A savings account is a type of deposit account offered by financial institutions, primarily banks and credit unions. Unlike checking accounts, which are typically used for day-to-day transactions, savings accounts are designed to hold money not immediately needed for regular spending. They often offer interest, allowing the account holder to earn a return on their deposited funds. Interest rates can vary based on the bank, the type of savings account, and prevailing economic conditions. For many, this represents a cornerstone of financial planning, serving as a buffer for unforeseen expenses or a place to save for future goals. By segregating funds from regular checking accounts, individuals are often less tempted to dip into their savings impulsively, thereby allowing the funds to grow over time. Furthermore, a savings account acts as a low-risk investment option. The security and accessibility of the funds, combined with federal insurance protection in many jurisdictions, make savings accounts an appealing choice for conservative savers. If you're contemplating closing your savings account, it's essential to know that it's more than just a single phone call to your bank. Here's a detailed guide to walk you through each step. Before you close your current savings account, especially if it's your primary one, consider opening a new one to avoid a gap in your banking needs. Begin by researching banks or credit unions that offer competitive interest rates, minimal fees, and superior customer service. Numerous online reviews and comparison tools can aid in narrowing down your choices. Once you've selected a new institution, gather the necessary documents, such as identity proofs and address verification, to facilitate the opening process. Transitioning to a new savings account is more than just shifting funds; it also involves rerouting all automatic transactions. Start by listing all your recurring payments, including utility bills, subscriptions, or loan installments linked to your old account. If you receive a regular salary or other recurring deposits, ensure you inform the respective parties to redirect these to your new account. Keep in mind that it might take a couple of billing cycles for all these changes to fully take effect, so it's essential to be patient during this transition phase. Once you're ready to move on, begin transferring your funds out of the old savings account. This can be done using online banking, facilitating a swift transfer from your old to your new account. Alternatively, if you prefer a more traditional approach, writing a check to yourself can serve the same purpose, effectively moving your money between the two accounts. With your transactions rerouted and your funds transferred, it's time to formally initiate the closure process. Contact your current bank, expressing your intent to close your savings account. Some institutions may allow closures over the phone, while others might require an in-person visit. Every bank or financial institution has its own set of procedures and required paperwork when it comes to closing an account. This is to ensure that both the bank and the account holder have a clear understanding and agreement on the account's termination and any associated conditions. Before heading to the bank or preparing to close your account online, it's advisable to research or directly contact the institution to get clarity on the documents needed. This proactiveness can save you multiple trips or additional communications. When you have the required forms, take the time to review each section. Filling out forms hastily can lead to oversights, which might cause delays or even compel you to restart the entire process. If any part of the paperwork is unclear, seek guidance from bank representatives. Even if you've communicated with your bank verbally, it's a good practice to send a formal letter indicating your wish to close the account. This letter serves as a tangible record of your request and can help clear up any potential disputes in the future. Remember to be explicit in your letter: mention your account number, the date, and the reason for closure (if you're comfortable sharing). After sending, keep a copy for your records. If mailing, consider opting for certified mail, which provides proof of delivery. Finally, once your account is closed, insist on receiving written confirmation from the bank. This document confirms that your account was closed in good standing and can be invaluable if any questions arise later on. There are multiple reasons someone might decide to close a savings account: Better interest rates elsewhere Dissatisfaction with customer service Consolidation of finances Change in financial situation or goals High fees Relocation Switch to alternative financial tools Account inactivity Unfavorable changes in bank policies Regardless of the underlying reason, it's vital to deliberate the decision thoroughly, ensuring it aligns with your unique financial situation. Closing a savings account is a financial decision that requires thoughtfulness and a strategic approach. If you're considering taking this step, here are some tips to ensure the process is as smooth as possible: • Check for Pending Transactions: Ensure there are no pending transactions, like checks waiting to be cleared, or automatic bill payments scheduled. Address these first to avoid any complications. • Avoid Early Closure Fees: Some banks impose fees if an account is closed within a certain time frame after opening, typically within 90 to 180 days. Ensure you're outside this window to avoid any penalties. • Maintain a Small Buffer Initially: When transferring funds, consider leaving a small amount in your old account temporarily to cover any unforeseen automatic withdrawals or fees. Once all transactions are clear, you can move the remaining balance and proceed with the closure. • Document Everything: Keep records of all interactions and communications with the bank regarding the closure. This includes phone calls, in-person meetings, emails, and formal letters. • Securely Dispose Associated Documents: Once you're certain the account is closed and won't be reopened, it's a good idea to shred old checks, deposit slips, and any other sensitive documents related to that account. A savings account is a valuable financial tool offered by banks and credit unions, designed to hold funds not immediately needed for day-to-day expenses. It serves as a crucial element of financial planning, providing a buffer for unforeseen expenses and a means to save for future goals. When considering closing a savings account, a strategic approach is necessary. First, open a new account to avoid a gap in banking needs. Then, transition scheduled payments and deposits to the new account. After redirecting all transactions, transfer funds from the old account. Contact the bank, complete the required documents, and send a formal closure letter. Keep records of interactions and obtain written confirmation for a hassle-free process. By following these tips and precautions, individuals can navigate the process effectively and maintain financial stability.What Is a Savings Account?

