Financial planning for academics and educators is the process of creating a comprehensive financial strategy that meets their unique needs and goals. It involves managing their income, expenses, investments, and taxes in a way that maximizes their financial success and stability. Financial planning for academics and educators may involve creating a budget that takes into account their income, which may include a combination of salary, research grants, and stipends. They may also need to plan for future income changes, such as a promotion or a change in employment. Academics and educators may face unique financial challenges due to the nature of their careers, such as fluctuating income, limited retirement options, and varying insurance needs. Financial planning can help them address these challenges and achieve financial stability and security. Identifying financial objectives is a crucial first step in the financial planning process. Academics and educators should consider their short-term and long-term goals, such as paying off student loans, saving for a home, or funding a sabbatical. Setting realistic and achievable objectives can help provide a clear direction and focus for financial planning efforts, ensuring resources are allocated effectively and efficiently. Understanding the financial resources available is essential for creating a viable financial plan. This includes assessing income sources, such as salary, consulting fees, and royalties, as well as savings, investments, and other assets. Accurate assessment of financial resources allows academics and educators to better understand their financial position and develop strategies to achieve their goals. Analyzing financial needs involves estimating the costs associated with various financial goals and evaluating the resources needed to achieve them. This may include calculating the amount needed for retirement, education expenses, or debt repayment. Understanding financial needs can help academics and educators prioritize their goals and create a targeted plan to meet their objectives. Developing a comprehensive budget requires defining all sources of income and expenses. This involves tracking monthly income from various sources and categorizing expenses into essential and discretionary spending. A well-defined budget can help academics and educators better understand their financial situation and identify areas for improvement or adjustment. Fixed expenses are those that remain constant each month, such as rent or mortgage payments, while variable expenses may fluctuate, such as utility bills or discretionary spending. Differentiating between fixed and variable expenses can help identify areas where spending can be reduced or controlled. By focusing on reducing variable expenses, academics and educators can free up additional resources to allocate towards their financial goals. A spending plan involves allocating income towards various expenses and financial goals. This may include setting aside funds for savings, investments, and debt repayment, as well as covering essential living expenses. A well-structured spending plan can help academics and educators maintain financial stability, avoid overspending, and make progress towards their financial objectives. Debt can come in various forms, such as student loans, credit card debt, or personal loans. Understanding the different types of debt and their associated interest rates and repayment terms is essential for creating a debt management strategy. By prioritizing high-interest debt and focusing on paying it off first, academics and educators can save money on interest and reduce their overall debt burden more quickly. A debt repayment plan involves outlining a strategy for paying off debt over time. This may include determining monthly payment amounts, setting repayment deadlines, and identifying opportunities to accelerate debt repayment. A well-designed debt repayment plan can help academics and educators stay on track, reduce interest costs, and achieve a debt-free future. Reducing interest rates and fees can significantly impact the overall cost of debt and the time it takes to pay it off. Academics and educators can explore options such as refinancing loans, consolidating debt, or negotiating with creditors to secure lower interest rates or waive fees. Taking proactive steps to reduce interest rates and fees can help academics and educators save money and achieve their debt repayment goals more quickly. Academics and educators should familiarize themselves with various investment options, such as stocks, bonds, mutual funds, and real estate. Understanding the risks and potential returns associated with each option can help them make informed investment decisions. By diversifying their investment portfolio, academics and educators can minimize risk and maximize potential returns over time. Setting clear investment goals can help academics and educators determine the appropriate investment strategies and asset allocations. Goals may include saving for a down payment on a home, funding a sabbatical, or building a retirement nest egg. Aligning investment strategies with specific goals can help ensure that resources are allocated effectively and efficiently. An investment strategy involves determining the appropriate mix of assets and investments to achieve specific financial goals. This may include considering factors such as