Remarriage financial planning is the process of developing a financial strategy for couples entering a new marriage after one or both partners have been previously married. This planning aims to help the couple navigate their financial life together, taking into consideration their unique circumstances, such as previous financial commitments, blended families, and individual financial histories. Financial planning is crucial in any relationship, but even more so in a remarriage. Couples often face unique challenges due to past experiences and existing obligations. By proactively addressing financial concerns, the couple can build a strong foundation for their future together and avoid potential conflicts. The primary objectives of remarriage financial planning are to establish open communication, develop a joint financial vision, manage finances effectively, address legal and financial considerations, and plan for blended family situations. It is essential for both partners to be transparent about their financial past, including previous debts, assets, and financial obligations. This openness will help build trust and create a strong foundation for making joint financial decisions. Discuss individual financial goals and priorities with your partner to understand each other's values and aspirations. This conversation can help the couple align their goals and work together toward a common financial vision. Both partners should create a list of their assets and liabilities to determine their individual net worth. This information will serve as a starting point for developing a joint financial strategy. Calculate each partner's net worth by subtracting liabilities from assets. Understanding the couple's combined net worth will help in setting realistic financial goals and making informed decisions. The couple should work together to establish short-term and long-term financial goals, such as paying off debt, saving for a home, or planning for retirement. These goals will guide the couple's financial planning and decision-making. Identify and prioritize the most important financial goals to focus on, considering both partners' preferences and values. This step will help ensure that the couple's financial resources are allocated effectively. Develop a joint budget that outlines the couple's income, expenses, savings, and investments. This budget will serve as a roadmap for managing the couple's finances and tracking their progress toward their financial goals. Divide household expenses equitably, considering each partner's income and financial responsibilities. This approach can help promote fairness and avoid resentment between partners. Regularly review and update the budget to ensure it remains accurate and reflects the couple's current financial situation. Adjustments may be necessary due to changes in income, expenses, or financial goals. Establish an emergency fund to cover unexpected expenses or financial hardships. This fund can help the couple maintain financial stability during challenging times. Plan for retirement by contributing to retirement accounts, such as 401(k)s or IRAs. Consider the unique circumstances of a remarriage, such as potential Social Security benefits from previous marriages, when developing a retirement strategy. If the couple has children, create a plan to save for their future education expenses. Consider using tax-advantaged accounts, such as 529 plans, to maximize savings. Review each partner's debts, including credit cards, student loans, and mortgages. Develop a joint debt repayment plan that outlines how the couple will pay off their existing debts. Prioritize high-interest debts and allocate resources efficiently to reduce the overall interest paid. Strive to minimize the accumulation of new debt by living within the couple's means and using credit responsibly. This approach will help maintain a healthy financial foundation for remarriage. A prenuptial agreement is a legal document outlining how assets and liabilities will be divided in the event of a divorce. It can help protect each partner's financial interests and clarify expectations before entering the remarriage. Include provisions for the division of assets, debts, spousal support, and inheritance rights in the prenuptial agreement. Seek legal advice to ensure the document is valid and enforceable. Update or create wills and trusts to reflect the couple's current wishes for the distribution of assets upon their death. This process will help protect the couple's financial legacy and ensure their wishes are carried out. Review and update beneficiary designations on life insurance policies, retirement accounts, and other financial instruments to ensure they align with the couple's intentions. Establishes durable powers of attorney for healthcare and finances, granting each partner the authority to make decisions on behalf of the other in case of incapacity. Evaluate the couple's life insurance needs and update policies as necessary to ensure adequate coverage for the remarriage. Review health insurance options and choose the most suitable coverage for the couple and their family. Consider obtaining disability insurance to protect against the financial impact of a disabling event. Understand the financial obligations related to child support and alimony from previous relationships. Ensure that these commitments are factored into the couple's financial planning. Plan for college expenses for children from both previous and current marriages. Understand the implications of remarriage on financial aid eligibility and adjust savings strategies accordingly. Discuss and plan for the financial responsibilities associated with blended families, such as inheritance for children from previous marriages. Consider using tools like trusts to ensure a fair distribution of assets. Select a financial advisor who has experience working with remarried couples and understands their unique financial challenges. Evaluate potential financial advisors based on their fee structures, services, and expertise to find the best fit for the couple's needs. Work with a tax advisor to understand the tax implications of remarriage and optimize the couple's tax strategy. Consult with an estate planning attorney to create or update wills, trusts, and other legal documents to protect the couple's financial interests. Remarriage financial planning is an ongoing process that requires regular attention and adjustments. Continuously monitoring and updating the couple's financial strategy will help ensure their long-term financial success. Schedule regular financial check-ins to review the couple's financial progress and make necessary adjustments to their financial plans. By addressing the unique financial challenges of remarriage, couples can build a strong financial foundation that supports their relationship and ensures a successful future together.Definition of Remarriage Financial Planning

