An unsecured personal line of credit is a loan that gives borrowers access to a flexible and revolving source of funds without providing collateral or assets as security. This type of loan can be an attractive option for those who need money for personal expenses but who do not have sufficient savings or assets to borrow against. An unsecured personal line of credit works by providing borrowers with access to a flexible and revolving source of funds without requiring them to provide collateral or assets as security. The credit limit for an unsecured personal line of credit is usually determined based on the borrower's creditworthiness, income, employment history, and other factors. Lenders may also consider the purpose of the loan and the borrower's existing debts when determining the credit limit. The interest rate for an unsecured personal line of credit is usually calculated based on the borrower's credit score, the prime rate, and other factors such as income and employment history. The interest rate is typically variable, which means it can go up or down depending on market conditions. The repayment terms and options for an unsecured personal line of credit vary depending on the lender and the type of line of credit. With a revolving line of credit, borrowers typically have a minimum monthly payment based on the borrowed amount. With a non-revolving line of credit, borrowers must make regular payments until the loan is paid off. An unsecured personal line of credit may involve fees charged by lenders, including cash advances, balance transfers, or annual fees. Borrowers need to read the terms and conditions carefully and understand the fees and charges associated with using the line of credit. There are two main types of unsecured personal lines of credit: revolving and non-revolving. A revolving line of credit is a type of loan that allows borrowers to draw on their line of credit as needed. The borrower is only charged interest on the amount of money they have drawn from their line of credit, not on the entire credit limit. A non-revolving line of credit is a type of loan that provides borrowers with a lump sum of money that must be repaid over a set period of time. Once the borrower has repaid the loan, they cannot borrow any more money from the line of credit. Qualifications for obtaining an unsecured personal line of credit typically include having a good credit score and financial history, stable income and employment, and a reasonable debt-to-income ratio. One of the main qualifications for obtaining an unsecured personal line of credit is a good credit score and financial history. Lenders will typically look at a borrower's credit report and credit score to determine their creditworthiness. The higher the credit score, the more likely the borrower will be approved for a line of credit. Lenders also look at a borrower's income and employment history to ensure that they have a stable source of income to repay the loan. Borrowers who are self-employed or have irregular income may find it more difficult to obtain a line of credit. Lenders also look at a borrower's debt-to-income ratio, which is the amount of debt they have compared to their income. Borrowers with a high debt-to-income ratio may find it more difficult to obtain a line of credit. In making a lending decision, lenders may also take into account other factors like the borrower's purpose of loan, age, and credit history duration. By following these steps, borrowers can confidently apply for an unsecured personal line of credit and find the best option for their financial needs. Researching Lenders and Comparing Rates: It is important for borrowers to research lenders and compare rates before applying for an unsecured personal line of credit. This can help them find the best rates and terms for their needs. Gathering Required Documents: Borrowers must gather documentation such as their credit report, proof of income, and identification to apply for an unsecured personal line of credit. Submitting Application: Once borrowers have found a lender and gathered the necessary documentation, they can submit their application for an unsecured personal line of credit. Approval Process: The approval process for an unsecured personal line of credit varies depending on the lender and the borrower's creditworthiness. Borrowers may receive an instant decision or may have to wait a few days to receive a decision. An unsecured personal line of credit can be an excellent option for borrowers in several situations. Home Renovations or Repairs: Unsecured personal lines of credit can be a good option for homeowners who need to make repairs or renovations to their homes but do not have the cash on hand to pay for them. Medical Expenses: Unforeseen medical expenses can be costly and stressful. An unsecured personal line of credit can provide borrowers with the funds they need to cover these expenses. Emergency Expenses: Unexpected emergencies such as car repairs, job loss, or natural disasters can happen anytime. An unsecured personal line of credit can give borrowers the funds they need to handle these emergencies. Consolidating High-Interest Debt: Borrowers with high-interest credit card debt may find that consolidating their debt with an unsecured personal line of credit can save them money on interest charges. Covering Unexpected Expenses: Unsecured personal lines of credit can give borrowers the funds they need to cover unexpected expenses such as a wedding, vacation, or other large expenses. Unsecured personal lines of credit offer borrowers several benefits, such as access to funds without collateral, flexibility to access funds as needed, lower interest rates compared to credit cards, and an easy application process. One of the main advantages of an unsecured personal line of credit is that borrowers can access funds without providing collateral or assets as security. This means that they do not have to risk losing their valuable possessions if they cannot make payments on the loan. Another advantage of a line of credit versus a loan is that it allows borrowers to access funds as needed. Instead of receiving a lump sum of money, as with a traditional loan, borrowers can draw from their line of credit as needed. This makes it an excellent option for those who need access to funds over a longer period of time or for unexpected expenses. Unsecured personal lines of credit typically have lower interest rates than credit cards. This can make it a more affordable option for borrowers who need to borrow money. Borrowers who use their unsecured personal line of credit responsibly and make timely payments can improve their credit scores. This can make it easier to obtain credit in the future. The application process for an unsecured personal line of credit is usually straightforward and simple. Borrowers can apply online or in person at a bank or credit union. While an unsecured personal line of credit can be a beneficial financial tool for borrowers, it also carries some risks. Borrowers who do not make timely payments on their unsecured personal line of credit may be subject to high-interest rates and late fees. The flexibility of an unsecured personal line of credit can be a double-edged sword. Borrowers who are not disciplined in their spending may find themselves overspending and unable to repay their debt. Borrowers who do not use their unsecured personal line of credit responsibly may damage their credit score and find it difficult to obtain credit in the future. An unsecured personal line of credit can be an excellent option for individuals who need access to funds without providing collateral or assets as security. It offers flexibility, lower interest rates, and the potential to improve credit scores. However, borrowers must meet specific qualifications and understand the different types of lines of credit, how they work, and the associated risks. Researching lenders, gathering the necessary documentation, and going through the approval process are crucial. If you need funds and believe an unsecured personal line of credit may be right for you, it is recommended that you seek the services of a reputable lender. They can guide you through the process, help you determine the appropriate credit limit, and answer any questions you may have. By responsibly using an unsecured personal line of credit, you can access the funds you need and improve your financial standing. Take action today and explore your options for an unsecured personal line of credit by reaching out to a bank near you.What Is an Unsecured Personal Line of Credit?

