A business credit score represents your company's creditworthiness. It provides potential lenders, suppliers, and even clients with an idea of how responsibly your business handles its finances. The score is influenced by several factors like payment history, credit utilization rate, company financials, and other related elements. Some reports even include public records, like judgments or liens against the business. Prominent agencies such as Dun & Bradstreet, Equifax Business, Experian Business, and FICO Small Business Scoring Service (SBSS) provide these scores, each with its own unique methodology. Regularly monitoring and enhancing the score is crucial for businesses aiming for financial stability and growth. Various credit bureaus, with established reputations have made it a point to provide business owners with easy-to-access platforms to check their scores. However, before diving into the process, it's essential to understand the pivotal role these scores play. A leading global business services company established in 1841, renowned for its comprehensive data analytics and business credit insights. It introduced the D-U-N-S Number, a unique nine-digit identifier for businesses, setting a global standard for business identification. D&B's signature PAYDEX Score evaluates a company's payment performance, giving lenders and partners a quick view of financial reliability. Besides offering in-depth business credit reports, D&B furnishes tools for risk management, sales and marketing strategies and integrates its data into various CRM systems, positioning itself as an indispensable resource for businesses. CreditSignal: This is a free tool by D&B that provides alerts when your business credit scores change. CreditBuilder: A premium product, CreditBuilder helps businesses improve their credit scores by adding positive payment history to their D&B file. Supplier Risk Manager: This tool assists in managing supply chain risks by giving insights into a supplier's payment behavior and creditworthiness. Equifax Business is a dedicated division of Equifax Inc., one of the premier credit reporting agencies founded in 1899. This segment specializes in providing businesses with a spectrum of services beyond traditional credit reporting. It offers in-depth analyses of company financials, payment trends, risk assessments, and industry benchmarks. Leveraging a vast database, it generates detailed business credit reports, helping enterprises understand their credit standings, evaluate potential business partnerships, and navigate financial decisions. Moreover, with products like the Business Credit Risk Score and Business Failure Score, Equifax Business empowers companies to anticipate potential delinquencies or operational cessations, making it an invaluable tool in the modern business landscape. Business Credit Risk Score: This predicts the likelihood of a business becoming delinquent on its payments. Business Failure Score: It predicts the possibility of a business ceasing its operations without paying all creditors in full over the next 12 months. Payment Index: Reflects the payment habits of a business, showing whether payments were made on time or if they were late. Experian Business is a crucial segment of Experian plc, a global information services group known for its expertise in credit reporting and data analytics. Catering to businesses, Experian Business provides a suite of solutions that encompass credit reporting, risk management, and targeted marketing insights. At its core, it offers the "Intelliscore Plus," a proprietary business credit score formulated by analyzing over 800 variables to predict a company's credit behavior. By offering a detailed view into a firm's creditworthiness, outstanding debts, payment histories, and potential risks, Experian Business equips enterprises with vital intelligence for making informed financial and strategic decisions. Blended Score: For newer businesses, Experian might blend both business owner and business credit data to give a more comprehensive picture. ProfilePlus Report: A detailed business credit report by Experian, it provides a deep dive into a company's credit obligations and payment histories. CreditScore Report: Provides a quick view of a business's credit health, focusing primarily on the credit score. This is a predictive analytic scoring model developed by FICO, a company renowned for its consumer credit scores. Specifically designed for small business lending decisions, the SBSS evaluates both personal and business credit data to determine the risk associated with a small business loan or credit application. The score ranges from 0 to 300, with higher scores indicating lower credit risk. Significantly, the U.S. Small Business Administration (SBA) often uses the SBSS when vetting applications for its popular 7(a) loan program, typically requiring a minimum score for eligibility. The comprehensive nature of SBSS, evaluating multiple facets of creditworthiness, makes it a vital tool for lenders aiming to make informed and swift lending decisions for small businesses. Loan Applications: SBSS scores are used primarily for credit line and loan applications up to $1 million. Comprehensive Data Evaluation: The score evaluates both personal and business credit data, ensuring a thorough creditworthiness assessment. Quick Decision Making: Given that the SBA and other lenders use SBSS, it's designed for rapid, consistent credit decisions, making the loan application process smoother. Understanding your business credit score is more than just knowing the number—it's about comprehending its implications and the underlying factors driving it. Typically, business credit scores oscillate between 0 and 100. Higher scores are indicative of better creditworthiness, suggesting that the business is low-risk and has a history of meeting its financial obligations promptly. However, it's imperative to remember that scoring benchmarks might not be uniform across the board. Different credit bureaus can have their own proprietary scoring models and criteria. Your credit report is a comprehensive document painting a holistic picture of your business's financial behavior. Beyond the overarching score, it delves into the various elements that influence your creditworthiness. Outstanding Balances: This section provides insights into the total outstanding amounts, helping you gauge the overall debt health. Payment History: This segment illustrates the consistency and punctuality of past payments. Regular, on-time payments boost your score, while delinquencies, defaults, or late payments can drag it down. Age of Credit Account: The longevity of your credit accounts can influence your score. Older accounts, when managed well, can positively impact the score, suggesting stability and consistent financial behavior. Credit Inquiries: Too many hard inquiries in a short span can be a red flag, indicating potential financial desperation or overextension. Highlighted factors that negatively affect your score are critical. These aren't just mere observations but actionable insights. Addressing these points—be it settling outstanding debts, rectifying discrepancies, or strategizing better financial practices—can pave the way for an improved score in the future. After all, understanding the problem is the first step toward resolution. Build Trust With Suppliers: A commendable business credit score acts as a badge of trustworthiness. Suppliers, assured of your financial stability, are often more inclined to engage in transactions and offer better trade terms. Improve Cash Flow: Favorable payment terms, extended due to a solid credit score, mean businesses can retain cash longer. This can enhance liquidity, giving businesses more flexibility in managing operational costs without resorting to short-term financing. Leasing and Renting: Whether it's a new office space or vital equipment, leasing companies and landlords are more amenable to offering attractive terms to businesses with high credit scores. Procurement Advantages: When purchasing equipment or services, especially on credit, vendors may offer prioritized services or discounts to businesses with stellar credit scores, recognizing their reliability. Neglecting this score comes with its set of challenges and potential setbacks. Costly Borrowing: An overlooked or low credit score can be a financial strain. Lenders might levy higher interest rates on loans or credit extensions, translating to heightened financial burdens in the long run. Growth Stagnation: Vendors might reconsider extending trade credit, or they might do so under stringent conditions. The ripple effect of this can impede inventory management, sales, and even market expansion. Perception and Partnerships: A subpar credit score can radiate signals of potential financial mismanagement or instability. A business credit score is a crucial indicator of a company's creditworthiness, influencing potential lenders, suppliers, and clients. Several factors, including payment history, credit utilization, and financials, contribute to the score, with some reports also considering public records. Notable agencies such as Dun & Bradstreet, Equifax Business, Experian Business, and FICO SBSS offer unique methodologies to assess and provide business credit scores. Understanding the implications of the credit score, addressing negative factors, and leveraging the score for advantages in operations, such as building trust with suppliers and improving cash flow, are vital. Neglecting the business credit score can lead to costly borrowing and growth stagnation and hinder potential partnerships and collaborations. Therefore, staying vigilant about the business credit score is crucial for the long-term success of any enterprise.What Is a Business Credit Score?

