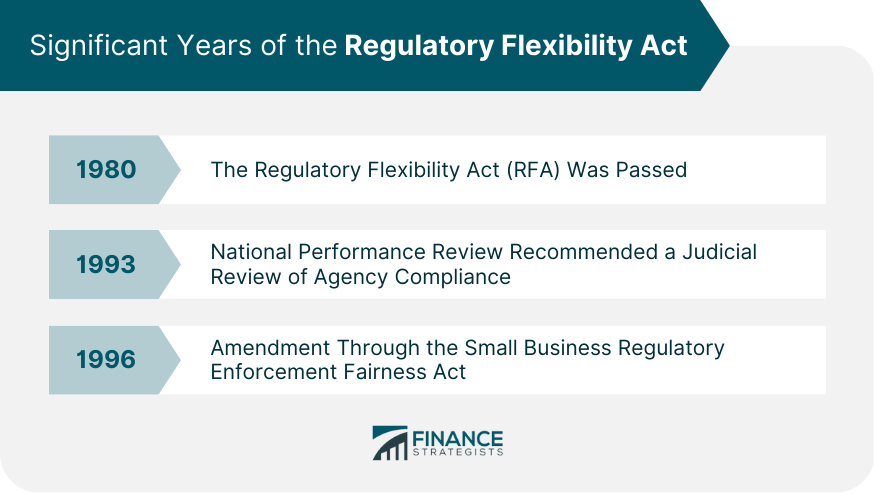

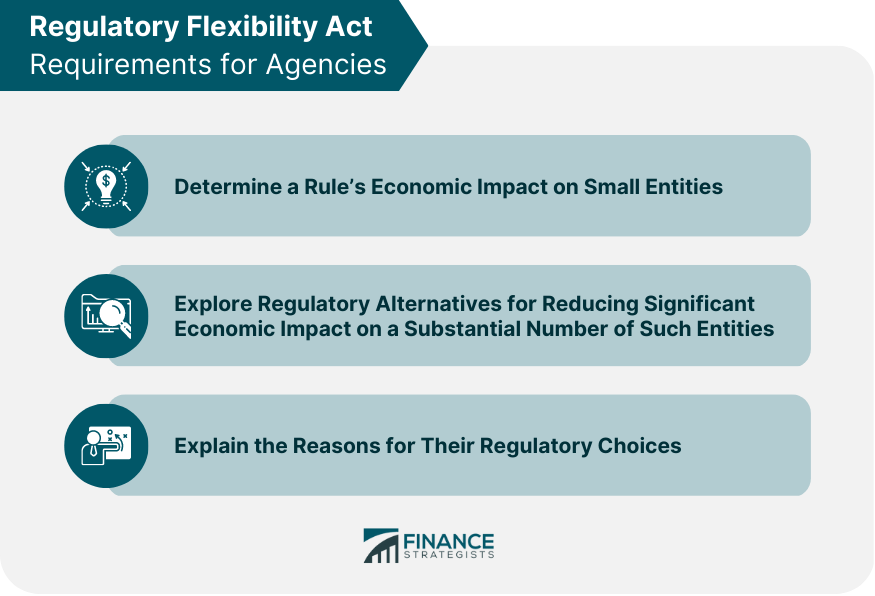

The Regulatory Flexibility Act is a federal law passed in 1980 to ensure federal agencies consider the effects of their regulations on small businesses and other entities. If a rule is expected to have a significant economic impact, the RFA requires agencies to consider all possible regulatory impacts and alternatives that will reduce this impact. The 1996 amendment to the RFA - the Small Business Regulatory Enforcement Fairness Act - included provisions for judicial review, small business advocacy review panels, and agency production of compliance guides. The Regulatory Flexibility Act was passed in 1980 to address the disproportionate economic impact of federal regulations on small businesses. The RFA required federal agencies to analyze how their regulations would affect small businesses and consider possible alternatives to reduce their burden. Despite this, some agencies failed to comply with the RFA, prompting significant pressure from small businesses and Congress for an amended version. In 1993, the Clinton administration's National Performance Review task force recommended a judicial review of agency compliance with the RFA. This ultimately led to its amendment in 1996 through the Small Business Regulatory Enforcement Fairness Act. This newly amended RFA included provisions such as judicial review, small business advocacy review panels, and agency production of compliance guides to ensure greater protection for smaller organizations. According to the Regulatory Flexibility Act of 1980, federal agencies must consider small entities' special needs and concerns when engaged in rulemaking. This includes preparing and publishing a regulatory flexibility analysis in the Federal Register that describes potential impacts on small businesses, organizations, and governmental jurisdictions unless the agency head certifies that the proposed rule will not have a significant economic impact. In 1996, the RFA was amended to include IRS interpretive rules containing small entity information collection requirements. This provides greater protection for smaller organizations by allowing them an opportunity to give input into agency decisions. Prior to publication, these agencies must provide notice and transmit copies of their initial RFA to the Chief Counsel for Advocacy at the Small Business Administration (SBA). Additionally, they are encouraged to provide actual notice of proceedings to affected small entities, hold public hearings on proposed rules as they affect small entities, and identify individuals to represent small entities to collect comments and suggestions. The Environmental Protection Agency (EPA), Occupational Health and Safety Administration (OSHA), or Bureau of Consumer Financial Protection (BCFP) must also convene a regulatory review panel consisting of employees from that agency, the Office of Management and Budget (OMB), and the Chief Counsel. The report from this panel becomes part of the rulemaking record that can be used to amend proposed rules or RFAs. Finally, each agency must publish its final rule with a final RFA summarizing significant issues raised by comments received. The Regulatory Flexibility Act encourages agencies to make their regulations less burdensome for small entities by tiering them. It requires an initial RFA to identify any “significant alternatives” that could achieve the same goals while minimizing impacts on small entities, such as modifying compliance or reporting timetables, simplifying requirements, using performance standards instead of design standards, or exempting small entities from certain requirements. The final RFA must explain why any alternatives were not adopted and the steps taken by the agency to minimize the effects of the regulation on small entities. The RFA also mandates semiannual regulatory agendas to be published, which identify current and upcoming rulemaking proposals that are likely to have a significant economic impact on many small entities. In addition, it directs agencies to apply regulatory flexibility analysis to their existing rules initially over ten years and review them periodically. Executive Order 13272, Proper Consideration of Small Entities in Agency Rulemaking, was signed by President Bush in 2002. This Order restates the requirements of the Regulatory Flexibility Act. It also gives prominence to the role of the Chief Counsel for the Advocacy of the SBA. It requires an agency to