A business line of credit is a flexible financial instrument that allows businesses to borrow funds up to a predetermined limit, similar to a credit card. Companies can draw from this line, pay it back, and draw again, as long as they stay within their specified limit. It's a versatile solution for businesses that need to manage cash flow, purchase inventory, or handle unexpected expenses. Its importance in the business landscape cannot be overemphasized. With the uncertainties that come with running a business, having an accessible pool of funds can be the difference between capitalizing on an opportunity or missing out. A business line of credit is especially crucial for companies that have seasonal fluctuations, ensuring continuous operations even during lean periods. Starting with the application, a business line of credit might seem daunting, but with the right preparation, it can be straightforward. Prospective borrowers will need to provide various documentation, which could include business financial statements, tax returns, and a detailed business plan. The documentation helps lenders evaluate the business’s financial health and its capacity to repay the borrowed amount. Eligibility criteria vary among lenders but typically revolve around a business's credit score, its operational history, and its profitability. A strong business credit score and a proven track record increase the chances of securing favorable terms for the line of credit. Once approved, accessing funds from a business line of credit is often straightforward. Most lenders offer multiple methods, be it through online transfers, writing checks, or card transactions. It's similar to having a business credit card but with a much higher limit. However, it's essential to note that you only pay interest on the amount you draw, not on the total credit line. This aspect sets it apart from conventional loans and can save businesses a significant amount in interest payments if used wisely. Interest rates on business lines of credit can be either fixed or variable. While fixed rates remain constant throughout the term, variable rates fluctuate based on market conditions. Repayments typically consist of the drawn amount plus interest, and while some lines might have a minimum monthly payment, others might allow more flexibility. Moreover, some lenders might offer interest-only payment options for a set period, allowing businesses to pay back just the interest portion. This can be beneficial for businesses going through a rough patch, but it's crucial to remember that the principal amount still needs repayment. Business lines of credit, while beneficial, can come with various fees. These could include annual fees, maintenance fees, or even withdrawal fees. Some lenders might charge a fee for unused portions of the credit line as a way of ensuring they earn some revenue, even if the business doesn't fully utilize its line. Additionally, late payment fees and over-limit fees can apply if businesses are not diligent with their repayments or if they exceed their credit limit. It's essential to be aware of all associated charges to manage the line of credit effectively. One of the primary benefits of a business line of credit is its inherent flexibility. Unlike term loans, which provide a lump sum amount, a line of credit allows businesses to draw funds as and when needed. This flexibility ensures that companies aren't borrowing more than necessary, leading to reduced interest payments. Moreover, once repaid, the amount becomes available for borrowing again. This revolving nature ensures that businesses always have access to funds, catering to both planned and unexpected expenses. Unlike other financing options where interest might be charged on the entire loan amount, with a line of credit, you're only charged for what you use. If your business doesn't draw from its line, no interest is charged. This setup can result in significant savings, especially for businesses that don't require the full credit line immediately. The ability to control your borrowing and, by extension, your interest payments, provides businesses with financial agility, ensuring they're only in debt for what they genuinely need. For businesses, particularly those with seasonal operations, cash flow can be a significant concern. During off-peak seasons, revenues might dip, but operational costs remain, leading to potential cash flow challenges. A business line of credit can bridge this gap, allowing businesses to continue operations unhindered. Moreover, for businesses looking to capitalize on bulk purchase discounts or limited-time opportunities, having access to a credit line can ensure they don't miss out due to cash flow constraints. A business line of credit doesn't come with the same usage restrictions that some other loans might. Whether it's to purchase inventory, invest in marketing campaigns, hire additional staff for peak seasons, or manage day-to-day expenses, the funds are at the business's discretion. This versatility ensures that businesses can make decisions swiftly without navigating the often time-consuming process of securing specific-purpose financing. While a business line of credit offers numerous benefits, it's not without its drawbacks. The interest rates can sometimes be higher than those of traditional term loans. The flexibility and convenience provided by a credit line come at a premium, which can accumulate if large amounts are drawn and not repaid promptly. Businesses need to weigh the convenience against the potential cost, ensuring they're making a financially sound decision. With a substantial amount readily available, there's a temptation to draw more than what's necessary. Over-borrowing can lead to substantial debts and increased interest payments, which can strain a business's financial health. It's crucial for businesses to exercise discipline, ensuring they only borrow what's