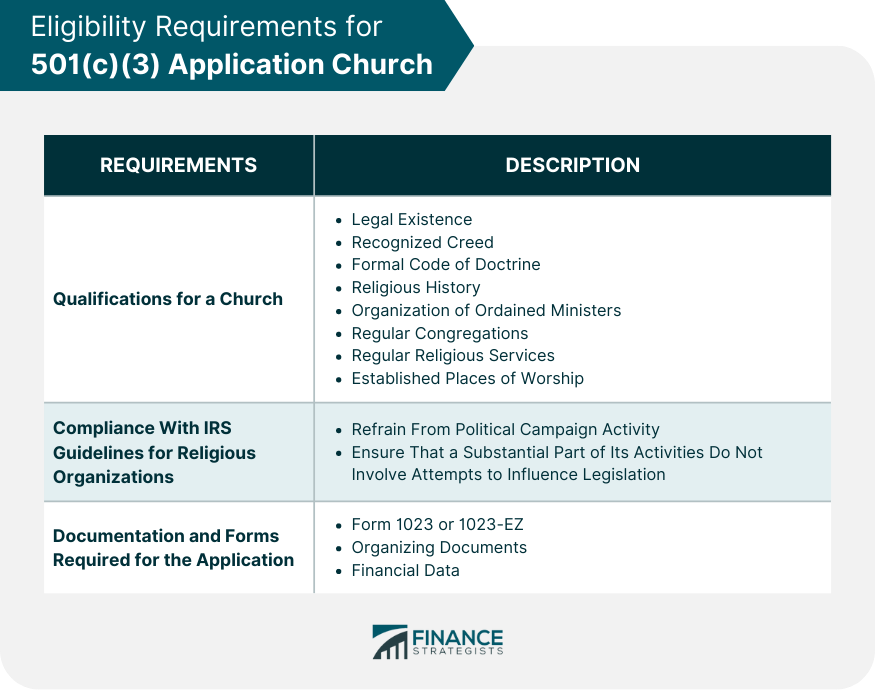

A 501(c)(3) church is a religious organization that has been recognized by the Internal Revenue Service (IRS) as tax-exempt under section 501(c)(3) of the Internal Revenue Code. This status means that the church is exempt from federal income tax and, typically, state taxes as well. Furthermore, contributions made to the church by donors are tax-deductible, making it an appealing avenue for those seeking to contribute charitably. The road to becoming a 501(c)(3) church begins with an application to the IRS. Interestingly, while churches are inherently considered tax-exempt, obtaining official 501(c)(3) recognition provides added assurance and legitimacy. It bolsters the church's standing in the eyes of potential donors, as they can confidently claim their contributions as tax deductions. Plus, this status allows the church to apply for grants and other funding that may require 501(c)(3) recognition. To qualify as a church for the 501(c)(3) application, a religious organization must meet certain criteria defined by the IRS. Among these criteria are a distinct legal existence, a recognized creed and form of worship, a formal code of doctrine and discipline, and a distinct religious history. Additionally, the organization should have an organization of ordained ministers, regular congregations, regular religious services, and established places of worship. Compliance with IRS guidelines is a non-negotiable aspect of the 501(c)(3) application process for churches. In order to maintain tax-exempt status, a church must refrain from participating in any political campaign activity for or against political candidates and must ensure that a substantial part of its activities does not involve attempts to influence legislation. On a practical level, applying for 501(c)(3) status requires a completed Form 1023 or 1023-EZ (Application for Recognition of Exemption), the church's organizing documents (like articles of incorporation or bylaws), and financial data. Preparation is key when approaching the 501(c)(3) application process. The church should ensure it meets the qualifications laid out by the IRS and prepare the necessary documents. The centerpiece of the 501(c)(3) application is Form 1023. This comprehensive form requests information about the church's organizational structure, religious activities, financial data, and compliance with IRS regulations. Filling out Form 1023 requires careful attention to detail and a deep understanding of the church's operations and mission. Form 1023-EZ, Streamlined Application for Recognition of Exemption, is a shorter, simpler version of the application that's available to churches with gross receipts of $50,000 or less and assets of $250,000 or less. Once the application is submitted, the IRS review process begins. This process can take anywhere from a few weeks to several months, depending on the complexity of the application and the IRS's workload. If the IRS approves the application, it issues a determination letter recognizing the church's 501(c)(3) status. A crucial part of the 501(c)(3) application is the inclusion of a Statement of Revenue and Expenses. This document provides a clear picture of the church's financial health and operations, detailing all sources of revenue and where that money is spent. A balance sheet, another key financial document, offers a snapshot of the church's financial position at a specific point in time. It details the church's assets, liabilities, and net assets, providing insight into its financial stability. While it may seem intrusive, the IRS does require a list of contributors as part of the 501(c)(3) application. This doesn't include every person who puts money in the offering plate, but it does include any individual or organization that has made a substantial contribution to the church. A copy of the church's most recent Form 990, Return of Organization Exempt from Income Tax, should also be included in the application. While churches are generally exempt from filing this form, if the church has filed it in the past, a copy should be included in the 501(c)(3) application. Finally, copies of bank statements for the church provide further evidence of the church's financial activity. They can support the information provided in the revenue and expense statement and balance sheet. To obtain 501(c)(3) status for a church, the organization must meet certain criteria defined by the IRS, such as having a distinct legal existence, a recognized creed and form of worship, and an organization of ordained ministers. The church must also comply with IRS guidelines, such as refraining from participating in any political campaign activity. The application process for 501(c)(3) status for churches begins with filing Form 1023 or Form 1023-EZ, depending on the church's size and financial resources. The application must include information about the church's organizational structure, religious activities, financial data, and compliance with IRS regulations. Once the application is submitted, the IRS will review it and may request additional information. If the application is approved, the IRS will issue a determination letter recognizing the church's 501(c)(3) status.What Is a 501(c)(3) Church?

