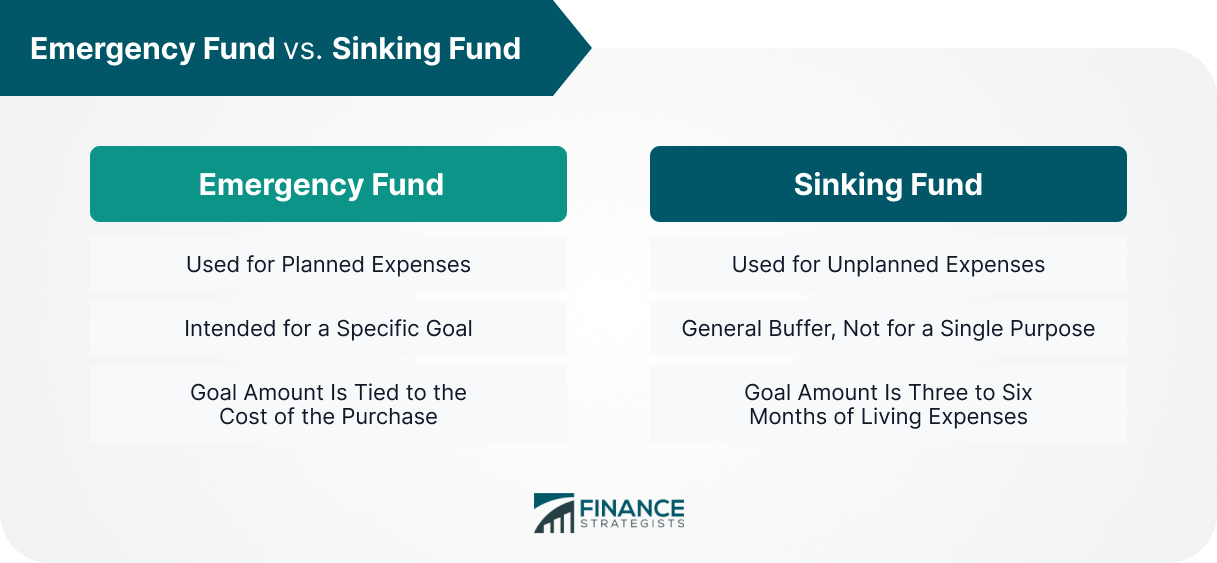

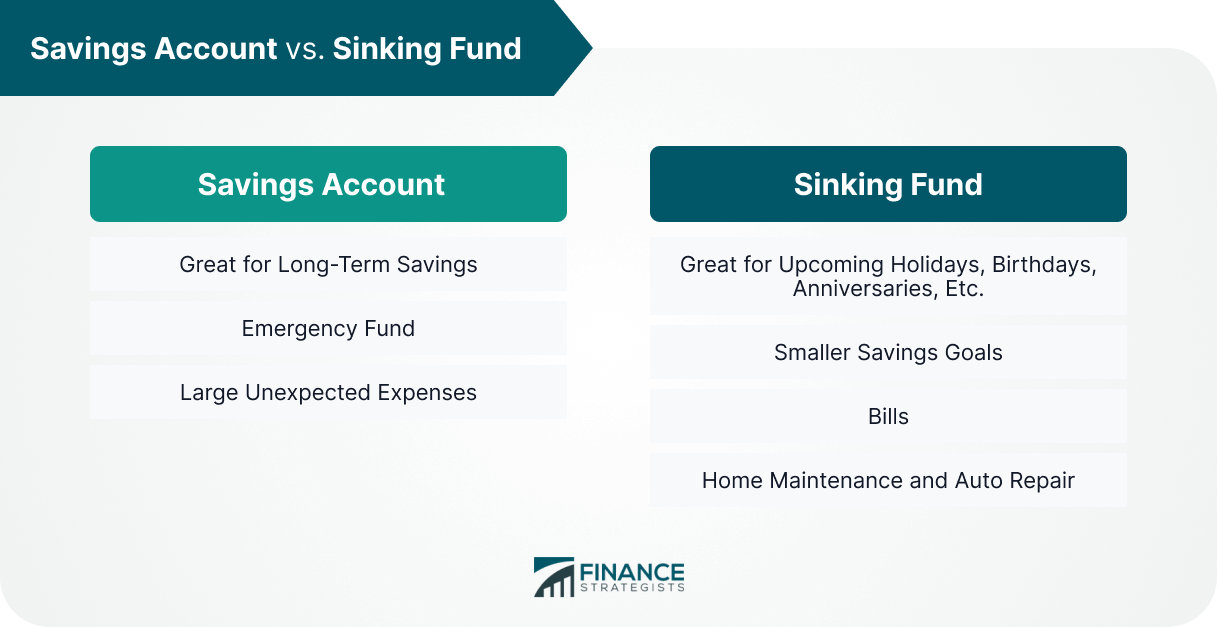

In finance, a sinking fund is a fund set aside from current income for the repayment of debt. The term "sinking fund" can also be used to refer to a method of repaying a debt by setting aside money each year to amortize it more quickly. A sinking fund is almost always associated with bonds and bond funds, though it can also be used for mortgages. If you are not familiar with the concept of a sinking fund, you may still have heard the term before since they are often required by lenders on certain types of debt. Sinking funds are usually set up to repay long-term debts or bonds. These loans have an interest rate that is determined by a specific number of years. Have questions about Sinking Funds? Click here. A sinking fund is set up by defining a certain amount of money that will be put toward the loan each month or year. What happens with this money is that each time it gets paid, the interest on your debt decreases slightly. You, then are able to pay off your debt faster, which reduces the total interest you pay on the loan. The way sinking funds are often described can actually cause confusion because there is also something known as an "emergency fund." What an emergency fund does is simply help you cover unexpected expenses, such as car repairs or medical bills. A sinking fund actually helps you do is repay debt. The confusion between the words "sinking" and "emergency" can also lead to people using their emergency funds in place of a sinking fund. Sinking funds and savings accounts are both very closely related, so if you have a sinking fund, it's possible that you also have a savings account. Both a sinking fund and a savings account work in almost exactly the same way: each month or year, a set amount of money is taken out and put toward the loan. The difference between them is, however, is that your sinking fund will be immediately applied to your debt, while your savings account will not. For a sinking fund, you get the ability to pay back debt faster, but not necessarily incur less interest. A savings account has the ability to earn interest on that money while it sits there until you are ready to use it for something else. Having a sinking fund is very important if you have a loan that has an interest rate that changes as you pay it off. This helps you decrease the total amount of interest that you end up paying on the loan. What happens with most loans, including mortgages and car payments, is that they give you a certain interest rate for a set number of years before the rates change after that. Having a sinking fund will help you to pay off your loan more quickly so that when the interest changes, you won't have as much left to repay. In return, it saves you money because if your rates have increased, you will not have as much total interest to pay on the principal. The advantage of having a sinking fund is that you will be able to pay off your loan faster. You won't have to spend as much time or money paying back the loan in the long run. Another benefit is what all saving accounts offer: earning interest on your money while it sits there without being used for