necessary and have a clear plan for repayment. The flexibility of a business line of credit, while an advantage, can also be a pitfall if not managed correctly. Since it's a revolving credit, businesses might fall into the trap of making minimal payments, leading to prolonged debt and escalating interest payments. Businesses must approach their line of credit with a strategy, ensuring they're not just managing their current needs but also considering their long-term financial health. Before applying for a line of credit, businesses should take a close look at their financial health. Lenders will scrutinize financial statements, credit scores, and operational histories. A business in good financial standing is more likely to secure favorable terms. It's advisable to address any financial red flags, be it outstanding debts or inconsistencies in financial statements, before approaching lenders. While it might be tempting to apply for the maximum amount, businesses should have a clear understanding of what they genuinely need. Overestimating can lead to unnecessary costs while underestimating might leave the business without the required funds when needed. By forecasting financial needs based on historical data and future projections, businesses can arrive at an amount that aligns with their operational requirements. Businesses should also consider the duration for which they'll need the funds. If the requirement is short-term, a line of credit is ideal. However, for long-term needs, other financing options might prove more cost-effective. Understanding the time frame can guide businesses in choosing the most suitable financial product, ensuring they're not paying more in interest than necessary. Taking on a business line of credit is a significant commitment, and businesses must be aware of their other financial obligations. Existing debts, loans, or other financial commitments can influence the business's ability to manage another credit line. By reviewing all financial obligations, businesses can ensure they're not overextending themselves, potentially jeopardizing their financial stability. Much like personal credit scores, a business credit score plays a pivotal role in securing a line of credit. A strong score indicates financial responsibility, making lenders more inclined to offer favorable terms. Businesses should regularly review their score, address any discrepancies, and take measures to improve it. By paying suppliers on time, managing debts effectively, and ensuring all financial statements are accurate, businesses can bolster their credit score, positioning themselves favorably with lenders. Lenders will undoubtedly review a business's financial statements during the application process. Accurate, up-to-date financial statements can streamline this process, reducing potential delays. Regularly updating and reviewing financial statements not only aids in the application process but also provides businesses with a clearer picture of their financial health, guiding decision-making processes. It's essential for businesses to understand the terms associated with their line of credit fully. This understanding extends beyond interest rates to include all fees, charges, and any penalties that might apply. By thoroughly reviewing all terms and seeking clarifications where needed, businesses can avoid unforeseen costs and manage their line of credit more effectively. Not all lines of credit are created equal. Lenders can vary significantly in terms of interest rates, fees, and terms. By comparing different offers, businesses can ensure they're securing the best possible deal. It's also worth considering the lender's reputation, customer service, and any value-added services they might offer, ensuring a smooth and beneficial relationship. One of the most common mistakes businesses make is not thoroughly reviewing all the terms associated with their line of credit. While the interest rate might be a focal point, other fees and charges can quickly add up, making the line of credit more expensive than initially anticipated. It's crucial to take the time to understand every aspect of the credit line, ensuring there are no surprises down the line. Overestimating funding needs can lead to increased costs. While it might seem prudent to have extra funds available, if they're not used, they can result in unnecessary charges, particularly if the lender imposes fees on unused portions of the credit line. By accurately assessing financial needs, businesses can avoid the pitfalls of over-borrowing. Regularly updating financial records might seem like a routine task, but it's a crucial one. Outdated or inaccurate records can not only delay the application process but also influence a lender's decision. Ensuring all financial records are up-to-date and accurately reflect the business's financial health is essential, not just for securing a line of credit but for the overall management of the business. Securing a business line of credit can offer companies unparalleled flexibility, enabling them to adeptly navigate both expected and unforeseen financial challenges. With its revolving nature, businesses can access funds on demand, ensuring liquidity and promoting growth. However, it's crucial to approach this financial instrument with a clear understanding of both its advantages and potential pitfalls. From meticulously maintaining financial records to comprehensively reviewing terms and fees, businesses must exercise due diligence throughout the application and management process. By accurately assessing funding needs, diligently maintaining a strong business credit score, and comparing lender offerings, businesses can maximize the benefits of a line of credit while mitigating potential drawbacks. Ultimately, a business line of credit, when managed correctly, can be a valuable tool in any company's financial arsenal.What Is a Business Line of Credit?

