The distribution waterfall is a financial concept used to allocate profits among partners or investors in a hierarchical manner. It's vital in investment structures such as private equity, venture capital, and real estate, determining the order of profit distribution. Despite its simple concept, its execution can be complex due to diverse interests. Typically, the distribution waterfall begins by refunding investors' initial capital, followed by a preferred return or hurdle rate. Next, the general partner receives a portion of the profits through the "catch-up" provision. Any leftover profits are then divided between the general partner and investors according to a predetermined ratio during the "carried interest" or "promote" phase. Limited Partners, or LPs, are the primary capital providers in investment funds. They usually comprise institutions like pension funds, endowments, and high-net-worth individuals. The first tier in a distribution waterfall is typically the return of capital to LPs. This means that LPs first receive distributions equal to their initial investment before profits are shared. Carried interest is the share of profits that the general partners (GPs), who manage and operate the fund, receive. This is often a significant portion of their compensation and is meant to incentivize the GPs to maximize the fund's performance. It is usually calculated as a percentage of the total profits and typically ranges from 20% to 30%. The hurdle rate, also known as the preferred return, is the minimum rate of return that the LPs expect on their investment before the GPs start receiving their carried interest. This rate is often set between 5% and 10%. It helps ensure that the investors receive a satisfactory return before the fund managers can share in the profits. A catch-up provision is a clause that allows the GPs to receive a greater share of profits after the hurdle rate has been met but before the final profit split. This clause is designed to "catch up" the GPs to a specified level of profitability. The catch-up rate is typically 80% to 100% of profits. The high water mark is a concept that protects investors from paying performance fees twice. This mechanism ensures that fund managers do not receive carried interest on the same capital more than once. If a fund experiences a loss in a particular period, the GPs must first recover the loss in subsequent periods before they can claim any carried interest. The European waterfall structure, also known as the "whole fund" model, is a more conservative approach. In this model, the GPs do not receive their carried interest until the LPs have received back their entire initial investment plus the preferred return. This structure is designed to protect the LPs and ensure they achieve their expected returns before the GPs start taking profits. The American waterfall structure, or "deal-by-deal" model, allows the GPs to receive their carried interest as soon as each individual investment is realized, rather than waiting for the entire fund to be liquidated. This structure can potentially benefit the GPs as they can receive their carried interest earlier, but it also entails more risk for the LPs as they may not have received their initial investment back when the GPs start taking profits. As the name suggests, the hybrid waterfall structure combines elements of both European and American structures. It may allow GPs to receive carried interest on a deal-by-deal basis but includes provisions to claw back some of this interest if the overall fund does not achieve a certain level of performance. This model attempts to balance the interests of both the GPs and LPs, providing earlier profits to the GPs while still offering protection to the LPs. In private equity, the distribution waterfall serves as a pivotal method for allocating profits between the limited partners (LPs) and the general partner (GP). This distribution method is crucial because it aligns the interests of both the GP, who manages the fund and the LPs, who provide the majority of the fund's capital. By determining the order in which profits are distributed, the distribution waterfall ensures that the GP is incentivized to maximize the fund's performance while also ensuring that the LPs receive a fair return on their investment. The calculation of the distribution waterfall in private equity often follows a four-tiered structure: 1. Return of Capital: The initial investment by the LPs is returned. 2. Preferred Return/Hurdle Rate: LPs receive a pre-determined rate of return on their initial investment, often in the range of 6-10%. 3. Catch-up: The GP starts to receive a share of the profits until a certain split (such as 80/20) is achieved between the GP and LPs. 4. Profit Split/Carried Interest: The remaining profits are split between the GP and LPs according to an agreed-upon percentage, usually around 20% for the GP and 80% for the LPs. In real estate investments, the distribution waterfall delineates how cash flows and profits are divided among the project's stakeholders, including the project sponsor and investors. It is a critical part of a real estate investment's financial structure as it defines the economic relationship between the parties involved. The calculation of the distribution waterfall in real estate investments often follows a similar structure to that of private equity: 1. Return of Capital: The initial equity investment is returned to the investors. 