provide a draft of any rule that may have a significant economic impact on small entities to OIRA or the Chief Counsel at a reasonable time before publication. The Chief Counsel can advise on proposed rules and litigate as an amicus curiae when necessary. The Small Business Regulatory Enforcement Fairness Act of 1996 contained provisions for simplifying small entities' regulatory compliance. This included requiring agencies to create compliance guides, responding to inquiries, and establishing a Small Business and Agriculture Enforcement Ombudsman and Regional Small Business Regulatory Fairness Boards. Additionally, it gave agencies the power to waive civil money penalties for certain small entities. The Regulatory Flexibility Act Periodic Review of Rules is an ongoing review process that requires federal agencies to assess any rules issued and determine whether they should be kept, modified, or removed. This review aims to ensure that the rules in place are still necessary, effective, and up-to-date. It also serves as a way for agencies to identify potentially outdated or overly burdensome regulations. The RFA aims to reduce overly burdensome regulation on small businesses while upholding key regulatory standards. The Regulatory Flexibility Act Periodic Review of Rules requires federal agencies to review any rules issued every ten years. This review aims to uphold key regulatory standards while reducing overly burdensome regulations on small businesses. An extension may be granted if a comprehensive assessment still needs to be completed by the established date. This review shall include the continued need for the rule, complaints or comments from the public, the complexity of the rule, potential overlap or conflict with other federal, state, and local regulations, and any changes in technology, economy, or other factors that might affect the area that the rule covers. This review aims to uphold proper standards while reducing overly burdensome regulations on small businesses. Every year, federal agencies must publish a list of rules that have a major economic influence on small entities. This list should include short descriptions of each rule and its legal purpose and open up the opportunity for public feedback. Small entities that are adversely affected by final agency regulations may seek judicial review within one year of the action. During this period, if the agency delays issuing a final regulatory flexibility analysis, claimants may extend their review period to either one year after publication or an additional number of days dictated by law. If the court finds a breach in compliance with relevant laws, they may order corrective action, including remanding and delaying enforcement of the rule unless deemed necessary for public interests. Under the proposed amendment to Section 611 of Title 5, small entities would be granted the ability to conduct judicial reviews of agency compliance with the Regulatory Flexibility Act. This is meant to counter current practice that allows agencies to disregard the intent and spirit of RFA. The key features of this new provision include the following: Judicial Review can only take place if it regards a final rule; Judicial Review can be requested due to the wrong certification that a rule will not have a significant economic impact on small entities or an inadequate/non-existent Final Regulatory Flexibility Analysis; Small entities must request a judicial review within 180 days of the effective date of a final rule - unless another statute stipulates a lesser period; Agencies will be granted up to 90 days to correct any deficiencies in regulatory flexibility. After that point, a court may stay in enforcement of the rule or apply for other suitable relief. The Regulatory Flexibility Act is a federal statute that requires U.S. agencies to consider the impact of their regulations on small businesses and adjust those regulations accordingly. The RFA has several important elements that are designed to protect small businesses. US agencies must account for the potential impact of their regulations on small businesses and make appropriate adjustments. There are also procedures in place to analyze, review, and allow for public comment on rules that affect small entities. In addition, the RFA ensures that any government policy or regulation changes cannot disproportionately harm small businesses. Lastly, they have an avenue to seek redress in situations where necessary.What Is the Regulatory Flexibility Act (RFA)?

