Return on Investment (ROI) is a core financial performance measure used to evaluate the efficiency of an investment and to compare the efficiency to other investments. Most financial and business concepts build upon ROI because its purpose is to tell investors how much money they stand to make in the future if they make an investment right now. By comparing the profit or loss from an investment to its initial cost, ROI provides a clear picture of the investment's relative success or failure. In essence, it measures the gain or loss made on an investment relative to the amount of money invested. ROI's are very useful for short term investments, but can be misleading for long term investments because they do not factor in the time value of money. Time value of money is based on the principle that a dollar today is worth more than a dollar paid at a later date. The ROI is still a useful metric because it is both versatile and simple, allowing investors to estimate the profitability of their investments. ROI is applicable across a variety of investments such as real estate investments, stock market investments, or investments in updating factory tools and machinery. By offering a quantifiable measure of an investment's success, it helps investors discern which ventures are likely to yield the highest returns, ensuring that their funds are allocated efficiently. For businesses, ROI isn't just a tool for assessing external investments; it's also crucial for internal performance measurement. Departments, projects, or campaigns can be evaluated based on the ROI they generate, ensuring accountability and efficient utilization of resources. In corporate settings, where resources are finite, ROI plays a pivotal role in determining how these resources are allocated. Projects with a higher expected ROI are naturally prioritized, ensuring that the company's capital and efforts are channeled in the most lucrative directions. ROI is expressed as a percentage or ratio and is calculated as follows: In addition, the appreciation of a stock and depreciation of material assets are taken into consideration when calculating ROI. An ROI value can be positive or negative, representing a gain or loss on the investment, respectively. A higher ROI indicates that the investment gains compare favorably to its cost, signifying a successful venture. Conversely, a negative or low ROI suggests that the returns do not justify the costs. Essentially, ROI acts as a lens, providing clarity on whether an investment is yielding a favorable return. Simple ROI, often just referred to as ROI, provides a direct comparison of the returns from an investment to its initial costs. It serves as the foundational ROI metric and is versatile in its application, offering a clear, undiluted perspective on the efficiency of an investment. This basic form can be applied to a multitude of investment scenarios, from purchasing stocks in the financial market to investing in a new business venture or even evaluating the returns from a marketing campaign. Simple ROI offers stakeholders a direct snapshot, allowing them to quickly gauge if an investment has been, or is likely to be, fruitful. Return on Equity, or ROE, is a nuanced measure that dives into a company's internal financial performance. It assesses how well a company is generating profit from its equity, effectively showcasing management's ability to use shareholders' funds profitably. When investors want to gauge the internal efficiency of a company, especially in comparison to competitors in the same industry, ROE becomes a pivotal metric. A higher ROE usually indicates that a company is better at converting equity investments into profits, signaling effective management practices and a potentially more lucrative investment opportunity for shareholders. Return on Assets, commonly abbreviated as ROA, offers insights into a company's ability to generate profits from its total assets. It reveals the efficiency with which a company is converting its investments in assets, such as machinery, buildings, or other infrastructure, into net income. ROA becomes especially significant for businesses where large capital investments are the norm, such as manufacturing or real estate. By looking at ROA, stakeholders can deduce how well a company is managing its assets in relation to generating profits. This not only aids investors in making informed decisions but also helps company management in strategizing for better asset utilization. Broader industry and market trends play a crucial role. A booming sector might yield higher ROIs across the board, while stagnant or declining sectors might suppress returns, irrespective of individual investment merits. Factors like inflation rates, interest rates, and economic growth can sway investment returns, making some ventures more lucrative during economic booms and less so during downturns. For businesses assessing internal ROIs, operational efficiency is paramount. Efficient operations, streamlined processes, and effective management can