A business line of credit is like a credit card that lenders provide to businesses. Small businesses can take advantage of them as well but may be charged more interest if they have a limited credit history. However, many lenders offer favorable rates even to very young businesses. A small business line of credit is a financial tool that allows business owners to borrow up to a predetermined limit, pay interest only on the borrowed amount, and maintain the option to draw more as repayments are made. Essentially, it is similar to a credit card where businesses have a pool of money to tap into for operational costs or other business-related expenses. This type of credit is flexible and can provide businesses with greater control over their loan amounts and repayment schedules. One option for a line of credit that is ideal for small businesses is a secured line of credit. If you have property or real estate that you would be willing to secure the LOC with, you may be able to get a higher credit limit and lower interest. Other options include online lenders, who typically have lower credit requirements. To be eligible for a small business line of credit, lenders often require a strong credit score and a stable financial history. While specific requirements can vary among lenders, a high credit score typically indicates lower risk for the lender. Additionally, a solid financial history exhibiting responsible credit usage and consistent revenue can enhance a business's chances of obtaining a line of credit. When applying for a small business line of credit, borrowers must be prepared to provide an array of information and documents. This could include business and personal tax returns, bank statements, business financial statements, and a detailed business plan. Lenders use this information to assess the financial health of the business and the risk associated with extending credit. Depending on the lender and the borrower's financial health, a small business line of credit may be secured or unsecured. Secured lines of credit require collateral, which could be business or personal assets. Conversely, unsecured lines of credit do not require collateral but often require a personal guarantee, which makes the borrower personally responsible for the debt if the business fails to repay it. These factors offer lenders a snapshot of the business's financial performance and ability to repay the borrowed funds. Typically, a steady stream of revenue and consistent profitability can significantly enhance the likelihood of credit approval and better credit terms. A revolving line of credit is a flexible financing option where the business can borrow, repay, and borrow again up to the approved limit. It's a continually available source of funds that replenishes as debts are paid off, providing businesses with ongoing access to capital for various operational needs. Unlike a revolving line of credit, a non-revolving line of credit does not replenish once the borrowed funds are repaid. The total loan amount is available until it is fully utilized, and once repaid, the account is closed. While it may not offer the same flexibility as its revolving counterpart, it can still be a valuable tool for financing large, one-time expenses. A secured line of credit requires the borrower to provide collateral as a guarantee for the loan. This collateral can be assets such as real estate, inventory, or equipment. If the borrower defaults, the lender has the right to seize the collateral. Secured lines of credit often come with lower interest rates due to the decreased risk for the lender. An unsecured line of credit does not require the borrower to provide any collateral. Because of the increased risk for the lender, these credit lines often come with higher interest rates and may require a strong credit history and high credit scores. Despite the higher costs, an unsecured line of credit can be an attractive option for businesses lacking substantial assets. A small business line of credit can play a pivotal role in managing cash flow, one of the most critical aspects of running a successful business. It provides a cushion for businesses during times when incoming cash flow is slow or expenses are high, thus ensuring smooth operations and financial stability. Unlike traditional term loans, where borrowers receive a lump sum and start accruing interest immediately, a line of credit allows businesses to borrow only what they need and pay interest only on the borrowed amount. A small business line of credit is an excellent tool for covering short-term expenses, such as inventory purchases, payroll, and unexpected costs. By providing quick access to funds, it allows businesses to meet their short-term financial obligations without hindrance. Regular use and timely