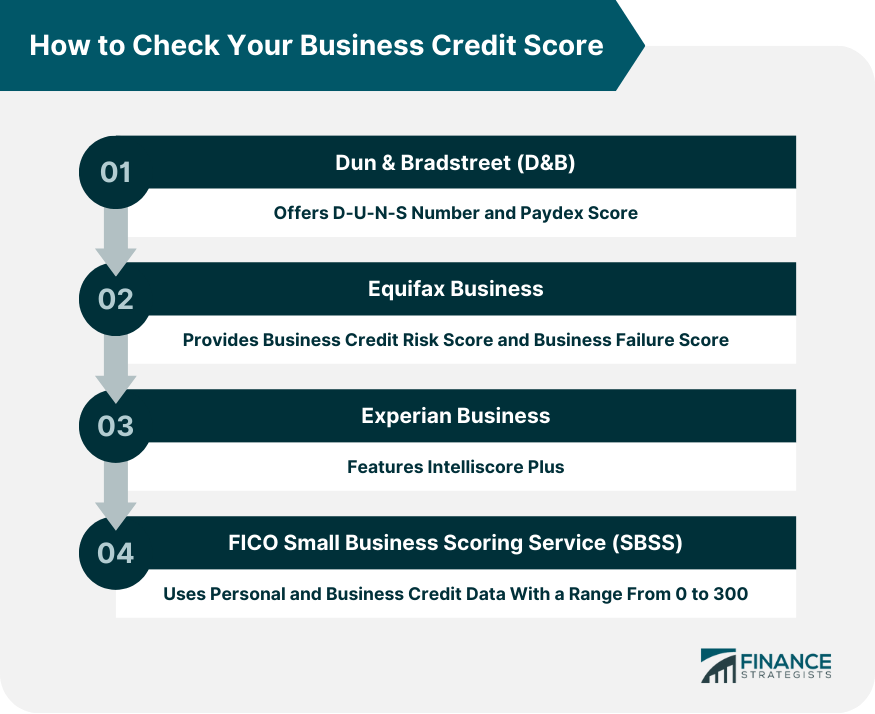

How to Check Your Business Credit Score

Dun & Bradstreet (D&B)