2. Preferred Return: Investors receive a preferred return, often between 5-12%. 3. Catch-up: The project sponsor receives a larger share of profits until a specific proportion is reached. 4. Profit Split: The remaining profits are divided between the project sponsor and investors, usually around 20% for the project sponsor and 80% for the investors. In venture capital, the distribution waterfall serves to distribute the proceeds from successful exits (via public offerings or sales) to the fund's investors and managers. It establishes the order in which profits are divided, ensuring that both the LPs and the venture capital firm have a clear understanding of how they will share in the fund's success. The distribution waterfall in venture capital is generally simpler than in private equity or real estate due to the typically higher risk and longer investment horizon. It usually involves only two steps: 1. Return of Capital: The LPs receive back their initial investment. 2. Profit Split: Any remaining profits are then divided between the LPs and the venture capital firm, often at around 80/20, respectively. The legal framework underpinning the distribution waterfall is complex, primarily based on contractual agreements between parties and applicable securities regulations. These agreements usually take the form of limited partnership agreements or operating agreements. They detail the rights, obligations, and responsibilities of each party, including how profits will be distributed. In addition to following the provisions set out in the partnership or operating agreement, the parties involved in a fund or investment must also comply with securities regulations. In the United States, this includes regulations set forth by the Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Compliance with these regulations is vital to maintain the legality and legitimacy of the fund. Tax laws significantly influence the structure and operation of distribution waterfalls. Different structures may have varying tax implications for both the LPs and the GP. Therefore, it's essential to understand these implications and design the distribution waterfall in a way that is tax-efficient while still meeting the needs and objectives of the parties involved. Developing a distribution waterfall model requires an in-depth understanding of financial modeling, the needs and objectives of the parties involved, and the potential risks and returns of the investment. The model must be comprehensive enough to account for various scenarios and flexible enough to adapt to changes in circumstances or objectives. Once the model is developed, it needs to be implemented effectively to ensure that the actual distribution of profits aligns with the agreed-upon model. This involves keeping accurate and up-to-date records of the investment's performance, calculating the distributions at each tier accurately, and distributing the profits in a timely manner. One of the common pitfalls in the distribution waterfall is a lack of clarity or specificity in the partnership or operating agreement. This can lead to disputes or misunderstandings over how profits should be distributed. Other pitfalls include failing to comply with applicable securities regulations, not considering the tax implications of the distribution waterfall, and not keeping accurate records of the investment's performance and distributions. Transparency is crucial in maintaining healthy investor relations. By providing clear and detailed information about the distribution waterfall, fund managers can build trust with investors and help them understand how they will share in the profits of the fund. The structure and operation of the distribution waterfall can significantly impact investor confidence. If the distribution waterfall is designed and operated in a way that aligns with the investors' interests and provides them with a fair return, it can boost investor confidence and encourage further investment. The distribution waterfall also plays a critical role in investors' decision-making. Before investing in a fund, investors will carefully examine the distribution waterfall to ensure that it aligns with their risk tolerance and return objectives. The structure of the waterfall can therefore be a decisive factor in attracting or deterring potential investors. The distribution waterfall is a critical financial concept that dictates the allocation of profits between parties in an investment. It is composed of several key components, such as the return of capital, preferred return, catch-up provision, and carried interest. The waterfall can take various forms, including European, American, and hybrid structures. In practice, the distribution waterfall plays a substantial role in private equity, real estate, and venture capital investments. It impacts investor relations, influences legal considerations, and shapes the models that guide wealth management services. As you navigate the world of investments, understanding the distribution waterfall can provide you with a better grasp of your financial journey. To fully leverage this financial strategy, it is prudent to seek the advice of experienced wealth management services that can guide you in achieving your investment goals.What Is a Distribution Waterfall?