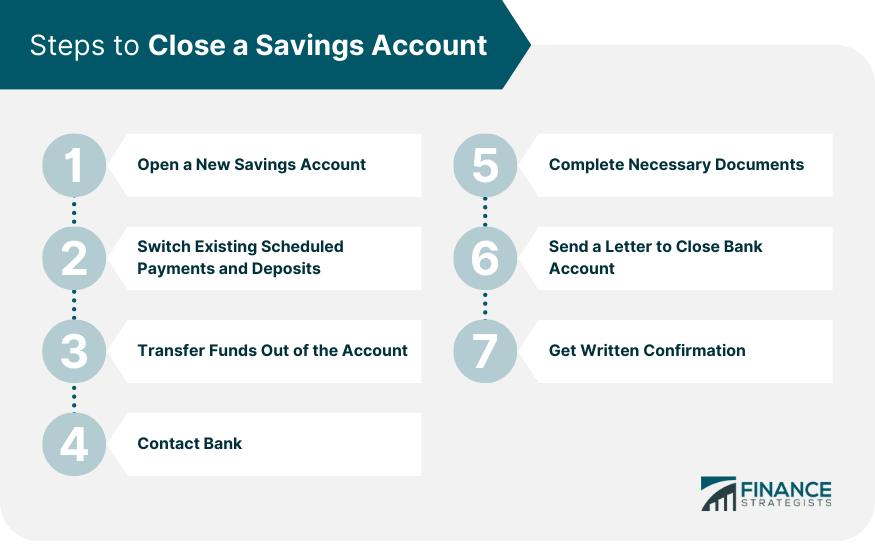

How to Close a Savings Account

STEP 1: Open a New Savings Account

STEP 2: Switch Existing Scheduled Payments and Deposits

STEP 3: Transfer Funds Out of the Account

STEP 4: Contact Bank

STEP 5: Complete Necessary Documents

STEP 6: Send a Letter to Close Bank Account

STEP 7: Get Written Confirmation

Reasons for Closing a Savings Account

Tips for Closing a Savings Account

Conclusion

How to Close a Savings Account FAQs

To close a savings account, contact your bank, complete the required documents, and send a formal closure letter.

Yes, opening a new account beforehand can avoid a gap in your banking needs during the transition.

Transition them to the new account to ensure a smooth shift and avoid any disruptions.

You can transfer funds online using your bank's online banking platform or write a check to yourself for the transfer.

Keeping records helps ensure a hassle-free closure and serves as proof of your communication with the bank.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.