Break-even time (BET) is an essential concept that allows businesses to understand the relationship between their costs and profits. It calculates how long it'll take for a company to break even after investing money in a particular project/activity, and when their expenses will be matched by their revenue. Knowing when your business will reach profitability allows you to plan ahead more effectively and make informed decisions about investments, which are key elements for ensuring long-term success. Other factors such as fixed costs, variable costs, inflation rates, market trends, seasonality, etc., must also be considered in order to calculate break-even time more precisely. There are also various methods that can provide further insight into finances, such as activity-based costing or margin analysis. Break-even time is a concept that helps business owners and managers understand the relationship between their costs and profits. It is calculated by taking the total sales revenue of a business minus the cost of the goods sold, divided by the gross profit per unit. BET represents the amount of time it takes for a business to break even and make no money or lose none, despite covering all their costs. Understanding how various factors affect break-even time allows businesses to develop successful strategies and improve financial performance over time. Here are some of the key aspects that influence break-even time: COGS includes the direct production costs associated with producing goods. This includes materials, labor costs, packing supplies, shipping fees, etc. Higher manufacturing costs can heavily impact BET, making it longer for businesses to reach profitability. To make sure they remain competitive, businesses must continuously assess their COGS and take steps to reduce them where possible. The selling price also plays an important role in determining BET, as higher prices may lead to greater profits but fewer customers could mean fewer sales volume. As such, businesses must think carefully about pricing strategy and ensure that it balances maximizing profits without deterring potential customers from buying products or services. The number of units sold has a large effect on BET since it determines how much revenue is generated from each sale and whether or not this covers all the associated expenses incurred in running the business. Therefore, businesses should constantly monitor their sales data on an ongoing basis in order to gauge how well their products are performing in different markets or against competitors. Fixed costs are expenses that remain consistent regardless of changes in activity levels. These include rent/mortgage payments, insurance premiums, etc. Variable costs are those that fluctuate depending on volumes, like materials used or wages paid to staff members working overtime. Knowing which expenses are fixed or variable allows businesses to gain insight into managing financial expectations more sustainably throughout periods when sales dip or rise substantially compared to normal levels. Overall, understanding these various factors that can affect break-even time helps businesses create effective strategies for reaching profitability faster while allowing them to make more accurate predictions about their short-term future outlooks. Knowing how to calculate break-even time can help businesses develop successful strategies by forecasting when they can expect to reach profitability and adjusting their plans accordingly. The first step in calculating break-even time is to identify all the relevant costs associated with running your business, such as fixed costs and variable costs, materials used in production, labor costs, etc. This will give you an idea of what expenses will need to be covered before reaching profitability. Once you have identified all the relevant costs, it is vital to establish a period of time over which these expenses must be paid out. This should include any seasonal variations or one-off events that could significantly impact your expenditure, such as introducing new products or services. Fixed costs are those that remain consistent no matter how much or little activity is taking place, such as insurance premiums. To calculate this amount, simply add up all fixed costs incurred over the specified period of time and subtract any upfront payments that may have been received at the start of the period. Variable costs, on the other hand, fluctuate depending on activity levels, so it is important to take this into consideration when calculating BET. These include materials used in production or wages paid to staff members working overtime, so make sure you factor in any unexpected charges here when estimating total expenditures. Once you have subtracted all relevant costs from the total sales revenue generated over the specified period of time, divide this number by gross profit per unit sold and multiply it by 100. This gives you your break-even point - the point where your business starts making no money or loses none despite covering all its expenses incurred throughout this particular period of time. By going through these steps and tracking your finances carefully on an ongoing basis, businesses can gain better insight into their financial standing, which allows them to forecast when they might hit profitability more accurately. Understanding break-even time thus allows companies to plan ahead more effectively while avoiding potential cash flow problems in future periods. Calculating the break-even time for a project can be an important step in determining whether it is worth pursuing. The break-even time is the point at which total costs are equal to total revenue, meaning that additional investments of time or capital will no longer be necessary for the project to turn a profit. There are several steps to calculating your break-even time, and the following are some examples to illustrate how it works. Before you can accurately calculate your break-even time, you need to gather all of the relevant data related to costs and revenue associated with your project. This includes any funding you've received, as well as any expenses incurred while developing the project. Once you have gathered all of the relevant information regarding your project's costs, add them together to determine the total costs associated with the project. The next step is to divide the total cost of your project by its projected monthly revenue in order to determine when you expect it should become profitable (i.e., generate more money than it costs). For example, if a project's total cost is $50,000 and its estimated monthly revenue is $5,000 then it would take 10 months for the project to reach its break-even point ($50,000 / $5,000 = 10). Finally, once you have determined when you expect your project will reach its break-even point (i.e., turn a profit) it is important that you monitor performance closely so that any course corrections necessary are taken promptly and appropriately. With these steps, you can quickly and easily calculate your break-even time for any new business venture or other investment opportunities, so that you know just how long until profits start rolling in. Break-even time is an essential concept that helps business owners and managers understand the relationship between their costs and profits. Tracking BET allows businesses to make more informed decisions about their financial performance, enabling them to develop successful strategies while improving future outlooks and ensuring they remain competitive in their respective markets. Here are some reasons why tracking break-even time should be a priority for all businesses: The most obvious benefit of tracking BET is the potential to increase profits, as it allows businesses to plan ahead by formulating strategies focused on increasing revenue or reducing costs. For example, businesses can identify ways to boost sales volume or reduce overhead expenses such as production costs before making any major investments that could lead to greater money lost than gained. Another key benefit of tracking BET is planning for business growth and expansion by assessing whether current activities generate enough revenue to cover associated expenses over the long term. This enables companies to forecast accurately whether they can finance new projects or expand into other markets, while avoiding cash flow problems down the line that could limit their ability to achieve desired goals. Aside from planning for business growth and expansion, being able to track break-even time can also help companies improve how they manage their cash flow. By understanding where exactly their money is going each period, businesses can take steps such as introducing more payment options or offering discounts in order to encourage customers who may be withholding payments, etc., improving their overall profitability over time. Calculating break-even time helps with cost savings by allowing companies to spot areas where expenditure needs reducing without compromising any necessary activities taking place within the organization. This includes renegotiating supplier contracts to lower material costs or implementing measures like employee carpools for staff members working overtime, ultimately leading to improved efficiency across different departments, which translates into greater profits. Finally, knowing when your business will reach profitability greatly enhances budget management, as you have a better idea of when funds are available for investment opportunities such as launching new products/services or expanding existing operations. This enables companies to allocate resources relatively effectively throughout different periods and make better use of tight budgets by prioritizing certain tasks over others, depending upon current activity levels, ultimately driving better performance financially long term. Overall, understanding and tracking the break-even point should be a priority for all businesses looking at maximizing profits while expanding operations sustainably without running out of cash flow in future periods. Tracking break-even time is essential for any business looking to maximize its profits and ensure sustainable growth and expansion. Knowing when your business will reach profitability allows you to plan ahead more effectively, make informed decisions about investments, allocate resources relatively well, and manage cash flow in an efficient manner. All of which are key elements for ensuring a business's long-term success.What Is Break-Even Time (BET)?