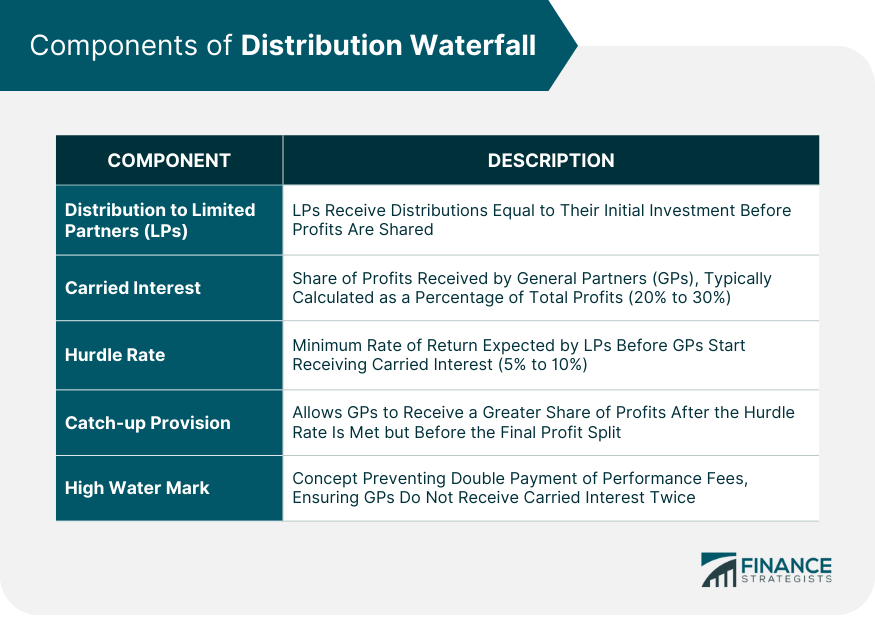

Components of Distribution Waterfall

Distribution to Limited Partners (LPs)

