A secured business line of credit is a type of financing that provides small business owners with access to funds backed by collateral. It allows businesses to borrow money as needed up to a predetermined credit limit, similar to a credit card. However, unlike a credit card, a secured business line of credit is secured by collateral, such as inventory, accounts receivable, equipment, or real estate. This makes it a lower-risk option for lenders and allows borrowers to access funds at a lower interest rate. Business owners can draw on the line of credit as needed, and the amount they borrow is repaid with interest over time. Once repaid, the line of credit becomes available again for future use. A secured business line of credit comes in several different types. Here are the three main types: A traditional secured business line of credit is backed by collateral, typically in the form of inventory, accounts receivable, or other assets owned by the business. This type of line of credit is also known as a revolving credit line because it allows the business owner to access funds as needed and repay the borrowed amount, replenishing the line of credit. An asset-based line of credit uses assets as collateral, such as accounts receivable, inventory, equipment, or real estate. This type of secured line of credit is useful for businesses with many assets but may not have strong credit scores or financial statements. The amount of the line of credit depends on the value of the assets pledged as collateral. A real estate secured line of credit uses commercial or residential real estate as collateral to secure the loan. This type of line of credit is best suited for businesses that own real estate, as the loan amount depends on the equity in the property. The real estate can be used as collateral for other financing options, such as equipment loans, working capital loans, or other secured loans. Lenders have requirements that small business owners need to meet, such as the following: The collateral requirement varies depending on the type of secured business line of credit. For instance, traditional secured business lines of credit require inventory, accounts receivable, or other assets as collateral. Asset-based lines of credit require assets such as inventory, equipment, or real estate, while real estate-secured lines of credit require commercial or residential real estate as collateral. Lenders want to ensure that they lend to borrowers with good credit scores. For secured business lines of credit, lenders typically require a minimum credit score of 580 or above. Lenders use the credit score to determine the interest rate and the amount of the line of credit. Lenders require financial statements to evaluate a small business owner's financial health. The financial statements typically include balance sheets, income statements, and cash flow statements. The statements should be up-to-date and accurately reflect the business's financial situation. Lenders may also require a business plan that outlines the business's goals, how the business will generate revenue, and how the funds from the secured business line of credit will be used. This helps lenders understand the borrower's vision for the business and how they plan to use the loan. Applying for a secured business line of credit requires careful planning and preparation. Here are the steps to apply for a secured business line of credit: Research and compare lenders that offer secured business lines of credit to find one that meets your business's needs. Look for lenders that offer competitive interest rates, flexible repayment terms, and favorable collateral requirements. Prepare the necessary documents that lenders require, including financial statements, business plans, and collateral documentation. Create a comprehensive business plan that outlines your business's goals, strategies, and how you plan to use the funds from the secured business line of credit. Submit the application and all required documents to the lender. Be prepared to answer any additional questions or provide further information if needed. Secured business lines of credit have several benefits that make them an attractive financing option for small business owners. Here are some of the most significant benefits: A secured business line of credit allows the business owner to borrow only the amount they need, making it a flexible financing option. The business owner can access the funds as needed and only pay interest on the amount they borrow rather than paying interest on the entire line of credit. Secured business lines of credit typically have lower interest rates than credit cards or unsecured loans, as they are backed by collateral. This makes them a more affordable financing option for small businesses. With a secured business line of credit, small business owners can access funds quickly and easily when they need them without having to go through the lengthy process of applying for a loan. By making timely payments on the secured business line of credit, small business owners can build a positive credit history, which can help them qualify for better financing options in the future. While secured business lines of credit have many benefits, they also have some drawbacks. Here are some of the most significant drawbacks: If a borrower defaults on a secured business line of credit, they risk losing the collateral that was pledged to secure the loan. This can be particularly risky for small businesses that may not have many assets to pledge as collateral. Secured business lines of credit may come with higher fees and costs than other financing options, such as unsecured loans or credit cards. This is because lenders must cover the cost of assessing and managing the collateral. The application process for a secured business line of credit can be lengthy and time-consuming, as lenders need to evaluate the collateral, creditworthiness, and financial statements of the borrower. A secured business line of credit is a flexible financing option for small business owners who need access to funds to manage their operations. The requirements include collateral, a good credit score, up-to-date financial statements, and a comprehensive business plan. Secured business lines of credit have benefits such as flexible borrowing limits, lower interest rates, and quick access to funds. Still, they also come with risks like the potential loss of collateral and higher fees and costs. Therefore, it is important to evaluate whether it's the right financing option for your business needs. If you do decide to apply for a secured business line of credit, be sure to do so wisely and carefully. A mortgage broker can provide you with guidance as you navigate through the loan application process.What Is a Secured Business Line of Credit?

