The portability of generation-skipping transfer (GST) tax exemption is a provision that allows a surviving spouse to utilize the unused portion of their deceased spouse's generation-skipping transfer tax exemption. This means that if the deceased spouse did not use up their entire GST tax exemption, the remaining amount can be added to the surviving spouse's own exemption, potentially doubling the amount that can be transferred to future generations without being subject to GST tax. This provision helps preserve tax exemptions, simplifies estate planning, and offers flexibility in wealth transfer between spouses. It is essential for effective estate planning and is subject to eligibility criteria, such as U.S. citizenship or residency for both spouses and timely estate tax return filing. The concept of portability in GST tax exemption is governed by the Internal Revenue Code (IRC) and related Treasury regulations. The relevant provisions outline the conditions under which portability applies and the procedure for claiming it. Portability was first introduced in the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. It was later made permanent by the American Taxpayer Relief Act of 2012, ensuring that taxpayers could continue to benefit from the portability of the GST tax exemption. The portability of GST tax exemption applies only to spouses. In order to benefit from portability, the surviving spouse must be a U.S. citizen or resident, and the deceased spouse must have been a U.S. citizen or resident at the time of death. To claim portability, the executor of the deceased spouse's estate must file a timely estate tax return (Form 706) even if the estate is not otherwise required to file due to being below the filing threshold. The portability of GST tax exemption allows the surviving spouse to use the deceased spouse's unused GST tax exemption, referred to as the Deceased Spousal Unused Exclusion (DSUE) amount. This amount can be applied to the surviving spouse's own lifetime GST tax exemption or estate tax exclusion. In order to claim portability, the executor of the deceased spouse's estate must file Form 706 within nine months of the date of death, or within any extended period granted by the Internal Revenue Service (IRS). Proper documentation and recordkeeping are essential when claiming portability. Executors' responsibilities are to maintain records of the deceased spouse's assets, liabilities, and other relevant financial information. As mentioned earlier, Form 706 must be filed within nine months of the date of death. However, filing Form 4768 before the original due date may request a six-month extension. The IRS may audit the estate tax return to verify the accuracy of the information provided. Executors should be prepared to provide documentation and respond to any inquiries from the IRS. Preservation of Tax Exemptions: Portability allows the surviving spouse to use the deceased spouse's unused GST tax exemption, thereby preserving the overall tax exemptions available to the couple. Simplified Estate Planning: Portability simplifies estate planning by allowing spouses to use each other's unused GST tax exemption without the need for complex trusts or other legal structures. Flexibility in Wealth Transfer: Portability provides greater flexibility in wealth transfer planning, allowing the surviving spouse to use the deceased spouse's unused GST tax exemption for either lifetime gifts or transfers at death. Applicability Only to Spouses: Portability is limited to spouses, which means that it does not apply to unmarried couples or other family members. Limited to Federal Level: Portability of the GST tax exemption applies only at the federal level and does not affect state-level estate or inheritance taxes. Some states may have their own estate tax regimes with different exemption amounts and rules. Exclusion Amount Changes: The federal GST tax exemption is subject to change due to legislation or inflation adjustments. Portability may be affected by these changes, and taxpayers should monitor the exemption amount to ensure proper planning. Credit Shelter Trusts: Before the introduction of portability, credit shelter trusts were commonly used to preserve the estate tax exemption of the first spouse to die. Marital Trusts: Marital trusts, such as Qualified Terminable Interest Property (QTIP) trusts, were used to provide for the surviving spouse while deferring estate taxes until the surviving spouse's death. Complementary to Traditional Techniques: Portability can be used in conjunction with traditional estate planning techniques to provide additional flexibility and tax-saving opportunities. Greater Flexibility in Wealth Transfer: Portability offers greater flexibility in wealth transfer planning, allowing the surviving spouse to use the deceased spouse's unused GST tax exemption for either lifetime gifts or transfers at death. The portability of GST tax exemption is a provision that allows a surviving spouse to utilize the unused portion of their deceased spouse's generation-skipping transfer tax exemption. The legal framework for portability is governed by the Internal Revenue Code (IRC) and related Treasury regulations. To claim portability, the surviving spouse must be a U.S. citizen or resident, and the deceased spouse must have been a U.S. citizen or resident at the time of death. While there are benefits to portability, such as preserving tax exemptions, simplifying estate planning, and offering flexibility in wealth transfer, there are also limitations to consider. Portability can be used in conjunction with traditional estate planning techniques to provide additional flexibility and tax-saving opportunities. Overall, proper planning and understanding of the rules and regulations around portability are essential for effective estate planning.What Is the Portability of GST Tax Exemption?