Importance of Financial Planning in a Remarriage

Goals of Remarriage Financial Planning

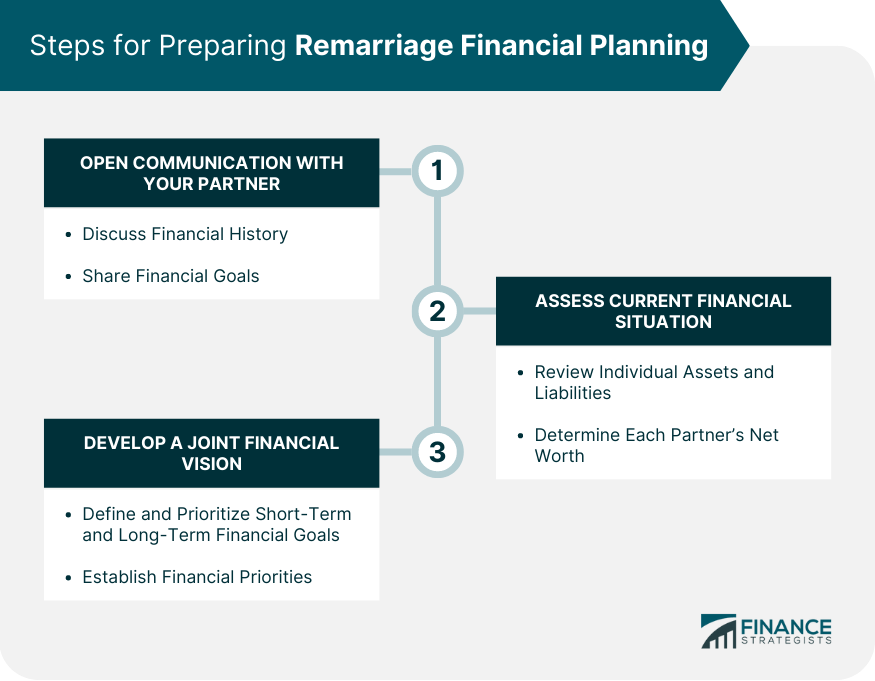

Preparing for Remarriage Financial Planning

Open Communication With Your Partner

Discuss Financial History

Share Financial Goals

Assess the Current Financial Situation

Review Individual Assets and Liabilities

Determine Net Worth

Develop a Joint Financial Vision

Define Short-Term and Long-Term Financial Goals

Establish Financial Priorities

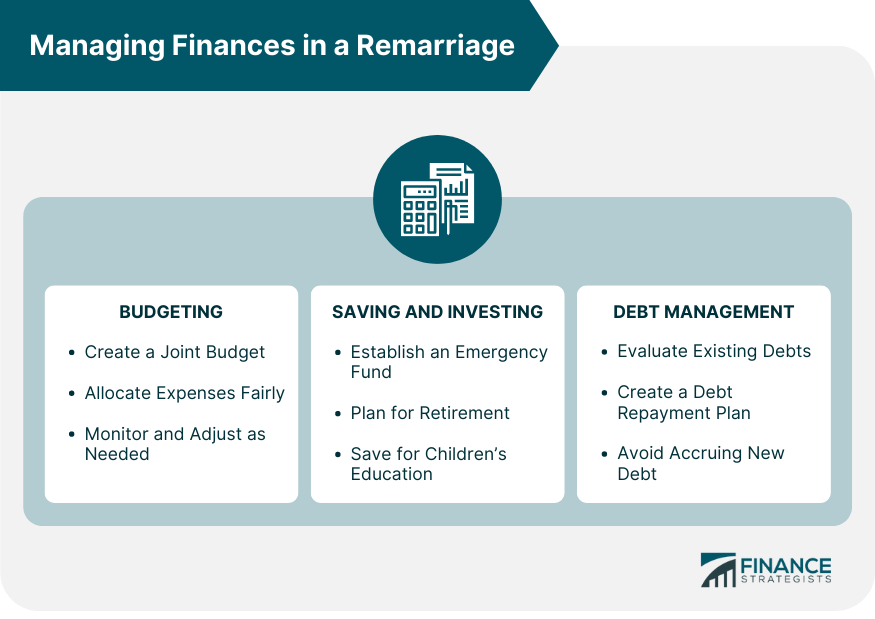

Managing Finances in a Remarriage

Budgeting

Create a Joint Budget

Allocate Expenses Fairly

Monitor and Adjust the Budget as Needed

Saving and Investing

Emergency Fund

Retirement Planning

Education Savings for Children

Debt Management

Evaluate Existing Debts

Create a Debt Repayment Plan

Avoid Accruing New Debt

Legal and Financial Considerations

Prenuptial Agreements

Purpose and Benefits

Key Elements to Include

Estate Planning

Wills and Trusts

Beneficiary Designations

Power of Attorney

Insurance

Life Insurance

Health Insurance

Disability Insurance

Financial Planning for Blended Families

Child Support and Alimony Considerations

College Savings and Financial Aid

Inheritance and Financial Responsibilities

Working With Financial Professionals

Hiring a Financial Advisor

Finding the Right Fit

Fee Structures and Services

Collaborating With Other Professionals

Tax Advisors

Estate Planning Attorneys

Conclusion

Remarriage Financial Planning FAQs

Remarriage financial planning is the process of creating a financial strategy for couples entering a new marriage after one or both partners have been previously married. It is important because it helps couples navigate their unique financial situations, such as blended families and past financial commitments, ensuring a strong foundation for their future together.

Remarriage financial planning differs from regular financial planning in that it addresses the unique challenges and considerations that come with blending finances in a remarriage. These may include managing child support and alimony obligations, estate planning for blended families, and navigating the legal and financial implications of joining assets and liabilities from previous marriages.

The key steps in the remarriage financial planning process include open communication with your partner, assessing your current financial situation, developing a joint financial vision, managing finances through budgeting, saving, and debt management, addressing legal and financial considerations like prenuptial agreements and estate planning, planning for blended families, and working with financial professionals.

Remarriage financial planning can help protect your assets in a blended family situation by addressing estate planning needs, such as updating wills and trusts, and ensuring fair distribution of assets to children from previous marriages. Additionally, creating a prenuptial agreement can clarify expectations and protect each partner's financial interests in the event of a divorce.

While it is possible to conduct remarriage financial planning on your own, working with a financial advisor experienced in remarriage situations can be beneficial. An advisor can provide expert guidance, help navigate complex financial issues, and ensure that your financial plan is tailored to your unique circumstances. Additionally, collaborating with other professionals like tax advisors and estate planning attorneys can further support your remarriage financial planning process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.