repayment of a line of credit demonstrate to lenders that the business is capable of managing its debts, which can pave the way for additional financing options in the future. Businesses should understand the total cost of borrowing, including any origination fees, service fees, and annual fees. A line of credit with lower interest rates and minimal fees can significantly reduce the overall cost of borrowing. When choosing a line of credit, businesses should consider their financial needs and ensure the credit limit meets those needs. They should also look for a line of credit that offers flexibility in how and when the funds can be used, enabling them to manage their financial obligations effectively. Understanding the repayment terms and conditions is vital when choosing a line of credit. This includes the repayment schedule, the minimum payment amount, and any penalties for late or early repayment. Businesses should ensure they can meet the repayment terms to avoid damaging their credit history. The lender's reputation and the quality of their customer service can significantly impact the borrowing experience. Businesses should research potential lenders, read reviews, and ensure they are known for their integrity, transparency, and customer support. The first step in applying for a small business line of credit is researching and selecting a lender. This may involve comparing various lenders' offerings, including interest rates, fees, credit limits, and repayment terms. Selecting a lender that aligns with the business's financial needs and goals can pave the way for a successful borrowing experience. Once a lender has been selected, the next step is gathering the necessary documents and information. This usually includes business and personal tax returns, financial statements, and bank statements. Businesses should ensure all documents are accurate and up-to-date to expedite the application process. When applying for a line of credit, accuracy is crucial. Businesses should ensure all information on the application form is correct and complete. Any errors or omissions can lead to delays in approval or even rejection of the application. After completing the application form, the next step is to submit it and await the lender's decision. Depending on the lender, this may take a few days or a few weeks. Businesses should follow up with the lender to check on the application status and provide any additional information if requested. Effective management of a small business line of credit begins with creating a budget and cash flow projections. These tools can help businesses understand their financial position, anticipate future expenses, and plan how to use their line of credit most effectively. Businesses should strive for responsible borrowing, meaning they should only draw on their line of credit when necessary and aim to repay it as quickly as possible. This not only helps maintain a lower balance and minimize interest costs but also signals to lenders that the business is a reliable borrower. Regularly monitoring credit usage and interest charges can help businesses stay on top of their line of credit. This can involve tracking how much has been borrowed, how much is still available, and how much interest is accruing. Regular monitoring can help prevent over-borrowing and ensure the line of credit is being used wisely. A line of credit should be used strategically and for purposes that can benefit the business. This could be anything from managing cash flow during slow periods to taking advantage of growth opportunities. By using their line of credit strategically, businesses can ensure they're maximizing its benefits and driving their business forward. A small business line of credit is a valuable financial tool for businesses, offering numerous benefits and flexibility. It allows businesses to manage their cash flow effectively, access funds when needed, and cover short-term expenses. By establishing a credit history through responsible borrowing and timely repayments, businesses can enhance their chances of obtaining additional financing in the future. When choosing a line of credit, factors such as interest rates, fees, credit limits, and repayment terms should be carefully considered. Researching and selecting suitable lenders, gathering necessary documents, and accurately completing the application form are crucial steps in the application process. Once approved, businesses should focus on responsible borrowing, regular monitoring of credit usage and interest charges, and utilizing the line of credit strategically for business purposes. With proper management, a small business line of credit can provide the necessary financial support to fuel business growth and success.What Is a Small Business Line of Credit?

