Closing a line of credit refers to the process of terminating an existing revolving credit account that a borrower has with a financial institution. While many are familiar with the concept of opening a credit line for access to funds, the notion of closing it, and the nuances that come with it might be less understood. Like other financial instruments, a line of credit can be closed or terminated either at the request of the borrower or by the lender, often due to prolonged inactivity or default. People might choose to close a line of credit for several reasons, such as streamlining their finances, reducing the temptation of overspending, or moving to a better financial product. Regardless of the reason, closing a line of credit has its implications. One of the most notable implications is its potential impact on a person's credit score. While it can provide a psychological boost and remove potential liabilities, its impact on one's financial standing, especially concerning credit history and utilization, must be fully grasped before taking action. Starting the closure process for a line of credit usually begins with the borrower contacting their lender or bank. This might involve a formal written request or a simple call to the customer service department, depending on the institution's protocols. It's also crucial to be aware of any pre-closure charges or conditions that might be in place. Some institutions may require a notice period, while others might charge a fee for early closure. Before a line of credit can be closed, any outstanding amounts or debts must be settled. This means that the borrower will need to pay off any remaining balance in full. Failing to clear outstanding amounts can lead to additional penalties or even legal actions. Furthermore, it's essential to consider that paying off a large sum at once can have a temporary strain on personal finances, so planning ahead is crucial. One of the primary benefits of closing a line of credit is the potential for improved debt management. By removing an available source of borrowing, individuals can reduce the temptation of unnecessary spending and borrowing, leading to better financial discipline. Additionally, without multiple credit lines to monitor, tracking and managing finances can become more straightforward and less error-prone. The very nature of a line of credit offers flexibility, but it also presents the potential risk of overspending. By closing it, individuals eliminate one avenue through which impulsive or unplanned debt can accumulate. Moreover, with the account closed, there's also the added benefit of not having to pay any potential maintenance fees or inactivity fees that some banks charge for unused lines of credit. Closing a line of credit can lead to a dip in one's credit score. One significant reason is its effect on the credit utilization ratio, which compares the amount of credit used to the total available credit. Closing an account reduces the available credit, which can skew this ratio if there's outstanding debt elsewhere. Additionally, for those with a long history of their line of credit, closing it can shorten the average age of credit accounts, which is another factor in credit scoring. Lines of credit, especially those with high limits, can serve as a safety net in financial emergencies. Closing them can mean giving up this buffer. For instance, in case of unexpected medical bills or home repairs, having a line of credit can be immensely helpful. If closed, one would need to reapply, which takes time and might not guarantee the same terms or limits as before. Financial institutions sometimes impose fees or penalties for closing a line of credit, especially if done before a specified period or if certain conditions aren't met. These charges can come as an unwelcome surprise for individuals looking to streamline their finances. Hence, always reviewing the terms of the agreement before initiating closure can prevent unexpected costs. Long-term and short-term financial objectives play a significant role in the decision to close a credit line. For those aiming for a debt-free life or a simplified financial portfolio in the short term, closing might make sense. However, for individuals planning large investments or purchases in the future, maintaining a healthy line of credit can be advantageous. It's also essential to evaluate the broader landscape of one's debts and liabilities. If a person has other substantial outstanding loans or credit card balances, closing a line of credit might adversely affect their credit utilization rate. Moreover, in unforeseen emergencies, an available line of credit can be a lifesaver. After initiating the closure of a line of credit, it's crucial to obtain a written confirmation from the bank or financial institution. This documentation serves as proof of closure and can be vital if disputes arise later on. With a closure confirmation in hand, it becomes easier to address any potential discrepancies or misunderstandings. Once the line of credit is closed, individuals should monitor their credit reports to ensure the account reflects as "closed" and not "terminated by the creditor," which can have different implications. It's also vital to rectify any discrepancies promptly. Regularly reviewing one's credit report helps maintain a clear financial picture and ensures that all information is accurate and up-to-date. Closing a line of credit is a decision that carries significant financial implications. It's a step taken by many to streamline finances, reduce the temptation of overspending, and enhance debt management. While the process can be initiated simply by contacting the bank, it's crucial to settle all outstanding debts to avoid penalties. However, closing can affect one's credit score due to the alteration in credit utilization ratio and might limit financial flexibility in emergencies. Moreover, potential bank fees can come into play, emphasizing the need to review terms beforehand. After closure, obtaining written confirmation ensures clarity and prevents future disputes, while monitoring the credit report maintains financial transparency. In all, understanding the entire process and implications is key before making a final decision on closing a line of credit.What Is Closing a Line of Credit?