Types of Secured Business Line of Credit

Traditional Secured Business Line of Credit

Asset-Based Line of Credit

Real Estate Secured Line of Credit

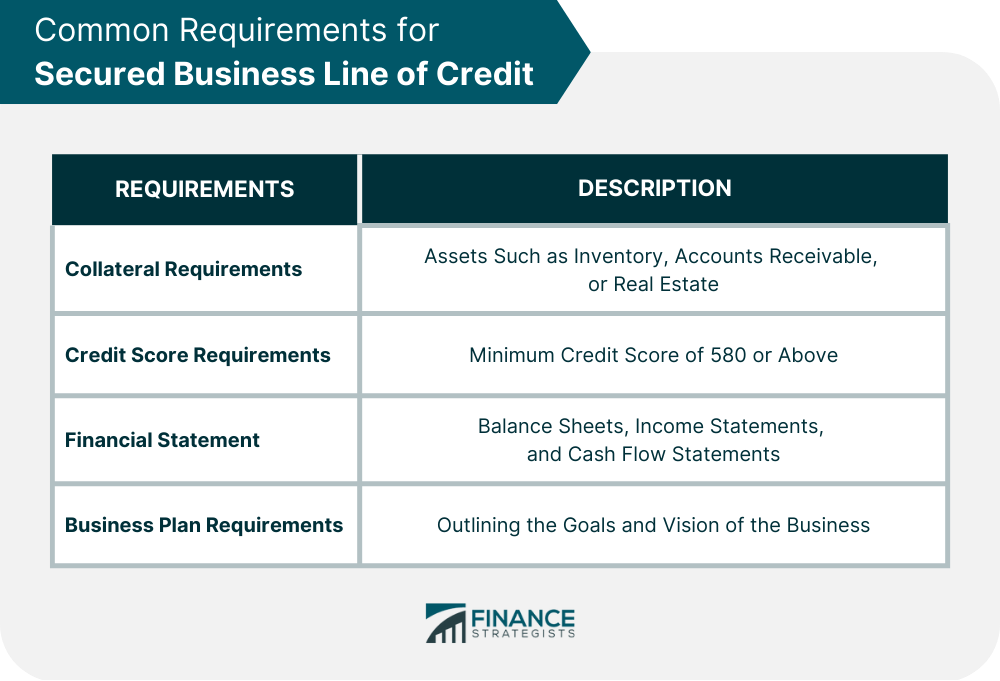

Requirements for Secured Business Line of Credit

Collateral Requirements

Credit Score Requirements

Financial Statement Requirements

Business Plan Requirements

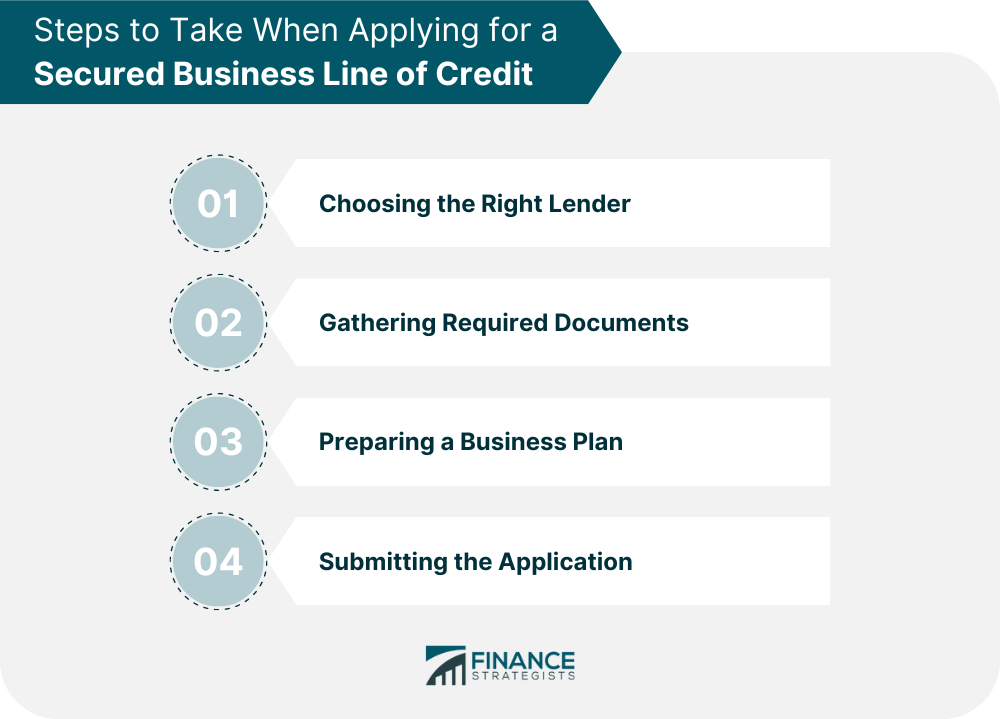

How to Apply for a Secured Business Line of Credit

Step 1: Choosing the Right Lender

Step 2: Gathering Required Documents

Step 3: Preparing a Business Plan

Step 4: Submitting the Application

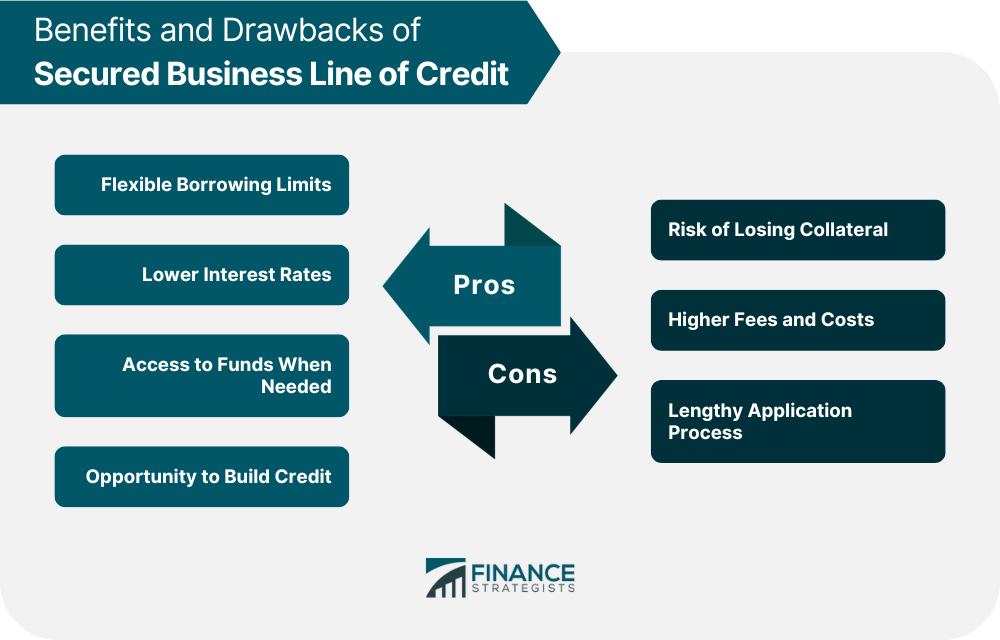

Benefits of Secured Business Line of Credit

Flexible Borrowing Limits

Lower Interest Rates

Access to Funds When Needed

Opportunity to Build Credit

Drawbacks of Secured Business Line of Credit

Risk of Losing Collateral

Higher Fees and Costs

Lengthy Application Process

Final Thoughts

Secured Business Line of Credit FAQs

A secured business line of credit is a type of financing that provides small business owners with access to funds backed by collateral.

The requirements for a secured business line of credit include collateral such as inventory or real estate, a minimum credit score of 580 or above, up-to-date financial statements, and a comprehensive business plan.

The benefits of a secured business line of credit include flexible borrowing limits, lower interest rates, quick access to funds, and the opportunity to build credit.

The drawbacks of a secured business line of credit include the risk of losing collateral, higher fees and costs, and a lengthy application process.

To apply for a secured business line of credit, research and compare lenders, gather the required documents, prepare a comprehensive business plan, and submit the application and all required documents to the lender. You may also seek the assistance of a mortgage broker.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.