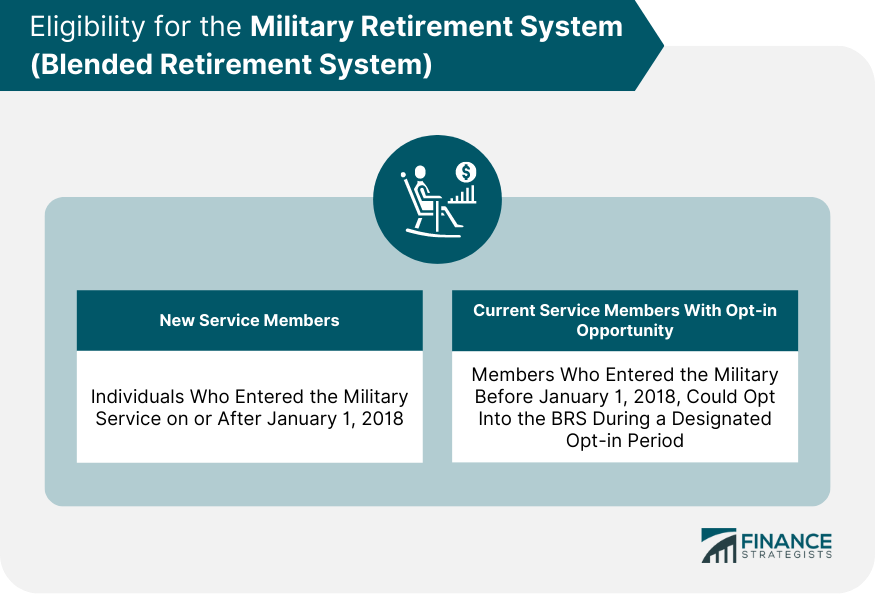

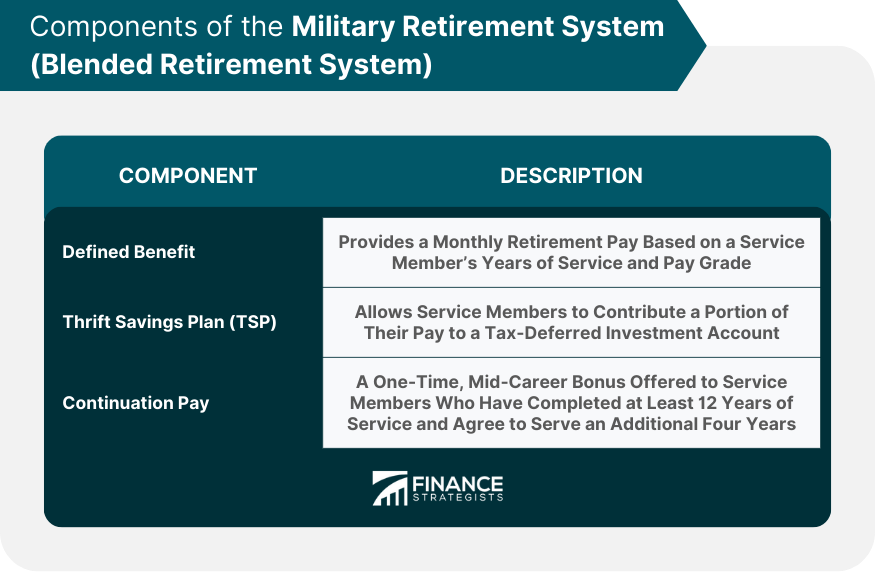

The Military Retirement System is a comprehensive and essential part of the benefits package offered to those who serve in the United States Armed Forces. The Blended Retirement System (BRS) is a modernized retirement plan designed to provide greater flexibility and benefits to service members. The BRS aims to ensure long-term financial security for service members and their families, regardless of whether they served a full 20-year career or were separated from the military earlier. The Blended Retirement System is available to two main groups of service members: New Service Members: Individuals who entered the military service on or after January 1, 2018, are automatically enrolled in the BRS. Current Service Members With Opt-in Opportunity: Service members who entered the military before January 1, 2018, could opt into the BRS during a designated opt-in period. The opt-in period for eligible service members to switch to the BRS was from January 1, 2018, to December 31, 2018. Service members were required to complete mandatory BRS training before deciding to opt-in or remain in the legacy retirement system. The defined benefit component of the BRS provides a monthly retirement pay based on a service member's years of service and pay grade. The defined benefit portion of the BRS also includes cost-of-living adjustments (COLA) to ensure that the purchasing power of retirement pay is maintained over time. The Thrift Savings Plan (TSP) is a federal government-sponsored retirement savings and investment plan that allows service members to contribute a portion of their pay to a tax-deferred investment account. The BRS includes: Automatic Contributions: The Department of Defense (DoD) automatically contributes an amount equal to 1% of a service member's basic pay to their TSP account. Matching Contributions: The DoD matches service members' contributions up to an additional 4% of basic pay for a total potential DoD contribution of 5%. Investment Options: Service members can choose from various investment funds, including lifecycle funds that automatically adjust the investment mix based on the service member's projected retirement date. Withdrawal and Rollover Options: TSP participants can withdraw funds upon retirement or separation from the military or roll over their TSP account to another qualified retirement plan, such as an IRA or a 401(k). Continuation pay is a one-time, mid-career bonus offered to service members who have completed at least 12 years of service and agree to serve an additional four years. Continuation pay varies by service branch and may be paid in a lump sum or installments. Active Component service members who complete 20 or more years of service qualify for full retirement benefits under the BRS. Reserve Component service members who accumulate at least 20 qualifying years of service, including active duty and reserve time, are eligible for retirement benefits under the BRS. Service members who are determined to be unfit for duty due to a service-related disability may qualify for disability retirement benefits under the BRS, depending on the severity of the disability and the length of service. Defined benefit payments and continuation pay under the BRS are generally subject to federal income tax. TSP withdrawals are also taxable, except for qualified Roth TSP withdrawals. State income tax treatment of military retirement pay varies by state. Service members should consult their state's tax regulations for specific information. TSP withdrawals are subject to federal income tax, except for qualified Roth TSP withdrawals. Rollovers to other qualified retirement plans, such as an IRA or a 401(k), are generally not subject to tax if completed within the required time frame. SBP payments are generally subject to federal income tax but may be partially or fully excluded from state income tax, depending on the state. The BRS differs from the legacy retirement system in several key ways, including adding the TSP with automatic and matching contributions, including continuation pay, and a reduced defined benefit multiplier (2.0% under BRS compared to 2.5% under the legacy system). The BRS offers greater flexibility and benefits to service members who serve a partial 20-year career. At the same time, the legacy system provides a higher defined benefit for those who reach the 20-year milestone. Each system has its advantages and disadvantages, depending