risk tolerance, investment time horizon, and expected returns. Developing a well-defined investment strategy can help academics and educators make informed decisions and minimize the potential impact of market fluctuations on their financial goals. Retirement planning for academics and educators may involve various options, such as employer-sponsored retirement plans, individual retirement accounts (IRAs), and annuities. Understanding the features, benefits, and limitations of each option can help them make informed decisions about their retirement savings. Considering multiple retirement options can help academics and educators create a diversified and flexible retirement plan that meets their unique needs. Setting specific retirement goals can help academics and educators better understand the resources needed to achieve a comfortable and secure retirement. Goals may include determining the desired retirement age, estimating annual living expenses, and identifying potential sources of income. Having clear retirement goals can help focus planning efforts and ensure that resources are allocated effectively. A comprehensive retirement plan involves outlining a strategy for accumulating and managing retirement assets, as well as planning for potential financial challenges, such as healthcare costs and long-term care. This may include determining contribution amounts, selecting appropriate investments, and considering tax implications. Developing a well-defined retirement plan can help academics and educators prepare for a financially secure and comfortable retirement. Insurance planning involves assessing various types of insurance, such as life, disability, health, and long-term care insurance, to determine the appropriate coverage needed. Understanding the benefits and limitations of each type of insurance can help academics and educators make informed decisions about their insurance needs. Having appropriate insurance coverage can provide financial protection and peace of mind in the event of unexpected life events. Determining the appropriate amount and type of insurance coverage requires evaluating personal and financial circumstances, such as income, dependents, and financial goals. This may involve calculating the financial impact of a loss of income, illness, or death on one's financial situation. Identifying insurance needs can help academics and educators ensure they have adequate financial protection in place. An insurance plan involves selecting the appropriate types and amounts of coverage, as well as identifying potential strategies to reduce premiums and maximize benefits. This may include comparing quotes from different providers, adjusting deductibles, and considering riders or additional coverage options. Developing a comprehensive insurance plan can help academics and educators protect their financial future and provide peace of mind. Estate planning is the process of organizing and managing one's assets to ensure they are distributed according to one's wishes after death. This can include creating a will, setting up trusts, and designating beneficiaries. Estate planning is essential for academics and educators to protect their loved ones and minimize potential tax liabilities. By engaging in estate planning, academics and educators can ensure their assets are preserved and distributed as intended, providing financial security for their loved ones. Estate planning goals may include providing for dependents, minimizing tax liabilities, or ensuring the continuity of a family business. Identifying specific goals can help academics and educators develop a customized estate plan that addresses their unique needs and circumstances. Clear estate planning goals can help ensure that assets are distributed according to one's wishes and provide financial stability for loved ones. Developing an estate plan involves working with legal and financial professionals to create the necessary documents and strategies to achieve one's estate planning goals. This may include drafting a will, setting up trusts, or designating beneficiaries for retirement accounts and insurance policies. A well-designed estate plan can help academics and educators protect their assets, minimize tax liabilities, and provide financial security for their loved ones. Financial planning is a critical process that enables academics and educators to achieve their financial goals and secure their financial future. By assessing financial goals, creating a budget, managing debt, investing for the future, planning for retirement, insurance planning, and estate planning, academics and educators can better navigate their unique financial challenges. Taking action to create and implement a comprehensive financial plan can significantly impact the financial stability and security of academics and educators. By proactively addressing their financial needs and goals, they can improve their financial well-being and achieve their desired financial outcomes. There are numerous resources available to assist academics and educators in their financial planning journey, such as financial planners, estate planning attorneys, and insurance agents. Seeking professional guidance can help ensure that financial plans are tailored to individual needs and circumstances, increasing the likelihood of success in achieving financial goals.Definition of Financial Planning for Academics and Educator