How Closing a Line of Credit Works

Initiation of the Closure Process

Impact on Debt

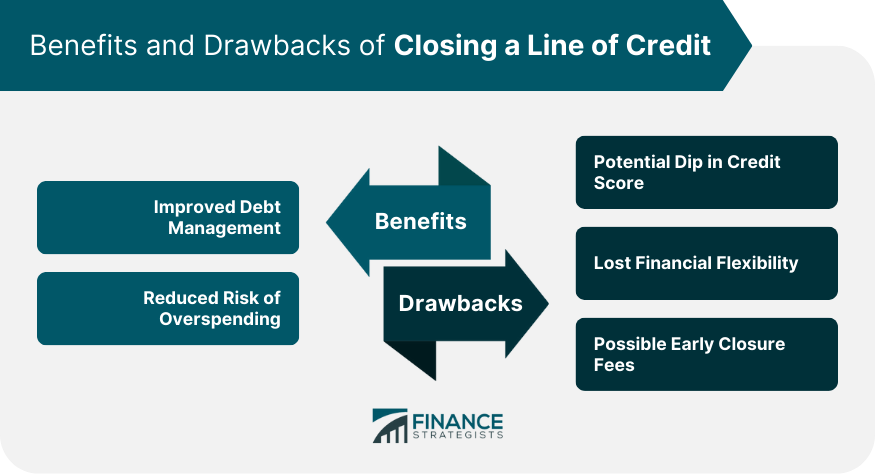

Benefits of Closing a Line of Credit

Improved Debt Management

Reduced Risk of Overspending

Drawbacks of Closing a Line of Credit

Potential Dip in Credit Score

Lost Financial Flexibility

Possible Early Closure Fees

Factors to Consider Before Closing a Line of Credit

Your Financial Goals

Current Debt Landscape

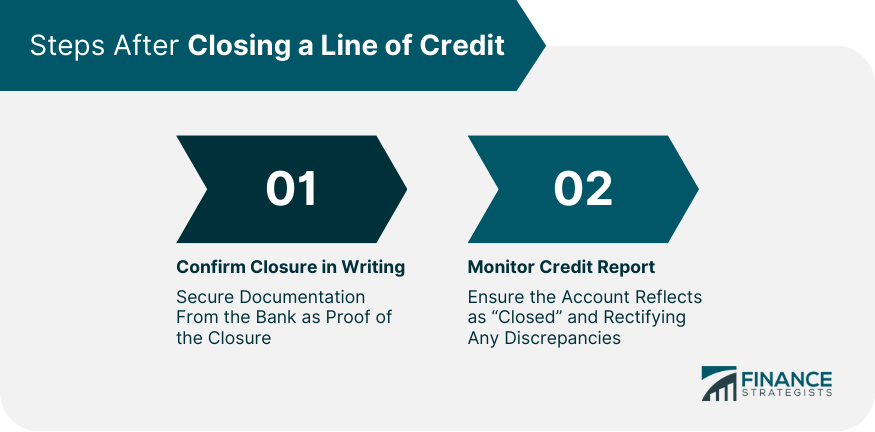

Steps After Closing a Line of Credit

Confirm Closure in Writing

Monitor Credit Report

Conclusion

Closing a Line of Credit FAQs

Closing a line of credit refers to terminating an active revolving credit account, making it no longer available for borrowing.

Individuals might consider closing a line of credit to better manage their finances, reduce overspending temptations, or transition to more advantageous financial products.

Yes, closing a line of credit can impact your credit score, particularly by affecting the credit utilization ratio and the average age of credit accounts.

Some banks or financial institutions may charge early closure fees for closing a line of credit, so it's essential to review terms before proceeding.

After closing a line of credit, always obtain written confirmation from the bank or institution, and regularly monitor the credit report to ensure the account reflects as "closed."

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.