Legal Framework for Portability of GST Tax Exemption

Relevant Legislations and Provisions

Introduction of Portability Concept in GST Tax Exemption

Eligibility Criteria for Portability of GST Tax Exemption

Marital Status Requirements

Timely Filing of Estate Tax Return

Deceased Spousal Unused Exclusion (DSUE) Amount

Process of Claiming Portability

Filing of Form 706

Documentation and Recordkeeping

Deadline for Filing and Extensions

Potential Audits and Disputes

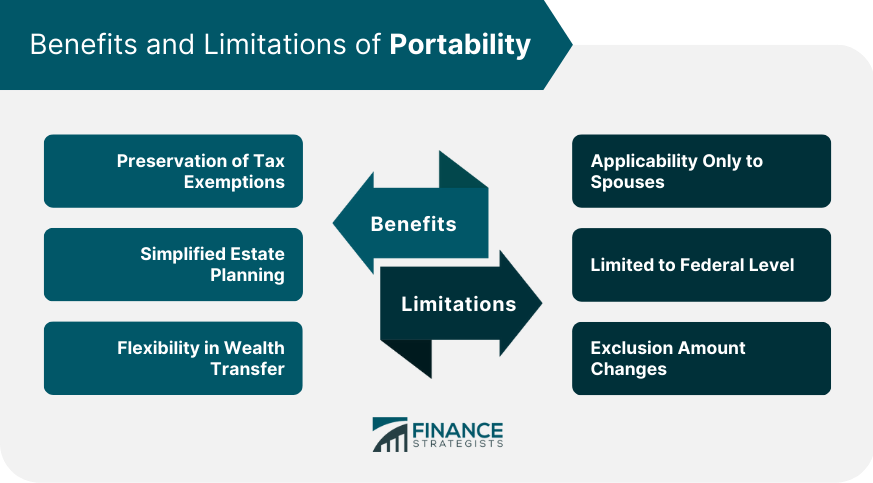

Benefits and Limitations of Portability

Benefits

Limitations

Portability and Its Impact on Estate Planning Strategies

Traditional Estate Planning Techniques

These trusts allowed the surviving spouse to benefit from the trust assets without including them in their taxable estate.Role of Portability in Estate Planning

For instance, a combination of credit shelter trusts and portability can be used to preserve both spouses' estate tax exemptions and maximize wealth transfer to beneficiaries.

This flexibility can help families adapt to changing circumstances and take advantage of tax-saving opportunities.Conclusion

When developing estate planning strategies, estate planning professionals should consider portability, and individuals are encouraged to consult with professionals for tailored tax planning advice.

Portability of GST Tax Exemption FAQs

The portability of GST tax exemption allows a surviving spouse to use the unused portion of their deceased spouse's generation-skipping transfer (GST) tax exemption. It benefits spouses by preserving tax exemptions, simplifying estate planning, and providing flexibility in wealth transfer.

Yes, there are eligibility criteria for using the portability of GST tax exemption. The surviving spouse must be a U.S. citizen or resident, and the deceased spouse must have been a U.S. citizen or resident at the time of death. Additionally, the executor of the deceased spouse's estate must file a timely estate tax return (Form 706) to claim portability.

To claim the portability of GST tax exemption, the executor of the deceased spouse's estate must file Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return within nine months of the date of death, or within any extended period granted by the Internal Revenue Service (IRS).

Yes, there are limitations to the portability of GST tax exemption. It applies only to spouses, which means that it does not apply to unmarried couples or other family members. Additionally, portability applies only at the federal level and does not affect state-level estate or inheritance taxes. Finally, the federal GST tax exemption is subject to change due to legislation or inflation adjustments, which may impact portability.

How does the portability of GST tax exemption affect traditional estate planning techniques? GST tax exemption's portability can be used with traditional estate planning techniques, such as credit shelter trusts and marital trusts, to provide additional flexibility and tax-saving opportunities. Portability offers greater flexibility in wealth transfer planning, allowing the surviving spouse to use the deceased spouse's unused GST tax exemption for either lifetime gifts or transfers at death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.