An annuity is a contract between an individual and an insurance company, wherein the individual invests a sum of money in exchange for a series of periodic payments. These payments can be made for a predetermined period or continue for the annuity holder's lifetime. Annuities can offer guaranteed income, which is particularly beneficial for individuals concerned about outliving their retirement savings. There are two primary types of annuities: immediate and deferred. Immediate annuities provide a stream of income payments starting shortly after the initial investment. The annuity holder receives periodic payments for a predetermined period or for the remainder of their life. Deferred annuities accumulate funds over time and can be converted into an income stream at a later date. This option is suitable for those who want to accumulate savings and defer income until a future time. There are two subcategories of deferred annuities: fixed and variable. Fixed annuities offer a guaranteed rate of return, and the insurance company invests the funds in low-risk investments such as bonds. This type of annuity provides a stable, predictable income. Variable annuities allow the annuity holder to invest in various investment options, and the rate of return depends on the performance of those investments. This type of annuity offers the potential for higher returns but also carries higher risks. Understanding the taxation of annuities is crucial for proper financial planning and optimizing retirement income. The tax treatment of annuities depends on the type of annuity, the timing of income payments, and the specific product features. One of the main advantages of annuities is their tax-deferred growth. This means that earnings on the annuity are not taxed until they are withdrawn or paid out as income. This tax-deferred growth allows the annuity holder to benefit from compound interest, enabling their investment to grow more rapidly than if taxes were paid on earnings each year. The exclusion ratio is a tax concept that applies to annuity income payments. It determines the portion of each payment that is considered a tax-free return of principal versus taxable interest income. This ratio helps ensure that annuity holders are not taxed on their initial investment, only on the earnings generated by that investment. The tax treatment of annuities also depends on whether they are classified as qualified or non-qualified. Qualified annuities are purchased with pre-tax dollars through a retirement plan, such as a 401(k) or an IRA. Non-qualified annuities are purchased with after-tax dollars and are not subject to the same contribution limits and withdrawal rules as qualified annuities. The primary difference between the two is the tax treatment of contributions and withdrawals. Upon the annuity holder's death, beneficiaries may be subject to taxes on the inherited annuity. The specific tax treatment depends on various factors, including the type of annuity, the relationship between the annuity holder and the beneficiary, and the payout options chosen. Immediate annuity payments typically consist of two components, each with its tax implications: This portion represents the return of the initial investment and is not subject to taxation. The exclusion ratio, as mentioned earlier, determines what percentage of each payment is considered a tax-free return of principal. Interest earnings are the portion of the annuity payment that represents the growth of the initial investment. This part is taxed as ordinary income at the annuity holder's marginal tax rate. In some cases, annuity holders may choose to receive a lump-sum distribution instead of periodic payments. The tax treatment of lump-sum distributions from an immediate annuity depends on the amount of the distribution that represents earnings on the initial investment. The taxable portion, which includes any earnings, is taxed as ordinary income. Periodic payments from an immediate annuity are taxed based on the exclusion ratio, which determines the taxable portion of each payment. The tax-free return of principal is spread out over the payment period, and the interest earnings are taxed as ordinary income. Deferred annuities offer unique tax advantages, but also come with specific tax considerations when funds are withdrawn or annuitized. Earnings on deferred annuities grow tax-deferred until withdrawn or converted into an income stream through annuitization. This tax treatment allows the annuity holder to benefit from compound interest and potentially accumulate more significant savings for retirement. The tax treatment of withdrawals from deferred annuities depends on various factors, including the annuity holder's age and the timing of withdrawals: Withdrawals made before age 59½ may be subject to a 10% early withdrawal penalty in addition to taxes on earnings. This penalty aims to discourage annuity holders from accessing their funds prematurely and jeopardizing their long-term financial security. Withdrawals from a deferred annuity are taxed on a "last in, first out (LIFO)” basis, meaning earnings are taxed before the return of principal. This tax