on individual circumstances and career plans. Service members who had the opportunity to opt into the BRS should have considered factors such as their expected length of service, investment risk tolerance, and personal financial goals when making their decision. The Military Retirement System, specifically the Blended Retirement System (BRS), is an important component of the benefits package provided to United States Armed Forces personnel. The BRS was introduced to offer greater flexibility and enhanced benefits, ensuring long-term financial security for service members and their families. The BRS consists of key components such as the defined benefit, Thrift Savings Plan (TSP), and continuation pay. Retirement options under the BRS include full retirement benefits for active component service members who complete 20 or more years of service and retirement benefits for reserve component service members with at least 20 qualifying years. Disability retirement is also available for service members with service-related disabilities. When considering tax implications, it is important to note that defined benefit payments, continuation pay, and TSP withdrawals are generally subject to federal income tax, although qualified Roth TSP withdrawals may be tax-free. State income tax treatment varies by state. Overall, the Military Retirement System, particularly the Blended Retirement System, aims to provide service members with a comprehensive retirement plan that promotes financial security and rewards their dedicated service to the nation.What Is the Military Retirement System (Blended Retirement System)?

Eligibility and Enrollment for the Military Retirement System (Blended Retirement System)

Eligibility Criteria for BRS

Opt-In Period and Process

Components of the Military Retirement System (Blended Retirement System)

Defined Benefit

Thrift Savings Plan (TSP)

Continuation Pay

Retirement Options Under the Military Retirement System (Blended Retirement System)

Active Component Retirement

Reserve Component Retirement

Disability Retirement

Tax Implications of the Military Retirement System (Blended Retirement System)

Federal Income Tax Considerations

State Income Tax Considerations

Tax Treatment of TSP Withdrawals and Rollovers

Tax Implications for SBP Payments

Blended Retirement System vs. Legacy Retirement System

Comparison of Key Features

Pros and Cons of Each System

Factors to Consider When Choosing Between the Two Systems

Conclusion

Military Retirement System (Blended Retirement System) FAQs

The Military Retirement System (Blended Retirement System) is a modernized retirement plan for U.S. service members. It combines a defined benefit, Thrift Savings Plan (TSP) contributions, and continuation pay to provide greater flexibility and benefits for service members, regardless of their length of service.

The Military Retirement System (Blended Retirement System) differs from the legacy system in several ways. For example, the BRS has a lower defined benefit multiplier (2.0% vs. 2.5%), includes automatic and matching TSP contributions, and offers continuation pay as a mid-career bonus. The BRS is designed to benefit a broader range of service members, not just those who complete a full 20-year career.

New service members who entered military service on or after January 1, 2018, are automatically enrolled in the Military Retirement System (Blended Retirement System). Current service members who entered the military before January 1, 2018, had the opportunity to opt into the BRS during a designated opt-in period from January 1, 2018, to December 31, 2018.

The Military Retirement System (Blended Retirement System) has three main components: a defined benefit based on years of service and high-3 base pay, the Thrift Savings Plan (TSP) with automatic and matching contributions from the Department of Defense, and continuation pay, which is a one-time, mid-career bonus for service members who commit to an additional four years of service.

Yes, there are tax implications related to the Military Retirement System (Blended Retirement System). Defined benefit payments and continuation pay are generally subject to federal income tax. TSP withdrawals are also taxable, except for qualified Roth TSP withdrawals. State income tax treatment of military retirement pay and SBP payments varies by state. Service members should consult their state's tax regulations for specific information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.