Financial advisor marketing refers to the strategies and activities that financial professionals use to promote their services, attract new clients, and maintain relationships with existing ones. This type of marketing is unique because it's centered around building trust and establishing credibility with potential and existing clients. Given the sensitive nature of financial matters, clients need to be assured of the advisor's expertise, integrity, and understanding of their individual financial goals. The methods used in financial advisor marketing can vary widely and may include online advertising, content creation (like blogs or webinars), social media engagement, email campaigns, networking events, and referral programs. The overarching goal is not just to attract clients but to create long-lasting, trust-based relationships that lead to sustained business and client satisfaction. A professional, user-friendly website serves as a digital business card, showcasing an advisor's expertise, services, and testimonials. It's the first impression many potential clients will have, so it's essential to make it count. Search engine optimization (SEO) practices, like using relevant keywords and updating content regularly, can ensure that a website ranks higher in search results, making it easier for clients to find the advisor online. A strong online presence also conveys adaptability, signaling to clients that the advisor is up-to-date with industry changes. Furthermore, it allows advisors to tap into a wider client base, from local clients to those in different regions or even countries. Platforms like LinkedIn, Twitter, and Facebook are not just for networking; they can be tools for engagement, answering client queries, and showcasing the advisor's personality. Regular interactions and sharing valuable insights can help in building trust and rapport with both current and prospective clients. The dynamic nature of social media also allows for real-time engagement, fostering immediacy in interactions. Plus, insights gained from social metrics can help advisors tailor their content more effectively. Offering valuable content, whether through blogs, videos, or infographics, can establish a financial advisor as an expert in their field. It's an opportunity to address common financial questions, provide market updates, or share investment strategies. By delivering content that resonates with their target audience, advisors can build credibility and foster client loyalty. Additionally, regularly updated content can also improve website SEO, driving more organic traffic. For financial advisors, this is a way to keep clients informed with personalized messages, newsletters, or market updates. Segmenting email lists based on client interests or needs can lead to more targeted and effective campaigns. It's essential to provide content that adds value, ensuring clients look forward to receiving and reading the emails, further strengthening the client-advisor relationship. A well-timed, informative email can also act as a gentle reminder of the advisor's value, especially in volatile market conditions. Moreover, it provides an avenue for clients to easily reach out, fostering open communication. Word-of-mouth and personal referrals are gold in the financial advisory business. By building strong relationships with current clients and other professionals, advisors can tap into a network that brings in new clients. Attending industry conferences, local business events, or hosting workshops can provide opportunities for networking. Satisfied clients are often the best promoters, so offering referral incentives can also be beneficial. Establishing relationships with other professionals, like accountants or lawyers, can lead to mutual referrals, widening the potential client base. Additionally, a robust network can also serve as a support system, offering advisors insights, collaborations, or partnership opportunities. While organic strategies are vital, paid advertising can give financial advisors an immediate reach boost. Platforms like Google Ads or Facebook Ads allow for targeted promotions, ensuring the right audience sees the advisor's services. By setting clear objectives, tracking metrics, and continuously refining campaigns based on feedback, advisors can optimize their return on investment, attracting potential clients more efficiently. The adaptability of paid advertising means that advisors can quickly change strategies in response to market shifts or emerging trends. Small businesses often require financial guidance, whether for investments, retirement plans, or business growth strategies. By positioning themselves as a resource for these businesses, financial advisors can establish local credibility and gain clients who value community ties. Engaging with the local business community can also offer insights into regional economic trends or challenges, enabling advisors to better tailor their services. Plus, as these businesses grow, they can provide a steady stream of clients, ensuring long-term growth for the advisor. Trust and credibility are foundational pillars in the world of financial advising. They represent the essence of what allows clients to confidently place their financial futures in the hands of an advisor. Trust is cultivated over time and is a byproduct of consistent reliability, honesty, and expertise. Clients need to believe not only in the competence of their financial advisor but also in their unwavering commitment to acting in the client's best interests. Credibility is established when advisors consistently demonstrate their expertise and uphold ethical standards. It's further enhanced by continuous professional development, ensuring that the advisor is abreast of the latest industry trends, regulations, and tools. Transparency plays a pivotal role; clear communication about fee structures, potential conflicts of interest, and investment strategies helps eliminate ambiguities and potential mistrust. Additionally, leveraging testimonials can also fortify credibility, providing tangible proof of the advisor's capabilities and successes. Financial advisor marketing is a unique and delicate endeavor that revolves around trust, credibility, and personalized engagement. The sensitivity of financial matters necessitates strategies that assure clients of an advisor's expertise, integrity, and alignment with their financial goals. A strong online presence acts as a digital business card, while social media engagement positions advisors as industry leaders. Content marketing establishes expertise and fosters loyalty through valuable insights, while email campaigns keep clients informed and engaged. Networking and referrals tap into valuable word-of-mouth recommendations. Paid advertising provides targeted reach, and local engagement through small businesses builds community ties. Ultimately, building trust and credibility stands as the foundation of successful financial advisor marketing, underpinned by consistent reliability, ethical standards, transparency, and ongoing professional development.Understanding Financial Advisor Marketing