Line of Credit for Small Business

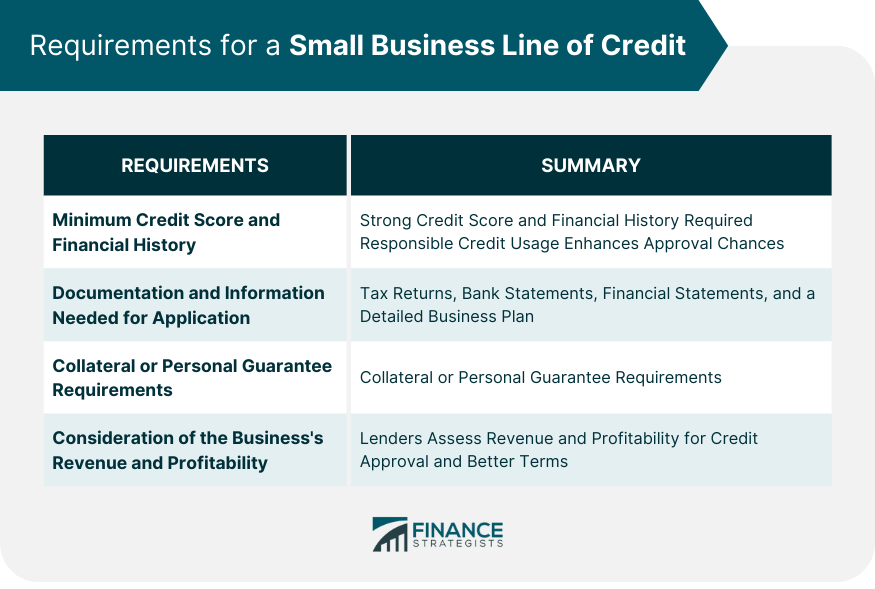

Requirements for a Small Business Line of Credit

Minimum Credit Score and Financial History

Documentation and Information Needed for the Application Process

Collateral or Personal Guarantee Requirements

Consideration of the Business's Revenue and Profitability

Types of Small Business Line of Credit

Revolving Line of Credit

Non-revolving Line of Credit

Secured Line of Credit

Unsecured Line of Credit

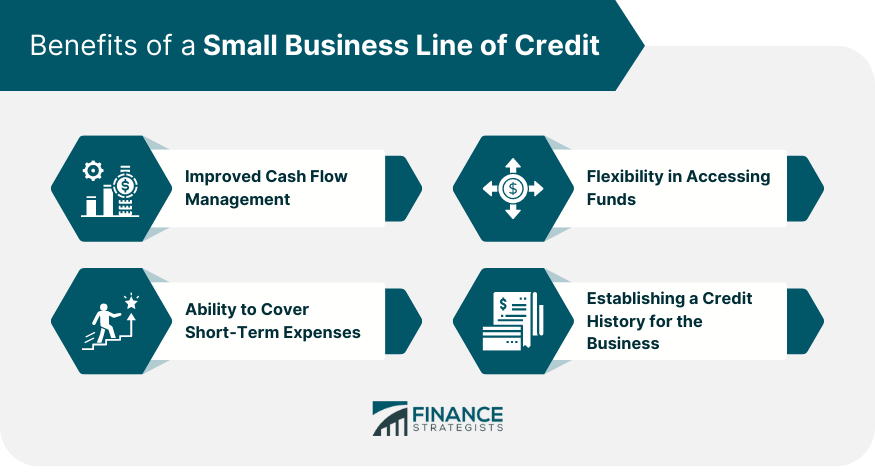

Benefits of a Small Business Line of Credit

Improved Cash Flow Management

Flexibility in Accessing Funds

Ability to Cover Short-Term Expenses

Establishing a Credit History for the Business

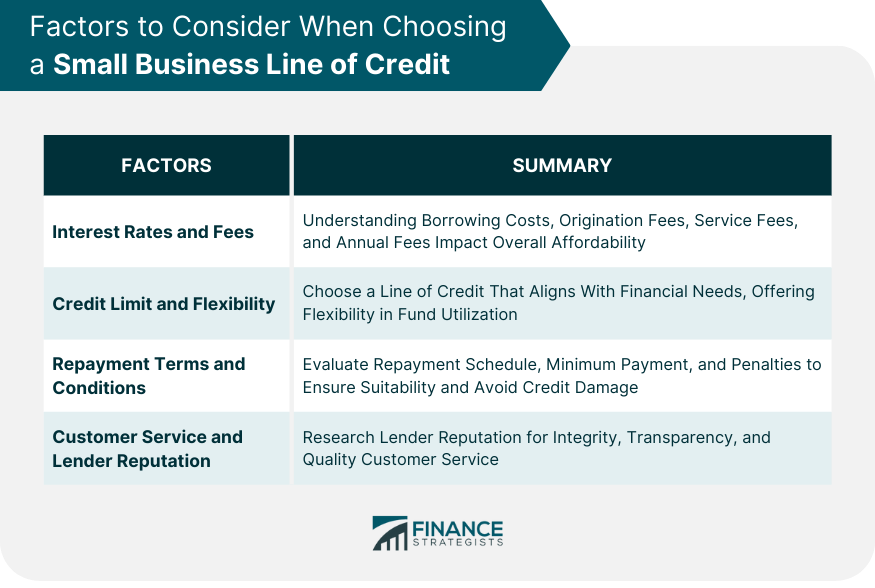

Factors to Consider When Choosing a Small Business Line of Credit

Interest Rates and Fees

Credit Limit and Flexibility

Repayment Terms and Conditions

Customer Service and Lender Reputation

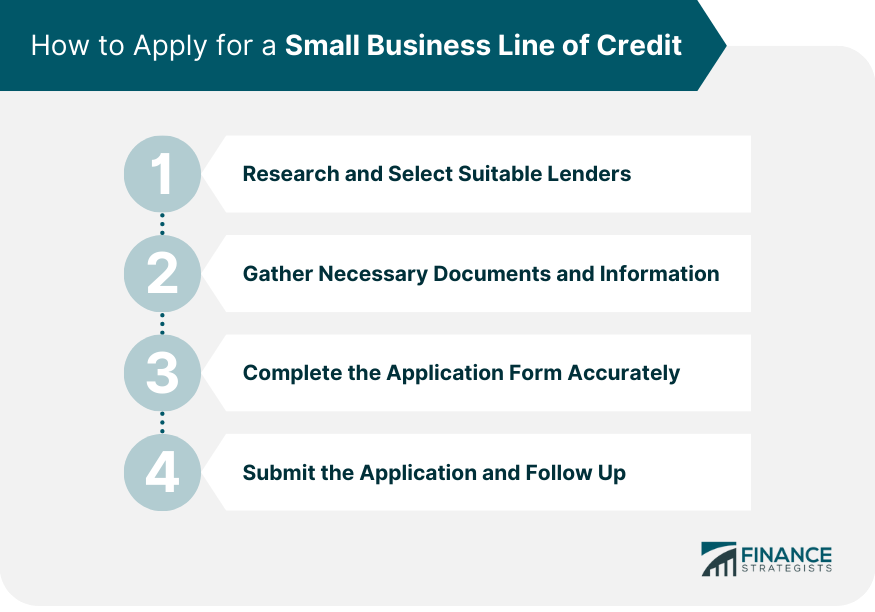

How to Apply for a Small Business Line of Credit

Researching and Selecting Suitable Lenders

Gathering Necessary Documents and Information

Completing the Application Form Accurately

Submitting the Application and Following Up

Managing a Small Business Line of Credit

Creating a Budget and Cash Flow Projections

Responsible Borrowing and Debt Management

Regularly Monitoring Credit Usage and Interest Charges

Utilizing the Line of Credit for Strategic Business Purposes

Conclusion

Small Business Line of Credit FAQs

A small business line of credit is a revolving line of credit loan that provides access to working capital for use in managing short-term cash flow needs and financing new projects. It allows businesses to draw on funds as needed, up to a predetermined limit authorized by the lender.

A small business line of credit can be used in various ways, such as covering gaps in cash flow, making inventory purchases, purchasing equipment or even taking advantage of special one-time opportunities like bulk discounts or early payouts from vendors.

A small business line of credit can give businesses the flexibility to access working capital when needed, as well as the ability to take advantage of opportunities in times of need or profitable opportunity. This type of financing also helps improve cash flow and allows businesses to purchase supplies and materials without having to wait for customer payments or issue invoices.

In order to qualify for a small business line of credit, applicants must typically have an established business with at least one year in operation and good credit history. Additionally, applicants may need to provide financial statements and tax returns, as well as other documents in order to assess their current financial situation.

The terms and rates associated with a small business line of credit vary depending on the lender and also depend on factors such as the borrower’s credit score, financial history and current cash flow. Generally, lenders will offer lines of credit from one to five years in duration with interest rates ranging from prime plus 1% to prime plus 6%. Additionally, some lenders may require collateral in order to secure the loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.