How Unsecured Personal Line of Credit Works

How Credit Limit Is Determined

How Interest Rates Are Calculated

Repayment Terms and Options

Fees and Charges Associated With Using a Line of Credit

Types of Unsecured Personal Line of Credit

Revolving Line of Credit

Non-Revolving Line of Credit

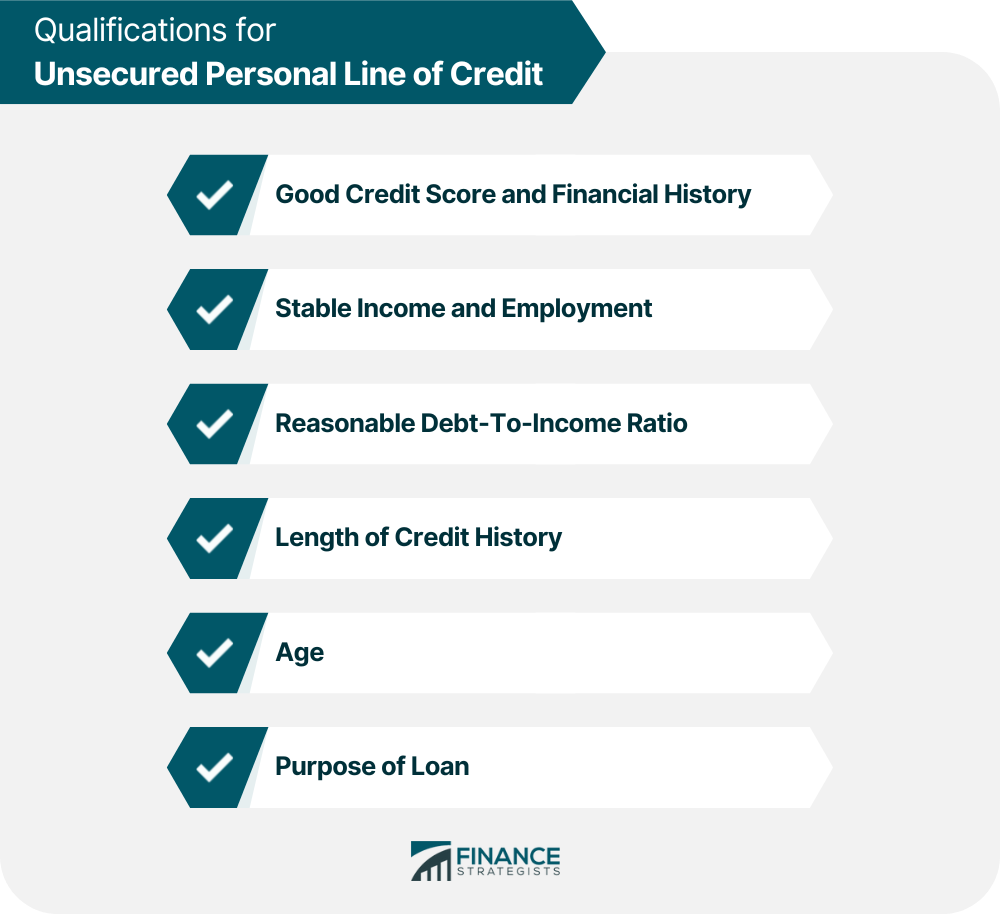

Qualifications for Unsecured Personal Line of Credit

Good Credit Score and Financial History

Stable Income and Employment

Debt-To-Income Ratio

Other Factors Lenders Consider

How to Apply for an Unsecured Personal Line of Credit

When to Use Unsecured Personal Line of Credit

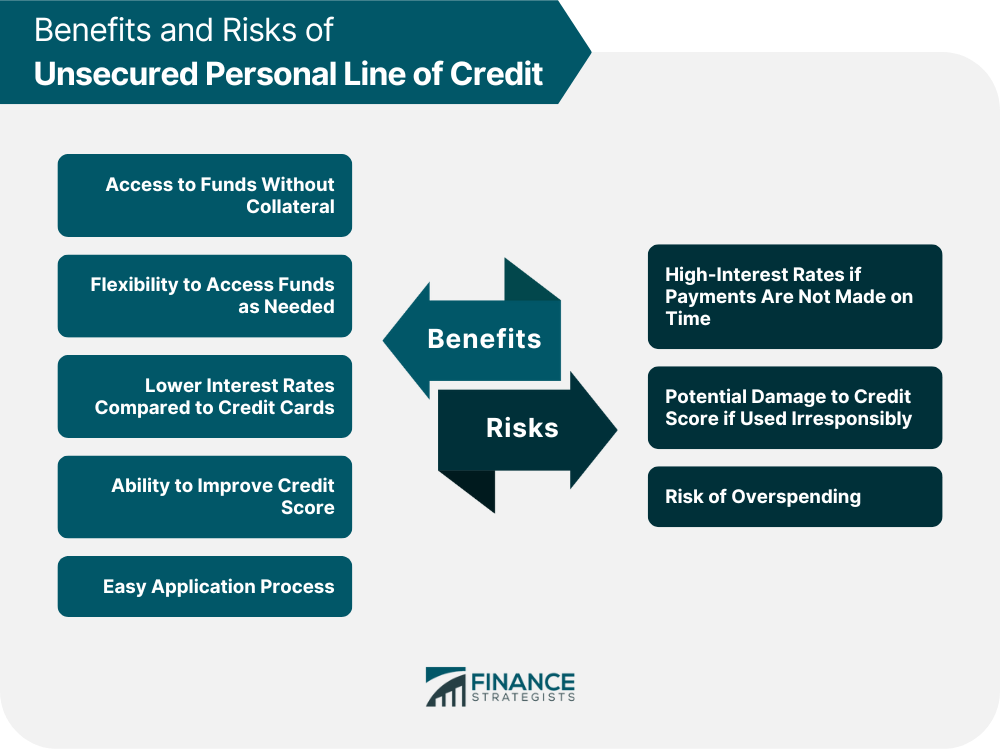

Benefits of Unsecured Personal Line of Credit

Access to Funds Without Collateral

Flexibility to Access Funds as Needed

Lower Interest Rates Compared to Credit Cards

Ability to Improve Credit Score

Easy application process

Risks of Unsecured Personal Line of Credit

High-Interest Rates if Not Repaid on Time

Risk of Overspending

Potential Damage to Credit Score if Not Used Responsibly

Final Thoughts

Unsecured Personal Line of Credit FAQs

An unsecured personal line of credit is a type of loan that provides borrowers with access to a flexible and revolving source of funds without having to provide collateral or assets as security.

The benefits of an unsecured personal line of credit include access to funds without collateral, flexibility to access funds as needed, lower interest rates compared to credit cards, the ability to improve credit scores, and an easy application process.

Qualifications for obtaining an unsecured personal line of credit include having a good credit score and financial history, stable income and employment, and a reasonable debt-to-income ratio.

The risks of using an unsecured personal line of credit include high-interest rates if not repaid on time, the risk of overspending, and potential damage to credit score if not used responsibly.

To apply for an unsecured personal line of credit, you should research lenders, gather the required documentation, submit an application, and go through the approval process. It is recommended that you seek the services of a reputable lender who can guide you through the process and answer any questions you may have.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.