anything else. What you can do with this money is use it for something else when you're ready, such as a car down payment, home purchase, or college tuition. The disadvantage of not having a sinking fund is that you will have to pay back the loan over a much longer period. You would have to be spending more time under debt and paying more interest in the long run. What happens with most loans if they have an adjustable interest rate is that they give you a certain low-interest rate for anywhere from one to five years. What happens after is that the interest rates then change, usually increasing. The best practice when it comes to maintaining your sinking fund is to use a separate savings account and only put money into that for the purpose of paying off debt. Another best practice is you create a strict payment plan so that you can pay off as much as possible each month. This will definitely help you keep your sinking fund on the right track so that you are able to pay off debt faster and save yourself more money. Having a sinking fund is a great idea because it helps you pay off your debt faster. What you have to do is create a plan that includes how much money you will put into the sinking fund and then what the total payoff date on your loan will be when everything is done. This will give you a sense of control and help you to know that you're doing everything in your power to stay on track with paying off the loan. If you do this, it will allow the sinking fund to work for itself by helping you pay off debt faster so that when interest rates change, hopefully for the better, your repayment time is also lessened. How Does a Sinking Fund Work?

Emergency Fund vs Sinking Fund

Savings Account vs Sinking Fund

Why Do You Need a Sinking Fund?

The Advantages of Having a Sinking Fund

The Disadvantages of Not a Sinking Fund

The Best Practices When it Comes to Maintaining Your Sinking Fund

Final Thoughts

Sinking Fund FAQs

A sinking fund is essentially a savings account that you use specifically to pay off loans or other forms of debt.

Basically, you set up the sinking fund with your bank or financial institution and make regular contributions to it. What this will do is help you save money over time so that when the time comes to pay off your loan, you have already paid some of it off.

An emergency fund is a money that you put aside to use in case of emergencies, such as job layoffs or medical bills. What it's used for specifically can vary from person to person. Emergency funds help you out during times of crisis so that you don't have to keep borrowing money to cover the costs that come with your emergency.

A savings account is an individual bank account you can set up at any particular financial institution. What you use the account for is solely up to you. Savings accounts give you a place where you can save money over time and earn interest while doing so.

You need a sinking fund if you have debt, whether it's a car loan or a college loan or even a mortgage. A sinking fund will help you pay off your debt faster so that you can save money and generally be more financially responsible with your life.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.