treatment can result in a higher tax liability for annuity holders who make substantial withdrawals during their higher-income years. Surrendering a deferred annuity may result in taxes on any earnings and potential surrender charges imposed by the insurance company. These charges typically decline over time, so annuity holders should carefully consider the timing of their surrender to minimize fees and taxes. When a deferred annuity is annuitized, or converted into an income stream, the tax treatment of the payments is similar to that of an immediate annuity, with the exclusion ratio determining the taxable portion of each payment. This conversion allows annuity holders to spread their tax liability over time, potentially reducing their overall tax burden. The tax treatment of annuity products can vary depending on the specific product features and the type of income received. Fixed annuities provide a stable, predictable income stream, and their tax treatment depends on the type of income received: Interest earnings on fixed annuities are tax-deferred until withdrawn or annuitized, at which point they are taxed as ordinary income. This tax treatment allows annuity holders to benefit from tax-deferred growth during the accumulation phase. The return of principal from a fixed annuity is not subject to taxation. The exclusion ratio determines the tax-free portion of each annuity payment, ensuring that annuity holders are not taxed on their initial investment. Variable annuities offer the potential for higher returns, but also come with additional tax considerations due to their investment component: Investment gains within a variable annuity are tax-deferred until withdrawn or annuitized, at which point they are taxed as ordinary income. This tax treatment enables annuity holders to benefit from tax-deferred growth on their investment earnings. Similar to fixed annuities, the return of principal from a variable annuity is not subject to taxation. The exclusion ratio determines the tax-free portion of each annuity payment, ensuring that annuity holders are not taxed on their initial investment. There are several special tax considerations that annuity holders should be aware of when planning their financial and tax strategies: Qualified annuities are subject to required minimum distributions (RMDs) beginning at age 73. These RMDs mandate the annuity holder to withdraw a minimum amount each year, which is then subject to taxation. RMDs are designed to ensure that individuals do not accumulate tax-deferred savings indefinitely. A 1035 exchange allows the annuity holder to exchange one annuity for another without triggering a taxable event, as long as the exchange meets certain requirements. This provision can be advantageous for annuity holders seeking to upgrade their annuity product or change insurance companies without incurring tax liabilities. Annuities can have estate and gift tax consequences, depending on the annuity's structure and beneficiary designations. Annuity holders should consult with financial and tax professionals to understand these implications and develop appropriate estate planning strategies. Annuity holders can employ various tax planning strategies to optimize their retirement income and minimize tax liabilities: Annuity holders can strategically time withdrawals to minimize their tax liability, such as withdrawing during lower-income years or when they expect to be in a lower tax bracket. Partial surrender of an annuity allows the annuity holder to access a portion of the funds while maintaining the tax-deferred status of the remaining balance. This strategy can provide flexibility and help minimize taxes on withdrawals. Annuity riders, such as living benefit riders or long-term care riders, can provide additional tax efficiency by allowing the annuity holder to access funds in a tax-advantaged manner under specific circumstances. Charitable gift annuities and charitable remainder trusts can provide a tax-efficient means of donating to a favorite charity while also generating income for the annuity holder. These strategies can offer tax deductions, reduce estate taxes, and provide a stream of income during the annuity holder's lifetime. Understanding the tax implications of annuities is crucial for proper financial planning and optimizing retirement income. Annuity holders must be aware of the tax consequences associated with their specific annuity products and the various strategies available to minimize tax liabilities. Consulting with a financial advisor, insurance broker, or other professionals offering tax services can help annuity holders make informed decisions regarding their annuity investments and tax strategies. These experts can provide personalized advice and guidance based on the annuity holder's unique financial situation, goals, and risk tolerance, ensuring a well-rounded approach to retirement planning. By understanding the taxation of annuities and employing effective tax planning strategies, annuity holders can make the most of their investments, maximize their retirement income, and enjoy a more financially secure future.Overview of Annuities