Carried Interest

Hurdle Rate

Catch-up Provision

High Water Mark

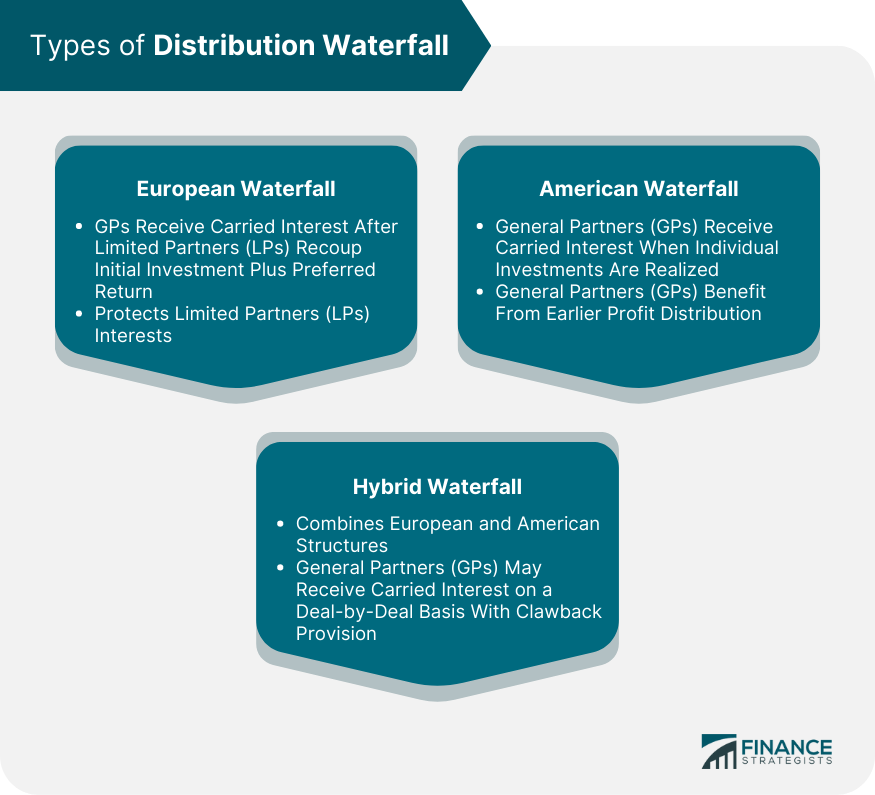

Types of Distribution Waterfall

European Waterfall Structure

American Waterfall Structure

Hybrid Waterfall Structure

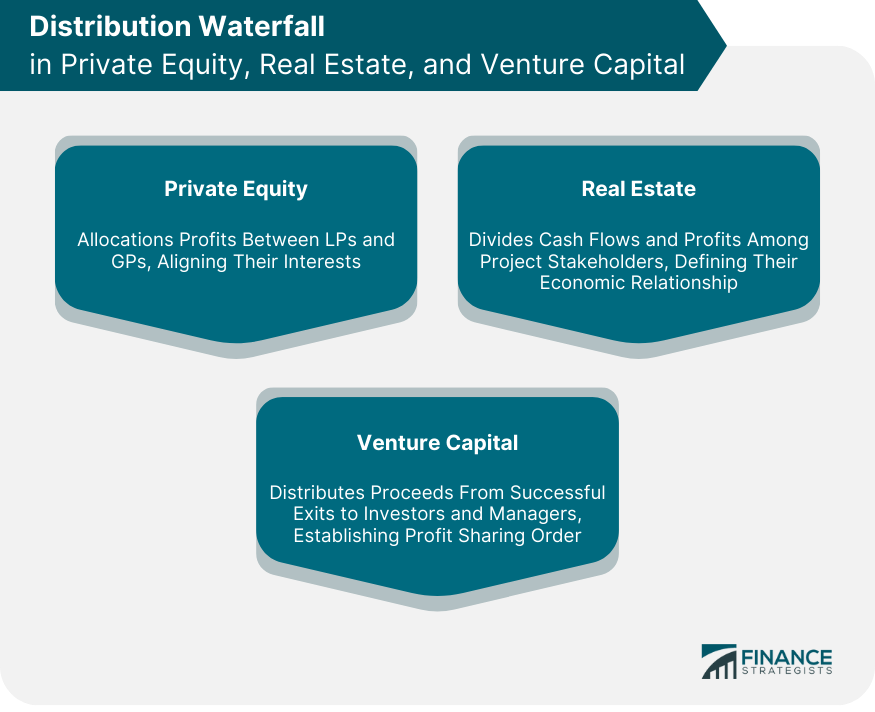

Distribution Waterfall in Private Equity

Role of Distribution Waterfall in Private Equity

Calculation of Distribution in Private Equity

Distribution Waterfall in Real Estate

Role of Distribution Waterfall in Real Estate

Calculation of Distribution in Real Estate

Distribution Waterfall in Venture Capital

Role of Distribution Waterfall in Venture Capital

Calculation of Distribution in Venture Capital

Distribution Waterfall and Legal Considerations

Understanding the Legal Framework

Regulatory Compliance

Impact of Tax Laws

Distribution Waterfall Models in Practice

Developing a Distribution Waterfall Model

Implementing the Distribution Waterfall Model

Pitfalls to Avoid

Impact of Distribution Waterfall on Investor Relations

Importance of Transparency

Impact on Investor Confidence

Role in Decision Making

Final Thoughts

Distribution Waterfall FAQs

A distribution waterfall is a method of distributing profits among investors and fund managers in an investment fund. It details the order and percentages in which profits are distributed.

The key components of a distribution waterfall usually include the return of capital, preferred return or hurdle rate, catch-up provision, and carried interest.

The three main types of distribution waterfall structures are the European, American, and hybrid structures, each with its own approach to distributing profits.

The distribution waterfall plays a crucial role in investor relations as it determines how profits are divided. A transparent and fair distribution waterfall can enhance investor confidence and foster stronger relations.

Understanding the distribution waterfall is important for investors as it provides clarity on how and when they will receive their share of the profits. It can impact investment decisions and expectations on returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.