Eligibility Requirements for 501(c)(3) Application Church

Qualifications for a Church

Compliance With IRS Guidelines for Religious Organizations

Documentation and Forms Required for the Application

Application Process for 501(c)(3) Status for Churches

Initial Steps to Prepare for the Application

Form 1023: Application for Recognition of Exemption

Alternative Form 1023-EZ

Review and Approval Process by the IRS

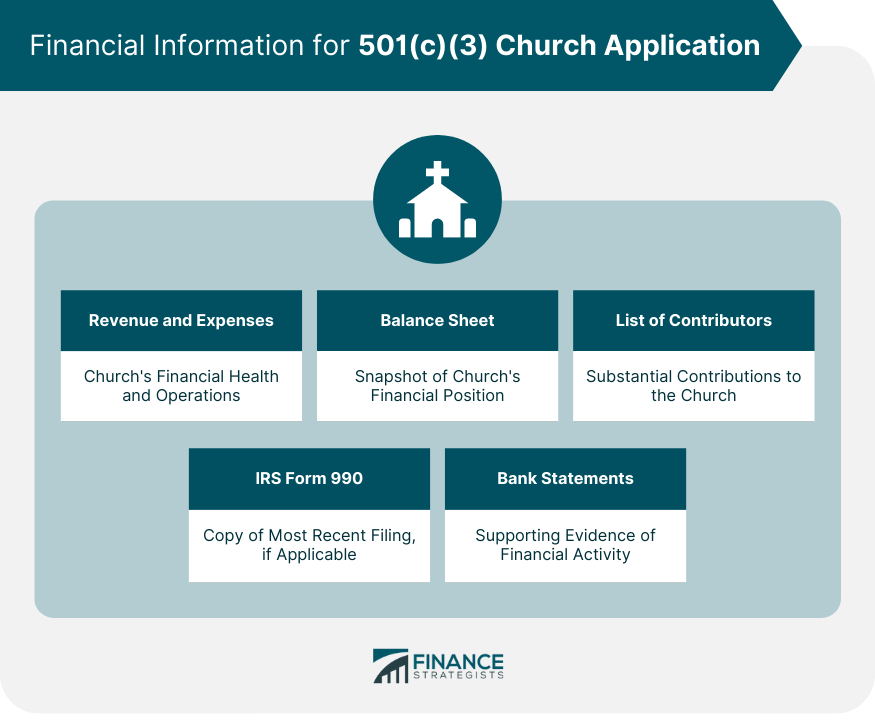

Required Financial Information for 501(c)(3) Church Application

Statement of Revenue and Expenses

Balance Sheet

List of Contributors

Copy of IRS Form 990

Copies of Bank Statements

Bottom Line

501(c)(3) Application Church FAQs

While churches are considered inherently tax-exempt, they aren't automatically granted 501(c)(3) status. To gain this official recognition, churches must apply to the IRS and meet specific requirements.

Yes, a church can lose its 501(c)(3) status if it fails to comply with IRS regulations. This could happen if the church engages in political campaign activity or if a significant part of its activities involves influencing legislation.

A 501(c)(3) church enjoys tax-exempt status, and its donors can claim their contributions as tax deductions. Additionally, 501(c)(3) status can open doors to grant opportunities and lends an extra layer of credibility to the church.

Generally, churches are exempt from the requirement to file Form 990. However, if the church has unrelated business income, it may need to file Form 990-T.

The IRS oversees the compliance of 501(c)(3) churches with tax laws and regulations. It reviews applications for tax-exempt status and has the power to revoke this status if a church fails to comply with the guidelines.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.