elevate ROI by reducing costs and maximizing returns from investments. The manner in which capital is allocated within an investment or business endeavor can greatly influence ROI. Investments that judiciously use capital, balancing short-term needs with long-term growth prospects, often reap higher ROIs. This measure provides a quantitative analysis of an investment's performance, encapsulating its efficiency in a single percentage. By doing so, ROI sidesteps the potential vagueness of qualitative assessments, offering stakeholders a concrete and unambiguous benchmark. Whether assessing the success of a marketing campaign, a new product launch, or an entire business venture, a clear ROI figure makes it easier to understand the return relative to the investment made. ROI assumes a pivotal role in shaping business choices. Its lucidity empowers stakeholders, spanning executives to investors, for data-driven decisions. The viability of market expansion, judicious marketing spend, and startup investments hinges on ROI's quantification of returns against outlays. This criterion ensures decisions are not only knowledgeable but also realistic. ROI isn't just a tool for introspective analysis, it's also a powerful instrument for communication. In business settings, ROI figures can be communicated to teams, shareholders, and other stakeholders, offering a transparent view of performance. Furthermore, by setting expected ROI targets, businesses can instill a sense of accountability. Teams understand the benchmarks they need to achieve, ensuring alignment with broader organizational objectives and fostering a culture centered on results. Money today isn't worth the same as money tomorrow. For long-term investments, especially, the simple ROI metric might not capture the diminishing value of returns received far into the future. This can potentially lead to misinterpretations, especially when comparing investments over different time horizons. ROI, for all its clarity, doesn't inherently account for risk. Two investments might have the same ROI, but one might be far riskier than the other. For stakeholders, understanding the potential volatility and uncertainties associated with an investment is crucial, and ROI, on its own, might not provide a complete picture in this regard. ROI is predominantly a financial metric, focusing on tangible returns. However, not all benefits from an investment are strictly monetary. For instance, a marketing campaign might bring enhanced brand visibility or improved customer loyalty—factors that have long-term implications but might not immediately translate into tangible financial returns. Relying solely on ROI could potentially overlook such non-financial advantages. The formula for ROI hinges on two primary factors: returns and costs. One straightforward way to bolster ROI is by curtailing costs. This could involve streamlining operations, renegotiating vendor contracts, or adopting more cost-effective technologies. By reducing the denominator in the ROI equation, the resulting figure naturally sees a boost. Boosting the returns from an investment, be it through improved sales strategies, expansion into new markets, or launching complementary products, can significantly elevate the ROI figure. Essentially, by amplifying the numerator, the ROI percentage becomes more favorable. By ensuring that every dollar invested is channeled into the most productive avenues, businesses can derive maximum returns from their investments. This involves regular audits, performance reviews, and strategic realignments to ensure that resources, both monetary and human, are deployed where they can generate the most value. The net present value of a company, which is the current value of all future cash outflows, is similar to ROI but is stated as a dollar amount and includes any discounts in the investment. When the net present value of an investment is net positive, then it is most likely a profitable investment. Investors should analyze the profitability of their investments using both ROI and NPV, and should avoid investments when negative ROIs are calculated. Return on Investment (ROI) quantifies the relationship between returns and investments, offering a clear framework to assess success or failure. While advantageous, ROI may overlook the time value of money, risk factors, and non-financial benefits. However, it remains indispensable for businesses and investors. ROI aids in investment evaluation, guiding resource allocation and performance measurement. It equips stakeholders with a tangible measure to gauge profitability, aligning teams and fostering accountability. Industry trends, economic conditions, operational efficiency, and capital allocation impact ROI outcomes. Efforts to enhance ROI include cost reduction, revenue enhancement, and efficient resource allocation. Overall, ROI's simplicity and versatility make it a fundamental tool for prudent decision-making, helping to ascertain the viability and success of investments.Return on Investment (ROI) Definition