Assessing Financial Goals for Academics and Educators

Determining Financial Objectives

Identifying Financial Resources

Analyzing Financial Needs

Creating a Budget for Academics and Educators

Defining Income and Expenses

Identifying Fixed and Variable Expenses

Developing a Spending Plan

Managing Debt for Academics and Educators

Different Types of Debt

Creating a Debt Repayment Plan

Reducing Interest Rates and Fees

Investing for Academics and Educators

Defining Investment Options

Identifying Investment Goals

Developing an Investment Strategy

Retirement Planning for Academics and Educators

Understanding Retirement Options

Identifying Retirement Goals

Developing a Retirement Plan

Insurance Planning for Academics and Educators

Understanding Different Types of Insurance

Identifying Insurance Needs

Developing an Insurance Plan

Estate Planning for Academics and Educators

Understanding the Importance of Estate Planning

Identifying Estate Planning Goals

Developing an Estate Plan

Conclusion

The unique nature of their careers often presents them with financial challenges such as fluctuating income, limited retirement options, and varying insurance needs.

Financial Planning for Academics and Educators FAQs

Financial planning for academics and educators is the process of creating a roadmap to achieve financial goals while working in the education sector.

Financial planning is important for academics and educators to ensure they are able to meet their financial needs and achieve their goals both during their working years and in retirement.

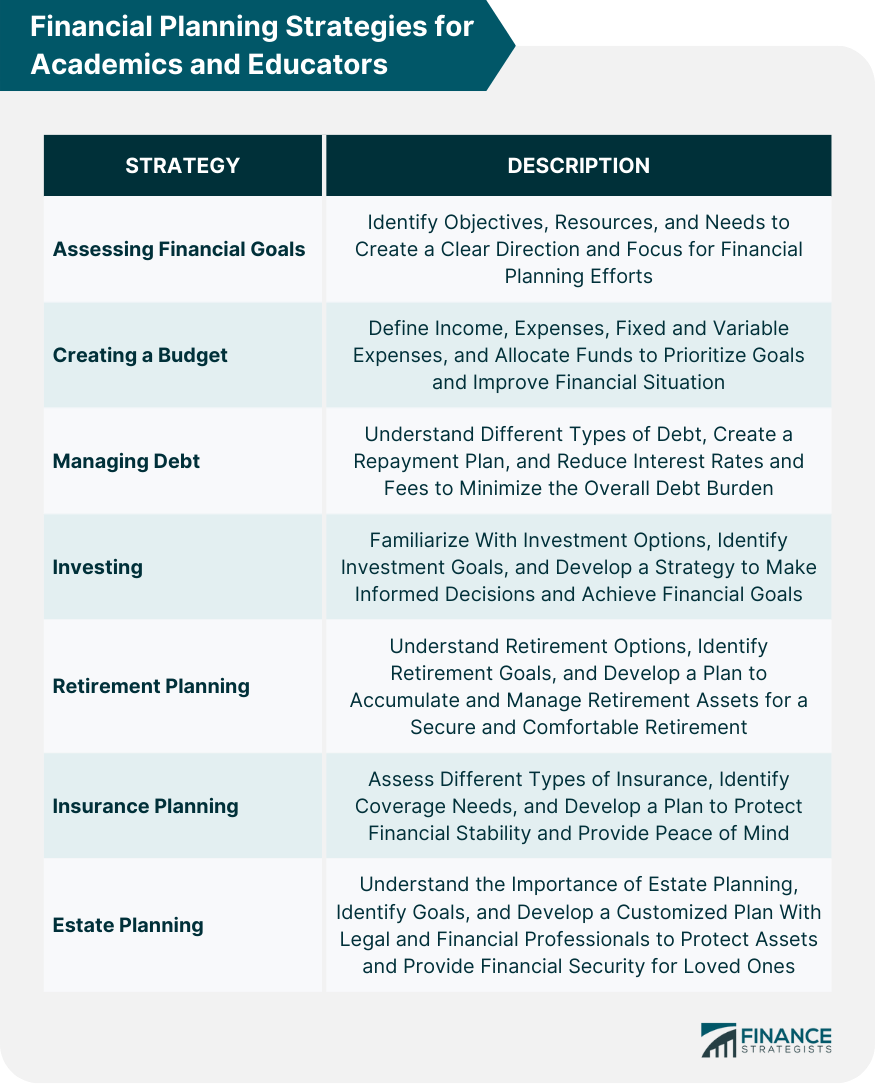

Key financial planning strategies for academics and educators include creating a budget, managing debt, investing for the future, retirement planning, insurance planning, and estate planning.

Academics and educators can get started with financial planning by assessing their financial goals, identifying financial resources, and creating a budget. It's important to consult with a financial advisor for guidance.

Yes, financial planning is beneficial for academics and educators with varying incomes. It can help individuals manage their finances more effectively and achieve their financial goals, regardless of their income level.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.