History of the RFA

Requirements of the RFA

RFA Periodic Review of Rules

RFA Judicial Review

Final Thoughts

Regulatory Flexibility Act (RFA) FAQs

The Regulatory Flexibility Act (RFA), enacted in 1980, requires agencies to consider the impact of their regulations on small entities such as small businesses, organizations, and local governments. It also requires that they review existing rules to determine if they need to be modified or replaced to reduce the burden on them. The RFA aims to ensure that government regulations are not burdensome for small entities.

The primary purpose of the RFA is to ensure that federal regulations do not burden small business owners. The law promotes economic growth by encouraging entrepreneurs and offering regulatory relief from costly compliance requirements. Additionally, it serves as a tool for industry groups and other small business advocates to hold agencies accountable for their rules impacts on the small business sector.

The RFA requires that all federal agencies examine current regulations to determine if they are overly burdensome on small entities. If they find that regulation is causing an undue burden, they must modify or replace it with a less restrictive one. Additionally, when an agency proposes a new rule, it must consider how it would affect small entities affected by the rule and provide alternatives as needed.

The RFA has had a positive effect on small businesses. Reducing the burden of compliance has enabled small businesses to focus more resources on core operations. It has also helped them to be more competitive in the marketplace by minimizing the costs associated with meeting regulatory requirements. Additionally, it has benefited small business owners in terms of access to capital.

The RFA was initially enacted in 1980, and several amendments have been made to the law since then. These amendments have clarified how agencies should consider the impacts of their regulations on small entities and strengthened enforcement provisions. In 2016, agencies were required to publish annual compliance action reports. These amendments aim to ensure the RFA continues to be effective in protecting small businesses from excessive regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.