed about challenges and potential solutions. By staying flexible and innovative, businesses can harness the power of revenue sharing to create value for all stakeholders involved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.