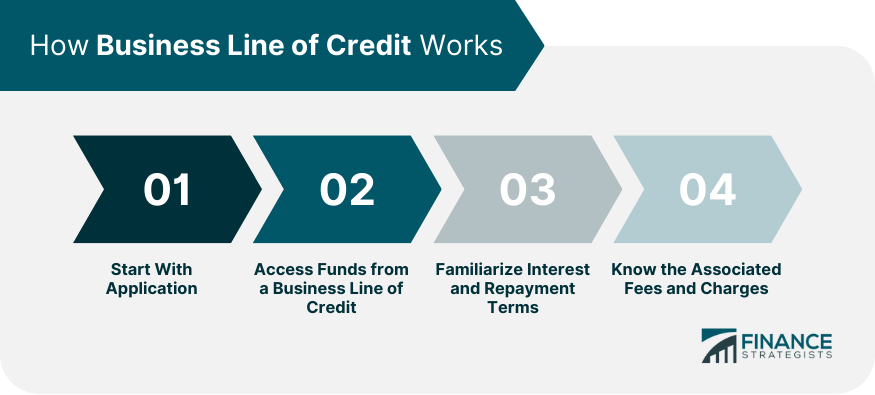

How a Business Line of Credit Works

Application Process

Accessing the Funds

Interest and Repayment Terms

Associated Fees and Charges

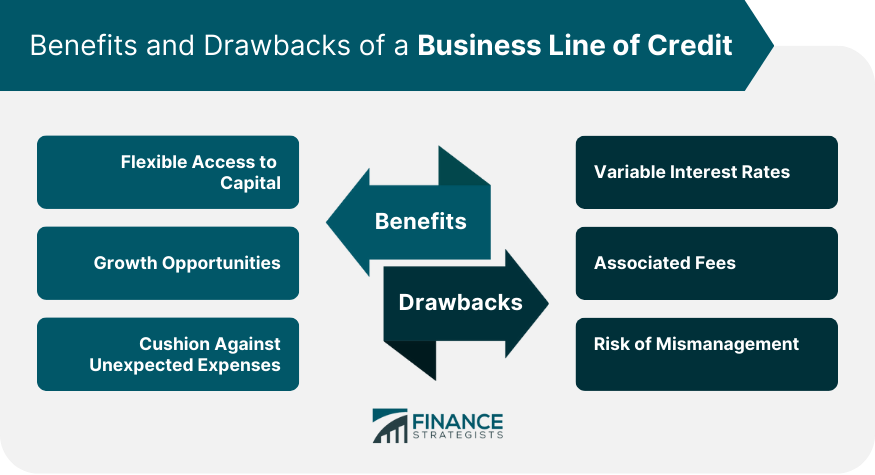

Benefits of a Business Line of Credit

Flexible Access to Capital

Interest Only Paid on Drawn Amount

Manage Cash Flow

Versatility in Usage

Drawbacks of a Business Line of Credit

Potential Higher Interest Rates

Risk of Over-Borrowing

Need for Disciplined Repayment

Key Considerations Before Applying

Assess Business Financial Health

Determine the Necessary Amount

Duration for Which Funds Are Needed

Review of Existing Financial Commitments

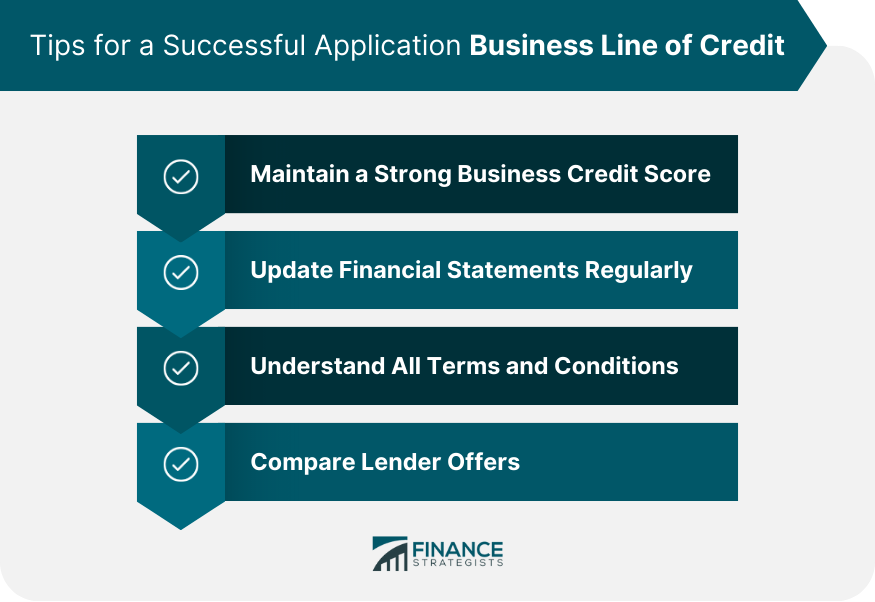

Tips for a Successful Application

Maintain a Strong Business Credit Score

Keep Financial Statements Updated

Thoroughly Understand the Terms

Compare Different Lenders and Their Offers

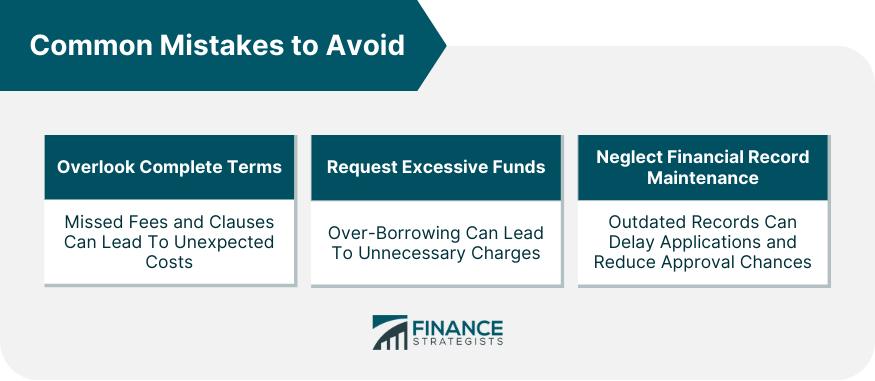

Common Mistakes to Avoid

Overlooking the Complete Terms

Requesting Excessive Funds

Neglecting Financial Record Maintenance

Conclusion

How to Apply for a Business Line of Credit FAQs

A Business Line of Credit offers flexible access to funds up to a predetermined limit, which can be drawn, repaid, and redrawn. Unlike traditional loans that provide a lump sum, this credit line provides revolving access to funds as needed.

When applying for a Business Line of Credit, assess your business's anticipated financial needs, considering both regular operations and potential opportunities or emergencies. This will guide you in choosing a suitable credit limit.

To apply for a Business Line of Credit, you'll often need business financial statements, tax returns, and a detailed business plan. Lenders use these documents to gauge your business's financial health and repayment capability.

To boost your approval odds for a Business Line of Credit, maintain a strong business credit score, ensure your financial statements are accurate and updated, and demonstrate a history of profitability and responsible financial management.

Yes, when you apply for a Business Line of Credit, you might encounter various fees such as annual fees, maintenance fees, and potentially even withdrawal fees. Always review the terms thoroughly to be aware of all associated costs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.