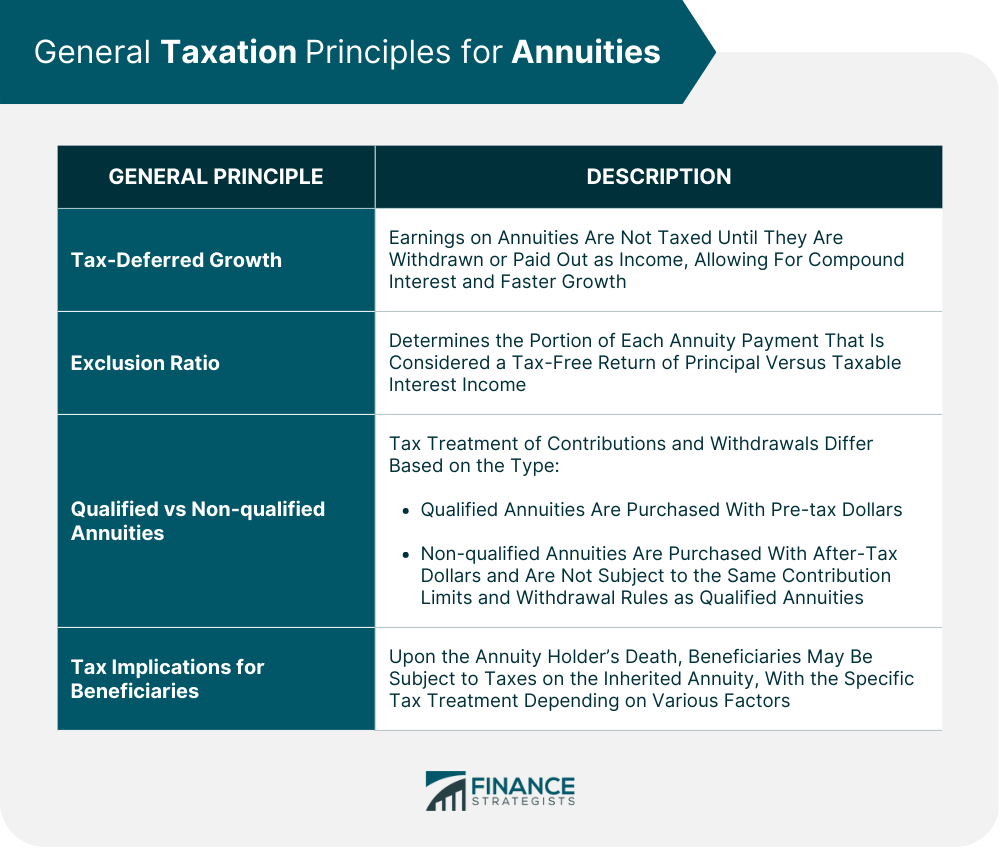

General Taxation Principles for Annuities

Tax-Deferred Growth

Exclusion Ratio

Qualified vs Non-qualified Annuities

Tax Implications for Beneficiaries

Taxation of Immediate Annuities

Annuity Payouts and Taxation

Partial Return of Principal

Interest Earnings

Taxation of Lump-Sum Distributions

Taxation of Periodic Payments

Taxation of Deferred Annuities

Tax-Deferred Growth

Withdrawals and Taxation

Early Withdrawal Penalties

Taxation of Earnings

Annuity Surrender and Taxation

Annuitization and Taxation

Taxation of Specific Annuity Products

Fixed Annuities

Taxation of Interest Earnings

Taxation of Principal

Variable Annuities

Taxation of Investment Gains

Taxation of Principal

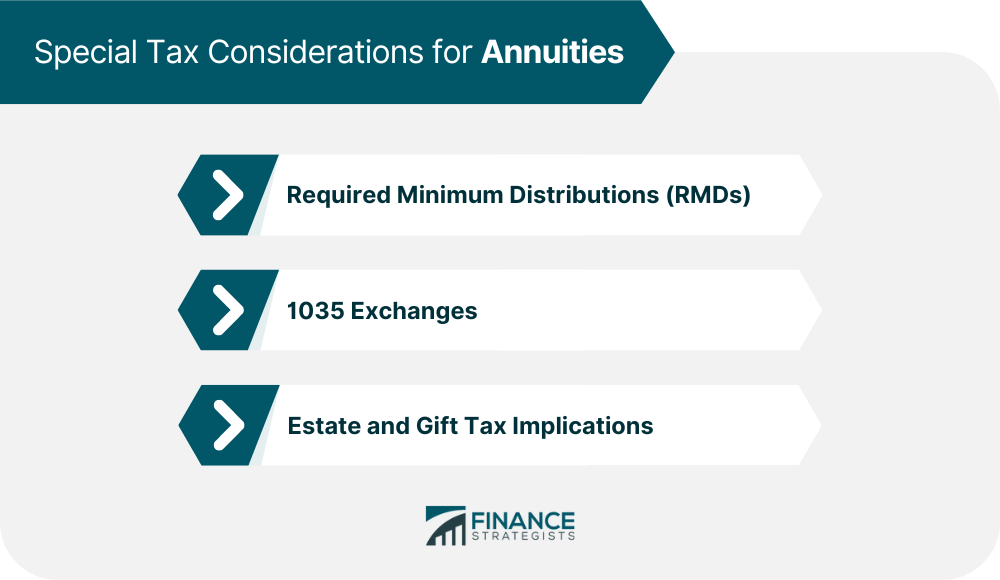

Special Tax Considerations for Annuities

Required Minimum Distributions (RMDs)

1035 Exchanges

Estate and Gift Tax Implications

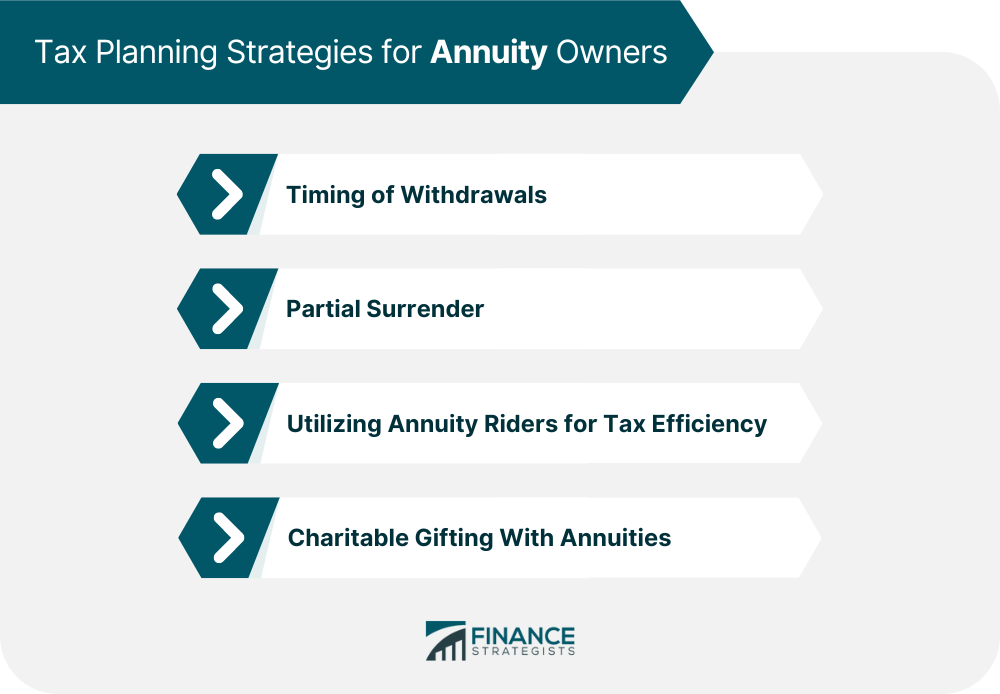

Tax Planning Strategies for Annuity Owners

Timing of Withdrawals

Partial Surrender

Utilizing Annuity Riders for Tax Efficiency

Charitable Gifting With Annuities

Final Thoughts

Taxation of Annuities FAQs

Yes, earnings on annuities are generally taxed as ordinary income when withdrawn or received as income.

The tax treatment of annuities upon withdrawal depends on whether they are qualified or non-qualified. Qualified annuities are taxed as ordinary income upon withdrawal, while non-qualified annuities are subject to a complex set of rules that determine the tax treatment of the withdrawal.

Yes, withdrawals from an annuity before age 59 ½ may be subject to a 10% penalty in addition to ordinary income taxes.

Yes, donating an annuity to a charity can provide significant tax benefits, including a charitable deduction for the value of the annuity and the avoidance of capital gains taxes.

The age of the annuity holder can affect the tax treatment of annuity withdrawals, particularly with regard to required minimum distributions (RMDs). Annuitants over age 73 are generally required to take RMDs from qualified annuities, which are taxed as ordinary income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.