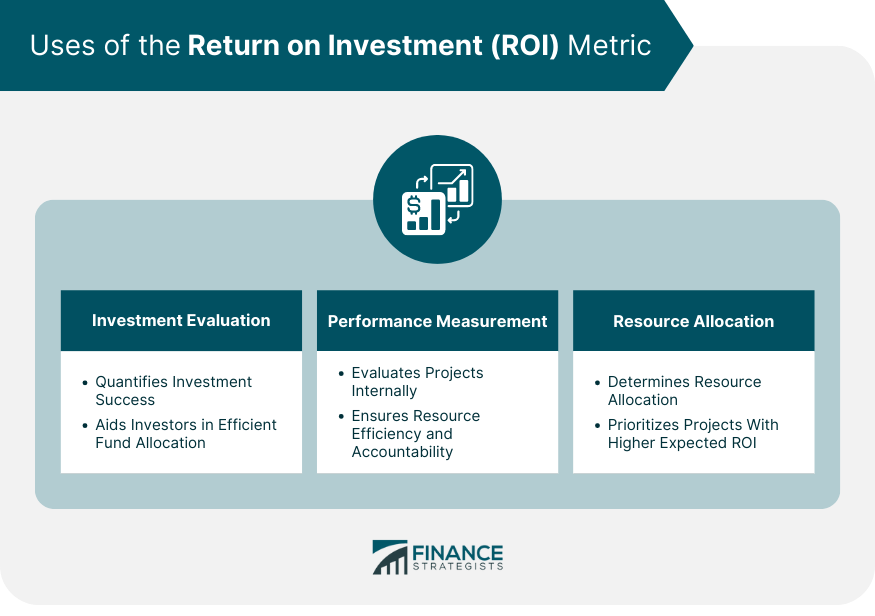

Uses of the ROI Metric

Investment Evaluation

Performance Measurement

Resource Allocation

Formula of Return on Investment (ROI)

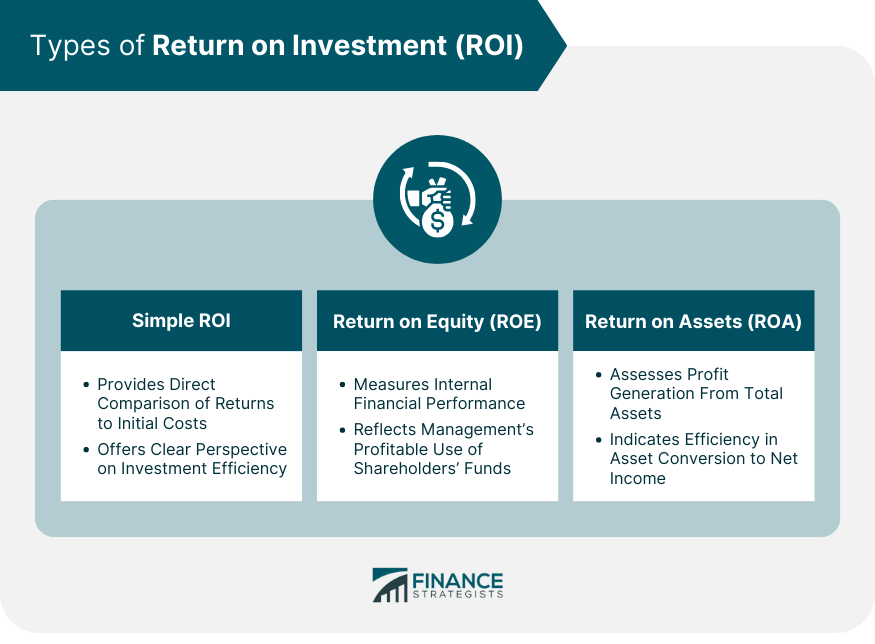

Types of ROI

Simple ROI

Return on Equity (ROE)

Return on Assets (ROA)

