Self-employed retirement planning refers to the process of preparing for financial security during retirement years, specifically for individuals who work for themselves as freelancers, contractors, or business owners. Unlike traditional employees who often have access to employer-sponsored retirement plans like 401(k) or pension plans, self-employed individuals need to take full responsibility for their retirement savings. Just like any planning process, retirement planning starts with setting clear and realistic goals. For instance, you might want to retire at a certain age, travel the world, or start a charitable foundation. Once you've outlined your goals, estimate the costs associated with them. Consider ongoing costs like housing, groceries, and healthcare, as well as one-time expenses like travel or home renovations. Your planned retirement age will significantly impact your savings strategy. The earlier you want to retire, the more aggressive your savings plan will need to be. Review your current savings, investments, and other assets. These will form the foundation of your retirement nest egg. An emergency fund provides a financial safety net, which is crucial for the self-employed who may experience variable income. Diversifying your investments can help minimize risk and potentially increase returns. This could involve investing in stocks, bonds, mutual funds, and other assets. Self-employed individuals have access to several tax-advantaged retirement accounts, such as: IRAs offer tax benefits that can help you save more for retirement. These plans allow for higher contribution limits than traditional 401(k) plans, making them a great option for the self-employed. SEPs are easy to set up and offer high contribution limits. SIMPLE IRAs are designed for small businesses and self-employed individuals, offering both employer and employee contributions. Real estate can provide ongoing rental income and potential appreciation. Other alternative assets, like private equity or commodities, can also be considered. Your risk tolerance and investment goals should guide your investment strategy. While higher-risk investments can offer higher returns, they can also lead to larger losses. Self-employed individuals are responsible for both the employer and employee portions of Social Security and Medicare taxes, which can significantly impact your retirement savings. The self-employed have access to various tax deductions and credits, which can lower overall tax liability. From contributing to retirement accounts to deducting business expenses, there are numerous strategies to reduce your taxable income. Here are some strategies for reducing taxable income: Maximize contributions to tax-advantaged retirement accounts such as a solo 401(k), Simplified Employee Pension (SEP) IRA, or a SIMPLE IRA. Take advantage of tax deductions for business expenses, including home office expenses, business travel expenses, and equipment purchases. Use Section 179 deduction to write off equipment or property purchased for business purposes. Consider forming a pass-through entity, such as a Limited Liability Company (LLC), S Corporation or Partnership, to reduce self-employment tax. Deduct health insurance premiums paid for yourself, your spouse, and dependents as a business expense. Use a Health Savings Account (HSA) or a Health Reimbursement Arrangement (HRA) to pay for medical expenses with pre-tax dollars. Consider deferring income until the next tax year or accelerating expenses to reduce current-year taxable income. Use depreciation to write off business assets over time instead of incurring a large expense upfront. Take advantage of education tax credits or deductions for eligible expenses related to business education. Consult with a tax professional to ensure compliance with tax laws and regulations. A tax professional can help you navigate the complexities of self-employment taxes and take full advantage of available deductions and credits. Healthcare can be a significant expense in retirement. Consider options like Health Savings Accounts (HSAs) or long-term care insurance. Long-term care insurance can cover the cost of assisted living or nursing home care, providing added security as you age. Disability insurance can replace a portion of your income if you become unable to work due to illness or injury. Life insurance can provide financial security for your loved ones in the event of your death, helping to cover living expenses, debt repayment, and other needs. A will or trust allows you to distribute your assets according to your wishes upon your death and can help minimize potential legal disputes. If you own a business, planning for its future is crucial. This may involve identifying a successor, creating a buy-sell agreement, or other strategies. Incorporating charitable giving into your estate plan can leave a lasting legacy and provide tax benefits. An estate planning attorney can help you create a comprehensive plan to protect your assets and ensure your wishes are carried out. Regularly assess your progress toward your retirement goals and make adjustments as needed to stay on track. Life changes, such as a new business venture or changes in personal circumstances, may require adjustments to your retirement plan. Stay informed about changes to tax laws and regulations to ensure your retirement planning strategies remain compliant and effective. Self-employed retirement planning is essential for entrepreneurs and freelancers to achieve financial security in their retirement years. By carefully assessing their financial situation, setting clear goals, and developing a diversified investment strategy, self-employed individuals can create a solid foundation for their future. Maximizing tax savings through tax-advantaged retirement accounts and effective tax management, along with considering essential health and insurance needs, further strengthens their retirement plan. Incorporating estate and legacy planning, engaging with professional resources, and regularly reviewing and adjusting their plan ensures a comprehensive and flexible approach to retirement planning. By taking these steps, self-employed individuals can navigate the unique challenges they face and enjoy a fulfilling and secure retirement.What Is Self-Employed Retirement Planning?