Factors That Affect Break-Even Time

Cost of Goods Sold (COGS)

Selling Price

Volume of Sales

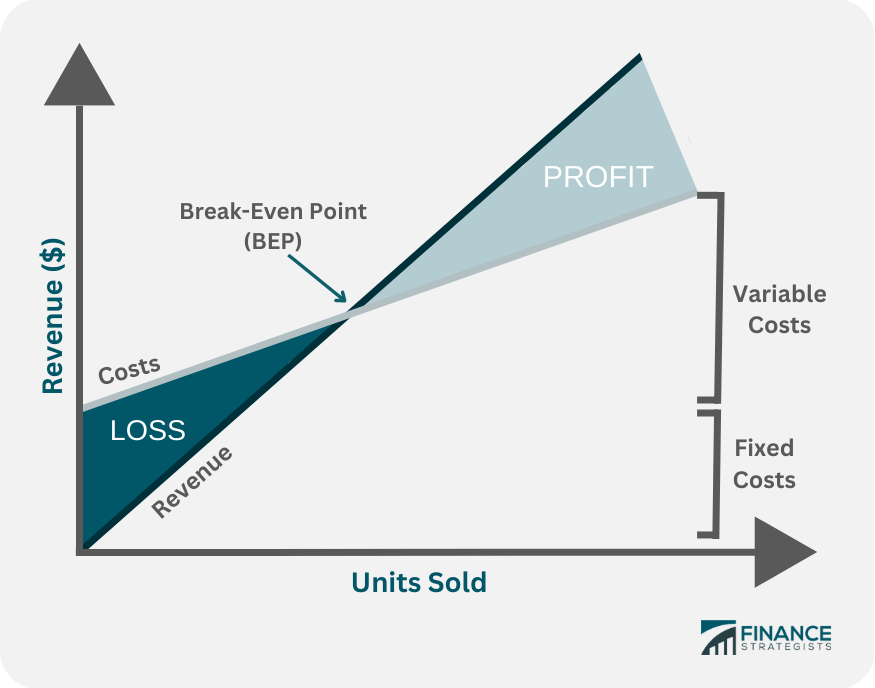

Fixed & Variable Costs

How to Calculate for Break-Even Time

Identify Relevant Costs

Establish a Time Period

Calculate Fixed Costs

Determine Variable Costs

Compute the Break-Even Time

Sample Calculation of Break-Even Time

Gather Your Data

Calculate Total Costs

Calculate Your Break-Even Time

Monitor Performance

Why Should Businesses Track Break-Even Time?

Increased Profit

Business Growth and Expansion

Improved Cash Flow

Cost Savings

Enhanced Budget Management

The Bottom Line

Break-Even Time (BET) FAQs

Break-even time (BET) is a vital concept that helps business owners and managers understand the relationship between their costs and profits. It allows businesses to identify how long it will take for them to break even after investing money in a particular project or activity.

Tracking BET enables businesses to make more informed decisions about their financial performance, allowing them to develop successful strategies while improving future outlooks and ensuring they remain competitive in their respective markets.

Some of the benefits of tracking Break-Even Time include being able to plan ahead, assess current activities and their associated expenses, improve cash flow management, and achieve cost savings by pinpointing areas where expenditure needs to be reduced without compromising necessary activities.

Knowing when your business will reach profitability greatly enhances budget management as you have a better idea of when funds are available for investment opportunities such as launching new products/services or expanding existing operations. This enables companies to allocate resources effectively throughout different periods and make better use of tight budgets by prioritizing certain tasks over others, which leads to better performance financially in the long term.

Calculating break-even time helps with cost savings by allowing companies to spot areas where expenditure needs reducing without compromising any necessary activities taking place within the organization. This includes renegotiating supplier contracts to lower material costs or implementing measures like employee carpools for staff members working overtime. This leads to improved efficiency across different departments, which translates into greater profits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.