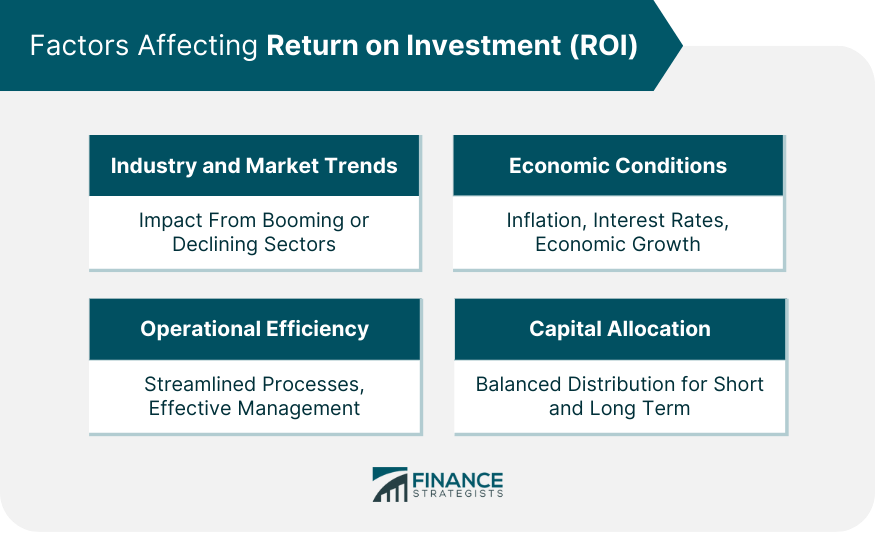

Factors Affecting ROI

Industry and Market Trends

Economic Conditions

Operational Efficiency

Capital Allocation

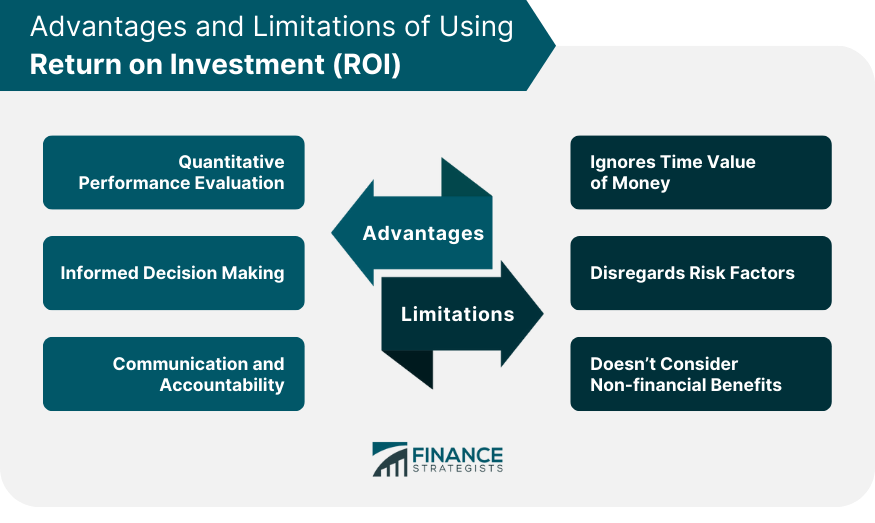

Advantages of Using Return on Investment (ROI)

Quantitative Performance Evaluation

Informed Decision Making

Communication and Accountability

Limitations of Using Return on Investment (ROI)

Ignores Time Value of Money

Disregards Risk Factors

Doesn’t Consider Non-financial Benefits

How to Improve Return on Investment (ROI)

Reduce Cost

Enhance Revenue

Allocate Resources Efficiently

Return on Investment & Net Present Value

Conclusion

Return on Investment (ROI) FAQs

ROI stands for Return on Investment.

Return on Equity is used to tell investors how much money they stand to make in the future if they make an investment right now.

ROI is calculated by subtracting the Current Value of an Investment from the Cost of an Investment and dividing that number by the Cost of the Investment. The result is expressed as a percentage.

Prudent investors will take many factors into consideration, such as earnings per share, return on invested capital, and return on total assets, before deciding to invest.

Investors should automatically avoid any company that yields a negative ROI calculation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.