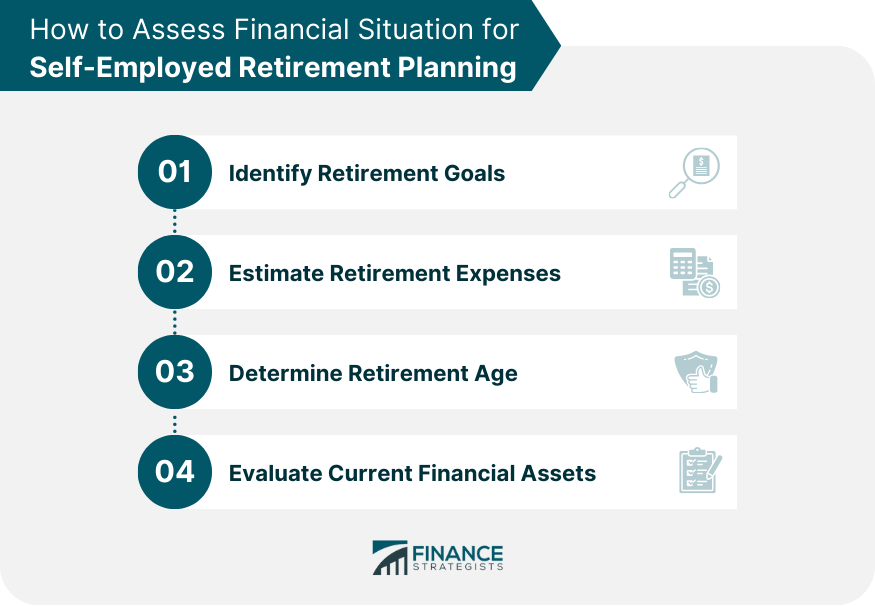

Assessing Financial Situation for Self-Employed Retirement Planning

Identifying Your Retirement Goals

Estimating Retirement Expenses

Determining Your Retirement Age

Evaluating Your Current Financial Assets

Savings and Investment Strategies for Self-Employed Retirement Planning

Building an Emergency Fund

Diversifying Investments

Utilizing Tax-Advantaged Retirement Accounts

Individual Retirement Accounts (IRAs)

Solo 401(k) Plans

Simplified Employee Pension (SEP) Plans

Savings Incentive Match Plan for Employees (SIMPLE) IRAs

Investing in Real Estate and Other Alternative Assets

Balancing Risk Tolerance and Investment Goals

Tax Planning and Management for Self-Employed Retirement Planning

Understanding Self-Employment Tax Implications

Utilizing Tax Deductions and Credits

Strategies for Reducing Taxable Income

Working With a Tax Professional

Health and Insurance Considerations for Self-Employed Retirement Planning

Planning for Healthcare Expenses in Retirement

Long-Term Care Insurance

Disability Insurance

Life Insurance

Estate and Legacy Planning for Self-Employed Retirement Planning

Creating a Will or Trust

Planning for Business Succession

Charitable Giving and Philanthropy

Consulting with an Estate Planning Attorney

Regularly Reviewing and Adjusting Plans for Self-Employed Retirement Planning

Monitoring Your Progress Towards Retirement Goals

Adapting Your Plan to Changes in Your Financial Situation or Goals

Keeping Up-To-Date With Tax Laws and Regulations

Bottom Line

Self-Employed Retirement Planning FAQs

Self-employed retirement planning differs from traditional planning as the self-employed typically lack employer-sponsored retirement benefits, have variable income, and are responsible for both the employer and employee portions of Social Security and Medicare taxes. They also have access to unique tax-advantaged retirement accounts tailored to their needs.

Self-employed individuals can utilize tax-advantaged accounts such as Individual Retirement Accounts (IRAs), Solo 401(k) plans, Simplified Employee Pension (SEP) plans, and Savings Incentive Match Plan for Employees (SIMPLE) IRAs. These accounts offer tax benefits, like tax-deferred growth and potential tax deductions, which can help maximize retirement savings.

When planning for retirement as a self-employed individual, it's crucial to consider healthcare expenses, long-term care insurance, disability insurance, and life insurance. These insurance products help protect against unforeseen health issues and provide financial security for both the individual and their loved ones.

Estate and legacy planning is essential for self-employed retirement planning as it helps protect and distribute assets according to the individual's wishes, ensures the continuity of their business, and can incorporate charitable giving and philanthropy. Consulting with an estate planning attorney can further strengthen this aspect of their retirement plan.

Working with professionals like financial advisors, Certified Public Accountants (CPAs), and estate planning attorneys can provide valuable guidance and support for self-employed retirement planning. These experts can help create customized plans, offer tax-saving strategies, and ensure that the individual stays on track toward their retirement goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.