Features and Offerings

Equifax Business

Features and Offerings

Experian Business

Features and Offerings

FICO Small Business Scoring Service (SBSS)

Features and Offerings

Interpreting Your Business Credit Score

Score Range and Significance

Diving Deep Into the Report

Addressing Negative Factors

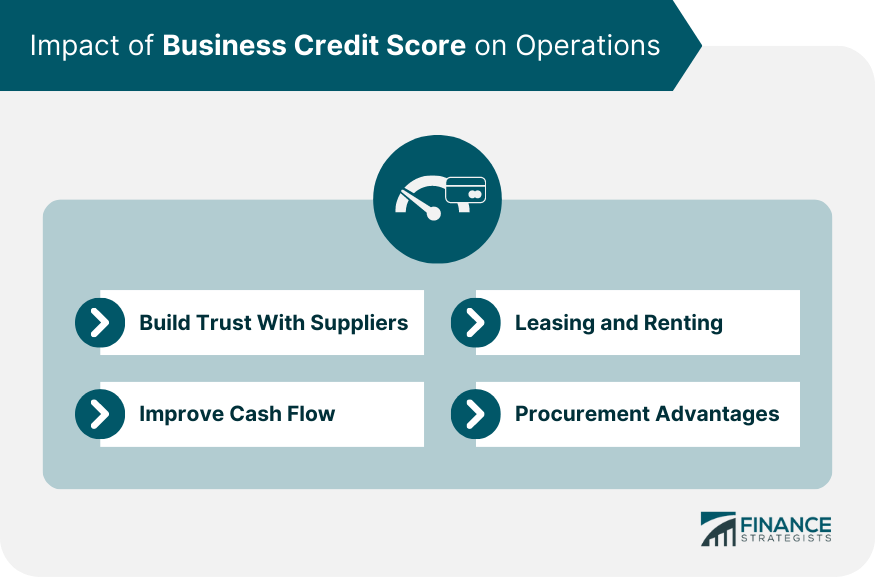

Impact of Business Credit Score on Operations

This can manifest in the form of reduced security deposits, better rental prices, and longer lease durations.

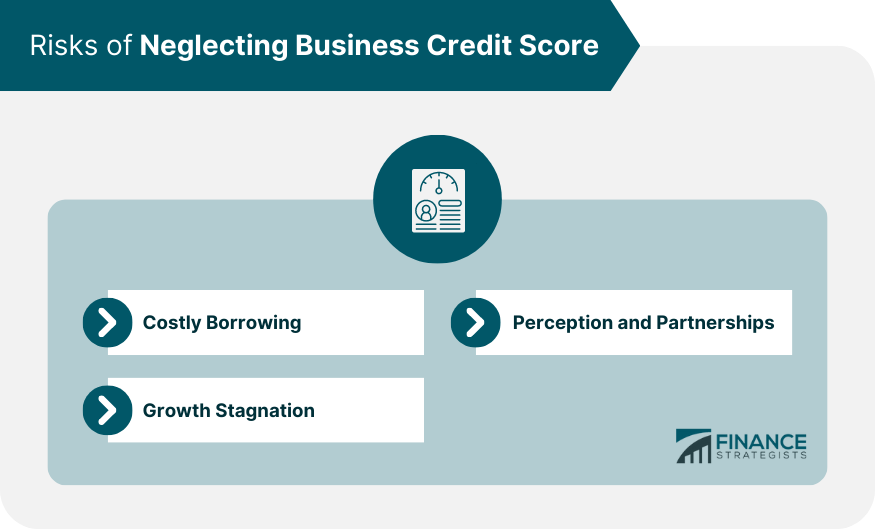

Risks of Overlooking Your Business Credit Score

Potential collaborators, investors, or even high-profile hires might be hesitant, restricting avenues for mergers, partnerships, or talent acquisition.

Conclusion

How to Check Your Business Credit Score FAQs

You can check your business credit score by contacting reputable credit bureaus like Dun & Bradstreet, Equifax Business, Experian Business, or FICO SBSS, which offer platforms for accessing your score.

Some credit bureaus like Dun & Bradstreet offer free tools like CreditSignal that provide alerts when your business credit score changes.

You can improve your business credit score by making timely payments, managing outstanding balances, and rectifying any negative factors listed in your credit report.

It is advisable to regularly monitor your business credit score, especially before applying for loans, seeking partnerships, or engaging in significant financial transactions.

No, checking your business credit score yourself does not affect your scores. These are considered soft inquiries, which have no impact on your score. Only hard inquiries from lenders can potentially influence your score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.