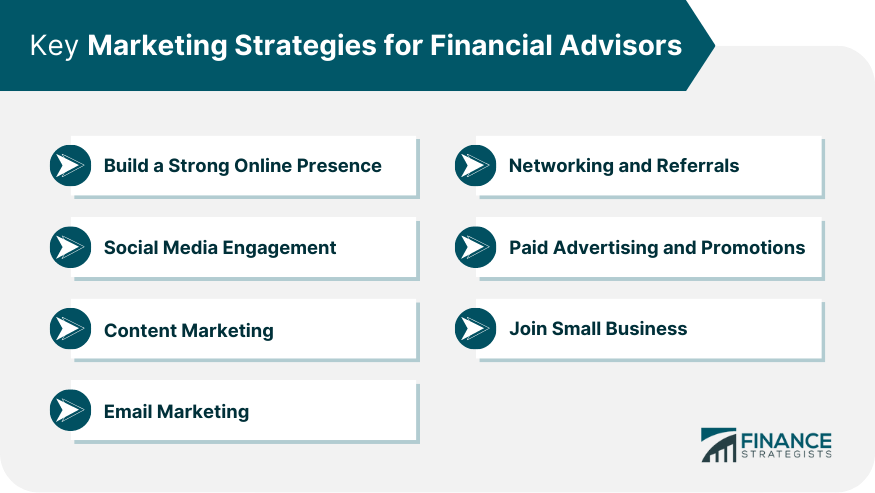

Key Marketing Strategies for Financial Advisors

Build a Strong Online Presence

Social Media Engagement

Content Marketing

Email Marketing

Networking and Referrals

Paid Advertising and Promotions

Join Small Business

Building Trust and Credibility

Conclusion

Financial Advisor Marketing Strategies FAQs

Financial advisor marketing strategies are plans and actions used by financial professionals to promote their services, attract new clients, and maintain relationships with existing ones.

Building a strong online presence is crucial in financial advisor marketing strategies. A professional website and effective use of search engine optimization (SEO) enhance visibility, credibility, and adaptability.

Social media engagement is key in financial advisor marketing strategies. Sharing informative content, industry news, and success stories on platforms like LinkedIn, Twitter, and Facebook establishes expertise, encourages interactions, and fosters trust.

Content marketing is integral to financial advisor marketing strategies. Delivering valuable content through blogs, videos, and infographics establishes expertise, builds credibility, and fosters client loyalty while improving website SEO.

Networking and referrals are essential components of financial advisor marketing strategies. Building strong relationships with clients and professionals, attending events, and offering referral incentives tap into word-of-mouth recommendations, expanding the client base and fostering growth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.